Summary:

- Unity Software’s stock fell into a bear market recently, declining more than 30% before buyers returned in August to stem a further collapse.

- Unity’s dominant leadership in real-time 3D positions it well for the shift toward mixed reality. However, monetization on Apple Vision Pro isn’t a near-term opportunity.

- My previous caution in late June panned out as I urged investors to avoid buying into its surge. Patient investors who waited are now afforded a much better risk/reward opportunity.

- I argue why investors who missed adding U’s lows in 2022 shouldn’t miss buying the recent consolidation, capitalizing on its dip buying momentum.

- Don’t wait till it surges again, as the golden opportunity could be gone by then.

Sundry Photography

I updated Unity Software Inc. (NYSE:U) investors in my June 2023 update that it was better to wait for a pullback before adding exposure. My caution emanated from the untimely surge that U holders leveraged into, banking on its recent AI hype and the optimism surrounding its partnership with Apple (AAPL) and Meta Platforms (META).

With Unity’s dominant leadership in real-time 3D or RT3D, I assessed that the company is well-positioned to benefit from the possible shift in computing platform toward mixed reality. However, the platform economics are still nascent and developing. In its second-quarter or FQ2 earnings conference, management also stressed that Unity doesn’t expect near-term monetization from Apple Vision Pro. As such, it remains at least a FY2024 growth story and beyond.

My June caution panned out as investors who sat out trying to catch its momentum surge avoided the steep decline as U topped out in July 2023. Accordingly, U formed a bull trap (false upside breakout), ensnaring late buyers anticipating a further surge. I urged investors in my June update to be wary about its price action. Despite that, I highlighted my conviction that it “would not likely fall back toward its May lows, which should support my thesis that U is in the earlier stages of recovering its upward bias.”

Accordingly, U fell more than 30% through its recent August bottom, entering a bear market before dip buyers returned. However, it remains well above its May lows, corroborating my previous thesis that U is in an uptrend recovery phase. In other words, dip buyers bought into U’s August lows, anticipating a further recovery in its execution, likely seeing appeal at the current levels.

U remains priced for growth, as seen in its valuation relative to its sector peers. However, based on Seeking Alpha’s Quant grade of “C-“, it doesn’t seem aggressive, suggesting opportunities to add are still reasonable if the fundamentals and price action are supportive.

Analysts’ estimates on Unity suggest further operating leverage gains as it scales. Management emphasized monetization and scalability as its primary focus, moving away from a lower-margin professional services model. As such, the company kept its guidance of achieving a $1B adjusted EBITDA run rate profitability by the end of 2024.

Furthermore, the company upgraded its FY23 outlook, telegraphing an adjusted EBITDA range of between $320M and $340M for a midpoint outlook of $330M. As a result, management anticipates a full-year adjusted EBITDA margin of about 15.3% at the midpoint. It’s a substantial improvement against the losses posted over the last three years. Hence, I believe the fundamental improvements in its operating model suggest that its scaling effect is working, as it works towards achieving a sustainable economic moat.

Now, let’s turn to U’s price action to ascertain whether buyers have demonstrated their confidence in supporting significant dips in U since it bottomed out last year.

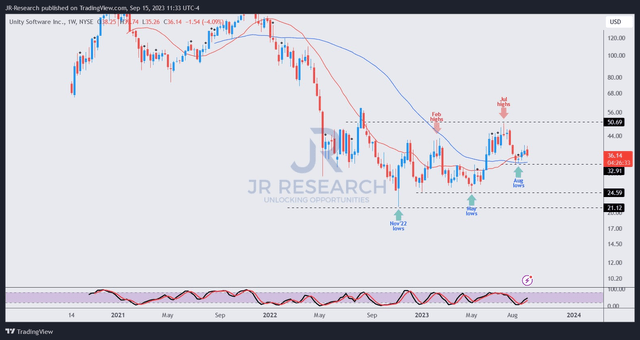

U price chart (weekly) (TradingView)

As seen above, U bottomed out in November 2022 and hasn’t looked back. Dip buyers bought steep pullbacks from January 2023 to May 2023, firmly holding the $24.50 critical support zone. Defending that zone allowed U to consolidate constructively before buyers rushed in as it surged toward its July 2023 highs.

With the recent bear market reversal that saw U falling toward its August lows ($33 level), I needed to see whether buyers were confident in returning. Accordingly, buyers have firmly held U’s August lows over the past four weeks, corroborating U’s uptrend recovery.

As such, with Unity’s worst in its operating performance and price action likely over, U holders looking to buy more shares as it fell into a bear market should capitalize on its recent dip buying momentum. Don’t wait for it to surge again, as the risk/reward profile would likely be much less attractive.

Rating: Upgraded to Buy. Please note that a Buy rating is equivalent to a Bullish or Market Outperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!