Summary:

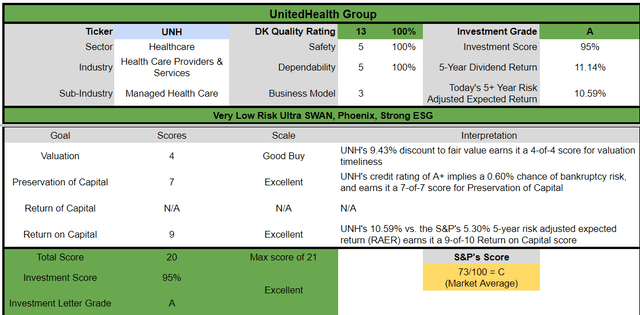

- UnitedHealth is a fast-growing, recession-resistant, 100% quality Ultra SWAN with a 1.5% yield and 13% to 16% long-term dividend growth potential.

- The company is an industry leader in safety, quality, and scale, with a strong long-term return potential of 14% to 15% compared to the S&P 500’s 10.2%.

- UnitedHealth is currently undervalued at 18.7x earnings, offering investors a potentially good buy with a 9% discount to historical fair value.

- It’s expected to grow 12% in the recession, grew 12% in the Pandemic, and earnings only shrank 8.5% in the Great Financial Crisis. This is as close to a recession-proof business as exists.

- UNH offers 140% return potential through 2029 – three times that of the S&P.

akinbostanci

This article was coproduced with Dividend Sensei.

To hear the stock market tell it, the recession has been canceled – economic growth won’t even slow, and earnings growth in the next few years will be a gangbuster 12% per year.

The actual economic data says that an average recession is likely starting in July with an earnings contraction of between 11% and 20%, likely causing the market to tumble 20% to 30%.

That might sound terrifying, and it likely will feel that way to many investors. It’s an average recession, average earnings decline, and average stock market correction for a recessionary bear market.

But how can smart income investors prepare for the likely market mayhem that’s coming? By buying recession-resistant Buffett-style world-beater blue-chips like UnitedHealth Group (NYSE:UNH).

Let me show you the three reasons why this is as close to the perfect fast-growing Buffett-style Ultra Sleep Well At Night blue-chip you can safely buy today for a likely rich retirement tomorrow.

The Ultimate Recession-Resistant Ultra SWAN For This Recession

Why is UnitedHealth the ultimate fast-growing dividend blue-chip for this recession?

How about the 15% dividend hike it just delivered, achieving a 13-year dividend growth streak and extending its streak without a dividend cut to 33-years?

UNH has never cut its dividend since it began paying one in 1990.

But UNH’s track record of delivering great results through rain and shine goes far beyond that.

UNH was founded in 1977 in Minnetonka, MN, and has survived and thrived through:

-

six recessions

-

two economic crises

-

inflation as high as 15%

-

interest rates as high as 20%

-

11 bear markets

-

dozens of market corrections and pullbacks

“UnitedHealth Continues to Lead the Managed Care Pack…

Under one roof, UnitedHealth combines a top-tier health insurer (UnitedHealthcare), pharmacy benefit manager (Optum Rx), provider (Optum Health), and health analytics franchise (Optum Insight).

The company’s integrated strategy has resulted in some of the best returns in the industry in recent years and has been copied at least in part by the late 2018 mergers at CVS Health (added Aetna’s medical insurance assets to its existing retail stores and market-leading PBM) and Cigna (added Express Scripts PBM assets to its existing medical insurance operations).

Outside of substantial regulator-led reforms, we think these vertically integrated organizations could help bend the healthcare cost curve in the United States, and UnitedHealth should be one of the key leaders of that charge.” – Morningstar

As Morningstar points out, UNH has been the industry leader in adapting to the changing landscape in US healthcare, becoming a vertically integrated giant that all other rivals are copying.

Yes, single-payer healthcare could destroy its business model, but that’s highly unlikely to actually happen (less than 5% probability, according to Morningstar, over the next decade).

Want proof that UNH is the king of industry adaptation? Consider this. The Affordable Care Act (Obamacare) was passed on March 23rd, 2010.

Here are the total returns for health insurance companies since then:

-

CVS: 164%

-

S&P 500: 375%

-

Elevance Health: 790%

-

Humana: 1,060%

-

UnitedHealth: 1,710%

Without single-payer, or at least a public option, any increase in health insurance coverage has to go through the health insurance industry, and that is why health insurance stocks have run circles around even the Nasdaq, much less the broader market since the ACA passed.

“UnitedHealth has demonstrated an uncanny ability to remain at the leading edge of changes affecting the industry. For example, its 2015 acquisition of Catamaran greatly increased its PBM scale and helped create a more holistic view of a patient’s care. That combination of services has created attractive synergies for clients, such as employers or government programs, that are seeking to lower overall healthcare costs rather than just pharmacy or medical benefits.” – Morningstar

UNH is harnessing the power of scale and vertical integration to lower costs while protecting its margins.

The medical cost ratio or MCR is the % of premiums a health insurance company spends on patient healthcare. The regulatory requirement is 80%, and for some large government-sponsored plans, 85%.

For decades healthcare costs have been rising at twice the rate of inflation, yet UNH has managed to maintain a steady MCR of 79% to 82.5% from 2015 to 2022.

Analysts expect it will rise to 83% by 2027, but that’s still one of the lowest in the industry.

UNH’s economies of scale should remain robust as it continues leading the industry in total customers.

It has 48 million US policyholders, and that’s expected to grow to 53.4 million by 2027.

UNH’s sales are expected to grow from $324 billion in 2022 to $522 billion by 2027.

That’s 10% sales growth powering even stronger earnings growth of 13.8%.

|

Metric |

2022 Growth |

2023 Growth Consensus (Recession) |

2024 Growth Consensus |

2025 Growth Consensus |

|

Sales |

13% |

15% |

7% |

9% |

|

Dividend |

14% |

15% |

12% |

3% (15-year streak) |

|

Earnings |

17% |

13% |

13% |

14% |

|

Cash Flow |

18% |

14% |

5% |

20% |

(Source: FAST Graphs, FactSet)

Do you see where in this medium-term forecast there is a recession for UNH? There isn’t one. UNH isn’t expected to participate in this recession.

-

Pandemic growth: +12%

-

Great Financial Crisis growth: -8%

There are few industries more recession-resistant than health insurance.

Why? Because skipping health insurance payments is one of the last things any reasonable person is going to do, even if they lose their job.

And remember, who pays most of these premiums? Corporations and the government. UNH is getting paid by the deepest pockets on earth.

“UnitedHealth aims to grow in nearly any regulatory environment by providing diverse yet connected services. It is shooting for 13%-16% earnings growth in the long run, including strong operational growth and capital allocation activities, such as acquisitions and repurchases. While some regulatory scenarios could eventually cut into that mission, we suspect that UnitedHealth’s value to the U.S. healthcare system will help it remain relevant in the long run.” – Morningstar

Management is guiding for 14.5% long-term EPS growth, powered by secular trends in higher healthcare spending, cost cutting, M&A, and buybacks.

Why am I excited to recommend a 1.5% yielding dividend stock? I’m not.

I’m excited to be recommending a 1.5% yielding Ultra SWAN whose management is guiding for a dividend that doubles every five years for the foreseeable future.

UnitedHealth’s Yield On Cost Guidance (Adjusted For Inflation)

-

5 years: 2.7%

-

10 years: 4.9%

-

15 years: 8.8%

-

20 years 15.8%

-

25 years: 28.5%

-

30 years: 51.4%

Even if you’re already retired, it’s worth considering the benefits of fast-dividend growth for your long-term retirement and estate planning needs.

According to JPMorgan, the average non-smoking woman alive today has a 13% chance of living to 100, and the average retired couple has a 19% chance that one of the partners will live to 100.

The chance of one of the spouses living to:

-

100 years: 19%

-

95 years: 46%

-

90 years: 73%

-

85 years: 90%

In other words, even if you’re 65 and retired, you must plan for a 30-year investing time horizon.

And that’s where the power of superstar dividend growth, like what UNH offers, is so useful.

Why is UNH my favorite insurance company? It’s not because it’s a Minnesota company (where I live). Minnesota companies are some of the best in the world, courtesy of our common-sense Midwest values and hard work ethic.

There’s Something In The Water When It Comes To Minnesota Companies

-

3M – dividend king

-

Polaris – dividend champion

-

Hormel Foods – dividend king

-

Target – dividend king

-

Medtronic – dividend aristocrat

-

Ecolab – dividend aristocrat

-

UnitedHealth

-

Donaldson – dividend champion

-

Ameriprise – future aristocrat

-

US Bancorp

Minnesotans love our safe dividends, so we have so many aristocrats, champions, and kings.

I’ll eat my hat if UNH doesn’t become a dividend aristocrat in 12 years and a king in 37 years.

“We continue to view the fixed cost leverage associated with processing claims on about 1.4 billion of the roughly 6 billion adjusted prescriptions filled annually in the U.S. as a scale-related advantage.” – Morningstar

UNH has a 25% market share in prescriptions.

UNH isn’t just the biggest Pharmacy Benefits Manager (PBM). They are America’s largest health insurance company, just ahead of Anthem (now called Elevance).

-

UnitedHealth: 48 million policies

-

Anthem: 43 million

-

Centene: 22 million

-

Humana: 19 million

-

Health Care Service Corp: 16 million

What about Medicare policies?

-

UnitedHealth: 24 million

-

Humana: 14 million

-

Aetna: 11 million

-

Blue Cross Blue Shield: 10 million

-

Centene: 6 million

What about Medicaid policies?

-

Centene: 15 million

-

UnitedHealth: 11 million

-

Molina: 5.5 million

-

Ameritas: 4.7 million

-

WellCare: 4 million

And finally, here are the top insurance companies by Tricare (military family) policies.

-

UnitedHealth: 1.5 million

-

Humana: 1 million

-

Blue Cross: 500,000

-

Aetna: 250,000

-

Cigna: 100,000

As you can see, UNH is #1 in almost everything and #2 in Medicaid. They are the industry leader in scale, and its 380,000 employees service 149 million people in the US and worldwide.

-

97% US

How big is UNH’s health insurance empire?

-

over 100 healthcare systems use it

-

about 2 million healthcare providers in the system

-

data on 285 million people (for improving outcomes) – total patients served, including family members

-

processes 22 billion transactions per year

-

80% of healthcare plans use Optum Insights (UNH’s analytics platform)

-

$31 billion in annual cost savings due to its data analytics

-

process prescriptions for over 61 million people per year

-

$124 billion in pharmacy prescriptions

-

$71 per average prescription savings

UNH has 51 million policyholders worldwide, including 3 million in other countries.

It has over 250,000 corporate clients and every government program, and its network includes almost 2 million healthcare providers and 6,400 hospitals.

UNH is larger than Canada’s single-payer health system and almost as big as the UK’s.

It’s a nation unto itself and a true world-beater blue-chip.

UNH has been able to reduce its Medicare plan costs by 40% compared to 2021 levels.

The government is counting on UNH to cut future healthcare spending costs, including the $880 billion in forecast Medicaid spending in 2025 alone.

The Silver Tsunami? Here’s what that means for US healthcare spending.

“The forecast US medical spending is expected to grow steadily over the next 77 years. The spending is expected to reach $19.5 trillion by 2100.” – Bard

According to the Congressional Budget Officer’s projections (extrapolated from 2053 forecasts), by 2100, the US economy, adjusted for inflation, will be $169 trillion.

-

Healthcare spending will be 11% of the economy.

US healthcare spending is expected to reach almost $20 trillion by 2100, and of course, it’s going to grow to massive levels long before that.

-

2023: $4.1 trillion vs. $25.5 trillion GDP = 16% of GDP

-

2033: $6.1 trillion vs. $39.3 trillion GDP = 16% of GDP

-

2043: $8.1 trillion vs. $56 trillion GDP = 14% of GDP

-

2053: $10.1 trillion vs. $80 trillion GDP = 12% of GDP

According to the Congressional Budget Office, America is going to spend exponentially more on healthcare in the future as our society ages and medical technology improves.

The good news is that as a percentage of GDP, it’s actually expected to go down, meaning we’ll be able to afford this higher medical spending.

So what does this mean for UNH investors?

Strong Growth Prospects For Decades To Come

We’ve already seen how UNH’s earnings are expected to grow about 14% annually through 2027. But what about the long term? Management is guiding for 13% to 16% growth, and here’s what analysts expect.

Twenty-eight analysts covering UNH for a living estimate a median long-term growth forecast of 13.1% annually.

-

11% to 16% range

Here’s what that potentially means for long-term investors.

|

Investment Strategy |

Yield |

LT Consensus Growth |

LT Consensus Total Return Potential |

Long-Term Risk-Adjusted Expected Return |

|

UnitedHealth |

1.5% |

13.1% |

14.6% |

10.2% |

|

ZEUS Income Growth (My family hedge fund) |

4.2% |

10.2% |

14.4% |

10.1% |

|

Vanguard Dividend Appreciation ETF |

1.9% |

10.7% |

12.6% |

8.8% |

|

Nasdaq |

0.8% |

11.2% |

12.0% |

8.4% |

|

Schwab US Dividend Equity ETF |

3.6% |

7.6% |

11.2% |

7.8% |

|

REITs |

3.9% |

7.0% |

10.9% |

7.6% |

|

Dividend Champions |

2.6% |

8.1% |

10.7% |

7.5% |

|

Dividend Aristocrats |

1.9% |

8.5% |

10.4% |

7.3% |

|

S&P 500 |

1.7% |

8.5% |

10.2% |

7.1% |

|

60/40 Retirement Portfolio |

2.1% |

5.1% |

7.2% |

5.0% |

(Source: FactSet, Morningstar)

14% to 15% long-term returns, possibly for the next few decades.

That’s better than the aristocrats, S&P, and even the Nasdaq.

It’s one of the lowest-risk ways to profit from one of the largest mega-trends in US history.

Historical Returns Since 1990

UNH has delivered 26% annual returns since 1990, turning $1 into $1,964.

-

$834 adjusted for inflation vs. $10 for the S&P 500

In fact, UNH has outperformed MSFT (22%) and Apple (21%) over the last 33 years.

UNH’s average 12-month return since 1990 has been 31% compared to MSFT’s 25% and Apple’s 34%.

And in the future, it’s expected to keep outperforming these tech titans.

And you don’t have to wait decades for UNH to deliver incredible income growth and total returns.

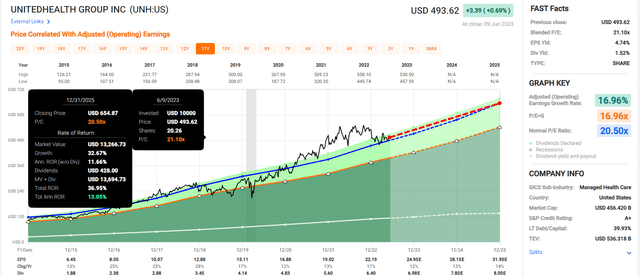

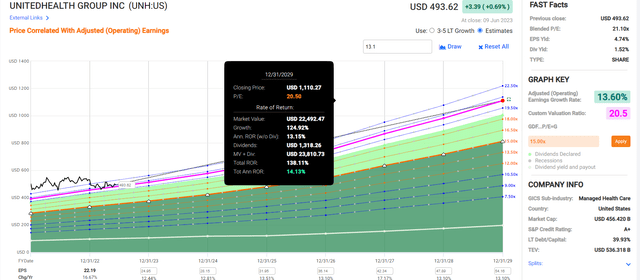

UnitedHealth 2025 Consensus Total Return Potential

FAST Graphs, FactSet

UnitedHealth 2029 Consensus Total Return Potential

FAST Graphs, FactSet

UNH offers about 3X the return potential of the S&P through 2029 and about 2X through 2025.

All with Ultra SWAN safety and an A+ credit rating.

A Wonderful Company At A Fair Price

It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.” – Warren Buffett

Since the ACA passed, UNH’s PE has been between 17 and 21, and it’s been trending higher over time, as management has proven that it is a master of the new health insurance order.

|

Metric |

Historical Fair Value Multiples (11-Years) |

2022 |

2023 |

2024 |

2025 |

12-Month Forward Fair Value |

|

13-Year Median Yield |

1.37% |

$466.42 |

$548.91 |

$548.91 |

$589.78 |

|

|

PE |

20.50 |

$454.90 |

$512.09 |

$577.08 |

$655.39 |

|

|

Average |

$460.59 |

$529.86 |

$562.64 |

$620.85 |

$544.99 |

|

|

Current Price |

$493.62 |

|||||

|

Discount To Fair Value |

-7.17% |

6.84% |

12.27% |

20.49% |

9.43% |

|

|

Upside To Fair Value (including dividend) |

-6.69% |

7.34% |

13.98% |

25.78% |

11.93% |

|

|

2023 EPS |

2024 EPS |

2023 Weighted FFO |

2024 Weighted FFO |

12-Month Forward PE |

Historical Average Fair Value Forward PE |

Current Forward PE |

|

$24.98 |

$28.15 |

$13.45 |

$12.99 |

$26.44 |

20.6 |

18.7 |

UNH is historically worth about 21X earnings and today trades at 18.7X, a 9% historical discount that offers a 12% upside to fair value in the next year.

Adjusted for cash, it trades at 13.4X cash-adjusted earnings, a PEG of 1 – strong growth at a reasonable price.

|

Rating |

Margin Of Safety For Very Low-Risk 13/13 Ultra SWAN |

2023 Fair Value Price |

2024 Fair Value Price |

12-Month Forward Fair Value |

|

Potentially Reasonable Buy |

0% |

$529.86 |

$562.64 |

$544.99 |

|

Potentially Good Buy |

5% |

$503.37 |

$534.51 |

$517.74 |

|

Potentially Strong Buy |

15% |

$450.38 |

$478.24 |

$463.24 |

|

Potentially Very Strong Buy |

25% |

$377.52 |

$421.98 |

$408.74 |

|

Potentially Ultra-Value Buy |

35% |

$344.41 |

$365.71 |

$354.24 |

|

Currently |

$493.62 |

6.84% |

12.27% |

9.43% |

|

Upside To Fair Value (Including Dividends) |

8.86% |

15.51% |

11.93% |

UNH is a potentially good buy for anyone comfortable with its risk profile.

Risk Profile: Why UnitedHealth Isn’t Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

UNH’s Risk Profile Summary

“We give UnitedHealth a Medium Uncertainty Rating with some risks related primarily to potential U.S. healthcare policy changes.

While the near-term outlook appears relatively benign, potential healthcare policy changes could create ESG-related risks for UnitedHealth, especially during election cycles, as access to universal, affordable coverage remains a key concern of the American public.

For example, the Medicare for All scenario debated in the lead-up to the Democratic primaries in 2020 called for eliminating the private insurance industry, which would have threatened most of the company’s operations.

While we view the probability of a Medicare for All-like scenario as virtually zero in the foreseeable future, other policy risks may threaten private insurer economic profit margins in future election cycles. After nearly universal coverage levels are reached, we would look for regulators to focus on reducing healthcare inflation rates, perhaps by cutting into MCO profits.

However, given how slow the U.S. may be at reaching nearly universal coverage, we think significant margin compression appears to be a long-term risk.” – Morningstar

UNH’s Risk Profile Includes

-

regulatory risk (Medicare for All, public option)

-

margin compression risk (also regulatory in the future, even without M4A)

-

M&A execution risk (UNH makes small, bolt-on acquisitions)

-

labor retention risk (tightest job market in over 54 years)

What is the largest realistic risk of single-payer healthcare or a public option that could really hurt UNH? Morningstar estimates a “near zero” chance over the next decade. But more conservatively, I asked Bard for its best estimates.

Bard’s base-case estimate is that M4A has a less than 1% chance of passing in the next decade, while a public option is a 5% risk.

Bard’s conservative estimate is a 5% probability of M4A and a 10% chance of a Public option.

Note that for either of these policy changes to pass, Democrats would need 60 Senate votes.

-

or the filibuster would have to be abolished

-

which Manchin and Sinema have said they would oppose

Regardless of your personal opinions about whether these are good or bad policy ideas, as far as UNH investors are concerned, the maximum realistic risk of a major disruption to UNH’s business appears to be about 10%.

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

DK uses S&P Global’s global long-term risk-management ratings for our risk rating.

-

S&P has spent over 20 years perfecting its risk model

-

which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

-

50% of metrics are industry specific

-

this risk rating has been included in every credit rating for decades

The DK risk rating is based on the global percentile of a company’s risk management compared to 8,000 S&P-rated companies covering 90% of the world’s market cap.

UNH Scores 97th Percentile On Global Long-Term Risk Management

S&P’s risk management scores factor in things like:

-

supply chain management

-

crisis management

-

cyber-security

-

privacy protection

-

efficiency

-

R&D efficiency

-

innovation management

-

labor relations

-

talent retention

-

worker training/skills improvement

-

occupational health & safety

-

customer relationship management

-

business ethics

-

climate strategy adaptation

-

sustainable agricultural practices

-

corporate governance

-

brand management

-

interest rate risk management

UNH’s Long-Term Risk Management Is 27th Best The Master List (95th Percentile In The Master List)

|

Classification |

S&P LT Risk-Management Global Percentile |

Risk-Management Interpretation |

Risk-Management Rating |

|

BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL |

100 |

Exceptional (Top 80 companies in the world) |

Very Low Risk |

|

UnitedHealth |

97 |

Exceptional |

Very Low Risk |

|

Strong ESG Stocks |

86 |

Very Good |

Very Low Risk |

|

Foreign Dividend Stocks |

77 |

Good, Bordering On Very Good |

Low Risk |

|

Ultra SWANs |

74 |

Good |

Low Risk |

|

Dividend Aristocrats |

67 |

Above-Average (Bordering On Good) |

Low Risk |

|

Low Volatility Stocks |

65 |

Above-Average |

Low Risk |

|

Master List average |

61 |

Above-Average |

Low Risk |

|

Dividend Kings |

60 |

Above-Average |

Low Risk |

|

Hyper-Growth stocks |

59 |

Average, Bordering On Above-Average |

Medium Risk |

|

Dividend Champions |

55 |

Average |

Medium Risk |

|

Monthly Dividend Stocks |

41 |

Average |

Medium Risk |

(Source: DK Research Terminal)

UNH’s risk management is in the top 5% of the world’s best blue-chips, on part with the likes of:

-

Novartis (NVS): Ultra SWAN global aristocrat

-

Microsoft (MSFT): Ultra SWAN future aristocrat

-

Canadian National Railway (CNI): Ultra SWAN global aristocrat

-

Lockheed Martin (LMT): Ultra SWAN

-

Abbott Labs (ABT): Ultra SWAN dividend king

The bottom line is that all companies have risks, and UNH is exceptional at managing theirs, according to S&P.

How We Monitor UNH’s Risk Profile

-

28 analysts

-

four credit rating agencies

-

32 experts who collectively know this business better than anyone other than management

-

and the bond market for real-time fundamental risk-assessment

“When the facts change, I change my mind. What do you do, sir?” – John Maynard Keynes

There are no sacred cows at iREIT or Dividend Kings. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: UnitedHealth Is The Perfect Fast-Growing Ultra SWAN For This Recession

Dividend Kings Automated Investment Decision Tool

Let me be clear: I’m NOT calling the bottom in UNH (I’m not a market-timer).

Even Ultra SWANs and aristocrats can fall hard and fast in a bear market.

Fundamentals are all that determine safety and quality, and my recommendations.

-

over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

-

in the short term; luck is 25X as powerful as fundamentals

-

in the long term, fundamentals are 33X as powerful as luck

While I can’t predict the market in the short term, here’s what I can tell you about UNH.

-

Industry Leader in safety, quality, and scale.

-

very safe 1.5% yield (1.0% risk of a dividend cut in a severe recession), growing 13% to 16% long-term

-

14% to 15% long-term return potential vs. 10.2% S&P

-

historically 9% undervalued

-

18.7X earnings vs. 17 to 21X historical

-

13.4X cash-adjusted earnings (PEG 1, growth at a reasonable price)

-

140% consensus return potential over the next six years, 14% annually, 3X more than the S&P 500

-

About 100% better risk-adjusted expected returns than the S&P 500 over the next five years

UnitedHealth is one of the world’s greatest companies (top 2% of the world’s best blue-chips).

Its management is battle-tested and adaptable, and its A+ balance sheet is a fortress.

It’s the industry giant that everyone else is trying to keep up with.

It’s a business that is as close to recession-proof as you can get, literally growing at a positive rate in most recessions.

If you’re looking for a world-beater addition to the growth portion of a diversified portfolio, consider UNH.

If you want to buy one of the best Buffett-style “wonderful companies at a fair price,” they don’t come much better than UNH right now.

If you’re looking for safe and rapidly growing dividends in a recession, UNH’s 15% hike last week proves they don’t get much SWANier than 100% UnitedHealth and its 100% safety score.

This is a company built to last that will, barring Medicare-For-All, outlive us all and probably our grandchildren as well.

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Get My New Book For Free!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and we recently added Prop Tech SPACs to the lineup. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.