Summary:

- Unity’s profit margins have been improving as the company emerges from a period of heavy investment.

- Performance of the Operate business has been disappointing, but a more constructive demand environment and synergies from the ironSource merger may change this.

- Unity’s valuation still does not reflect the fact that growth is likely to reaccelerate and that the company has a strong competitive position.

luza studios/E+ via Getty Images

While Unity’s (NYSE:U) organic growth continues to be sluggish, the company has rapidly improved its profit margins in recent quarters, and this is likely to continue going forward. Improving margins are largely the result of Unity reducing its pace of investment in intangibles and beginning to realize the benefit of past investments.

The performance of Unity’s Operate business continues to be somewhat disappointing but a more constructive demand environment and synergies from the ironSource merger may change this. The Create business continues to perform well and the expansion into artist focused tools should help to drive growth going forward.

Market

While there have been signs of stabilization in digital advertising, the economic environment is still challenging for Unity. Some gaming customers are not adding headcount and sales cycle for the Digital Twin business have lengthened. The China Create market is also soft at the moment, and given the current trajectory of the Chinese economy, this will likely worsen.

AI

AI continues to be a focus area for Unity, with the company recently releasing Muse, Sentis and an AI marketplace on the Unity Asset Store. Muse and Sentis are currently in closed beta, with Unity anticipating a broader roll out later in the year.

Unity Sentis is a cross-platform runtime inference engine that allows creators to deploy neural networks across any platform supported by Unity. This should help developers to create experiences that are more engaging, interactive and dynamic, while minimizing cloud compute costs and latency. Sentis will also drive consumption revenue and could help Unity to improve its expansion rate.

Unity Muse consists of tools that are designed to help accelerate the creation of real time 3D content. This appears to be a fairly nascent effort with little substance at this stage though. Unity Muse Chat is one of the first tools available and it acts as a chat interface to accelerate troubleshooting and accessing information. Over time, Unity plans on adding functionality to make it easier to create assets and animations with just a text prompt or a sketch.

Unity also recently launched a dedicated AI marketplace on the Unity Asset Store, including Verified Solutions for AI-driven game development. Verified Solutions are professional caliber third-party tools, plug-ins, and SDKs, tested for compatibility and supported by Unity. The AI marketplace provides a central location for Unity developers to find relevant AI solutions.

Solutions in the AI Hub cover a range of capabilities, including:

- Generative AI solutions – Tools that allow developers to generate assets

- AI/ML Integration solutions – Tools to enhance creation workflows or connect projects to services from AI vendors

- Behavior AI solutions – Tools that allow developers to create behavior in game worlds

These types of solutions could significantly expand Unity’s customer base as the company has a large number of free users who would stand to benefit from the capabilities that AI can offer. Improved capabilities will also be used by Unity to justify incremental price increases over time.

AR/VR

The impending launch of the Apple Vision Pro has brought attention back onto AR/VR, and Unity has positioned itself to capitalize on this. Unity has launched a beta program for visionOS which enables developers to create games and apps for the Vision Pro. The beta program for visionOS includes access to Unity PolySpatial, a technology designed to help developers port and create 3D experiences for Vision Pro. Unity has worked closely with Apple to offer support for visionOS and PolySpatial, so users can use Unity apps on the Vision Pro at launch.

While anything related to Apple is likely to generate a large amount of interest, the success of Vision Pro is not guaranteed, particularly not iPhone levels of success, and there are early signs that both user and developer interest is somewhat disappointing. Apple has been inviting developers to Vision Pro focused developer labs in recent months but interest has reportedly been weak. Developers still have more than six months to test and develop apps for the Vision Pro as it is not expected to launch until early 2024.

The Vision Pro had an initial sales target of one million units but estimates have now dropped to as low as 150,000 units. The reasons for this aren’t really clear at this stage, but it should be kept in mind that VR is likely to be far more niche than something like a watch or smartphone. The cost is also likely prohibitive for many, with the Vision Pro having roughly a 3,500 USD price tag. A more affordable AR headset is not expected to arrive before 2025.

Digital Twins

Unity’s Create business outside of gaming continues to be an area of strength and the company appears to be positioning itself to accelerate growth. Unity has stated that this business has been supply constrained and hence it hasn’t been able to make the most of demand. Its digital twins have been gaining traction in the market and Unity is now focused on delivering repeatable solutions and making the business more scalable. Interest is coming from areas like government, manufacturing, retail and AEC.

Unity is trying to reduce the reliance of its Create business on professional services which is expected to make the business more scalable and profitable. It is doing this by introducing turnkey solutions and by leveraging partnerships with companies like Capgemini and Booz Allen. This is likely to be a modest headwind to growth in the near term but should support long-term growth and margins.

ironSource Acquisition

Mobile game advertising is undergoing a transformation, driven by privacy initiatives and increased adoption of header bidding. Until relatively recently, waterfall fulfilment was used to serve ads in apps, but header bidding is now increasingly being used.

Adtech companies have positioned themselves for these changes by either introducing new products or making acquisitions. ironSource’s mediation platform was launched in 2019 and AppLovin (APP) acquired MoPub from Twitter in October 2021, moving MoPub customers over to its MAX mediation platform. AppLovin’s acquisition enabled it to aggregate a large quantity of mobile game ad inventory, providing it with unparalleled data access.

Unity announced its mediation platform in 2021, but this product struggled to gain traction. Unity subsequently merged with ironSource in 2022 in a move that likely has similar intended results to AppLovin’s MoPub acquisition.

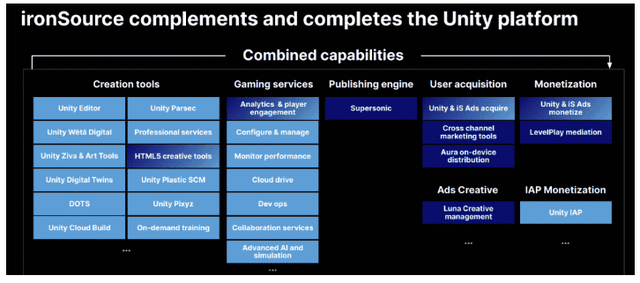

Figure 1: Combined Unity and ironSource Capabilities (source: Unity)

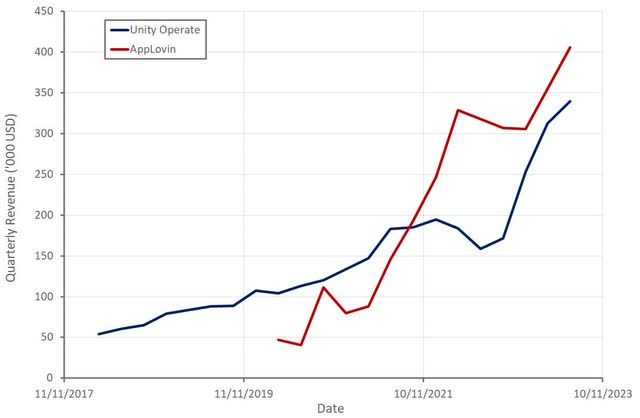

Recent performance seems to indicate that AppLovin currently has an advantage. AppLovin’s software revenue growth has significantly outpaced Unity’s Operate business growth over the past few years. AppLovin has attributed recent strong growth to the introduction of its improved recommendation engine, AXON 2. Unity has stated that the combined capabilities of Unity and ironSource are driving improvements in its AI capabilities, resulting in improved ROIs for advertisers. Further improvements are also expected in coming quarters. Whether this closes the gap with AppLovin remains to be seen though.

An important part of improving Operate growth will likely be expanding beyond gaming. Unity recently partnered with Tinder to power its video ad monetization. Expanding beyond games is likely necessary for Unity to improve the competitive positioning of its advertising solution and maximize the value of the ironSource merger.

Figure 2: Unity Operate Revenue (source: Created by author using data from company reports)

Financial Analysis

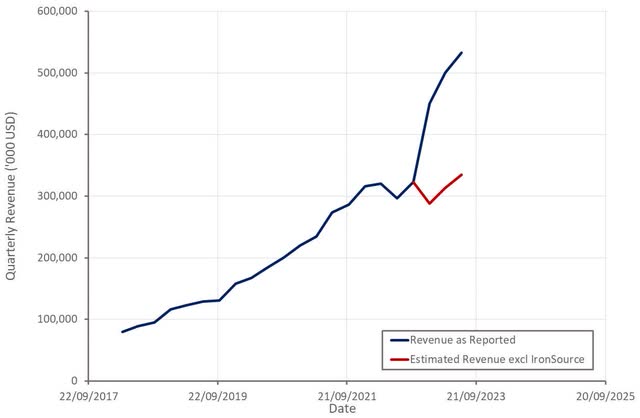

Create Solutions revenue was up 17% YoY in the second quarter, with Industries (beyond gaming) now representing 30% of Create Solutions revenue. Grow Solutions revenue increased 157% YoY, or 7% on a pro-forma basis. Quarter-over-quarter Grow Solutions growth was 9%.

Unity is guiding for 67-70% YoY revenue growth in the third quarter, or 7-9% on a pro-forma basis. This guidance assumes that the game ads market will be relatively flat through the remainder of the year, other than normal seasonality. Unity is also assuming that the market in China will continue to be soft and that the Professional Services business will further decelerate. For the full year, Unity is guiding for 52-58% revenue growth, or 5-9% on a pro-forma basis.

Figure 3: Unity Revenue (source: Created by author using data from Unity)

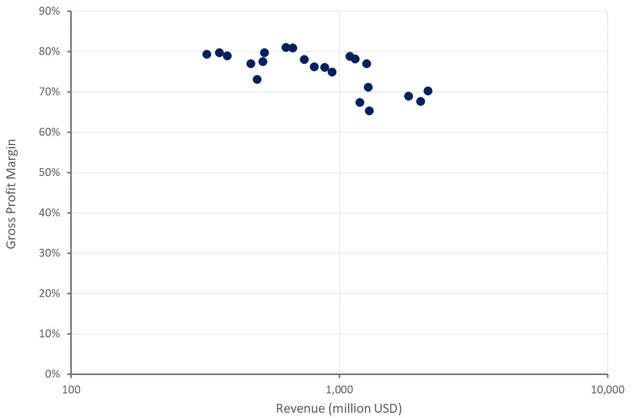

Unity’s gross profit margins have begun to rebound in recent quarters and should continue to improve as the company realizes synergies from the ironSource acquisition and begins to monetize the Weta tools business.

Figure 4: Unity Gross Profit Margins (source: Created by author using data from Unity)

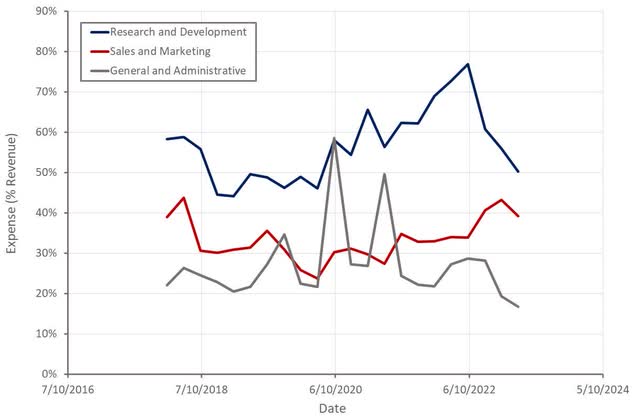

Unity is also beginning to reduce the burden of operating expenses, driven by acquisition synergies, a greater focus on cost control and a return to growth.

Figure 5: Unity Operating Expenses (source: Created by author using data from Unity)

Conclusion

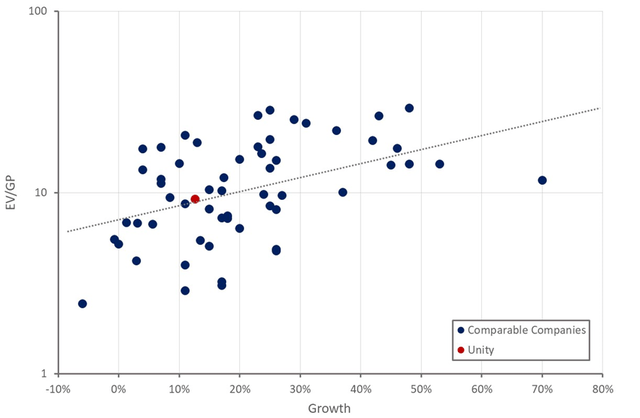

Unity’s recent performance has been disappointing, but investors have been overly focused on the company’s profit margins. Unity has been going through a period of heavy investment and because these investments have largely been in intangibles they have been recognized as expenses. Whether these investments result in reasonable returns remains to be seen, but regardless, Unity’s margins will continue to increase rapidly as the pace of investment eases.

Looking solely at Unity’s current growth rate and margin profile indicates that the company is priced in line with similar companies. This ignores both the large market opportunity ahead of Unity and the favorable structure of its market though. While Unity still has work to do in its advertising business, its game engine provides it with a strong competitive position which is likely to improve over time. Unity’s growth should reaccelerate in coming years and the company will likely be highly profitable in time.

Figure 6: Unity Relative Valuation (source: Created by author using data from Seeking Alpha)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of U either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.