Summary:

- UnitedHealth Group’s stock fell 8.1% despite beating Q3 estimates due to conservative 2024 and 2025 EPS guidance. However, I rate it as a Buy.

- The company’s long-term EPS growth target of 13-16% is achievable, supported by the company’s strong track record.

- UNH’s current valuation is attractive, trading at a P/E ratio that aligns with historical trends, suggesting potential for double-digit annual returns based on expected EPS growth.

- Risks include regulatory changes and cybersecurity threats, but the company’s stability and reasonable valuation make up for this.

jetcityimage

UnitedHealth Group (NYSE:UNH) tumbled 8.1% after reporting its Q3-2024 financial results, as its guidance fell short of expectations, but such a drop may not be justified. Either way, the stock looks reasonably priced right now, especially given the company’s reliability and steady growth over the years. At the current price, I think the total returns can be roughly in line with EPS growth, which is still expected to be strong in the long term. Thus, I rate UNH stock as a Buy.

What Caused UNH Stock To Fall After Earnings?

The market clearly didn’t like UNH’s earnings report, even though adjusted EPS of $7.15 beat estimates by $0.12 and revenue of $100.8 billion beat by $1.52 billion. That’s because usually, UnitedHealth forecasts a conservative EPS range for the next fiscal year and then raises that guidance. Instead, UNH lowered its FY2024 adjusted EPS guidance that it initially set last year from a range of $27.50-28.00 to a range of $27.50-27.75.

Further, regarding its 2025 EPS guidance, the company’s CEO stated in the Q3 earnings call, “At this distance, we expect the upper end of the likely range will offer in December has been around $30 per share.” Meanwhile, analysts expected $31.17 per share for 2025.

The Reasons For The Soft Guidance

UnitedHealth provided soft 2025 guidance for a few reasons. Two of these reasons are the “concurrent timing of the second year of the CMS Medicare rate cuts and the most significant Inflation Reduction Act impacts into a single year and the negative effects of that on the people we serve.” The inflation reduction act “eliminated the individual coinsurance requirement during the catastrophic coverage phase,” which sped up the prescription of high-cost drugs, negatively affecting the firm.

Also, there are timing mismatches in Medicaid rate adjustments, which could affect the company’s financials. Another factor is an increase in upcoding (when healthcare providers charge insurance companies more than they should).

Management noted that some entities have been aggressive with their upcoding practices, “having up shifted their coding intensity factors by more than 20%.” Nonetheless, UNH is looking into this problem.

Management Still Expects Good Growth In The Long Term

UnitedHealth is optimistic about its future. Even though the 2025 guidance may only suggest 8.6% EPS growth (if we’re using $30 as the target and $27.625 as the 2024 base), management reiterated that it expects 13-16% in long-term EPS growth. This comment from Andrew Witty, UNH’s CEO, is also worth mentioning: “As always, we will seek to advance beyond this initial view as the year progresses…” This suggests that the 2025 estimate could be revised higher by management next year and is just a conservative figure for now. Anyway, what makes management so confident in its future?

UNH’s CEO noted that the company’s commercial business and OptumRx continue to perform well. Further, due to its value proposition, Medicare Advantage is expected to be a growth driver for “many years to come,” while the Optum Health value-based care businesses are expected to become a key differentiator in the next few years as they are approaching the very early stages of their potential.

Andrew Witty also talked about the national gold card program that the firm introduced this month. This simplifies the care approval process by reducing the number of prior authorizations needed for in-network providers. The program is expected to reduce “authorizations by 500,000 every year for qualified in network providers,” which can “help improve both the quality and the affordability of care while reducing friction in the system.”

UNH is even tapping into AI to increase efficiency. For example, advanced practice clinicians are using AI to summarize patient histories, and nurses are using generative AI to documentation more efficiently. AI also helps with customer service.

UNH’s Track Record Suggests That Management’s Projections Are Reliable

Sometimes, when analyzing an investment, you have to rely on management’s projections, which is what I’m doing here. I’m bullish because I believe that management can achieve its 13-16% long-term growth target or at least come close to it, which is good at the current valuation.

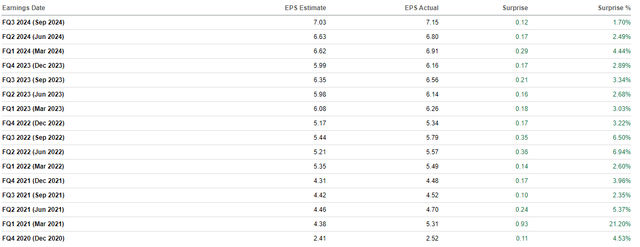

I wouldn’t believe the company if it had a track record of poor returns or overpromising and underdelivering. Take a look at its consistent EPS beats over the past four years. The firm just doesn’t miss. The conservative 2025 guidance with the goal of raising it also gives me more hope.

UNH’s Historical EPS Beats (Seeking Alpha)

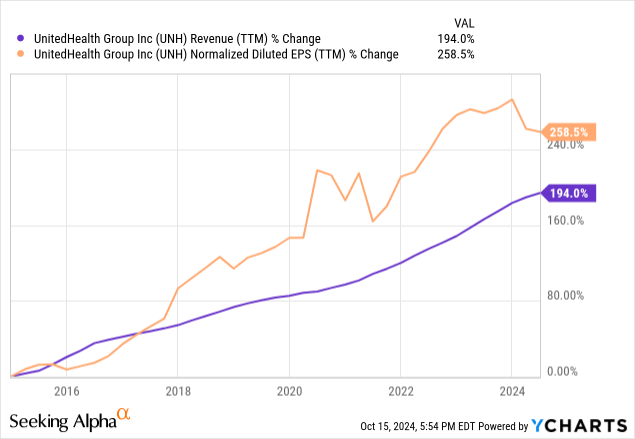

In addition, it’s a steady grower, with a 10-year revenue CAGR of 11.8%. Earnings have grown at a rapid clip as well. With this type of historical performance, 13-16% seems achievable.

Why The Valuation Is Attractive After The Drop

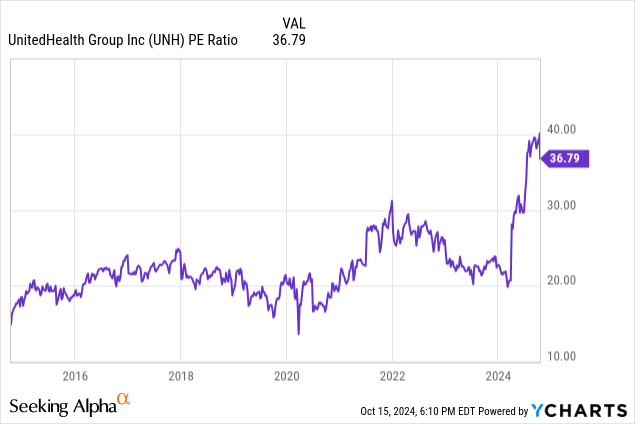

Following the 8.1% drop, UNH stock is reasonably priced. In the past 10 years, its P/E ratio has generally settled in the 20-22x area (closer to 22x). I believe it can maintain a 20x multiple into the medium-to-long term based on its continued growth and relative predictability. Right now, it shows a P/E ratio of 36.79x in the chart below because the numbers haven’t been adjusted for the most recent earnings report, but its TTM adjusted earnings are $27.02, giving it a P/E of 20.6x. Additionally, its forward P/E (3 months forward) is 20.14x if you take the midpoint of the 2024 guidance.

Essentially, UNH is trading at a valuation multiple that it can easily maintain based on historical trends, meaning that the stock price can increase more or less in line with EPS growth. While 2025 may see EPS growth under 9%, the long-term picture suggests double-digit annual gains if management’s projections are to be trusted.

What Are The Risks?

Even though UNH is a blue-chip stock, it still comes with some risks. The first risk is that regulatory changes can be somewhat unpredictable and can negatively affect the company — the same way the Inflation Reduction Act did. There are always debates about healthcare reform. If you invest in UNH, you need to be prepared for potential regulatory changes over the years.

Cyberattacks are another risk. For example, its adjusted EPS of $7.15 includes $0.12 in “business disruption impacts” but excludes $0.28 in “Direct Response Costs,” likely due to the Change Healthcare cyberattack impacts. However, direct response costs are a cost, and if cyberattacks become more common, then UNH may have to re-think how it adjusts its EPS to account for that.

Perhaps direct response costs will become a regular part of operations, not one-time adjustments, perpetually dragging earnings lower.

The Bottom Line On UNH Stock

UnitedHealth stock is now trading at a valuation level where it has historically found support. As a result, the stock price should be able to rise roughly in tandem with adjusted EPS growth over the next few years. Even though EPS growth is expected in the high-single digits in 2025, management is still confident in its long-term EPS growth target of 13-16%.

Given the company’s track record, I believe the management team, meaning that UNH can see double-digit annual returns from here in the medium-to-long term. Plus, based on historical trends, it’s likely that UNH’s management is being conservative, both with its 2024 and 2025 guidance, giving it a higher chance of meeting or surpassing expectations.

Cybersecurity and regulatory risks are things that I will monitor over time. However, I think the reasonable valuation and relative stability of the company make it a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.