Summary:

- UnitedHealth Group Inc.’s first-quarter earnings report might settle lower than anticipated as prices on long-term solutions have softened. Moreover, related costs are known for being sticky.

- Solid growth from Optum Health and OptumRx has likely been sustained during the past quarter. However, slower enterprise spending presents a worry line for Optum Insights.

- The company has a rich history of beating earnings estimates, and its cash-based earnings exceeded its accrual-based income in 2022. Nevertheless, a build-up in net unpaid claims conveys increased risk.

- In our view, UnitedHealth’s Q1 report might be the most uncertain in recent history. Additionally, the stock is overvalued relative to its normalized price multiples.

- We urge investors to be careful ahead of UnitedHealth’s first-quarter report.

Wolterk

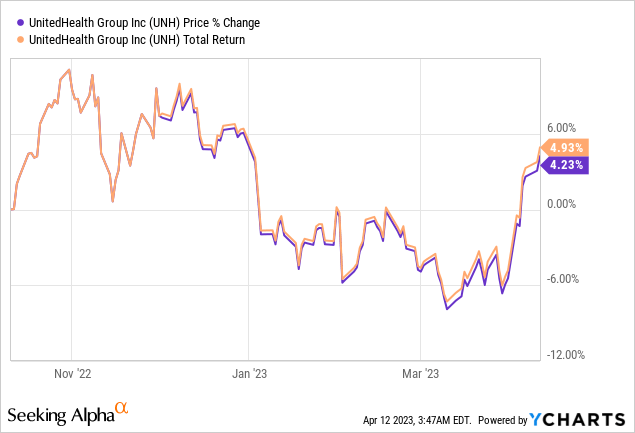

UnitedHealth Group Incorporated (NYSE:UNH) is set to release its first-quarter earnings results before trading opens on Friday, the 14th. Wall Street anticipates that the company will reveal a quarterly earnings increase with an average earnings-per-share target of $5.83 set by analysts.

With all else equal, UnitedHealth may add to its near 4.93% 6-month total return if the firm’s earnings target is realized. However, the question remains: Will UnitedHealth’s Q1 report live up to expectations? Let us delve into a deeper discussion to find out.

Operational Review

To best formulate what can be expected from UnitedHealth’s Q1 report, we reviewed its previous earnings report/s and interpolated its/their results by incorporating interim market-based events.

General Outlook and United HealthCare

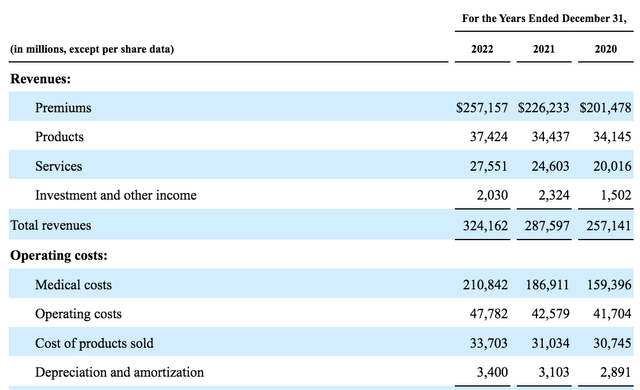

Unlike many other life and health providers, UnitedHealth generates most of its revenue from premiums and an almost negligible amount from investments. Moreover, the company offers various products and services spanning from pharmacy-related business to data and analytics.

UnitedHealth’s premiums revenue has grown steadily in the past two years as it has benefitted from higher-than-normal pricing. However, health and medical insurance prices have softened since the turn of the year, which was bound to happen as cyclicality played its hand. L&H premiums are less cyclical than property and casualty prices; however, they oscillate due to the industry’s competitive landscape.

Although premiums-based income may land softer for UnitedHealth, its underwriting expenses might take time to follow the same trajectory. The firm sells much of its contracts in-house, which generally adds to fixed costs, meaning that downward reversion is sticky. The enterprise’s income statement confirms my statement as it reveals that the company’s costs lagged its sales to the upside during the past two years, and the same is likely to happen to the downside.

Optum, Services, and Products

In terms of services, it is anticipated that UnitedHealth’s prescription retail unit, Optum RX, will expand its revenue between 5% and 8% over the next few years while sealing operating margins of 3% to 5%. The segment, which is considered a catalyst for renewed growth, proliferated by approximately 16.48% in its latest fiscal year, and we think that growth could resume in the next few quarters, given the segment’s impressive 21% market share.

Furthermore, UnitedHealth expects its at-home healthcare segment, Optum Health, to surge at double-digit numbers for the foreseeable future, with operating margins forecasted to settle between 8% and 10%. As this is an early-stage growth unit with little fixed costs, we anticipate the division’s Q1 results to come in strong.

Optum Insights is a secular growth business possessing cost benefits, and operating margins are forecasted to land between 18% and 20% in the next few years. Although its secular growth trend will likely lead to strong Q1 results, we would like to stress the fact that the business owns a market share of merely 0.68% and that enterprise spending has most likely stagnated during the uncertain macroeconomic environment in early 2023, which resulted in mass layoffs across industries, including the health care sector. Sure, a projected segmental revenue backlog of nearly $29 billion exists, but we need to consider the possibility of lower interim growth.

Deferred Accounting and Technical Metrics

The Good

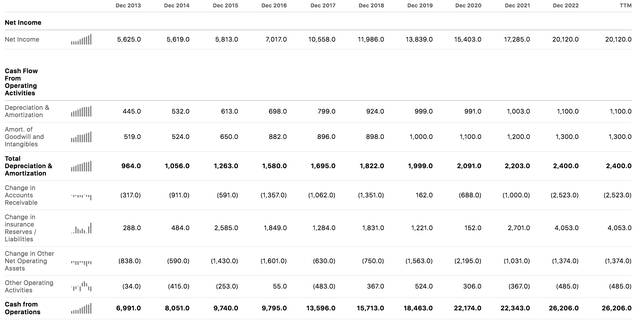

UnitedHealth’s latest fiscal results showed that the company’s operating cash flows outweighed its net income by approximately $6 billion, which is a positive sign as it suggests the firm has negative accruals. Accruals and cash-based earnings are expected to converge at some stage, lending the argument that UnitedHealth could bump up its future earnings purely due to income statement adjustments.

Although the company’s cash from investing activities is at roughly (-)$28 billion, UnitedHealth’s investments have primarily been geared toward acquisitions and CapEx. Therefore, we do not consider the figure to have a core effect on accruals.

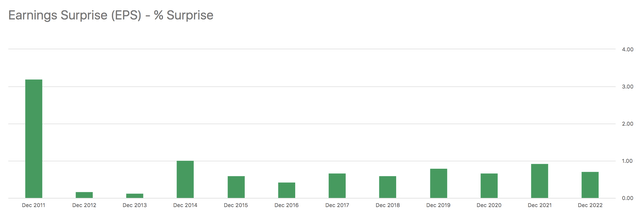

Furthermore, UnitedHealth owns a long history of beating its earnings-per-share target. Although it is a simple observation, past earnings beats enhance the probability of future earnings beats, lending a company’s stock with a premise for long-term price momentum.

UNH’s Past Earnings (Seeking Alpha)

The Bad

Despite its solid financial status, UnitedHealth’s balance sheet and profit and loss statements possess a few faultlines. Firstly, the firm’s unpaid claims have grown linearly in the past ten years. UnitedHealth’s unpaid claims to unearned premiums ratio stands at roughly 9.66, which is worrying to see. Sure, the firm’s premiums are earned in the short term, and its claims are amortized over multiple years; however, a consistent build-up of liabilities suggests that UnitedHealth’s risk profile is increasing.

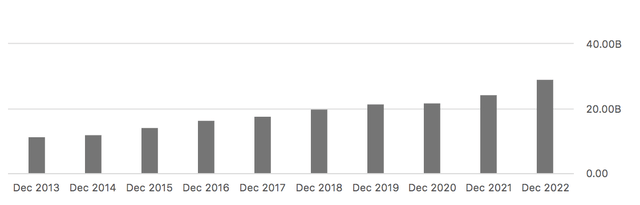

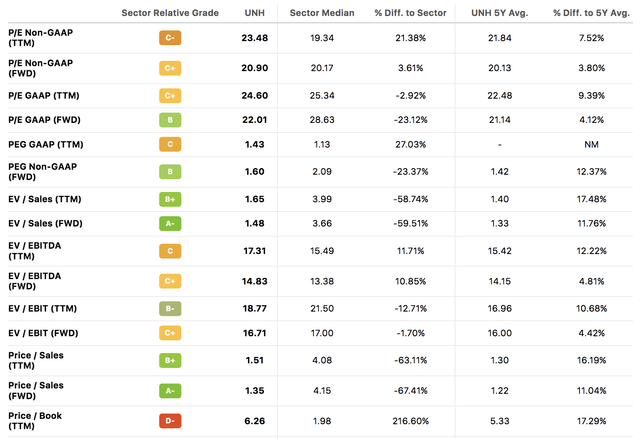

UnitedHealth’s forward dividend yield of 1.27% is supported by 13 years of retrospective growth. Moreover, the stock has experienced price returns of 7.67x in the past ten years, implying that it is a constant return asset. However, as things stand, most of UnitedHealth’s primary price multiples are above their normalized averages, suggesting that a price correction might be in the offing.

Valuation Scorecard (Seeking Alpha)

Final Word

Based on our analysis, UnitedHealth might have experienced slower-than-anticipated growth in Q1, which might lead to an unfavorable earnings report. Prices on life and health offerings have softened since the turn of the year, and related expenses are known for being sticky.

Furthermore, broad-based enterprise spending has curtailed in the earlier stages of the year amid fears of a recession, which might influence the company’s Optum Insights segment. Although we expect stability from OptumRx, and OptumHealth, slower interim growth is not out of the question.

UnitedHealth’s financial statements show negative accruals, which is encouraging to see. However, an exponential build-up in unpaid claims is unmatched by unearned premiums, indicating that the firm’s balance sheet is hosting more risk than before.

The company has a rich history of beating earnings estimates. Therefore, we are not encouraging investors to bet against UnitedHealth’s Q1 report. Instead, we urge investors to avoid throwing caution to the wind.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>