Summary:

- Unity’s monetization business continues to struggle, with falling revenue and large losses on the back of excessive stock-based compensation.

- Market conditions aren’t helping, but Unity’s problems are primarily self-inflected, and the company’s failure to address its problems doesn’t inspire confidence.

- While Unity’s valuation could eventually result in significant upside, this is likely a long way off.

- In the short-term, downside risk remains elevated due to Unity’s lack of growth and the ongoing dilution of existing shareholders.

Wachiwit/iStock via Getty Images

Unity (NYSE:U) has put considerable effort into turning around its business over the past few years to little avail. Management remains optimistic but investors have been fed largely the same message for several years now. Outside of the ironSource acquisition, revenue has been fairly flat, and while Unity has positive cash flows, losses remain large on the back of excessive stock-based compensation. Unity’s game engine provides it with a solid competitive position and a large end market. Revenue primarily comes from advertising though, and this part of the business is struggling. Unity’s market capitalization could prove low if the company can turn around its monetization business, but it is difficult to see this happening given ongoing struggles.

I previously suggested that Unity’s turnaround will take time and I continue to think this will be the case. The stock is down around 38% since I last wrote about Unity and will likely continue to fall until the company demonstrates genuine progress.

Market Conditions

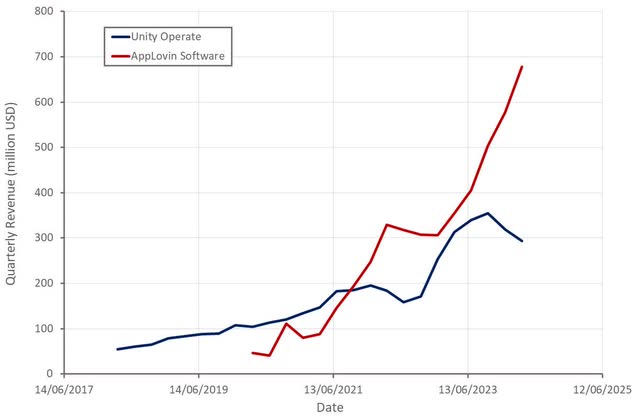

While the macro environment has been challenging in recent years, most of Unity’s problems are self-inflicted. AppLovin’s (APP) Software business continues to surge on the back of the higher returns its AXON engine offers advertisers. Until Unity closes this performance gap, its Grow business will likely struggle. Much of this appears to have been driven by Apple’s (AAPL) privacy efforts and the shift to real-time bidding. Unity has been trying to adjust to the current situation, including acquiring ironSource, but there is little sign of progress so far.

Figure 1: Unity and AppLovin Revenue (source: Created by author using data from company reports)

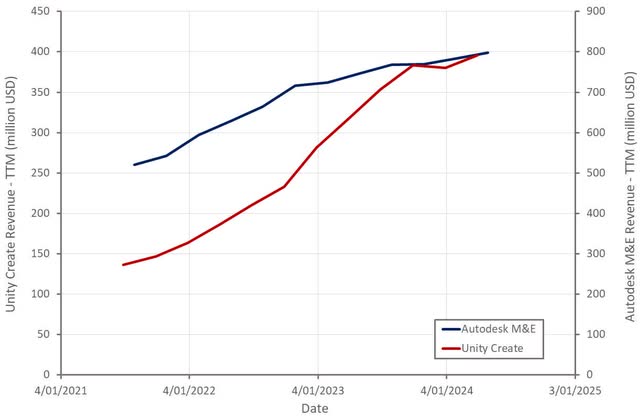

Unity’s Create business has outperformed its Grow business in recent years but is also struggling at the moment. While there has likely been some backlash against Unity’s runtime fees, moderating Create growth is probably more the result of the macro environment.

Figure 2: Unity and Autodesk Revenue (source: Created by author using data from company reports)

Unity Business Updates

Along with its restructuring and change of management, Unity is trying to become more product focused, and create a closer link between its Grow and Create businesses. Unity’s engine is a competitive advantage, and the company is uniquely positioned to offer an integrated solution. While runtime fees will help Unity to realize value from its engine, the company must address the problems with its monetization solutions.

Unity has suggested that the furor caused by its runtime fees are beginning to die down and that customers understand Unity needs revenue to support development. Matt Bromberg recently started as Unity’s new CEO, which is likely part of an effort to rebuild developer trust. Bromberg has over 20 years’ experience in gaming, including leadership roles at Zynga and Electronic Arts. I don’t expect a change in management to yield a meaningful shift in Unity’s prospects though. While Unity has made a number of strategic blunders, the company’s current issues are dominated by a lack of execution in the monetization business, which is difficult to pin on management alone.

Unity is investing in data acquisition and analytics to support monetization, although this isn’t showing up in revenue yet. Unity is now training its models using substantially more data, some of which has been enabled by improved integration of ironSource. The results of testing have reportedly been positive, with some large Max customers shifting to LevelPlay. Based on this, Unity believes that it will be able to close much of the gap with AppLovin, although this flies in the face of AppLovin’s commentary and may just be due to Unity trying to put a positive spin on a bad situation.

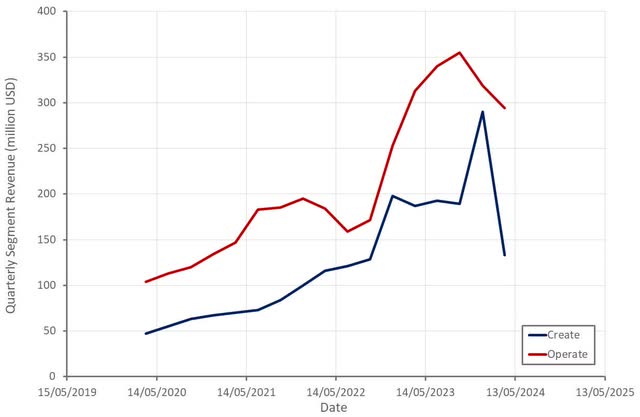

Financial Analysis

Total revenue in the first quarter was $460 million, a decline of 8% YoY. Unity’s strategic revenue increased 2% YoY, driven by Create strategic revenue growth of 17%. In comparison, strategic revenue in the Grow segment was down 4% YoY. The Create business is expected to continue outperforming the Grow business in the near-term, although the Grow business is expected to rebound in the second half of the year.

Unity expects $420-$425 million revenue from its strategic portfolio in the second quarter, representing a 6-7% decline YoY. For the full year, Unity is guiding to $1,760-$1,800 million revenue from its strategic portfolio, representing an increase of 2-4% YoY.

Figure 3: Unity Revenue (source: Created by author using data from Unity)

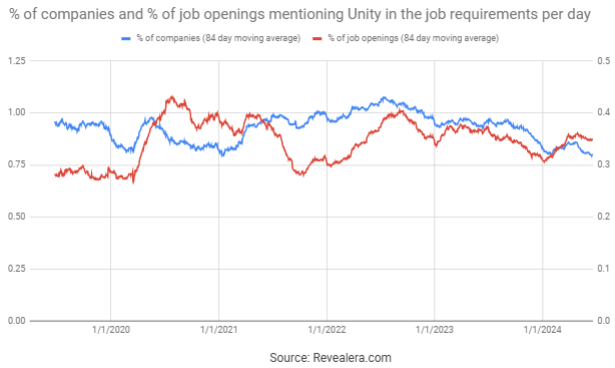

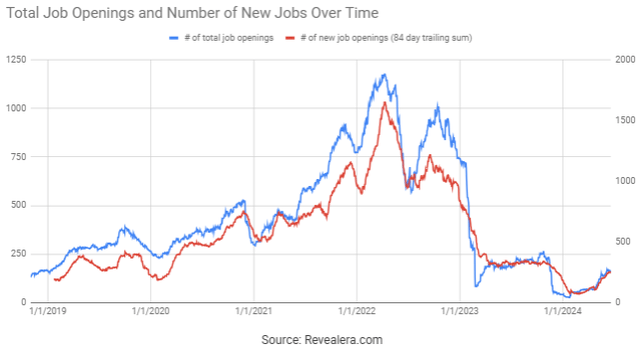

The number of job openings mentioning Unity in the job requirements has declined modestly over the past few years. While this is probably more the result of the macro environment than any Unity specific issues, it doesn’t point to a rebound in growth any time soon.

Figure 4: Job Openings Mentioning Unity in the Job Requirements (source: Revealera.com)

The number of Unity job openings has bounced back slightly in recent weeks, albeit from a very low level. This could indicate growing confidence in a return to growth, but given recent layoffs, I wouldn’t read too much into this.

Figure 5: Unity Job Openings (source: Revealera.com)

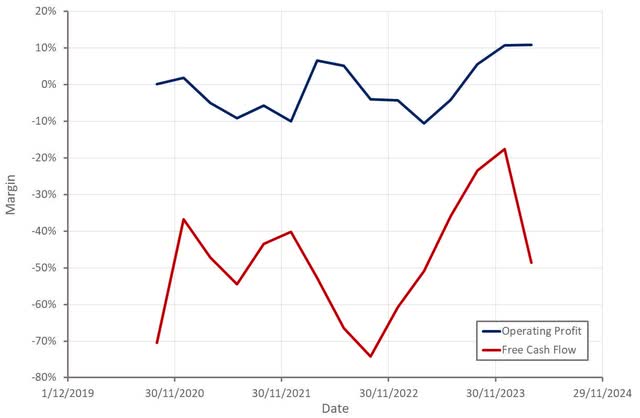

Unity has tried to place focus on its profitability in recent quarters, as this is one of the few bright spots for the business. Even here, results are actually fairly mixed though. Unity’s adjusted EBITDA continues to increase and the company’s cash flow from operating activity is positive. This is deceptive though given Unity’s heavy use of stock-based compensation.

Second quarter adjusted EBITDA is expected to be in the $75-$80 million range. Full year adjusted EBITDA is expected to be in the $400 -$425 million USD range, with Unity ending the year with an adjusted EBITDA margin of over 25%. This is somewhat meaningless given that SBC has averaged over 30% of revenue over the past three years.

Figure 6: Unity Margins (source: Created by author using data from Unity)

Conclusion

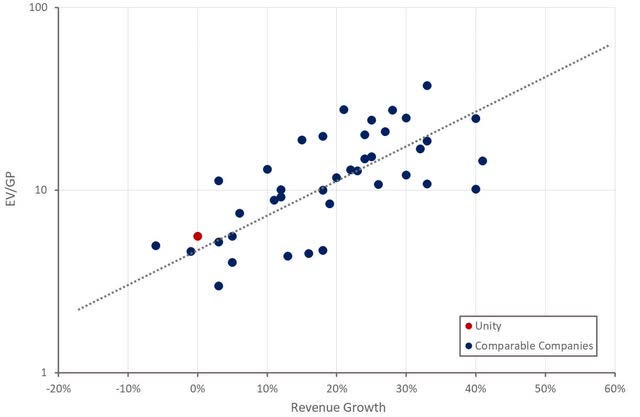

Unity continues to push a turnaround narrative, but it is hard not to be skeptical at this point in time. The Create business should return to healthy growth in time driven by runtime fees, industry use cases and a healthier macro environment. This part of the business is deserving of a reasonably high multiple.

It is hard to get excited about the Growth business though, and unfortunately this is where the majority of Unity’s revenue is generated. A lot of Unity’s problems are driven by poor execution. Failing to train machine learning models on all of the available data is unacceptable, particularly given Unity’s enormous personnel expenses. While Unity is cash flow positive, stock-based compensation probably means there is further downside, unless the company can begin to show tangible signs of progress in turning around its business.

Unity’s valuation is now fairly modest though, meaning the stock will likely perform reasonably well longer-term if Unity can improve the performance of its adtech. Investors should also not lose sight of the fact that Unity’s engine is an attractive asset that isn’t yielding as much value as it should be.

Figure 7: Unity Relative Valuation (source: Created by author using data from Seeking Alpha)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of U either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.