Summary:

- UnitedHealth Group is currently trading 12% below its all-time high and is undervalued by up to 30%.

- UNH has a history of strong stock price outperformance with low volatility and a well-covered dividend that has been steadily growing.

- The company’s business remains strong, with impressive revenue growth and a focus on expanding its care footprint and improving drug affordability.

pcess609

Introduction

I chose to go with a very bullish title. However, as usual, I refrain from using clickbait, as we’re dealing with a stock that fully warrants this title.

America’s largest healthcare plans corporation, UnitedHealth Group (NYSE:UNH), is currently trading 12% below its all-time high. While the company suffers from economic/interest rate uncertainties, its business remains strong.

Not only are core results convincing, but secular growth is likely to show promising results in the future, which would continue impressive historical growth.

UnitedHealth Group

On top of that, the company has an A(+)-rated balance sheet, it has a history of significant stock price outperformance with subdued volatility, and a well-covered dividend poised to keep growing at a strong, double-digit annual rate.

Even better, I believe that UNH shares are up to 30% undervalued, making the stock an attractive investment on stock market weakness for dividend growth investors and everyone interested in adding a defensive stock with tremendous long-term potential to their portfolios.

So, let’s dive into the details!

Low-Volatility Outperformance

In light of the start of the hurricane season, I found an interesting article that showed a concerning trend.

On August 28, the Wall Street Journal reported that an increasing number of people are skipping on their home insurance.

Wall Street Journal

According to the article (emphasis added):

Some skipping insurance say they are doing so because they can no longer afford the rising premiums. The national average for home insurance based on $250,000 in dwelling coverage increased this year to $1,428 annually, up 20% from 2022, according to Bankrate.

- At this point, 12% of homeowners in the U.S. have no homeowners insurance.

The only reason why I’m bringing this up in an article about a healthcare insurer is to emphasize the importance of buying companies with defensive characteristics – especially in the current challenging environment.

I think regardless of where you live, we’re all aware of rising premiums. Healthcare, car insurance, homeowners insurance, you name it, it’s all becoming more expensive.

In general, I’m not a huge fan of buying insurance companies. After all, it’s a highly competitive industry where it’s hard to build a moat.

UnitedHealth is different.

This company isn’t just a very anti-cyclical insurer, but it’s also the go-to place for defensive investments in this space.

For example, with a market cap of roughly $460 billion, it has a 9.2% weighting in the Health Care Select Sector SPDR ETF (XLV) and a mind-blowing track record.

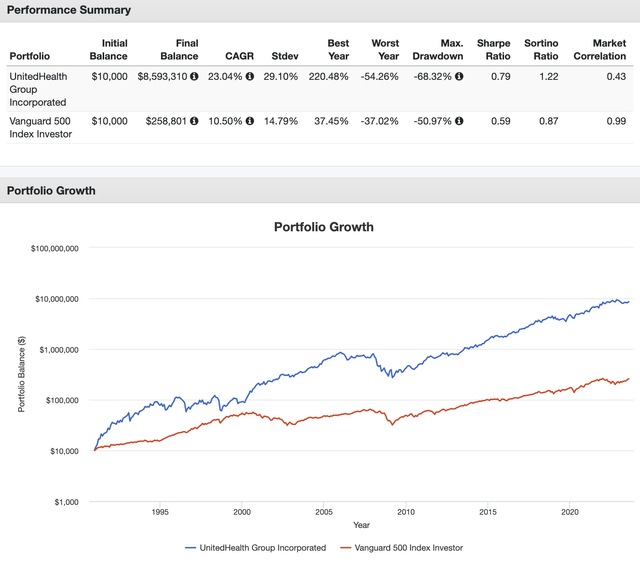

Since 1991, UNH shares have returned 23% per year, turning a $10,000 investment into $8.6 million! This includes reinvested dividends. The S&P 500 has returned 10.5% during this period, which isn’t bad either.

Portfolio Visualizer

Looking at the table above, we see that UNH was highly volatile during this period. The standard deviation was 29%, which is rather elevated.

However, this is mainly the result of the volatile years when the company was less mature.

Now, the company is very mature with subdued volatility. The good news is that it’s still outperforming.

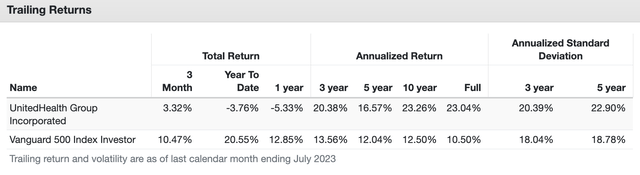

For example, over the past three years, UNH has returned 20.4% per year with a standard deviation of 20.4%. That’s just 240 basis points above the standard deviation of the S&P 500. Bear in mind that we’re comparing a single stock to a well-diversified basket of 500 stocks.

Portfolio Visualizer

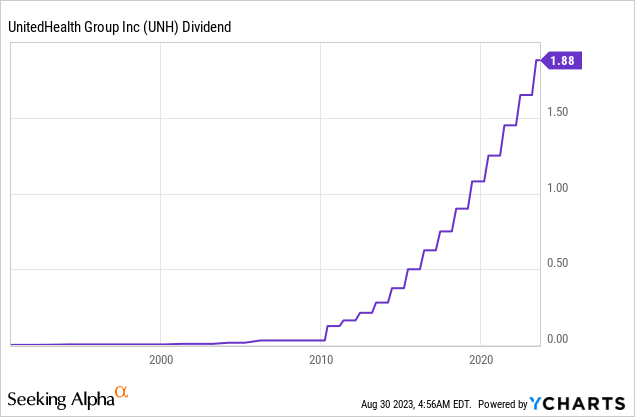

This fantastic performance also includes a steadily rising dividend.

A Steadily Rising Dividend

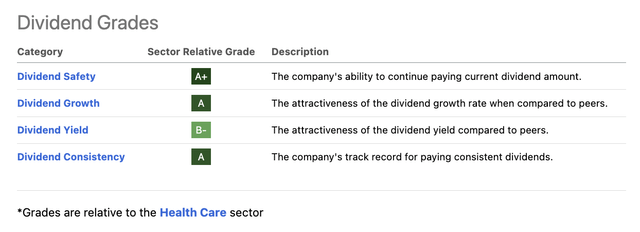

Looking at the company’s (Seeking Alpha) dividend scorecard, we see a sea of green.

Relative to the healthcare sector, the company scores very high on dividend safety, dividend growth, and consistency. Only its yield scores a B-.

Seeking Alpha

The company’s yield is the only drawdown here, as UNH shares yield just 1.5%. That’s not something to write home about.

However, the only reason why this yield is low is its stellar stock price performance, which generated tremendous wealth for investors who have been with UNH for many years.

Dividend growth is fine. More than fine, actually.

Over the past five years, the company has hiked its dividend by 16.7% per year – on average.

I also need to say that the company did not cut its dividend during the Great Financial Crisis. Since the recession, it has hiked its dividend every single year.

On June 7, the company announced a 13.9% hike.

Also, for what it’s worth, Morgan Stanley has the company in its dividend portfolio with an overweight rating.

Furthermore, this dividend is protected by a healthy balance sheet and loads of free cash flow.

The company hasn’t had a net leverage ratio of more than 1.0x since 2020. Next year, net debt is expected to fall to $23 billion, which would be less than 0.6x EBITDA. The company has an A+ credit rating, which is one of the best ratings on the market – in any sector.

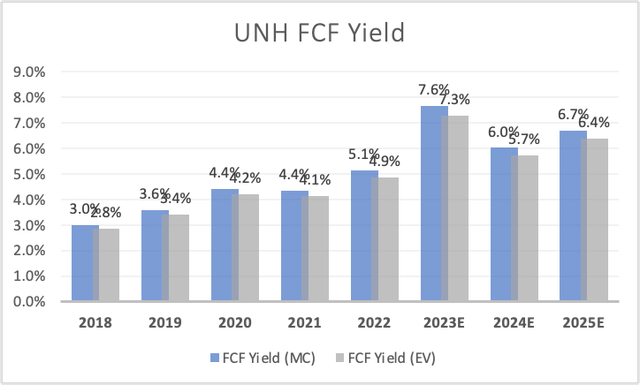

With regard to free cash flow, the company the company is expected to maintain a free cash flow yield exceeding 6%, which covers the 1.5% dividend with a wide margin.

Leo Nelissen (Based on analyst estimates)

As we can see in the chart above, the company is accelerating its free cash flow, which brings me to the next part of this article.

Beyond The Dividend – What To Make Of UNH

UnitedHealth is a well-known stock. I know that some of my readers have been shareholders for many years.

So, I’m not spending too much time on what UNH does to make money.

Essentially, the company operates two main business platforms: Optum and UnitedHealthcare.

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

UnitedHealthcare |

222,899 | 77.5 % | 249,741 | 77.0 % |

|

Optum Rx |

35,535 | 12.4 % | 38,837 | 12.0 % |

|

Optum Health |

24,831 | 8.6 % | 30,291 | 9.3 % |

|

Optum Insight |

4,332 | 1.5 % | 5,293 | 1.6 % |

The company’s mission is to improve people’s health and enhance the healthcare system’s performance.

UNG believes that these platforms work together to create a modern, high-performing health system that offers better access, affordability, outcomes, and experiences for individuals and organizations.

According to the company:

- Optum leverages clinical expertise, technology, and data to empower individuals, partners, and care providers to achieve better health. It serves a wide range of stakeholders, including payers, care providers, employers, governments, life sciences companies, and consumers.

- UnitedHealthcare offers a comprehensive range of health benefits, providing affordable coverage, simplified healthcare experiences, and access to high-quality care. Its services cater to various segments, including employers, Medicare beneficiaries, retirees, and state Medicaid and community programs.

This highly-regulated company is focused on a few pillars to grow on a long-term basis. These include value-based care and innovation. The company invests in expanding its care by focusing on home-based care, behavioral health, and seamless payment experiences.

In other words, incremental changes in an industry that needs continuing adjustments to changing economic/societal developments.

One of these developments is increasing efficiencies, which UNH aims to benefit from through the streamlining of payment processes and healthcare transaction efficiencies.

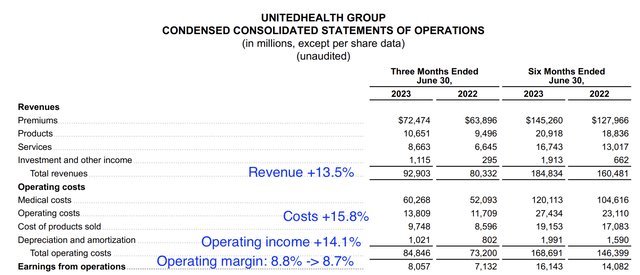

In light of these measures, the second quarter showed impressive results.

Revenue surged by 16% to $92.9 billion compared to the prior year. Both Optum and UnitedHealthcare contributed to this double-digit growth.

- OptumHealth’s revenue grew by 36% to $23.9 billion, driven by patient volume, complex needs, and expanded care services.

- OptumRx saw a 15% revenue growth to over $28 billion due to new customer acquisitions and strong performance in specialty, infusion, and community pharmacies.

- OptumInsight’s revenue grew by 42% to almost $4.7 billion, with a notable revenue backlog expansion to over $31 billion, partly attributed to the integration of Change Healthcare.

- UnitedHealthcare’s commercial business added nearly 500,000 people in the first half, while strong growth indicators are observed for the ’24 selling season and public sector programs.

UnitedHealth Group (Author annotations)

Having said that, while these efforts resulted in strong revenue growth, margins were down a bit in the quarter.

This is due to a number of reasons, including the company’s focus on more complex care, including behavioral care and seniors.

According to the company:

[…] the third area is a kind of, a good news story, but with short-term implication. So that’s really the growth of the membership that’s coming this year. As you know, we’ve grown very strongly this year, actually a little ahead of our expectations. We’ve also brought in a very significant number of complex patients as we invest in helping those folks manage their care better, that puts a little pressure on the margin in the short run. But that’s really laying super strong foundation stones, not just 4 million as we move through the year, but into ‘24, ‘25, ‘26. So those three elements, the senior trend piece, the behavioral piece, and then the effect of the strong growth is really what explains what goes on. We’re going to continue to lean into that growth very assertively. – UNH 2Q23 Earnings Call (emphasis added)

In other words, we’re dealing with a company that is sacrificing its margins a little bit to expand its care footprint. If the company is able to maintain stable margins going forward, this could pay off handsomely.

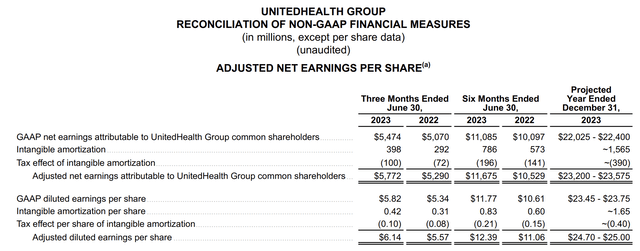

As a result, the company (favorably) narrowed its guidance. It now sees full-year adjusted diluted EPS of $24.70 to $25.00. In 1Q23, the lower range of this guidance was $24.50.

UnitedHealth Group

Going forward, the company will also focus on key issues to support top-line growth.

This includes drug affordability.

According to the company, its pharmacy benefit managers play a unique role in the drug supply chain, aiming to improve affordability for all stakeholders.

The company introduced the Price Edge feature, which identifies the lowest-cost medication options for patients, resulting in millions of dollars in customer savings.

So far, the company’s specialty medication management programs have led to potential savings of up to 20% on specialty drug costs.

UnitedHealth also introduced biosimilars as alternatives to costly medications, further expanding consumer choice and competition.

Going forward, I expect to see a lot more of this.

Valuation

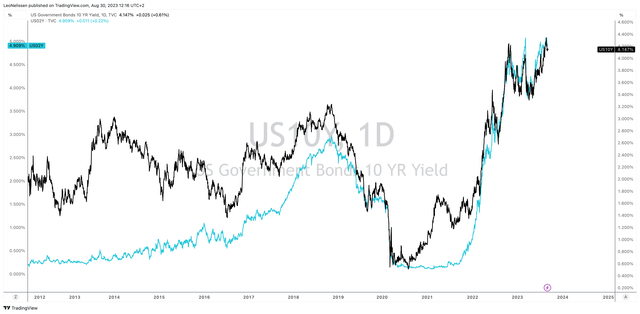

Excluding dividends, UNH shares have been unchanged since 4Q21. Like the market in general, the stock has run into resistance consisting of inflation fears, rising rates, and just poorer sentiment hurting stock prices.

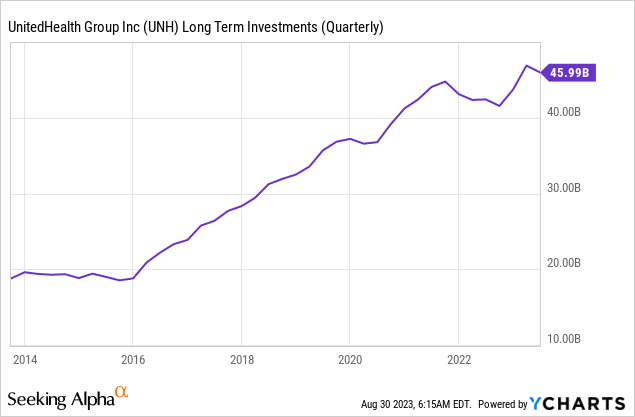

Rising rates, for example, make bonds relatively more attractive than stocks and pressure the balance sheets of insurers. After all, insurers invest proceeds instead of holding cash. Holding cash would just be irresponsible.

As of June 30, the company has roughly $46 billion in long-term investments and $42 billion in cash/equivalents.

Almost all of its investments are available-for-sale investments consisting of corporate debt state/municipal bonds and U.S. agency mortgage-backed securities.

Most of its debt has maturities of less than ten years.

While the surge in rates in the past few years was a net negative for UNH, I believe the worst is over. The risk/reward of debt – especially shorter-term government debt – seems to be attractive at these levels.

TradingView (US10Y, US02Y Yields)

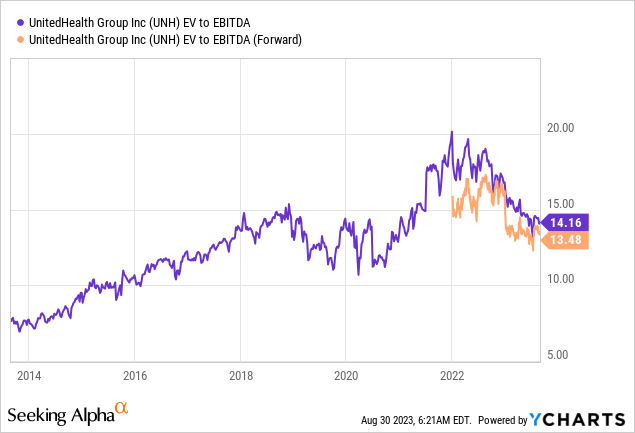

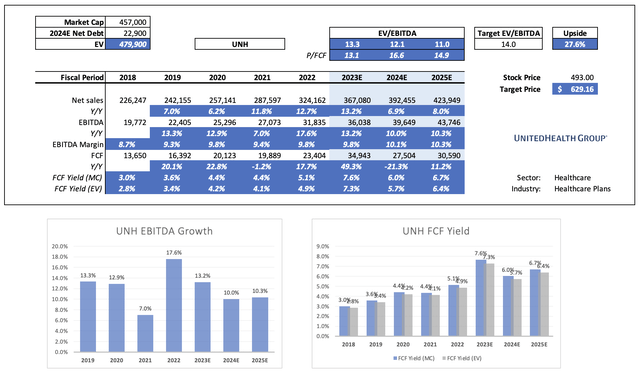

Having said that, when combining the company’s strong fundamental progress and somewhat poor stock price performance, we get a more than decent valuation.

Currently, UNH is trading at 13.5x NTM EBITDA, which is the cheapest valuation since the start of the pandemic.

Looking at the data below, the company is expected to keep growing its EBITDA at double-digit rates, which is truly impressive.

If we use next year’s net debt number without incorporating a further decline in net debt, the stock is trading at 11.0x 2025E EBITDA.

Bear in mind that the free cash flow yield is so high that aggressive net debt reduction is likely. So, there’s a margin of safety here.

If we apply a 14x long-term EBITDA multiple, the company is roughly 27-30% undervalued.

Leo Nelissen (Based on analyst estimates)

The current consensus price target is $573, which is 16% above the current price.

This makes me above-average bullish, although I need to add that I have a 2-3 year view, which could come with elevated mid-term volatility, as the Fed is trying to initiate a soft landing, which I believe might fail.

In other words, I believe that UNH is a great long-term investment that can be accumulated on weakness.

Takeaway

Despite economic uncertainties, UnitedHealth’s strong fundamentals and defensive profile make it a compelling option.

UNH’s A(+)-rated balance sheet, impressive historical/expected growth, and steady dividend growth underscore its stability.

Trading below its implied fair value, the stock is up to 30% undervalued and offers a strategic opportunity for dividend growth investors seeking long-term potential.

Its resilience during turbulent times, low-volatility outperformance, and commitment to effective incremental growth set it apart even further.

As rising insurance costs become a reality, UNH shines as a beacon of stability in a challenging environment.

With a 2-3 year outlook, I view UNH as a solid long-term investment worthy to be bought on weakness.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.