Summary:

- UnitedHealth Group remains well-positioned for long-term earnings growth despite near-term concerns about increased utilization and regulatory challenges.

- Management’s confident outlook and insights into OptumHealth’s value-based care offerings indicate potential for further expansion and growth.

- While some projections fell below analysts’ estimates, UnitedHealth’s market leadership and economies of scale should help mitigate near-term headwinds.

- Despite that, UNH’s valuation isn’t cheap, although bullish investors could argue it’s justified, given its best-in-class profitability and robust growth profile.

- I argue why I’m inclined to buy UNH only if I get a steep selloff for a much more attractive risk/reward profile.

mohd izzuan/iStock via Getty Images

I last updated UnitedHealth Group (NYSE:UNH) investors in early October, arguing why the bullish thesis in the leading integrated healthcare player was simple. UnitedHealth boasts best-in-class profitability against its healthcare peers and benefits from significant cost advantages and a network effect moat.

As a result, UNH investors weren’t perturbed even as the Wall Street Journal reported recently that Humana (HUM) and Cigna (CI) are “engaged in discussions about a potential merger.” The deal envisaged the combination of Humana’s leadership in commercial insurance and Cigna’s PBM scale as both companies look to enhance their competitive edge in the market. However, regulatory challenges and the terms of the deal will remain under intense scrutiny, suggesting why UNH holders weren’t unduly worried.

As a result, I believe UnitedHealth remains well-poised to execute its long-term earnings growth projections of between 13% and 16%. Despite that, there are near-term concerns regarding the increased utilization affecting UnitedHealth’s medical loss ratio or MLR. In addition, the regulatory challenges affecting Medicaid re-determination could hamper buying sentiment in the near term.

Despite that, management presented a confident Investor Day in late November 2023, underscoring its ability to manage the near-term headwinds. The company also provides deeper insights into OptumHealth’s value-based care offerings, which are expected to be a key growth driver in the medium- to long term. As a result, these structural changes could help UnitedHealth expand further into “commercial and state programs, recognizing the potential to improve health outcomes and reduce costs.”

Management provided keen insights into its FY24 outlook, which didn’t disappoint. The company anticipates revenue of $125B for OptumRx and over $300B for UnitedHealthcare. Notably, the company “expects to serve up to 550,000 more consumers,” although the projections came in below analysts’ estimates.

UnitedHealth’s update “represents an improvement of 450,000 to 550,000 from projections for 2023.” Despite that, the midpoint enrollment target of 8.045M Americans is markedly below Wall Street’s estimates of 8.4M. As a result, some investors could be concerned about the expected increase in MLR to 84%, which also underperformed analysts’ initial projections.

Despite that, management provided a confident adjusted EPS guidance for FY24, anticipating a range of between $27.50 and $28. As a result, it indicates broad-based growth for UnitedHealth, indicating an estimated 11.3% YoY growth at the midpoint of its guidance range.

Therefore, I believe the company’s market leadership and economies of scale should help to mitigate these near-term headwinds, underpinned by management’s confident outlook.

UnitedHealth is a solid growth compounder assigned a robust “B-” growth grade relative to its healthcare sector peers. Coupled with its “A+” profitability grade, I concur that its premium “D-” valuation is justified, although I’m not sure whether a Buy rating makes sense at the current levels.

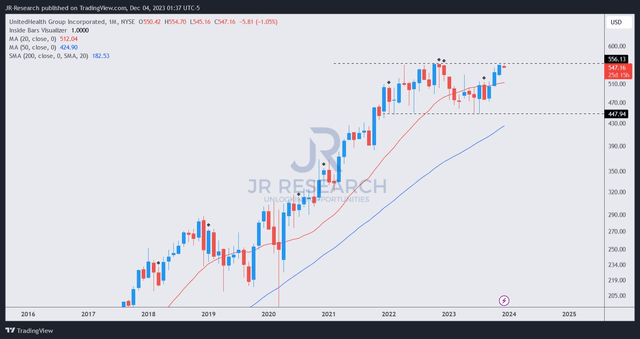

UNH price chart (monthly) (TradingView)

UNH’s price action has no sell signal or red flags that suggest investors should consider cutting substantial exposure. The long-term uptrend in UNH remains intact, although caution is noted at the current levels.

Its upward momentum has stalled since it failed to break above the $555 level decisively since early 2022. A series of subsequent re-tests also could not do so before the steep pullback toward its $445 support zone.

My assessment suggests UNH should remain in a consolidation phase between these two levels, with higher risk/reward buy levels closer to the low $400s zone.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!