Summary:

- UnitedHealth Group Incorporated’s Q3 earnings report is due October 15th.

- We expect sustained gross income from a favorable insurance pricing environment. However, claims remain unpredictable.

- Lower interest rates, tight credit spreads, and compressed SOFRs provide an enhanced asset-liability outlook.

- UNH stock’s valuation multiples are up for debate, yet we expect the company’s multiple to expand in late 2024, lending us a bullish argument.

PeopleImages

UnitedHealth Group Incorporated (NYSE:UNH) is set to report its third-quarter earnings results on October 15th, sparking widespread attention among market participants.

Whether actively trading the event, mitigating risk, or simply observing with interest, UnitedHealth’s earnings call marks a telling occasion on most investors’ calendars. Therefore, we decided to do an earnings preview by assessing UnitedHealth’s latest events.

Herewith is a summary of our thoughts.

Headline Earnings Metrics

UNH’s Q3 Earnings Expectations

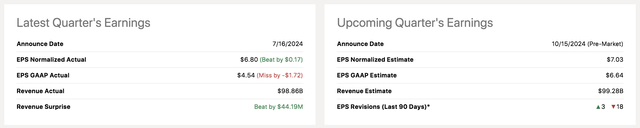

According to Seeking Alpha’s database, Wall Street analysts believe UnitedHealth’s GAAP earnings-per-share will settle at $6.64 for Q3, while its revenue is anticipated at $99.28 billion. Moreover, the company has received 18 downward earnings revisions and three upward revisions, communicating a doubtful environment.

Earnings Estimates (Seeking Alpha)

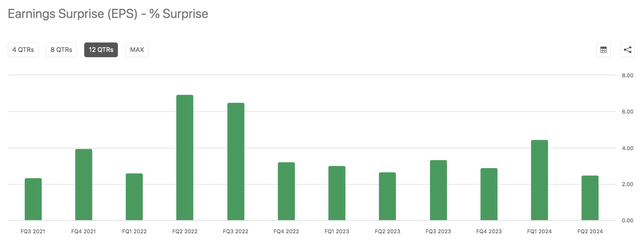

Whether UnitedHealth’s fiscal report will reach its intended target is debatable. However, as illustrated, the company has surpassed its last twelve quarterly earnings targets, raising optimism ahead of its Q3 release.

Past Surprises (Seeking Alpha)

Fundamental Review

We reviewed UnitedHealth’s Q2 earnings to set a base for a Q3 prediction. In addition, we decided to revise systematic factors, which assisted us with interpolation.

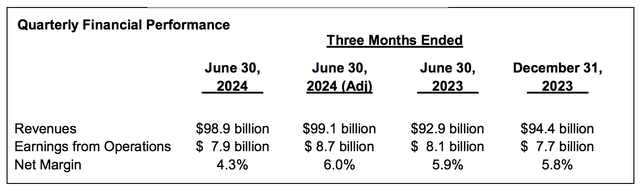

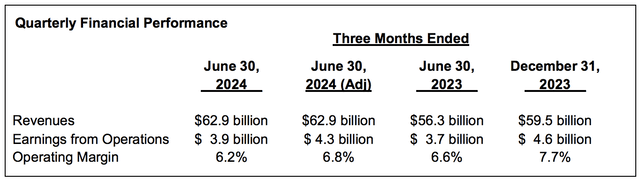

A broad-based view shows that the group’s earnings retraced in Q2, with its profit margins declining. Although other factors might’ve played a role, resilient employee costs and a cyclical medical claims environment likely influenced the end result.

Group Results (UnitedHealth)

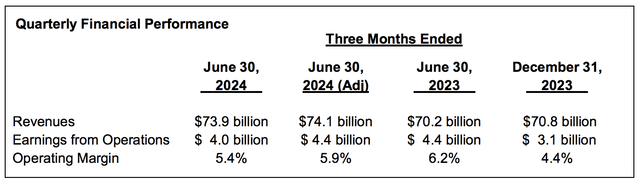

The UnitedHealthcare segment’s operating margin retraced to 5.4% from 5.9% a year earlier. The unit grew its domestic commercial offerings by 2.3 million. Moreover, the company saw its senior and complex needs consumer base surpass the 9.4 million market. Therefore, an unfavorable claims environment likely contributed to the segment’s margin compression.

UnitedHealthcare Results (UnitedHealth)

Optum also experienced soft results, as its operating margin decreased by 60 basis points to 6.2%. Revenue grew by 11.7% year-over-year, which is subdued by Optum’s standards, as it reached a segment compound annual growth rate of 16.4% between 2017 and 2023.

Optum Results (UnitedHealth)

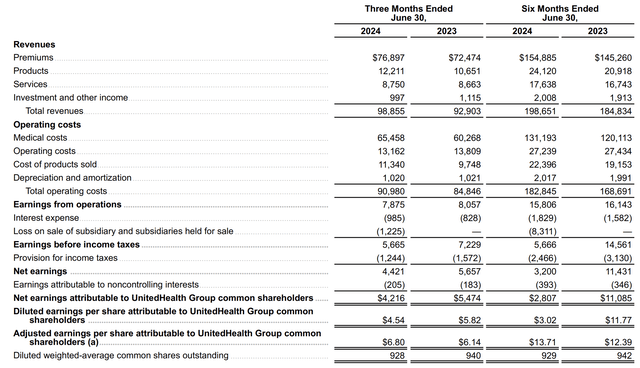

A consolidated view of UnitedHealth’s comprehensive income statement shows that its premiums-based revenue increased year-over-year. However, its medical loss ratio also increased, suggesting unfavorable claims line item.

Consolidated View (UnitedHealth)

Here’s what we calculated for MLR.

| Loss Ratio | |

| Q2’23 | 83.2% |

| Q2’24 (Latest) | 85.2% |

Source: Author’s Calculations, Data from UnitedHealth’s P&L

Where to from here?

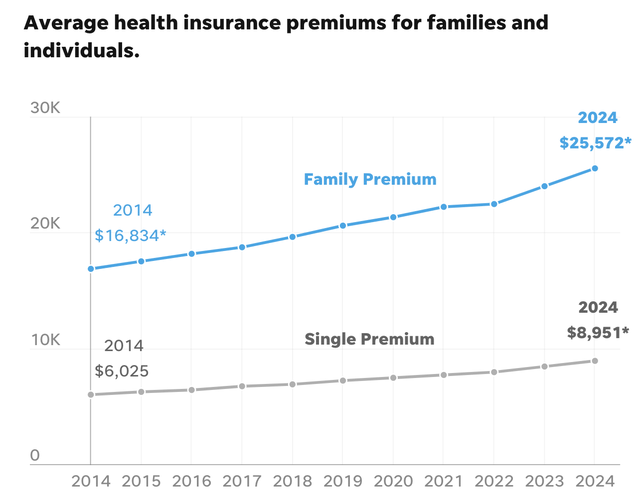

Health care premium costs have skyrocketed year-to-date, and, in Q3, especially. This could’ve assisted UnitedHealth’s gross revenue in Q3. However, I would refrain from commenting on the volume of claims, as it would require a more granular view of UnitedHealth’s internal operations.

Health Care Premium Pricing (USA Today)

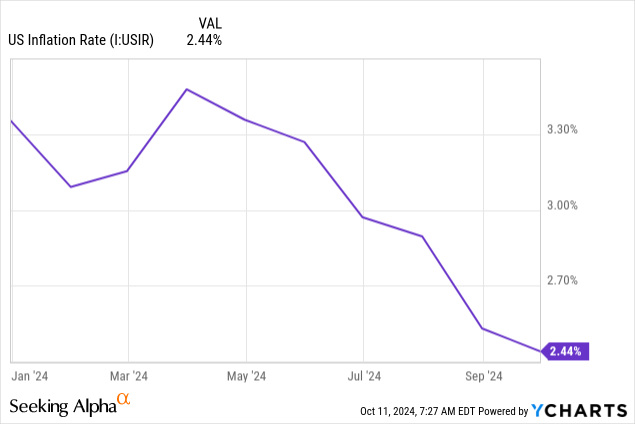

A softer U.S. labor market and lower broad-based inflation might’ve lowered UnitedHealth’s operating expenses. Commissions might’ve increased alongside premium pricing. However, we believe a positive net effect occurred in Q3.

Optum’s core business has a suite of synergies, including insights and Rx, which, we think, are multi-year multipliers. The prior provides data analytics, while the latter provides pharmacy care, both peripheral and complementary to Health, which provides direct care (including specialized and urgent care).

Given the above, we are bullish about Optum’s prospects. Will its Q3 numbers be strong? We think so; here’s a glance at Optum’s industry exposures and segmental growth rates.

| Industry | Annual Growth Rate (2017-2023) | |

| Optum Health | Direct Health Care | 29% |

| Optum Insights | Medical Research & Data | 15.2% |

| Optum RX | Pharmacy | 10.5% |

Source: Medicare Market Insights, Jared Strock

Valuation and Dividend Metrics

Balance Sheet

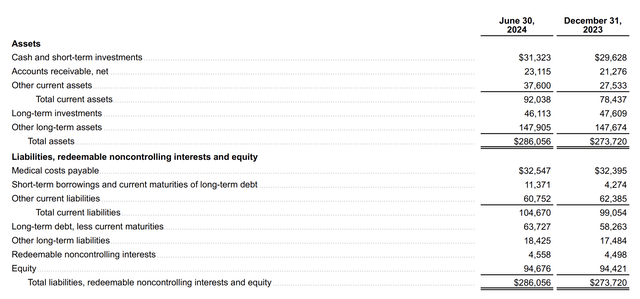

Insurers often invest a substantial portion of their cash to protect against unforeseen claims and/or to generate excess profits. While UnitedHealth has an equity surplus, it recorded a leverage ratio (or equity multiplier) of 3.02x in Q2, suggesting its asset-liability relationship is prone to volatility.

Balance Sheet (UnitedHealth)

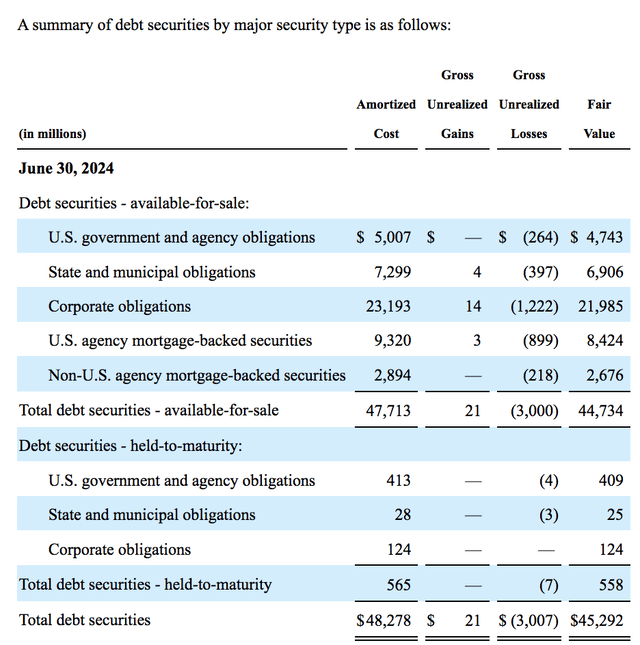

About 59% of the company’s AFS securities were invested in corporate and government debt in Q2. Treasuries and corporate bonds surged in Q3 amid a U.S. interest rate pivot and tight credit spreads. MBS might’ve counteracted the surge as mortgage rates have fallen. Nonetheless, we deem the firm’s AFS asset base favorable.

UnitedHealth’s HTM securities comprise about 1.2% of its investment portfolio. Government securities span approximately 73% of the HTM, which, given the aforementioned reasons, we deem favorable.

Investments (UnitedHealth)

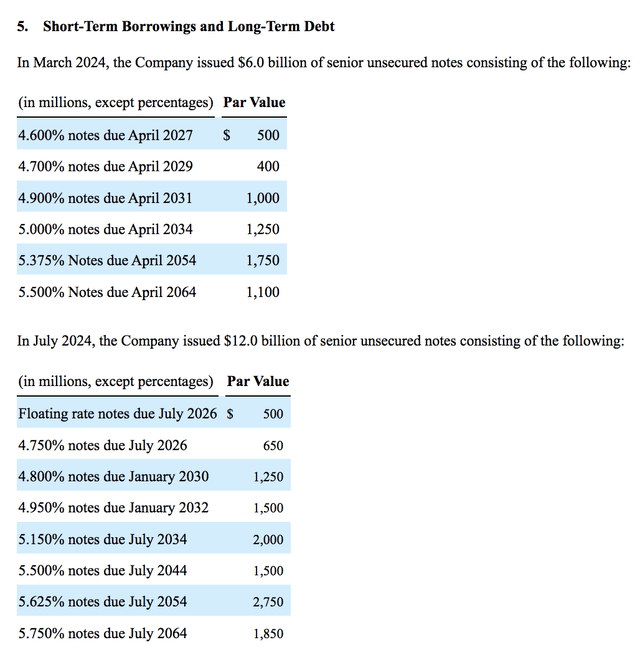

As for its liabilities, UnitedHealth has noteworthy short-term liabilities. We market participants will price refinancing prospects, given the lower U.S. interest rate structure. Moreover, a portion of the insurer’s short-term debt comprises floating-rate notes, which might’ve benefitted in Q3 via tighter overnight funding costs and lower base interest rates.

Liabilities (UnitedHealth)

Multiples

An analysis of UnitedHealth’s balance sheet and earnings set a base for an overview of its price multiples. I dispensed throughout-the-statement data by including its price-to-sales, price-to-book, price-to-earnings, and dividend yield ratios in the following diagram; a discussion follows.

| Metric | Value | 5-Y AVG. |

| Price-to-Sales | 1.42x | 1.36x |

| Price-to-Book | 6.16x | 5.55x |

| Price-to-Earnings | 22.37x | 21.86x |

| Dividend Yield | 1.35% | 1.36% |

Source: Seeking Alpha

UnitedHealth’s salient price multiples are above their five-year averages. Therefore, a normalized view suggests the stock is priced in. However, as shown in earlier sections, a higher pricing environment has occurred, which could boost UnitedHealth’s sales. Furthermore, an enhanced asset-liability outlook might influence the company’s book value (favorably).

We are unsure whether UnitedHealth’s bottom-line will improve and if its dividend will bolster. Therefore, we maintain a neutral stance on the company’s P/E and dividend yield.

Limitations of the Analysis

Much of the analysis assumes a systematic approach, meaning numerous company-specific events were overlooked. For example, UnitedHealth recently suffered a cyberattack, which may have impacted its financial performance. However, we don’t have the bandwidth to comment on certain company specific-maters.

Another limitation of the analysis relates to UnitedHealth’s asset base. We assessed its asset-liability structure in a static format, instead of accounting for dynamic asset allocation. Why? Well, it is impossible assessing dynamic asset-liability management without possessing material non-public information.

Concluding Thoughts

We see a tactical opportunity in UnitedHealth’s stock. A compelling pricing environment means sustained top-line growth is likely. Moreover, normalization of claims expenses might occur, while an enhanced outlook systematic of UnitedHealth’s investable asset base provides much to cheer about.

Despite being concerned by some of the company’s price multiples and resilient operating expenses, we deem the stock a buy ahead of its third-quarter earnings release.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Kindly note that our content on Seeking Alpha and other platforms doesn't constitute financial advice. Instead, we set the tone for a discussion panel among subscribers. As such, we encourage you to consult a registered financial advisor before committing capital to financial instruments.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.