Summary:

- Unity Software launched its AI marketplace, leading to a resurgence in buying sentiment. The AI hype has finally arrived for Unity.

- The company’s competitive advantage as the leading 3D engine for game creators has yet to demonstrate sustainable profitability. Hence, investors must still be cautious about chasing hype.

- Management has yet to bake in revenue and profitability accretion from its AI solutions, but the market has attempted to price it in. Moreover, U’s valuation is expensive.

- However, I gleaned that U is likely at the earlier stages of a turnaround play, suggesting that investors should watch its subsequent pullback closely for an attractive buying opportunity.

Sundry Photography

The AI hype train has finally caught up with Unity Software Inc. (NYSE:U) investors, as the company officially launched its AI marketplace for creators “to support AI-driven game development and gameplay enhancements.” As such, breakout investors/traders attempting to seize Unity’s AI opportunities have returned, anticipating further momentum gains.

I previously urged investors in February to be wary about chasing U’s momentum surge, which sellers stopped at its mid-February highs before reversing downward. Dip buyers who managed to board U’s train in March and May before the AI hype caught up have significantly outperformed the S&P 500 (SP500).

While I’m still cautious about adding to U’s recent surge (I’m more of a dip buyer), I assessed that its downward momentum could shift. In other words, I anticipate that dip buyers would not likely allow U to crash further below its March and May lows. As such, those support levels should help underpin U’s subsequent recovery, as it remains well below its all-time highs set in late 2021.

While I don’t expect those heady, speculative days to be reached in the near- or medium-term, as the Fed is expected to remain hawkish for a while, I believe Unity is well-positioned to stage a remarkable turnaround from here.

While moat-worthy, Unity’s competitive advantage as the leading real-time 3D engine for game creators has yet to demonstrate that it’s sustainable. In other words, unless Unity can deliver sustained profitable growth metrics, I believe investors will likely remain wary about allowing its valuation to surge significantly higher.

Semiconductor stocks like Nvidia (NVDA) and AMD (AMD) are regarded as the picks-and-shovels play for AI infrastructure. However, they have also parlayed their competitive advantages into sustainable profitability, driving significant shareholder value. As such, investors can more clearly assess their valuation metrics than U’s business model.

Management maintained its outlook that it remains on track to reach its $1B adjusted EBITDA run rate by the end of FY2024. That is also expected to translate into quarterly adjusted EBITDA generation of $250M by Q4FY2024. Analysts’ estimates indicate that the company could post an adjusted EBITDA of $273M for FY23, which is within the company’s updated guidance range. As such, it could represent a significant profitability accretion for the company based on these metrics.

Management has not updated its projected revenue and profitability accretion from its new AI growth drivers. Make sense? I gleaned that Unity has yet to change its guidance range for its adjusted EBITDA run rate from my previous update in February. However, I believe that management’s caution is reasonable, as it is likely still too early to assess the positive impact of its recently launched solutions.

Despite that, the market has reacted well, potentially indicating that recent momentum buyers anticipate a favorable outcome from the solutions. However, U’s current valuation has also likely baked in significant optimism.

U last traded at a forward EBITDA multiple of 46.3x, well above its SaaS peers’ median of 15.2x (according to S&P Cap IQ data). Even if I consider U’s FY24 adjusted EBITDA multiple of 29.4x, it’s still pretty aggressive. The company has yet to provide an upgraded outlook for its AI solutions, so it’s still too early to adjust its valuation outlook. It’s also critical to note that the company has not managed to deliver sustainable profitability, despite its market leadership, with more than 70% of games developed with Unity’s engine.

Therefore, I believe that investors should apply a reasonable margin of safety, even if they decide to partake in Unity’s AI hype train to reduce their chances of disappointment.

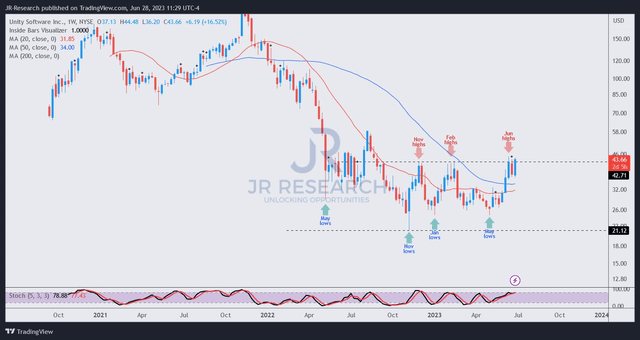

U price chart (weekly) (TradingView)

As seen above, Unity re-tested a well-established resistance zone this week, as buyers returned when the company launched its AI solutions.

However, U’s price action suggests that caution is still warranted. Moreover, its valuation remains aggressive, and I don’t expect dip buyers from March and May to support U’s attempted breakout at the current levels.

So, unless you are a breakout trader/investor, I believe it’s better to wait patiently for the next pullback before adding. That said, I assessed that U would not likely fall back toward its May lows, which should support my thesis that U is in the earlier stages of recovering its upward bias.

I will be watching for a potential retracement and consolidation closely.

Rating: Maintain Hold (on the watch for a rating change).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!