Summary:

- UnitedHealth Care Group is down slightly over the past year, presenting a buying opportunity for long-term investors.

- The healthcare sector has experienced headwinds and these are expected to continue into 2024.

- This cause management to set its American Medicare enrollments below Wall Street estimates.

- Despite this, I think the healthcare company will continue to outperform and see significant upside in the next year.

mohd izzuan/iStock via Getty Images

Introduction

As a dividend investor, I’m constantly on the hunt for strong, stable businesses that pay a well-covered, growing dividend. It helps me sleep better at night knowing that my while my holdings/companies may face headwinds, they will continue doing their job, paying me a dividend. UnitedHealth Group (NYSE:UNH) is one of those that come to mind. Growing cash flows, stable business model, and a growing dividend to help me reach my goal of financial freedom. Financial freedom is something I’ve always longed for, as I didn’t want to spend the rest of my life working. One way to do this is by collecting dividends and continuing to grow them no matter what lies ahead. In this article, I get into why UNH is a dividend grower you should consider buying for the long-term.

Underperformance Presents Buying Opportunity

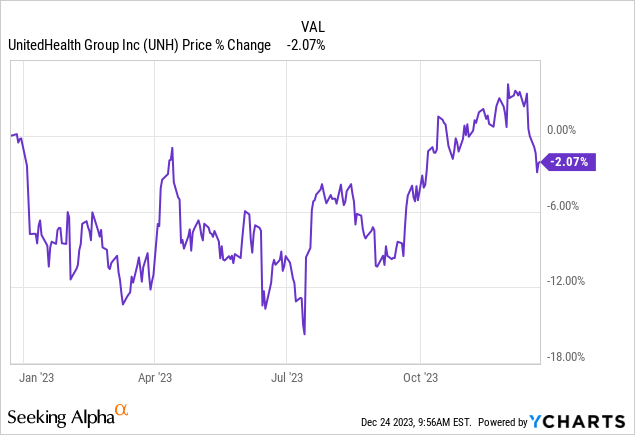

UnitedHealth Group has not performed exceptionally well in 2023, but then most of their peers are also down. Depending on the sector, some companies/businesses may face headwinds more so than others. We all know the current macro environment has affected companies’ performances, but as a buy-and-hold investor, I see this as temporary and a unique opportunity. Chaos creates opportunities if you look at it through the right lens or mindset. Throughout all the chaos the market & economy experienced this year, I’ve continued adding to my current holdings and searching for more stocks to potentially buy. Using the YCharts graph below, you can see UNH is down slightly over the year at 2%.

Although that may not seem like much, it’s still an opportunity to buy a company at some kind of discount when they’re down over a year-long stretch. Quality usually comes at a premium, and UNH is a mega cap company that has been around for quite some time. They also are the largest in the healthcare space and amongst their peers. The sector can be tricky and may experience more headwinds than others. But it is also a sector that generates a lot of cash flows because of the business. We all need some form of healthcare, and UNH offers consumers that through four segments.

Cash Flow Is King

UNH is a dividend contender with more than 30 years of paying an uninterrupted dividend. And I think this streak will continue into the foreseeable future. Not only because of the stellar business model, but increasing cash flows supporting that growth. The company increased the dividend back in February by roughly 14% from $1.65 to $1.88. And I’m expecting another similar increase in the coming months, anywhere from $2.05 to $2.15.

In the past 5 years, UnitedHealth has grown their dividend from $0.75 to the current $1.88, representing a 150% increase! During their Q3 earnings posted back in October, the healthcare company beat on both the top & bottom line. EPS of $6.56 beat analysts’ estimates by $0.21 while revenue of $92.36 billion beat by $950 million. That’s a beat by nearly $1 billion, showing the financial strength of the healthcare behemoth! Considering the macro environment, dividend investors can’t ask for anything better than that.

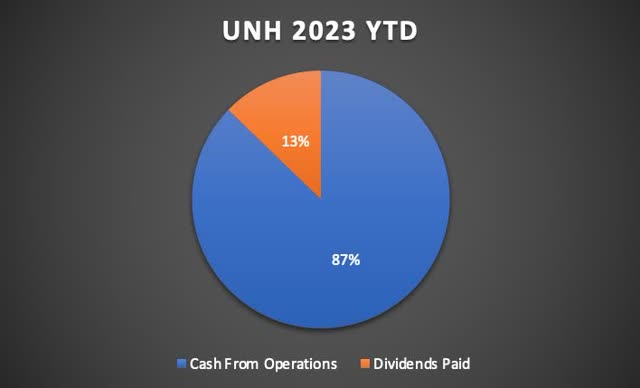

This was a double-digit increase of roughly 13% and 14% in both the top & bottom line from a year ago. And although cash from operations of $6.9 billion declined year-over-year from $8.7 billion, CFO of $34.3 billion grew 11.7% from $30.7 billion over the same period last year. In the chart below, you can see, UnitedHealth has only paid out a small portion of their cash flow in the form of dividends.

The rest has gone to share repurchases. YTD, the company has returned a total of $11.5 billion to shareholders in the form of dividends & buybacks. With roughly 940 million shares outstanding, the company has more than enough to continue growing its dividend for the foreseeable future. Next year, the company expects cash from operations to be in the range of $30 to $31 billion for 2024. And although this represents a slight decline, it is expected to grow to roughly $34 billion in 2025. Earnings & revenue are also expected to grow to $26.20 to $26.70 while revenue is expected to be in a range of $400 billion to $403 billion in 2024.

Total Return Machine

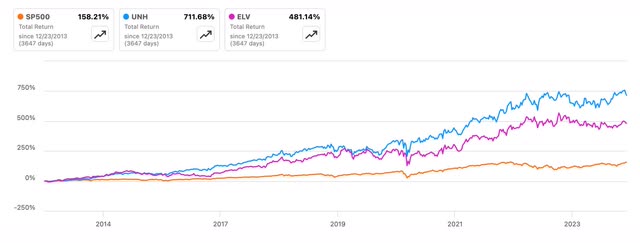

The healthcare company has also been a total return machine, beating the S&P and its largest peer, Elevance Health (ELV), handily over a longer period of 5 & 10 years. In the chart below, you can see UNH outperformed both pretty significantly over a 5-year time frame, with the S&P’s performance being slightly better than ELV.

Over a 10-year period is where UnitedHealth Group really outshines significantly, beating both with more than a 700% annual total return rate. That’s a total return of 28% & 71% annually!

Fortress Balance Sheet

UNH also has one of the best balance sheets in the business, with a credit rating of AA. Furthermore, the company was also able to grow its cash on hand year-over-year to $38.9 billion from $38.8 billion. They’ve also maintained a very manageable debt level this year and had a total of $45 billion at the end of Q3 according to their 10-Q. With almost the amount of total debt in cash, and no debt maturing until January of 2029, UNH’s financial position remains strong despite the challenging environment. The unsecured notes of $1.25 billion maturing in roughly 5 years has a weighted-average interest of 4.25%, so there’s a high likelihood the company will be refinancing at a significantly lower rate by then. Furthermore, the company’s Net-debt-to EBITDA ratio has been decreasing over the years and is expected to decline further in the next 12 months to just 0.42x.

Undervalued

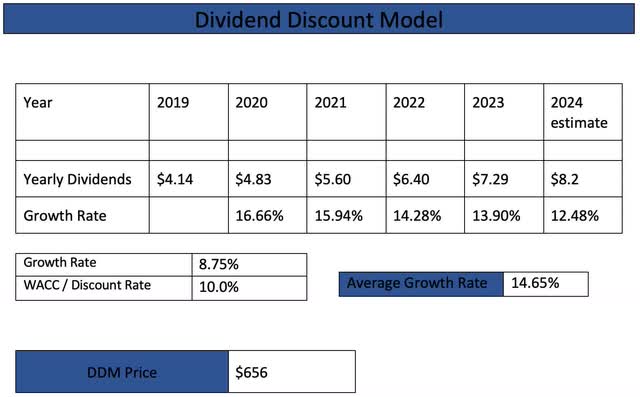

Using their FWD P/E of 21.94x, I think the stock is slightly undervalued as a result of the headwinds they’ve faced this year. The current P/E is roughly in-line with its 5-year average but well-below the sector median of nearly 30x. Additionally, the stock does offer some upside to their price target of $588 at the time of writing.

Using the Dividend Discount Model and a higher WACC than usual because of UNH’s outperformance, I have a price target of $656 for the healthcare giant in the next 12 months. Using the stock’s dividend history, I used an annual dividend payout of $8.20 instead of the estimate of $7.84. With rates expected to come down, I suspect the company will continue the path it has in the past. This gives investors more than 26% upside from the current price, making the stock a buy. UNH was also recently listed as one of 37 top overweight stocks with low volatility according to Morgan Stanley. This further strengthens my analysis on why UNH is a buy.

Risk Factors

With 2023 coming to a close and investors likely looking forward to better days for the market ahead, there is still the looming recession that is expected in the near to medium-term. A recession would likely cause a slowdown for the business. And this may be the reason the company set its 2024 Medicare enrollments for the year below Wall Street estimates. UNH expects a range of 8.02 million – 8.07 million for American enrollments, below the 8.4 million set by analysts. This would likely cause a slowdown in earnings & revenue for the year, which also could affect the stock price going forward.

Bottom Line

UnitedHealth Group has experienced some headwinds in 2023 and these are expected to continue into 2024 as seen by the conservative Medicare enrollments the company expects for the year. Despite this, the stock has performed well, even outperforming the S&P over a longer period of time. As a result of the stock being down over the year, it now presents a great buying opportunity for long-term dividend investors. Furthermore, UNH offers investors good upside to their price target of $588. Using the DDM, I have an even larger upside of nearly 26% in the next 12 months. With their aggressive buybacks, high dividend growth, and fortress balance sheet, UNH is a stock you want in your portfolio to take your income to the next level.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.