Summary:

- Unity faced backlash from game developers after announcing a radical pricing structure, resulting in a stock price crash.

- The company attempted a quick fix by introducing a restructured pricing model to avoid a mass exodus of developers.

- Wall Street’s confidence in Unity’s ability to increase prices has been diminished in my view, but the company’s underlying potential remains strong.

Steve Jennings

Introduction

Software pricing, something that is normally a mundane topic, has quickly become a flash point in the game development community. Over the course of the past month, we saw Unity (NYSE:U) announce a radically different approach to billing its customers (game developers), followed by a harsh and stern backlash among game devs, then a swift walk-back coupled with an apology issued by the founder of Unity, David Helgason.

“We f***** up on many levels. No other way to put it: a new business model for Unity was announced in a way that was hard to understand, but it also missed a bunch of important “corner” cases, and in central ways ended up as the opposite of what it was supposed to be. Now to try again and try harder. I am provisionally optimistic about the progress. So sorry about this mess.

-David Helgason

How did we get here? And how has, what must have seemed like to investors, a standard price increase, resulted in such a severe, and likely brand-damaging, chain of events?

And importantly for investors, can Unity even recover from here?

Some context

To understand the current environment we must first examine the past. We need to understand how Unity got into this pickle.

The Early Days

Originally incepted as a tool for the development of games on Mac OS, Unity’s founder, and a small team began to improve its capabilities, iterating year after year to make game development easier and easier. Unity grew based on the simple premise that a shared game engine between development studios would ultimately result in significantly cheaper game development. As studios focused on storytelling and gameplay the pooled resources at Unity made all parties more efficient. The company grew with funds provided by private equity and long-term-oriented growth investors who focused on revenue growth above all.

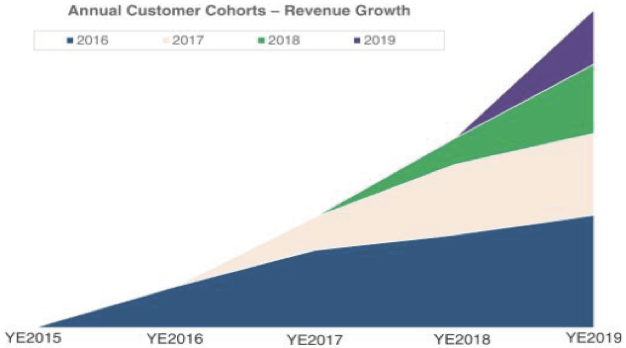

Unity S-1 (Unity)

It was late during this pre-IPO stage (2014) when current CEO John Riccitiello took the reigns from Unity’s founder, David Helgason. Soon after things began to rapidly change at the company. Revenue grew rapidly, but the philosophy began to shift too.

The IPO Era

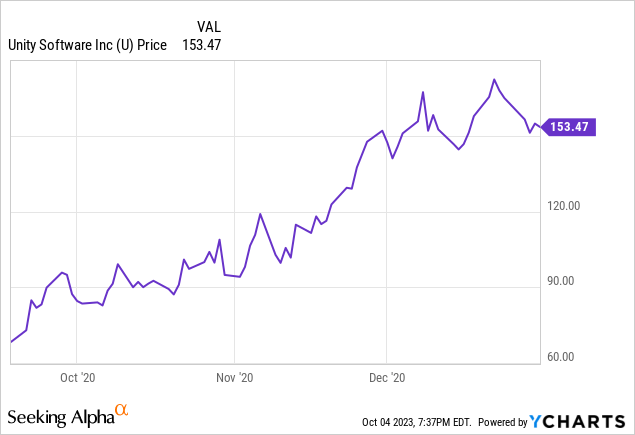

Coming to the market near the peak of the unprofitable tech bubble of 2020/2021, Unity continued to focus on revenue growth as investors rewarded them with a rich valuation regardless of profitability.

During this time frame, the game engine grew more powerful and added more users but some troubling signs began to present themselves, notably, a string of rapid acquisitions.

In 2021 Unity acquired Weta Digital, the VFX tool created by Peter Jackson and his team to deliver state-of-the-art visuals for some of the most demanding projects and applications. At the time this acquisition excited me greatly. And to a point, it still does.

Imagine if creating VFX for a major film was as easy as creating a game in Unity. If it were that easy well, then anyone could run their own small VFX shop and sell directly to the major studios. That would be a game-changer.

Additionally, the strength of Weta could likewise be incorporated into Unity’s game engine which might allow it to compete more directly with Epic’s Unreal Engine. We’ve yet to see the full vision for Weta unfold within Unity.

That major acquisition was followed by Speedtree, a game development tool, as well as a few others. Unity’s high stock price served as the ultimate tool to help it acquire other companies as it could use its richly priced equity as cheap capital to get deals done.

Forcing Profitability

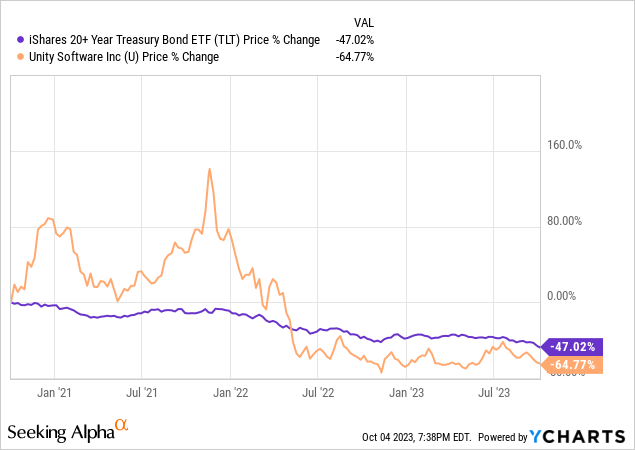

But alas, those euphoric early days soon came to a quick close. After years of loose monetary policy and careless fiscal policy globally, the war in Ukraine roiled global energy markets and exacerbated the inflationary challenges resulting from COVID-19 supply chain policies and put an end to easy money.

This meant that no more could companies like Unity continue to keep investors happy with revenue growth alone, they had to become profitable.

At first, the impacts were painful but stomachable. For example, the in-house game, Gigaya, designed to showcase the power of the Unity engine and serve as a learning tool for developers, was shelved and layoffs began to occur across the organization.

But the layoffs only went so far, a more radical shift was needed if the company were to become profitable.

In comes Ironsource, the Israeli mobile ad software provider, which connects game-makers with companies interested in mobile advertising. Ironsource seemed like the perfect fit as it was highly profitable and many of Unity’s customers were already customers of Ironsource too. The marriage was finalized as an all-stock deal whereby Ironsource investors would receive shares in Unity.

Yet, even with Ironsource, that was not enough to turn the ship around.

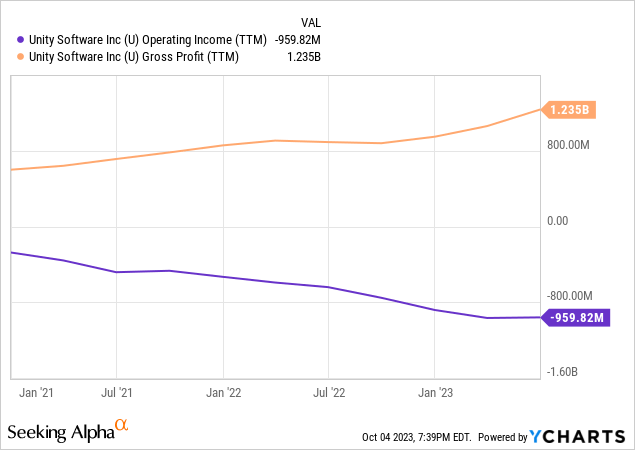

Despite improving gross profit, operating income continued to languish. It’s only been over the last quarter or so that operating losses have begun to flatten out and show some signs of a rebound.

The Big Mistake

After seemingly having run out of options on the cost-cutting front Unity shifted its lens to focus on revenue growth by squeezing more from its large customer base, the game development community. A tricky proposition to say the least.

It was then that Unity made, what seemed to me, like a very rushed announcement that it would be radically updating its Create pricing structure to include a per-game install fee of 20 cents. This sent shock waves through the community as developers raged against the radical shift lamenting about what many likely perceived as greed.

It didn’t help that the policy was launched with little explanation, or seemingly care for fringe cases such as pirated games, or reinstalls of a previously downloaded game. Further adding to the grievances, the install fee was derived from Unity’s estimates, that’s a tough sell after doing so much damage to your brand in my view.

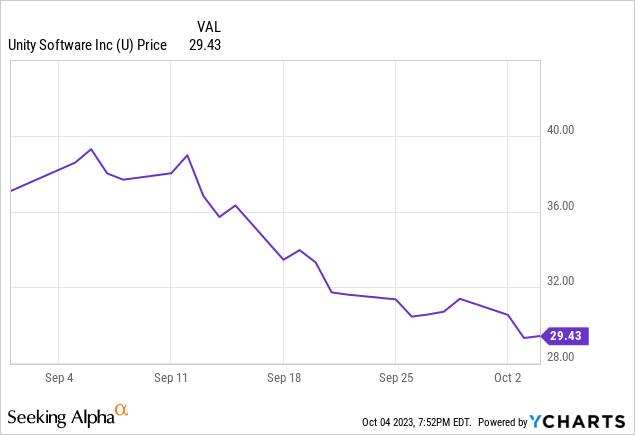

Soon after, developers started to protest en masse, many of whom vowed to never return to Unity unless the pricing model was adjusted. This resulted in a major stock price crash.

A Quick Fix

Perhaps sensing the financial peril, Unity’s exec team launched a restructured pricing model whereby developers would simply pay the lesser of 2.5% of revenue (above a threshold) or the per-install fee, both of which would be self-reported.

Judging by the relative calm in game development forums, this model proved to be much less controversial helping to avoid a mass exodus of developers.

While I believe that was the right choice for the business’s long term, it appears that Wall Street disagreed, sending the stock even lower after the updated pricing changes were made public.

Perplexing Dynamics

So if it’s good for the long-term business, why the pessimism from the street? Well, I can only provide my perspective but I would wager that Wall Street’s long-term confidence in Unity’s ability to increase prices has been somewhat diminished.

If Unity is so good, so irreplaceable, they should be able to raise prices however much they like, but like all companies, there is a point where increases will no longer be tolerated. Unity investors just found out that the threshold is lower than they expected.

While game developers are, to an extent, locked into the ecosystem they chose to master, it’s not a total lock. If egregious pricing moves are made by Unity or Unreal developers can choose to work with Godot, an open-source game development. While Godot is a massively inferior tool for 3D development it is workable for 2D games and the tool continues to improve over time as the community continues to update it.

I believe Unity and Unreal leadership’s plan should be to keep prices as low as they can for as long as possible until the point their offerings are so much better than any open-source alternative that they can more easily push pricing.

Fortnite had been a useful way for Epic to improve Unreal but those funds are clearly beginning to dry up and now most companies must balance their future growth plans with immediate needs. That’s not an easy challenge.

Valuation

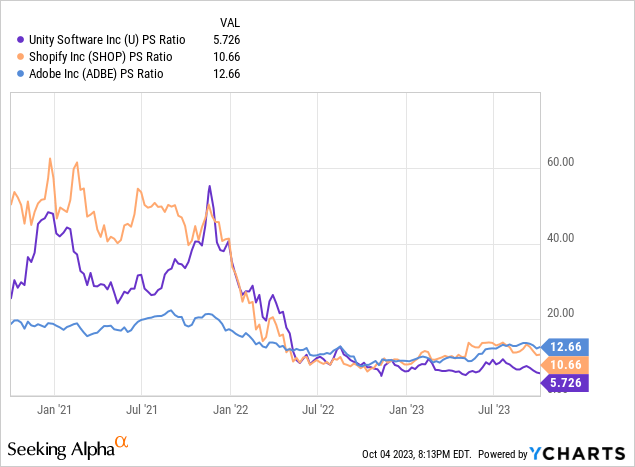

Unity’s price-to-sales ratio now sits at just 5.7x, far lower than Shopify (SHOP) at 10.7x, and Adobe (ADBE) at 12.7x. Over the long term, I expect Unity’s financial performance will look like something in between Adobe and Shopify as their game creation tool is similar to Adobe’s content creation tools, and their Operate business “operates” in a similar manner to Shopify’s business model. To better understand why I’ve selected these companies as the appropriate peers please refer back to my first article on Unity. But for context within this article, I believe that the steady recurring revenue model of a tool like Photoshop is similar to the business model of Unity’s create business and the incremental service offering and marketplace are reminiscent of Shopify’s strategy.

A note on valuation: in prior articles, I had included a discounted cash flow analysis and compared price to sales against other peers, those are missing from this article. And for good reason.

I believe that extensive price-to-sales comparisons for Unity are a futile exercise as their business model is so unlike any publicly traded company. That makes finding comparables very challenging.

Furthermore, with long-term rates and the ad market exerting as much volatility as they have been this year, I am not confident in the short-term direction the stock will move. Therefore you should interpret this article as a fundamental long-term bull case, not a short-term trade.

Conclusion

In conclusion, despite the recent turbulence surrounding Unity, its CEO, and its pricing strategy, its underlying potential remains strong. For investors who are comfortable with a greater degree of risk, Unity’s stock appears to be a compelling buy.

While the company has faced challenges (often self-inflicted), its position as a key player in the game development and VFX industries, coupled with a more transparent pricing model, could pave the way for increased trust with game developers and a bigger pot at the end of the rainbow.

Thank You

Thank you for reading my article on Unity today, I sincerely hope you enjoyed it or at least learned something new after having read it. On a personal note, I know I’ve missed the mark on my Unity analysis in prior articles, and for that, I apologize, clearly I was too euphoric in the Covid age of tech valuations. That said I believe Unity’s business model is fundamentally superior and as such will exhibit long-term competitive advantages.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of U either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.