Summary:

- While Unity’s Q2 results were in line with expectations, the company cut its guidance and announced that it was changing its CFO.

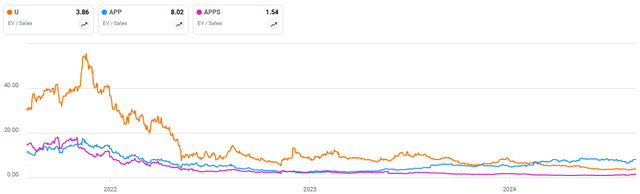

- Unity’s business appears to be stabilizing, but the company shows no signs of closing the performance gap with AppLovin.

- Outside of monetization issues, Unity’s Create segment is only growing due to its expansion outside gaming. This is concerning given the backlash created by runtime fees.

- Unity’s margins and cash flows are improving, but it is difficult to see the stock rebounding until growth returns.

airdone

Unity (NYSE:U) reported results that were broadly in line with expectations in the second quarter, but the company cut guidance and announced it was changing its CFO. While the initial response to this was unsurprisingly negative, the share price has since recovered. Given Unity’s relatively low valuation and improving cash flows, it is difficult to see too much additional downside.

I previously suggested that Unity was all talk, with little actual progress occurring in the business. While the company is now making moves that could help to turn the monetization business around, this is likely to be an extended process. In the meantime, investors face the prospect of dilution from excessive stock-based compensation and weak growth.

Market Conditions

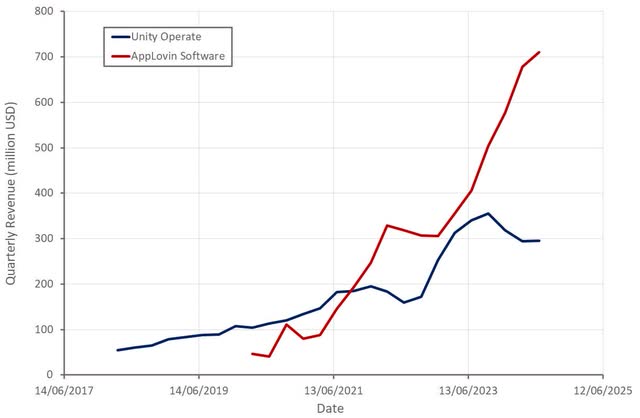

The large performance discrepancy between Unity’s Grow business and AppLovin’s (APP) Software business makes it clear that Unity’s problems are primarily company-specific. While Unity is working on its software, AppLovin believes that it can continue to improve its own software, making it difficult for Unity to close the performance gap.

Aside from the current headwinds facing mobile gaming, there is a large opportunity that is likely to increase over time. Mobile gaming is responsible for around 60% of the $130 billion spent on consumer apps annually.

Figure 1: Unity and AppLovin Revenue (Created by author using data from company reports)

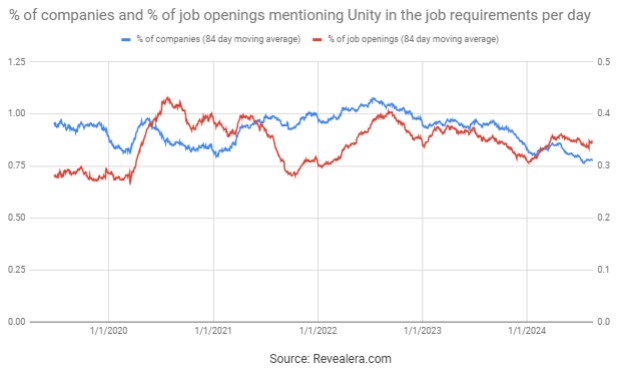

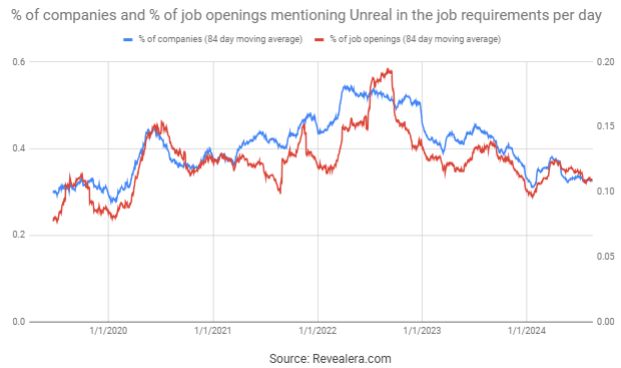

Many investors have been quick to blame Unity’s current struggles on mismanagement and developers abandoning the platform. While Unity’s acquisitions have been questionable, the company’s current issues stem largely from its adtech. The implementation of the runtime fee has likely created some headwinds, but in general, it appears that Unity’s engine hasn’t lost its appeal.

Figure 2: Job Openings Mentioning Unity in the Job Requirements (Revealera.com) Figure 3: Job Openings Mentioning Unreal in the Job Requirements (Revealera.com)

Unity Business Updates

Unity’s game engine remains an important and difficult to replicate asset. 70% of the top mobile games globally are built on Unity and there was an average of 3.7 billion downloads per month of applications built using Unity in 2023.

Most of Unity’s recent investments were focused on creating a more comprehensive engine that would take the company more in the direction of Epic. Unity now appears to have reduced its focus on artist tools and AI in the pursuit of profitability, though.

Unity still plans on introducing Unity 6 this fall. While this is unlikely to be an important update from a product perspective, it should help to improve monetization of the engine as it will see the introduction of runtime fees. This will take time to have a meaningful impact on Unity’s revenue, though.

Unity’s engine is still largely monetized through Unity’s advertising business, which currently has large problems. Unity should have the scale necessary to be successful in advertising, as it delivers over 65 billion impressions each month and reaches over 1.5 billion individual gamers.

The company’s adtech is lagging though, and based on recent commentary, it does not appear that this gap will be closed anytime soon. Unity has been making improvements to its ad network and mediation platform and has been encouraged by customer feedback. Despite this, Grow revenue remains soft and AppLovin continues to take market share at a rapid pace.

Unity now plans on undertaking a comprehensive rebuild of its machine learning stack and data infrastructure, with a stated goal of creating a more agile environment that enables innovation. This suggests that there are fundamental issues with Unity’s current approach that will not be easily resolved.

On a positive note, Unity is hiring Jim Payne as its new Chief Product Officer for advertising. Jim co-founded MoPub (mobile in-app ad server and exchange) and Max Advertising (mobile header bidding platform), which are now core parts of AppLovin’s business.

Financial Analysis

Unity generated $449 million in the second quarter, a 16% decline YoY. Revenue from the strategic portfolio totaled $426 million, down 6% YoY. Non-strategic portfolio revenue was $23 million in Q2 and is expected to reach the single digits by the end of the year.

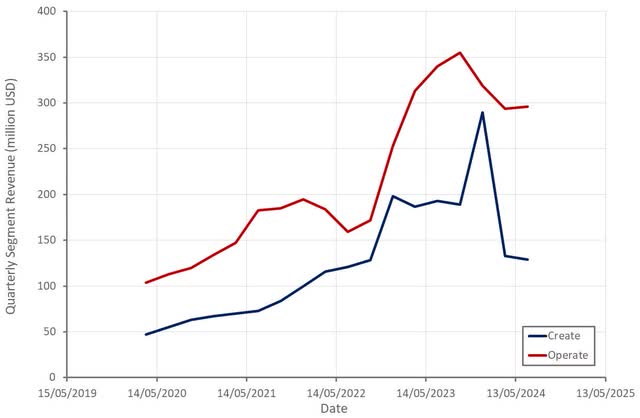

Strategic portfolio revenue in the Create segment was $129 million, up 4% YoY. This increase was due to 14% subscription growth, along with price increases and customers upgrading to higher-priced subscriptions. Create revenue was down sequentially though as a result of lower strategic partnership and professional services revenue. Industries grew 59% YoY in Q2 and remain the fastest-growing part of Unity’s business. It now constitutes 18% of total Create Solutions revenue. Outside of industries, Unity’s strategic Create revenue appears to have been fairly flat YoY.

Strategic portfolio revenue in the Grow segment totaled $296 million in Q2, down 9% YoY. This decline was attributed to pressures on the monetization business, partially offset by strong Aura performance. Aura is a device management solution whose key competitor is Digital Turbine (APPS).

Unity expects $415-420 million from its strategic portfolio in the third quarter, representing a 4-6% YoY decline. For the full year, the company now expects $1,680-1,690 million in revenue, representing a 2-3% drop YoY. This compares to previous guidance of $1,760-1,800 million revenues. Unity has suggested that while improvements to its ad network and LevelPlay products are yielding benefits, this is taking longer than expected to impact revenue.

Figure 4: Unity Revenue by Segment (Created by author using data from Unity)

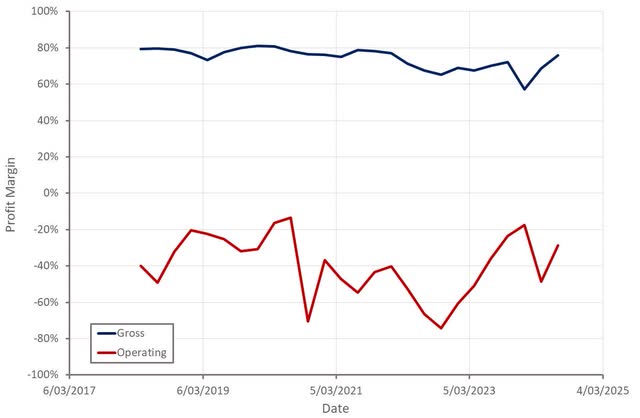

Unity’s gross margins continue to recover, on the back of cost control and revenue mix. There is also now less of a headwind from Weta engineers. This is being somewhat offset by investments in machine learning, though.

Unity’s adjusted EBITDA was $113 million in Q2, while the company’s operating loss was around $130 million. While Unity’s profits and cash flows are improving, the company has been trying to rein in costs for some time and has little to show for it.

Unity is guiding to $75-80 million adjusted EBITDA in the third quarter. Lower than initially anticipated revenue is likely to create a headwind in coming quarters.

Figure 5: Unity Margins (Created by author using data from Unity)

Conclusion

Unity’s Grow segment continues to struggle, and it appears like this situation will persist for some time while Unity tries to address its adtech performance issues. Unity’s digital twin solution for industries continues to be the strongest performing part of the business, but it is still too small to offset weakness in other parts of the business. Excluding industries, Unity’s strategic Create revenue appears to have been fairly flat YoY, despite the tailwind provided by price increases. This is concerning given the backlash against Unity’s runtime fee. While Unity’s margins and cash flows have improved, stock-based compensation remains a problem, and the company is still a long way off GAAP profitability.

Unity’s game engine is a strategically valuable asset, but there remain questions about how this value will be realized. The implementation of runtime fees should help with this, and adtech issues will also hopefully be resolved in time. It is difficult to see Unity’s share price moving significantly higher while the company is unprofitable and struggling to grow. I don’t think there is currently that much downside risk though, given that Unity is cash flow positive, with stabilizing revenue and improving margins.

Figure 6: Unity EV/S Multiple (Seeking Alpha)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of APPS, APP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.