Summary:

- UnitedHealth Group’s recent drawdown presents a lucrative investment opportunity to value-seeking investors.

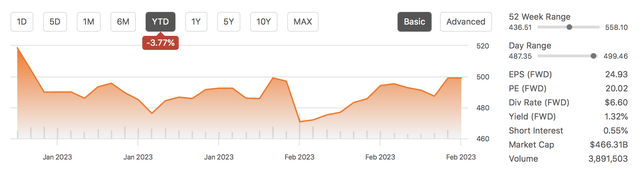

- The stock’s year-to-date slump is likely due to the financial markets’ recent risk-on appetite and the anticipation that insurance premiums could suffer from softer pricing in 2023.

- However, we think the stock market will level out in the coming months, subsequently providing support to lower beta securities such as UnitedHealth.

- Furthermore, UnitedHealth’s substantial market share means it is less susceptible to lower implied insurance prices. Moreover, investors need to remember that the company’s claims aren’t lumpy as it focuses on long-term solutions.

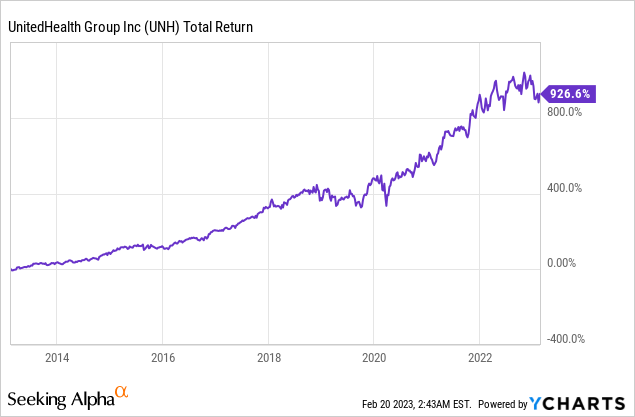

- Yes, UnitedHealth’s stock price multiples aren’t overly attractive. However, its countercyclical nature could phase out valuation-based risks. In fact, we believe the stock’s realized total returns could sustain into perpetuity.

Solskin

Despite a recent financial market recovery and a comprehensive earnings beat, UnitedHealth Group Incorporated’s (NYSE:UNH) stock finds itself lingering among the year-to-date losers. In our opinion, the market’s low-beta attitude, coupled with the unwanted prospect of softer life & health insurance pricing, has discouraged UnitedHealth’s investor base. However, we believe investors have overreacted and underestimated UnitedHealth’s near-term potential. Therefore, we decided to do a write-up on the company and its stock’s critical variables to present our readers with a potential ‘arbitrage’ opportunity.

United Health’s Trajectory Assessed

UnitedHealth’s revenue mix has shifted in recent years due to its Optum division’s robust growth, which is discussed later in the article. I want to focus on the firm’s broad-based earnings trajectory at first.

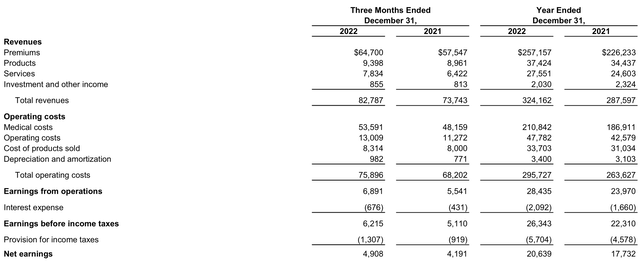

One of the reasons why we love UnitedHealth is due to its countercyclical attributes. The company focuses on long-term insurance and healthcare solutions, meaning its claims are less lumpy than insurers that host both short and long-term solutions. Moreover, UnitedHealth’s long-term business model allows it to better predict its liability, resulting in efficient underwriting, which is portrayed by the company’s medical loss ratio of 82.8%.

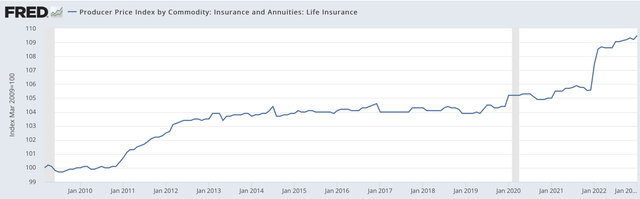

As portrayed by the firm’s recent financial statements, UnitedHealth experienced increased premiums income. Although key data suggests that premium prices are at a cyclical peak, as mentioned before, life and health solutions are less lumpy and typically yield more consistent pricing. In addition, UnitedHealth’s substantial 15.3% market share in the Life & Health insurance industry means it is less vulnerable to uniform price changes.

Although UnitedHealth generates less than 10% of its revenue from investments and income, it is essential to note that the recent upturn of the financial markets could mark up its investment portfolio and contribute to the firm’s revenue mix in the coming quarters.

Optum’s Synergies

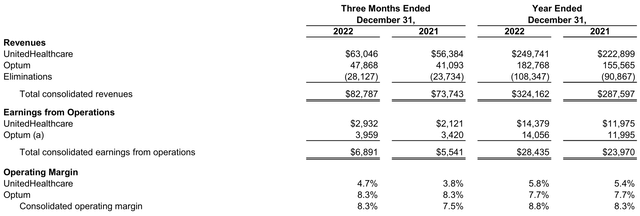

As mentioned before, UnitedHealth’s Optum unit plays a significant role in its revenue mix, with the business contributing approximately 57%. Although some of the unit’s revenue is classified as premium income, Optum delivers diversified revenue through data and analysis offerings, pharmacy care services, and online healthcare.

In our opinion, Optum is what sets UnitedHealth apart from its peers. The unit does not only contribute to top-line revenue, but it also provides valuable synergies as it allows cross-sales and economies of scope. In addition, Optum is aligned with the current evolution of online healthcare, which is expanding by roughly 29.5% per year.

Even though Optum’s operating profit margin is arguably tame at 8.3%, investors must consider that the unit’s emphasis is currently on industry consolidation, which is achieved by aggressive internal and external reinvestment rates. In our opinion, Optum will deliver residual value to UnitedHealth’s shareholders when the time is right.

Valuation & Dividends

At face value, UnitedHealth’s stock may seem fairly valued as its price-to-earnings, and price-to-book ratios of 23.56x and 5.8x do not exactly raise pulses. However, theoretically speaking, the stock’s countercyclical nature phases out valuation risk. Therefore, we do not see UnitedHealth’s price multiples as a concern.

Furthermore, UnitedHealth presents decent carry with a forward dividend yield of 1.32%, which is supported by 13 consecutive years of dividend growth, which has proliferated by 17.36% in the past five years.

Considering all aspects, we think UnitedHealth’s stock provides attractive returns for a security with a beta coefficient of only 0.69.

Risks

Despite UnitedHealth’s firm position in today’s economic and financial market environments, the stock possesses a few risks.

As mentioned earlier, insurance premium prices are hard at the moment, and cyclicality could inevitably cause an unwanted mean reversion, leading to a potential slump in UnitedHealth’s revenue growth. Industry-specific indicators back up the claim; for instance, it was recently revealed that Medicare advantage plan rates would increase slower than anticipated in the coming year/s, which could act as an unwanted catalyst to managed insurers such as UnitedHealth.

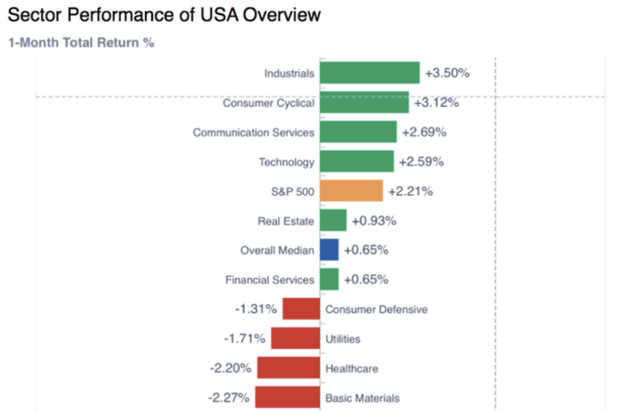

Furthermore, financial market-based indicators provide a threat to UnitedHealth’s stock. I say this because month-over-month returns suggest that investors are risk-seeking, which has caused some of the lower-risk stocks, such as healthcare assets, to sell off. Countercyclical stocks typically do not suffer from such cyclical features; however, it must be considered that the market often exhibits skewness, resulting in conviction-based investing.

M/M Sector Returns (GuruFocus)

Final Word

In our opinion, UnitedHealth’s year-to-date drawdown presents a buying opportunity. Although insurance premiums could be priced softer in 2023, UnitedHealth’s significant market position and support from Optum’s embedded growth will probably phase out most price-related risks.

Furthermore, Optum provides significant economies of scope, which we believe is underestimated by investors as most market participants still price UnitedHealth as a low-beta asset. However, on the other side of the pendulum, UnitedHealth’s low beta coefficient could assist its stock in 2023 as countercyclical assets might blitz through cyclical pressure.

UnitedHealth provides lucrative total return prospects, as revealed by its historical carry and price returns. Thus, we assign a strong buy rating with an indefinite holding period.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>