Summary:

- Unity Software Inc. investors have endured another hammering since Unity’s Q1 earnings release in May.

- The company is facing intense competition with AppLovin and might not be winning.

- Unity aims for revenue growth acceleration in the second half but faces challenges in non-core businesses and ad monetization.

- Uncertainties linked to Unity’s new direction under a new CEO and ad monetization uncertainties could hamper a further recovery.

- I argue why I can no longer maintain a bullish rating on Unity stock.

Sundry Photography

Unity Stock: Underperformance Is Justified

Unity Software Inc. (NYSE:U) investors have endured a massive hammering since Unity’s Q1 earnings release in May 2024. Therefore, the market seems to have assessed significant execution risks as ex-interim CEO Jim Whitehurst handed over the reins to new CEO Matthew Bromberg. Bromberg is a highly experienced gaming industry veteran, underscoring Unity’s refocus on capitalizing on gaming opportunities. Whitehurst has transitioned to Unity’s executive chair, providing continuity in the company’s strategic direction. Given Unity’s struggles to reignite growth, its ability to improve its ad monetization model is still expected to come under intense scrutiny.

I have been bullish on Unity’s thesis over the past year. However, that has proved incorrect, as Unity has not demonstrated sufficient ability to justify a sustained turnaround. In my bullish Unity rating in April 2024, I had anticipated U’s $22 level to hold robustly. However, buyers were deemed to have given up after Unity’s Q1 earnings scorecard, dealing a severe blow to the stock’s recovery.

Unity: Ad Monetization Comes Under Scrutiny

Based on Unity’s full-year outlook for FY2024, management anticipates a revenue growth acceleration in the second half. CFO Luis Visoso telegraphed his confidence in Unity’s “engine, cloud services, and monetization business to drive sustainable value creation and shareholder returns.” As a result, management expects to achieve more optimistic performance from its Create and Growth segments. However, management also highlighted transition challenges in its non-core businesses. As a result, Unity did not provide more clarity on the adjusted EBITDA allocation since “non-strategic portfolio EBITDA is deemed insignificant due to ongoing exits.”

Notwithstanding management’s optimism, Wall Street focused on assessing Unity’s ability to regain traction in its ad monetization business. Given AppLovin’s (APP) notable achievements, AppLovin’s success was also highlighted during Unity’s Q1 conference call.

Management acknowledged the challenges against AppLovin’s market leadership. AppLovin was enthused over the success of its Axon 2 model at its Q1 earnings conference call, which lifted advertising spending on its platform. In contrast, Unity was more guarded in its commentary, as Whitehurst articulated:

… And as we’re working through [ad monetization], again, where we’ve worked with a couple of partners specifically on these things, we’ve seen really good results against those things. So, whether we close the gap [with AppLovin] to 100% or to 70% or 80%, it’s really hard to say just as we’re kind of running through, because you don’t actually see the ROAS numbers across, but what we’re seeing is very positive trajectory, which will impact spend with these various advertisers. So that much I can say, it’s hard to compare benchmark to benchmark. – Unity Q1 earnings call

Consequently, I assess the market has likely resolved to de-rate U’s valuation to consider even higher execution risks. Worsened by uncertainties from Unity’s top leadership transition, the market is justifiably concerned about Unity’s ability to “close the gap” with AppLovin’s growing advantages.

U Stock Valuation: Still Not Undervalued

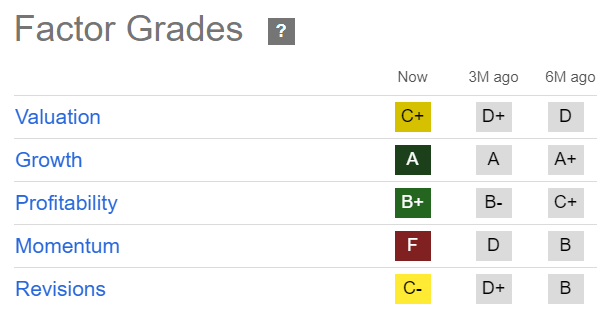

U Quant Grades (Seeking Alpha)

Notwithstanding the significant decline, U is still not assessed as undervalued (“C+” valuation grade). Despite that, bullish Unity investors could argue that U’s “A” growth grade suggests the market is likely too pessimistic.

Accordingly, U’s forward adjusted PEG ratio is only 0.48, more than 75% below its sector median. Consequently, the market has likely de-rated U’s growth prospects in the second half, assessing higher execution risks while undertaking a significant leadership transition.

Uncertainties relating to Unity’s competitive edge in mobile gaming ad monetization could further impact its revenue growth inflection. Moreover, Unity is still consolidating its non-strategic businesses, potentially increasing uncertainties over its forward guidance.

Is U Stock A Buy, Sell, Or Hold?

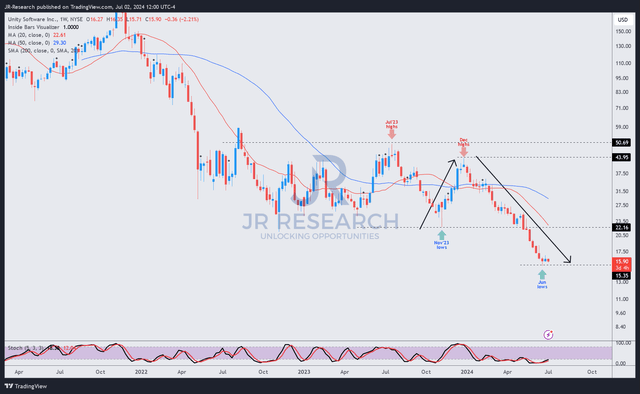

U price chart (weekly, medium-term) (TradingView)

Unity’s price action indicates a clear downward bias since buyers gave up its critical $22 support level.

That pivotal level has helped U consolidate constructively since November 2022. Therefore, losing that level decisively likely led to a rapid liquidation of bullish positions as buying momentum collapsed. The stock’s “F” momentum grade corroborates my observation, suggesting dip-buyers could be potentially catching a falling knife.

I expect a near-term consolidation in U as it’s well-oversold. However, I assess that Unity’s growth prospects have likely suffered a significant setback. Moreover, the company has not demonstrated sufficient ability to diversify its businesses outside its core gaming vertical, intensifying its concentration risks. A lack of GAAP profitability through the FY2026 forecast period could further hamper U’s recovery, suggesting investors should consider staying on the sidelines.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of APP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!