Summary:

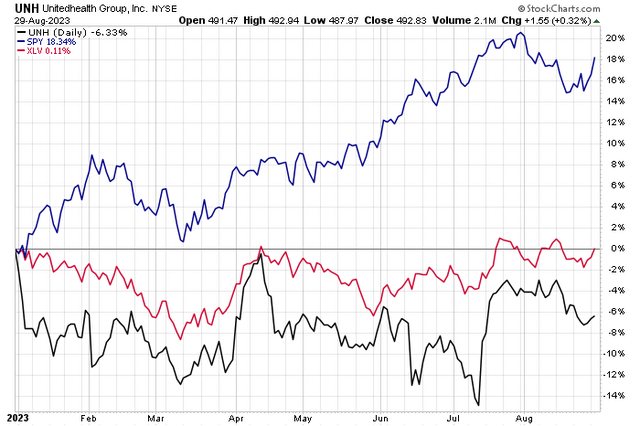

- The S&P 500 is up 18% on the year, but the Health Care sector is flat.

- UnitedHealth Group has been dragging down the sector and has a hold rating due to valuation and technical risks.

- UNH has strong growth prospects and a slightly cheap valuation, but the chart shows bearish patterns and poor relative strength.

- I outline key price levels to watch ahead of its October earnings release.

jetcityimage

The S&P 500 is up 18% on the year, when including dividends. That is a healthy return, but the Health Care sector is merely at the flat line. With shares of Eli Lilly (LLY) surging since March, if you back out that stock, then the sector is in the red. UnitedHealth Group (NYSE:UNH) has been dragging on the defensive sector, and the largest weight in the Dow Jones Industrial Average has done few favors for the large-cap blue chips despite a solid earnings-related jump in July.

I have a hold rating on UNH. I like the growth outlook, but the valuation is just mildly compelling, while its technical situation features risks that I will detail.

UNH, XLV Weaker Than SPY In 2023

According to Bank of America Global Research, UnitedHealth Group is one of the largest Managed Care Organizations (MCOs), serving members both in the US and internationally. UNH is the most diversified payer, either by product line, geography, or customer type. The company’s operating segments include United Healthcare, OptumRx, OptumInsight, and OptumHealth.

The Minnesota-based $457 billion market cap Managed Health Care industry company within the Health Care sector trades at a slightly elevated 22.1 trailing 12-month GAAP price-to-earnings ratio and pays a near-market 1.5% dividend rate. UNH is one of the early Q3 earnings reporters, and its current implied volatility is modest at just 17.5%, while the stock carries a low short interest of 0.7% as of August 29, 2023.

Back in July, UNH reported a strong Q2 with operating EPS of $6.14, which topped estimates of just $5.98, while it grew its top line by 16% year-on-year. Revenue verified at $92.9 billion, a nearly $2 billion beat. A modestly better-than-expected Medical Loss Ratio (MLR) supported strong overall results and the management team raised guidance, helping to assuage investors’ concerns about the profitability picture. Higher investment income also contributed to the bottom-line beat. What to watch for going forward is healthcare utilization rates, but long-term earnings growth should stem from its healthcare services area despite near-term pricing pressures. A concern was a drop in its net margin from 6.3% to 5.9%.

Potential risks for the stock include the possibility of rising healthcare utilization, leading to higher costs. Also, the growth targets set by Optum could be too lofty. Of course, regulatory and political factors could turn more challenging in the years ahead. The company does have strong scaling power and Optum offers a unique growth avenue that could drive upside potential, however.

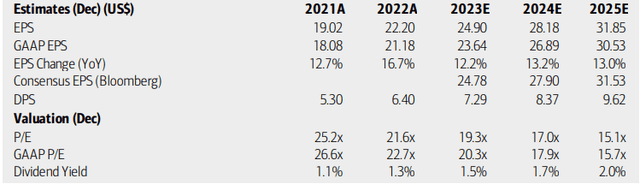

On valuation, analysts at BofA see earnings climbing at a robust pace through 2025, in the low double digits, with operating EPS seen as topping $31 by 2025. The Bloomberg consensus forecast is about on par with what BofA projects. Dividends, meanwhile, are seen as climbing quickly as well – should the share price remain where it is today, then the dividend rate would hit 2% by 2025. The biggest component in the Dow features a near-market forward non-GAAP P/E, which is attractive on the surface.

UnitedHealth Group: Earnings, Valuation, Dividend Yield Forecasts

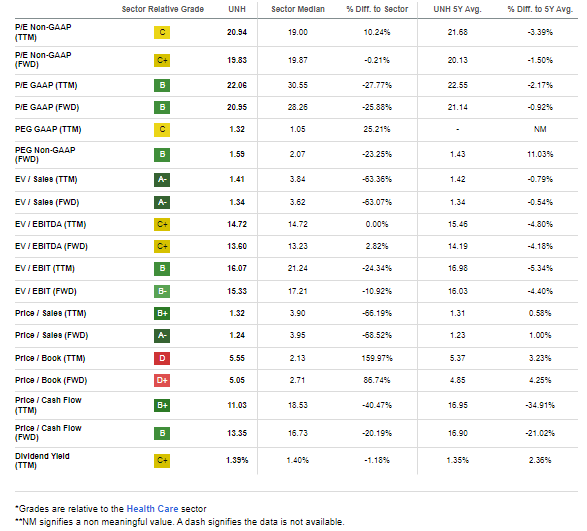

Looking closer at the valuation, UNH trades near its 5-year average forward non-GAAP P/E ratio, but considering the 13% growth rate over the coming years, the estimated PEG ratio is under 1.6, below the S&P 500 1.9 figure. While attractive on an absolute basis, that is actually at a premium to its LTA. If we assume normalized EPS of $25 over the coming 12 months and apply a 21 P/E, then we are talking about a share price fair value near $525, making the stock just slightly to the cheap side. With free cash flow per share at $41, that’s a very impressive 8%+ free cash flow yield. In my view, that tilts the scale in favor of a slight buy rating on valuation, but we must look at other determinants.

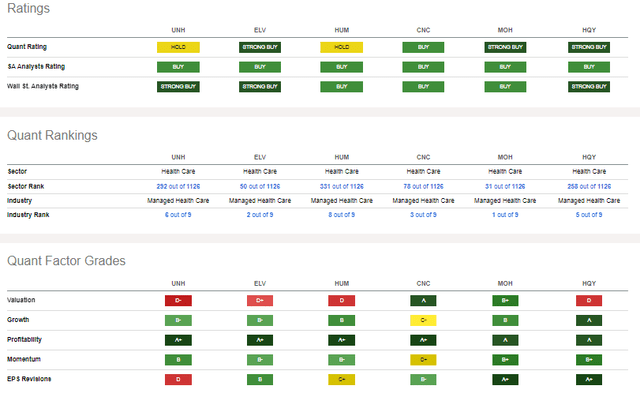

UNH: Valuation Slightly Cheap, But Near Long-Term Average Multiples

Seeking Alpha

Compared to its peers, UNH features comparable growth prospects and strong profitability trends. Its share price momentum is also solid, but I will note later that there are some concerns from a price action perspective. A concern is that analysts’ EPS revisions are not ideal with UNH, so the upcoming Q3 report is all the more important.

Competitor Comparison

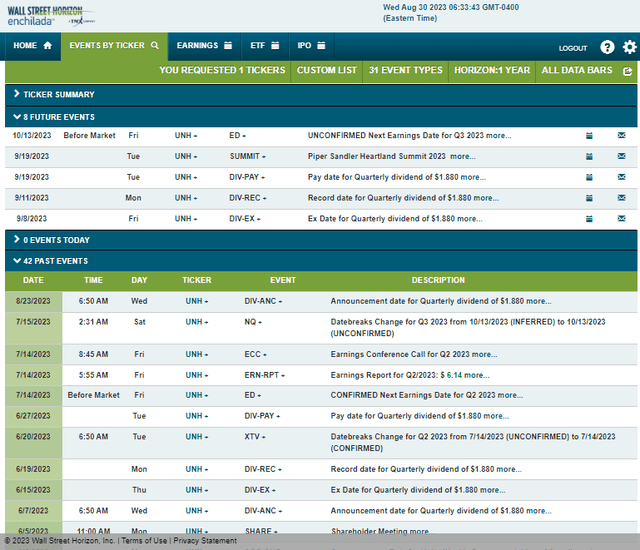

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3, 2023 earnings date of Friday, October 13 BMO. Before that, there could be some share price volatility from September 19 to 20 at the Piper Sandler Heartland Summit at which UNH’s management team is expected to present. The stock trades ex-dividend on Friday, September 8.

Corporate Event Calendar

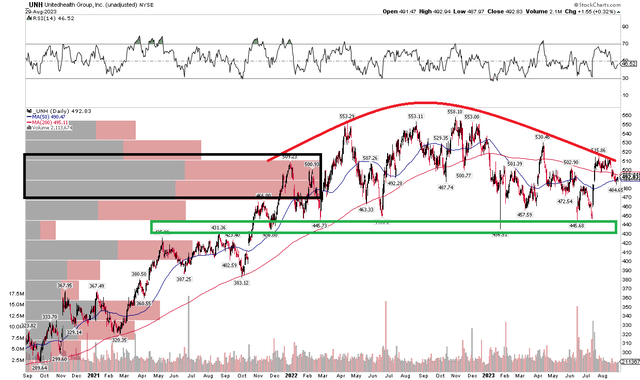

The Technical Take

With a favorable EPS growth trajectory and a valuation that is slightly on the bargain side, the chart has some risks. Notice in the graph below that UNH is putting in a bearish rounded top pattern. I see key support in the $430 to $450 range, while resistance is at $515 – the high from just a handful of weeks ago. What also makes for tough slogging for the bulls is that any further downside could be a high area of volume by price above the share price – evidenced by the horizontal bars on the left side of the chart.

Momentum, meanwhile, has been rangebound as UNH has worked off its highs from last year. The bulls were never able to rally shares above the $550 to $560 zone, and the long-term 200-day moving average line is now negatively sloped, a hallmark that the bears are in control. In the near term, a gap from late July has been filled, so we could see a bounce back to $515, but that would be a spot to take profits. I would be a buyer on a dip to $460 with a stop under $420 for a more favorable risk/reward setup.

Overall, the chart is just neutral, but a rally above the $515 to $530 range would be encouraging, while a buy-the-dip strategy could work well.

UNH: Bearish Rounded Top A Risk, Support Near $440

The Bottom Line

I have a hold rating on UNH. The valuation is modestly attractive, but the chart has some issues. Moreover, the stock has poor relative strength right now. Buying on a pullback into the mid-$400s would be a more opportunistic and potentially prudent play.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.