Summary:

- UnitedHealth’s Q3 earnings, released yesterday, revealed significant challenges, including rising healthcare costs and reduced rate increases, impacting profitability and leading to an 8% stock drop.

- Medicare Advantage headwinds and increased medical benefit ratios are squeezing margins, making the business less profitable than a year ago.

- The company has struggled with implementing value-based care, which was supposed to reduce costs but hasn’t yet delivered the expected savings.

- Despite long-term growth optimism, the issues are likely to persist, prompting a downgrade from “buy” to “hold” as share prices of MA exposed health insurers may suffer for years.

mokee81/iStock via Getty Images

Investment Overview

UnitedHealth Group (NYSE:UNH), the world’s third-largest healthcare company by market cap valuation (at the time of writing, at least) and the only healthcare company besides Eli Lilly (LLY), and Denmark’s Novo Nordisk (NVO) to enjoy a valuation over $500bn, announced its Q3 earnings yesterday.

I last covered UnitedHealth for Seeking Alpha after its Q2 earnings, and three issues led the agenda – the recent cyberattack on its Change Healthcare prescription business, the uncertainty surrounding Medicare Advantage healthcare plan pricing and rates – an industry UnitedHealth is heavily exposed to – and the sale of the company’s South American operations.

In a sense, all three issues had positive outcomes during Q2, with the full-year impact of the Change Healthcare issues apparently capped at $1.90-$2.05 per share, the cost of the South America divestitures estimated at ~$1.3bn, and management seeming “quietly confident” (my phrase from July) that it had the right strategy in place for its MA business, and reporting no “unexpected increases in medical care expenses during the quarter”.

In Q3, however, the Medicare Advantage headwinds have buffeted earnings more severely, and the market has responded by selling UnitedHealth stock, which was down 8% at the end of yesterday, finishing at $556 per share, having begun the day at ~$605.

Before we take a fresh look at this surprisingly challenging market, let’s quickly run through the headline figures.

UnitedHealth – Key Figures from Q3 Earnings

UnitedHealth posted revenue of $100.8bn in Q3, up from $98.9bn in Q2, and up from $92.4bn in Q3 2023, a rise of ~9%. Earnings from operations on a GAAP basis were $8.7bn, for a net margin of 6%, or, on an adjusted basis, $9bn, for a margin of 6.3%. The difference between GAAP and adjusted is the hit of $0.3bn from the Change Healthcare cyberattack. GAAP net margin was 6.3% in Q3 2023.

UnitedHealth’s Optum business – Optum works with payers, care providers, employers, governments, life sciences companies and consumers to “optimize care quality” – earned $63.9bn of revenues, up from $56.7bn in Q3 2023 – a raise of ~13%. Earnings from operations were $4.5bn, for a net margin of 7%, or, on an adjusted basis, $4.8bn, a margin of 7.4%. Margin in Q3 2023 was 6.9%, on $3.9bn of earnings. Once again, Change Healthcare accounts for the difference between GAAP and adjusted.

Optum RX’s performance was especially noteworthy, this division growing revenue by $5.4bn, to $34.2bn, which “reflects new customers served, deepened relationships with existing clients and the expansion of its comprehensive pharmacy services offerings”. Script volume grew to ~410m, from 380m in the prior year period.

So far so good, however, this is not the fundamentally problematic area of UnitedHealth’s business. That would be UnitedHealthcare, which “provides health care benefits globally, serving individuals and employers, and Medicare and Medicaid beneficiaries”.

This business delivered revenues of $74.9bn, up 7% year-on-year, however earnings from operations came to $4.2bn, versus $4.6bn in the prior year quarter, a fall of 9%, resulting in a margin of 5.6%, versus 6.6% in the prior year. The medical benefit ratio – essentially the percentage of premiums taken in that is spent on administering care – rose to 85.2%, up from 82.3% in the prior year, and up from 85.1% in Q2.

On a more positive note, UnitedHealth reported it had “returned $9.6 billion to shareholders via dividends and share repurchase”. The current dividend pays $2.10 per quarter, resulting in a current yield of 1.39%.

On a more negative note, management advised that full-year earnings per share [EPS] guidance had been “narrowed” to $27.50-$27.75 per share, to “reflect business disruption impacts and the care patterns”. GAAP EPS in 2023 was $24.12, and the GAAP EPS forecast for 2024 is $15.50 to $15.75.

While adjusted earnings per share across the first nine months of 2024 is reported as $20.85, versus $18.95 in 2023, on a GAAP basis, the figure is $9.53, versus $18.01 in 2023.

Analysis – United (Finally) Feeling The Health Insurance Pinch

During the Q3 earnings call with analysts, UnitedHealth CEO Andrew Witty reiterated management’s “13% to 16% long-term growth objective”, commenting:

We will balance our commitments to investing in the promising future before us with managing the known and potential challenges. We remain highly optimistic for the future, even as we are respectful of the pressures the sector faces again next year.

The pressure the CEO refers to primarily affects the UnitedHealthcare business, although given the Optum business essentially oils the wheels of the insurance business, the entire of UnitedHealth’s business is affected by this pressure, which management hopes will be short term, as company President and Chief Financial Officer John Rex suggested on the call:

Certain care patterns persisted at higher levels than we expected in the period for three specific, and we believe primarily transitory, reasons, two of which we noted last quarter.

The first issue relates to a “pronounced upshift in coding intensity by hospitals”, the second to “continued timing mismatch between the current health status of Medicaid members and state rate updates”, and the third was a “rapid acceleration in the prescribing of certain high-cost specialty medications”.

In fact, we can sum up all three all issues as follows: UnitedHealth has been blindsided by the rising cost of administering its plan member’s healthcare.

Hospitals are recommending more surgeries, consultations, and overnight stays than UnitedHealth anticipated, the state is paying less to UnitedHealth to administer plans than UnitedHealth expected it would do, and medicines are more expensive than UnitedHealth anticipated.

This primarily affects UnitedHealth’s Medicare Advantage business – defined as follows in a recent government pamphlet:

- A Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage.

- These “bundled” plans include Part A, Part B, and usually Part D.

- In many cases, you can only use doctors who are in the plan’s network.

- In many cases, you may need to get approval from your plan before it covers certain drugs or services.

- Plans may have lower or higher out-of-pocket costs than Original Medicare and you may also have an additional premium.

- Plans may offer some extra benefits that Original Medicare doesn’t cover – like certain vision, hearing, and dental services.

The Centers for Medicaid and Medicare [CMS] calculate how much they will pay the private insurer for administering these plans each year, and the private insurer is essentially allowed to pocket the difference between what it is paid by CMS, and how much it actually spends per patient, per plan. Bonuses are also awarded by CMS for any plans rated four stars or higher.

UnitedHealth, with close to 13m members, controls around 20% of the Medicare Advantage market, with CVS Health and Humana having the second and third-highest memberships. Medicare Advantage was, at first, a highly profitable business for these companies, but in 2023 the CMS began to push back, believing that too much taxpayer’s money ended up in the pockets of health insurers.

The annual rate increase the CMS introduced earlier this year, of 3.7%, stunned UnitedHealth, CVS and Humana, who interpreted it as a rate cut given rising costs of healthcare and increased utilization among patients. Their healthy profit margins were essentially wiped out in 2023, and the business is becoming more of a liability than a benefit.

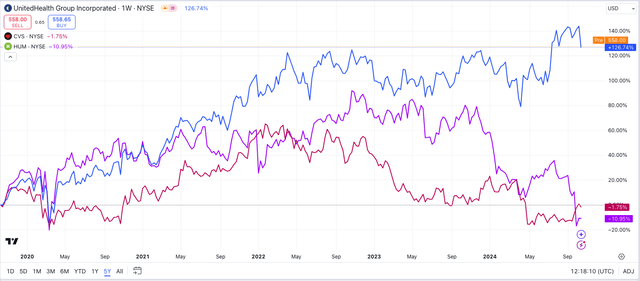

share prices of UNH, CVS, HUM compared (TradingView)

As we can see above, the share prices of UnitedHealth, CVS and Humana were buoyant between 2020 -2022, but CVS and Humana’s began to slip in 2023, and the pain has only intensified in 2024.

UnitedHealth initially looked as though it had anticipated the market dynamics better than its rivals, and did not seem to be affected by lower rate rises, or the danger that some of its plans may lose their four star or higher rating and no longer be eligible for bonuses.

The bubble now seems to have burst for UnitedHealth also, however, based on yesterday’s earnings, which show that UnitedHealthcare is now substantially less profitable than it was one year ago.

The Value-Based Care Conundrum

“Value-Based Care” was supposed to be the phenomenon that made health insurers’ MA businesses profitable. The idea is that, as opposed to “fee for service” where the health insurer pays all of a patient’s medical bills and hopes they come to less than the premium received, the health insurer takes a vested interest in holistically managing a patient’s healthcare, keeping them healthier. As CEO Witty commented on yesterday’s earnings call:

People served by OptumHealth’s value-based care models are more likely to receive cancer screenings and be in better control of their diabetes and hypertension than people in fee for service in Medicare and 10% less likely to visit the emergency room or be re-admitted to hospital program.

One example of the impact of better care coordination is our emergency room space discharge program, which helps patients who may be at risk for unnecessary and expensive ER use and readmissions.

UnitedHealth’s interest in its patients’ welfare is not completely altruistic – keeping patients away from doctors and out of hospitals results in massive cost savings to the health insurer, and keeps profit margins bulging.

UnitedHealth, CVS and Humana have all invested tens of billions in making “value-based care” work, and it seems to me that the CMS is essentially telling these companies – “you promised to reduce healthcare costs with VBC, so now it’s time to show us how well it works. We will kick things off by paying you less per plan”.

It is a gutsy call that seems to have blindsided the health insurers, who may have viewed VBC more as a marketing ploy than an actual business plan, believing rate rises, not cost savings, would keep the MA business profitable. Now, they are being forced to make VBC work, and the early signs are that it isn’t working, which is panicking the market.

UnitedHealthcare reported that it added 2.4 members in Q3, which represents strong growth for the top line, but now there is no guarantee that top line growth will trickle down to the bottom line – the higher the medical benefit ratio [MBR] climbs, the less profitable UnitedHealth becomes.

If UnitedHealth wants to keep patients out of hospitals, hospitals are likely to respond by charging patients more when they do have to visit. If UnitedHealth wants patients to use less medications, pharma companies are likely to respond by pushing up the prices of medications. If UnitedHealth tells the CMS it can use VBC to keep costs down, the CMS will respond by reducing rate rises.

In summary, UnitedHealth finds itself in a “Catch 22” situation, or “hoisted by its own petard”.

Final Thoughts On Q3 Earnings – These Headwinds Are here To Stay – The Current Dip Is An Unlikely Buying Opportunity

Despite expressing surprise at the issues it is facing – Witty told analysts on the earnings call that “we are clearly in an unusual situation right now in terms of the various pressures that we’ve seen” – the reality is that UnitedHealth, CVS and Humana ought to have seen these issues coming, and failed to do so.

These issues – rising costs of healthcare utilization, versus a reduction in rate rises – were supposed to be solved by “value-based care”, but health insurers have not been able to implement VBC fast enough, or, a worst-case scenario, VBC may not actually work.

UnitedHealth frequently talks about using AI and sophisticated new technology from its Optum insights division to achieve substantial cost savings, but this is also the company that failed to implement two-factor authentication within its Change Healthcare business and ended up being hacked, and forced to pay a ransom – as such, would you trust this company to manage your healthcare with AI?

UnitedHealth warned yesterday that the issues it faces will continue to hurt the business in 2025. After an analyst posed a question asking why growth in 2025 (management has set an EPS target of $30 in 2025) would likely be closer to 8% than the 13-16% promised by management, CEO Witty responded:

What we mustn’t do is pull away from investing in what’s going to drive the future of this organization over the next decade. What does that mean? That means, really making sure we’re investing in filling out and continuing to build out our value-based care platforms. It means really leaning into taking advantage of the technology opportunities, which now exist in reality.

What this tells me is that United is not viewing the growing lack of profitability in the MA markets as a temporary problem, but one that may take up to a decade to resolve.

Much of the impressive 140% rise in UnitedHealth’s share price across the past five years has been underpinned by the markets’ belief that Medicare Advantage would become the most dominant, and profitable form of healthcare insurance available, and with its commanding market share, UnitedHealth would be set to profit substantially.

That thesis is not quite dead yet, but the market is clearly losing faith, and insurers do not have a quick fix.

As such, after Q3 earnings, I would not conclude that the downward share price correction is temporary, and not view this as a buying opportunity. I am downgrading my rating on UnitedHealth from a “buy”, to a “hold”, because although I continue to believe many of the problems the MA industry has created for itself are temporary, I suspect they may take several years to resolve, and in the meantime, share prices are going to suffer.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.