Summary:

- UnitedHealth Group has been one of the best-performing compounders in the past decade.

- Optum is a major differentiator and should continue to drive growth moving forward, especially after the acquisition of Change Healthcare.

- The latest earnings were excellent with double-digit growth in both the top and the bottom line, driven by Optum.

- I rate the company as a buy.

JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

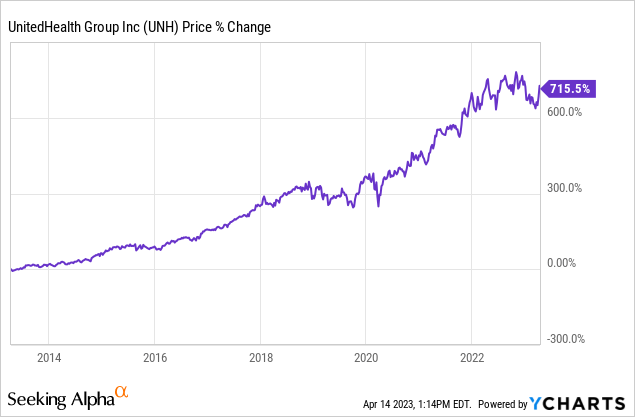

UnitedHealth Group (NYSE:UNH) has been one of the best-performing large-cap companies in the past decade with shares up over 700%, significantly outpacing the broader indexes. Besides yielding a high return, the company also has a low beta which translates to minimal volatility.

Optum continues to be the major highlight of UnitedHealth. The subsidiary differentiates the company from other healthcare providers as it diversifies the revenue stream through other services and helps generate stronger growth rates. Its first-quarter earnings remain outstanding with double digits growth in both the top and the bottom line, as Optum continues to see strong momentum. The current valuation is also very reasonable considering its superb prospect and growth. I believe the company will continue to outperform, and I rate UNH stock as a buy.

Optum As A Growth Driver

I want to talk a bit about Optum in this article. While investors may not pay much attention to it, it is one of if not the most important asset and growth drivers of UnitedHealth. The subsidiary was founded back in 2011 and is divided into three main segments including Optum Insight, Optum Health, and Optum RX.

Optum Health delivers patient-centered care through in-clinic, in-home, and digital clinical platform services. Optum Insights specializes in technology-enabled services and analytics, while Optum RX provides different pharmacy services such as price comparison. Optum has been growing rapidly, it accounted for roughly 26.9% of revenue in Q1 2012 and the number has already grown to 58.8% in the latest quarter.

What makes Optum compelling is its heavy emphasis on technology and innovation. In my opinion, it can somewhat even be considered the healthcare technology division of UnitedHealth. The pace of digital transformation has been accelerating rapidly, especially in the healthcare industry as the pandemic in 2020 drastically changed our behaviors. Digital health presents a massive growth opportunity as its TAM (total addressable market) is expected to reach $1.5 trillion by 2030 with a strong CAGR (compounded annual growth rate) of 27.4%, according to Bloomberg. The expansion of the market should provide ongoing tailwinds for the segment.

In early 2021, the company acquired Change Healthcare for a hefty $13 billion, which went on and merge with Optum Insights after closing late last year. Change Healthcare is a healthcare technology company that specializes in payments & revenue cycle management, patient engagement, and data & analytics. I really like the acquisition as it further increases the company’s presence in the fast-growing digital health market.

The combination should be highly synergetic as Change Healthcare is able to bring more comprehensive technology solutions to Optum Insights, and also expand the product breadth of the segment. I believe Optum, especially Optum Insights is well-positioned to benefit from the rise of digital health and should continue to drive growth.

Impressive Q1 Earnings

UnitedHealth Group just announced its first-quarter earnings and the results are very solid considering the current economic backdrop. The company reported revenue of $91.9 billion, up 15% YoY (year over year) compared to $80.1 billion. The growth is mainly attributed to the outstanding performance of Optum, which grew 25% YoY from $43.3 billion to $54.1 billion.

Optum Health led the segment with revenue growth of 37.7%, as the penetration of value-based care continues to increase. The backlog of Optum Insight also grew 35.7% to $30.7 billion, mostly driven by the contribution from Change Healthcare. Optum RX grew 15% to $27.4 billion, as it expanded its customer base and pharmacy offerings. The number of scripts grew 7.4% from 352 million to 378 million.

The UnitedHealthcare segment was slightly softer but still recorded double-digit growth of 13%, up from $62.6 billion to $70.5 billion. The number of total customers increased by nearly 2 million and the medical care ratio was 82.2% compared to 80% in the prior year.

Bottom-line growth continues to outpace the top line thanks to outstanding cost control and ongoing share buybacks. Despite inflationary pressure, operating costs as a percentage of revenue declined 30 basis points from 91.4% to 91.1%. This resulted in operating income increasing 16.4% YoY from $6.95 billion to $8.09 billion. The operating margin edged up 10 basis points from 8.7% to 8.8%. The diluted EPS was $6.26 compared to $5.49, up 14% YoY. This was partially dragged down by higher interest expenses and income taxes. The company repurchased $2 billion worth of shares during the quarter.

Investor Takeaway

I believe UnitedHealth Group currently presents a compelling buying opportunity. Optum is still seeing strong momentum, especially after new acquisitions, and should continue to be the major growth driver in the long run. Its strength is shown in the latest earnings, which led to impressive growth rates despite facing a tough macro backdrop. The company’s current EV/EBITDA ratio of 16.6x seems very reasonable considering its best-in-class fundamentals and long-term double digits growth rates. It should also be a great holding during the current volatile economy, as its business is highly defensive and non-discretionary, which should show strong resilience regardless of macro headwinds. Therefore I rate the company as a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.