Summary:

- Acquisition of ironSource is complete, but Unity still needs to execute the integration and demonstrate the combination will create value.

- Unity’s management team is expecting a soft market in 2023 and has given weak guidance.

- Unity is positioning itself to benefit from generative AI, but rapid changes could undermine the company’s competitive position.

- Unity’s stock is modestly valued, given the company’s long-term prospects, but the successful integration of Weta and ironSource along with a growth reacceleration will likely be needed before the stock reprices.

airdone/iStock via Getty Images

Unity Software (NYSE:U) is a leading game engine developer, and stands to benefit long-term from the proliferation of 3D content. Unity is likely to remain under pressure in the near-term though due to its reliance on advertising. Unity also still needs to demonstrate the successful integration of Weta and ironSource. Weta in particular has added to costs significantly without making a meaningful contribution to revenue. While generative AI presents an opportunity for Unity, it could also alter competitive dynamics in the game engine market, which are currently favorable.

Market

The macro environment has remained more resilient than Unity’s management expected, but end-market demand is still under pressure in spite of this. Within gaming, developers are continuing to produce a large number of games and Unity is witnessing strong DAUs on its network, suggesting that overall game play remains strong.

Management has stated that the ad market stabilized in the middle of 2022, and that they are currently seeing strong user engagement offset by weaker CPMs. While the market has stabilized, growth is expected to be negative in the first half of 2023, due to the strong comparable period in 2022. The market is expected to be flat YoY in the second half of 2023, resulting in something like -10% growth for the year in aggregate.

On the industry side of the business, demand continues to be robust, although management has suggested that some sales cycles have elongated.

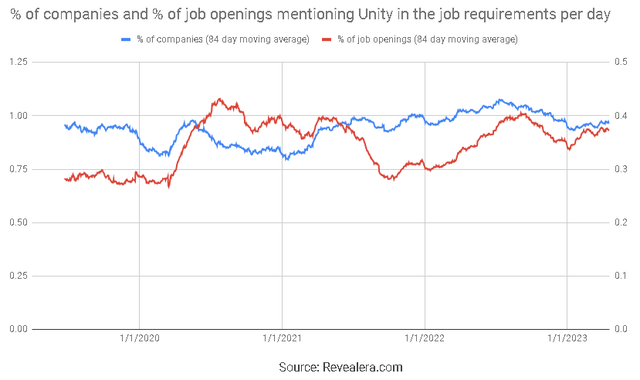

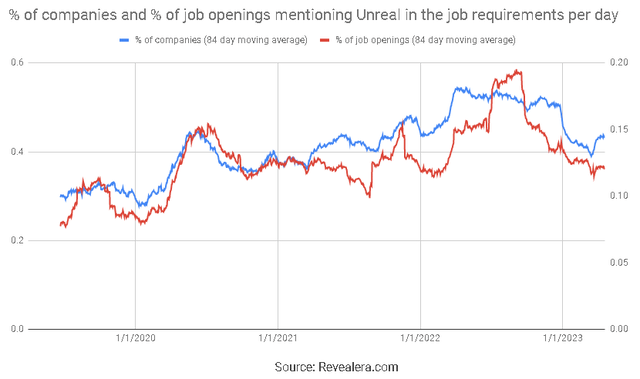

While this is a fairly bleak outlook, there is little to indicate that it is the result of Unity specific problems. Unity and Epic Games both appear to be facing a similar demand environment.

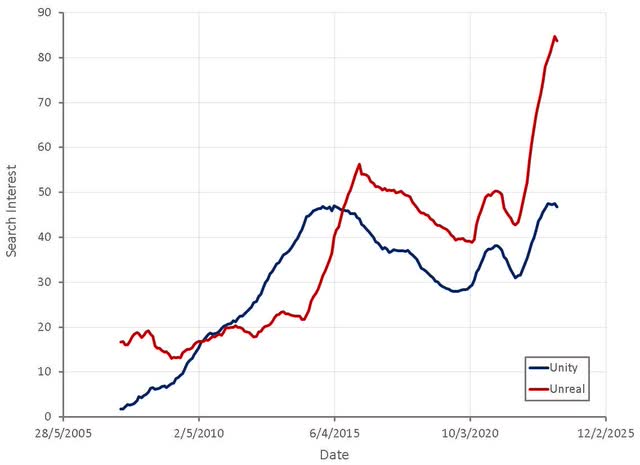

Figure 1: Job Openings Mentioning Unity in the Job Requirements (source: Revealera.com) Figure 2: Job Openings Mentioning Unreal in the Job Requirements (source: Revealera.com) Figure 3: Game Engine Search Interest (source: Created by author using data from Google Trends)

Unity

Unity is still digesting the relatively large acquisitions of Weta and ironSource, along with a number of smaller acquisitions. It will take time for synergies to be realized and for the full impact on the business to be seen. For example, the monetization of Weta tools is expected to begin in 2023, which will give the first insight into the success of Unity’s attempted expansion into artistry.

Pricing should also be supportive of growth in 2023. Unity recently raised prices but the impact of this is still flowing through to the financials, as Unity is honoring the pricing in existing contracts.

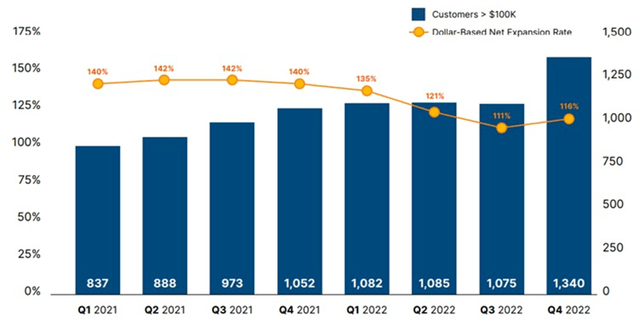

The benefits of product innovation, acquisition synergy and pricing are likely to be offset by a weak macro environment though. Unity’s Grow business is more dependent on the macro environment than the Create business. This can be seen in Unity’s net expansion rate, which has been declining in recent quarters due primarily to the Grow business.

Create

Unity expects to see continued growth within the Create business in 2023, based on games being built and launched at around the same pace as 2022. Industrial interest in Unity’s platform and digital twins also remains robust, although it would likely be impacted in the event of a recession. Unity reported over 100% growth in digital twins in 2022 and management has stated that demand continues to exceed their ability to supply. Unity’s digital twin platform went in to general availability in the third quarter of 2022. It is a ratable use-based platform for Digital Twins and has been attracting a large number of customers. While it will likely take time for this business to become significant, it is important to Unity’s future.

Within Gaming Unity is focused on software developers, artists and content creation professions. Multiplayer games and AI driven content generation are areas of development. There is also the prospect of tools like Weta and Ziva coming to market in 2023, which should provide a substantial tailwind. Unity expects to increase its take-rate through better segmented pricing and by adding ratable cloud services and serving more creator roles.

Within industries, energy, infrastructure, manufacturing and ecommerce are areas of focus. Unity offers cross-platform digital twins and the ability to store content and improve workflows.

Grow

Within the Grow business, Unity expects the in-game ad market to remain steady at current levels, resulting in roughly a 10% contraction in 2023. Management is hopeful that the acquisition of ironSource will be supportive of market share gains in 2023 though.

ironSource Integration

The ironSource integration is reportedly progressing as planned, although it is still fairly early days. Unity now offers best-in-class solutions across:

- Publishing – Supersonic

- Mediation – LevelPlay

- Ad Networks – Unity and ironSource

- Marketing – Luna

- Device-Management – Aura

Management has stated that there is strong interest in the combined offering and that they are already witnessing market share growth. They still need to demonstrate that these assets can be combined into an end-to-end platform which creates synergies for both customers and shareholders though. In particular, investors should look for signs that Unity is benefiting from the expansion of its mediation and ad network footprint into the mid-market and into apps beyond games.

Unity wants to establish itself as the leading mediation and ad platform for Android and iOS, and to establish Supersonic and Aura as the leading players for independent publishing and device management, respectively. Aura is a device management business whose key competitor is Digital Turbine (APPS). Aura drives installs of games and non-game applications on Android devices around the world based on carrier relationships.

AI

The capabilities of AI are rapidly increasing, but it will likely take time before its impact is fully felt in real-time interactive 3D experiences. While AI represents a large opportunity for Unity, and 3D content in general, it is probably more of a threat than an opportunity. The market for game engines has been evolving into a duopoly that has increasingly insurmountable barriers to entry due to the cumulative R&D investment in developing leading edge capabilities. Absent any impact from AI, Unity and Epic Games are likely to become increasingly dominant and in-house game engines may find it difficult to maintain competitive functionality.

The impact of generative AI is still largely unknown, but at best it likely helps game engines to proliferate without altering competitive dynamics in the industry. Worst case scenario, the competitive advantage of incumbents could be significantly undermined.

Unity employs AI across a wide range of areas, including monetization and content creation. Utilizing machine learning to optimize monetization is fairly mature use case, but generative AI is rapidly evolving and could lead to higher quality games and dramatically increased developer productivity.

Tools like Midjourney and Stable Diffusion enable the creation of graphics that can be used directly in games. Unity believes that the pace of development in this area is too rapid to stay on top of and hence it has made the decision to provide a two-sided generative AI marketplace for game developers.

While the ability to create 2D graphics from text is maturing rapidly, 3D graphics and 3D graphics with motion still have a way to go. There is also a lot of work being done around generating 3D content from ordinary videos, and this is likely to yield more near term benefits.

Financial Analysis

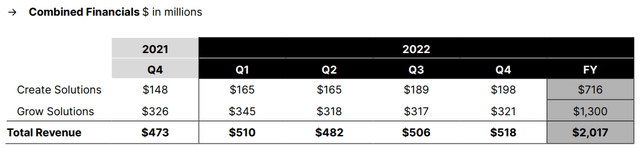

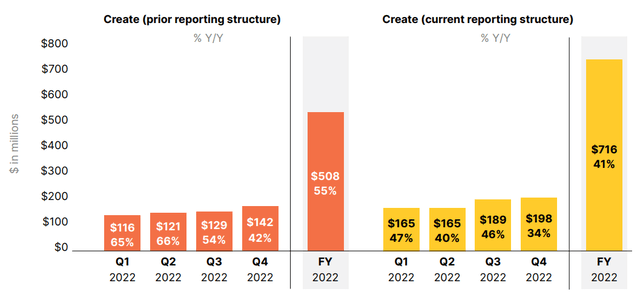

Unity’s revenue increased 43% YoY in the fourth quarter of 2022, although this was largely the result of the ironSource acquisition closing in November. Compared to the combined financials of Unity and ironSource, revenue only increased by approximately 9.5% YoY.

Figure 4: Combined Unity / ironSource 2022 Revenues (source: Unity)

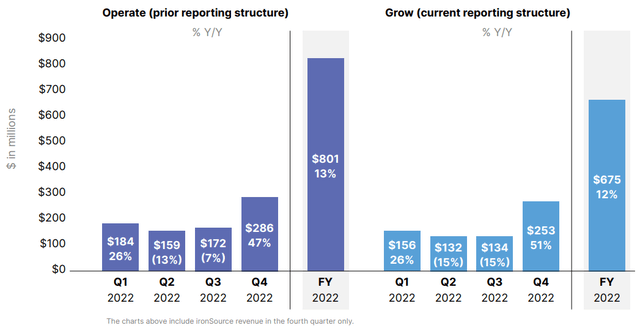

Going forward, Create Solutions will include all products that were included in Create Solutions in 2022 plus Unity Gaming Services, which was previously reported under Operate, and Strategic Partnerships, which was previously reported separately. Grow Solutions will include Unity’s Ad products, Supersonic, Aura and Luna.

Figure 5: Create Segment Results (source: Unity) Figure 6: Grow Segment Results (source: Unity)

With the inclusion of ironSource, Unity’s large customer count expanded significantly in the fourth quarter, although it should be noted that there was significant overlap between the customers of the two companies. Excluding ironSource, Unity would have had 1,056 customers with trailing 12-month revenue above 100,000 USD and a net expansion rate of 109%, both of which represent a continued moderate deterioration in performance QoQ.

Figure 7: Unity Customer Metrics (source: Unity)

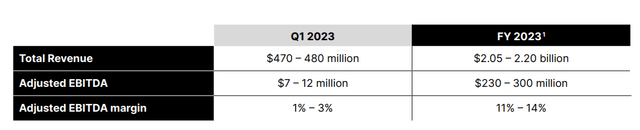

Unity currently expects revenue to be between 2.05 and 2.2 billion USD in 2023, representing 47-58% YoY growth. Again, much of this comes from the ironSource acquisition and excluding the impact of this, revenue is likely to be fairly flat. This would be a disappointing result given easy comparable periods as a result of issues in the Operate business in 2022. Guidance appears to be quite conservative though due to macro uncertainty. Within the Create business, growth is expected to come from pricing actions taken in 2022, growth in China and continued expansion of digital twins. The Grow business is expected to gain share in a down market on the back of synergies from the ironSource acquisition.

Figure 8: Unity 2023 Guidance (source: Unity)

Expenses

Unity is working on reducing expenses, but is currently still accruing large losses, largely as a result of stock-based compensation. The fourth quarter also included significant costs related to the merger and other restructuring costs. Management has put a cost control program in place for 2023 which is expected to improve productivity and reduce the impact of SBC. Margins are expected to improve throughout the year on the back of increased revenue and flat costs. Management also reiterated the $1 billion EBITDA run-rate target for the end of 2024 on the fourth quarter earnings call.

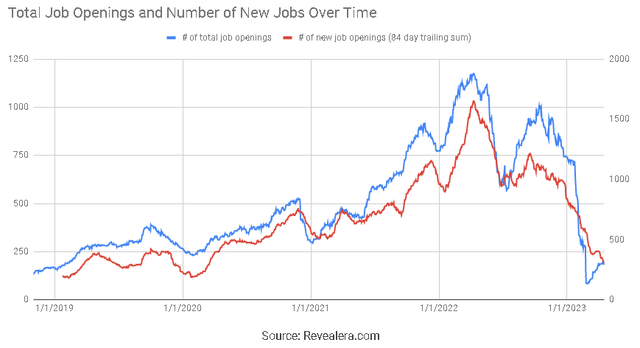

Unity has cut headcount and is being selective with new hires, which can be seen from the low number of job openings. Unity also plans on reducing the number of shares that are granted as part of compensation.

Figure 9: Unity Job Openings (source: Revealera.com)

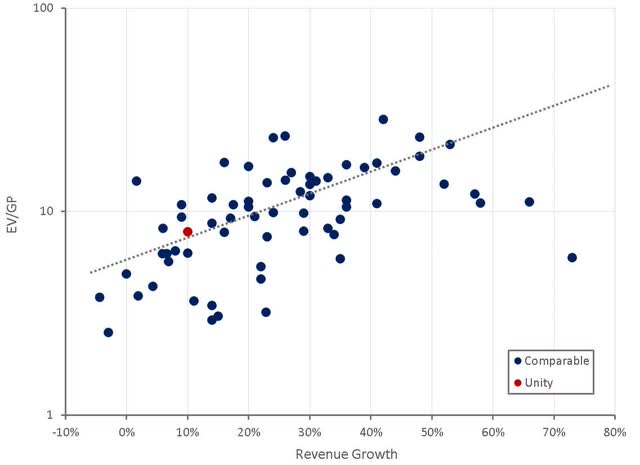

Valuation

Unity repurchased 42.7 million shares in the fourth quarter of 2022 at an average price of 35.1 USD per share. This amounts to 1.5 billion USD out of a total planned 2.5 billion USD share buyback program. The wisdom of this move remains to be seen, as Unity’s current share price is currently sitting well below the average repurchase price. It should be a reasonable indicator that management believes Unity’s stock is currently undervalued though.

While Unity’s ongoing losses and dilution are somewhat difficult for shareholders to swallow, this is largely in service of building a platform that is likely to see wider adoption going forward in a market that is a duopoly with enormous barriers to entry. In the future, game engines could underpin large amounts of economic activity and have significant pricing power.

Figure 10: Unity Relative Valuation (source: Created by author using data from Seeking Alpha)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of U either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.