Summary:

- The biggest beneficiary from the Vision Pro announcement surprisingly wasn’t Apple Inc.

- Unity Software Inc. will partner with Apple to bring its apps to the platform – adding yet another long-term secular driver to the business.

- Unity has seen pro-forma revenue growth stall amidst a tough macro environment, but expects a recovery moving forward.

- Unity stock still trades cheaply even after the post-partnership rally – I reiterate my strong buy rating.

Pekic/E+ via Getty Images

Unity Software Inc. (NYSE:U) is a name which has not gotten a lot of love for a while. Much of that is self-inflicted, with the company having some execution issues, and some is due to the tough macro environment. Unity Software is showing strong growth metrics on the surface, with these are boosted by the company’s acquisition of ironSource. But sentiment has changed rapidly in recent days after Apple (AAPL) announced that it is partnering with Unity to bring apps to its newly released Vision Pro headset.

While Unity Software is not a direct beneficiary of the boom in artificial intelligence, I remain optimistic for the long term relevance of its 3-D modeling software in the years to come. Unity Software stock is not expensively valued and management looks committed to driving improvements in the cost structure. I reiterate my buy rating in spite of the tough road ahead.

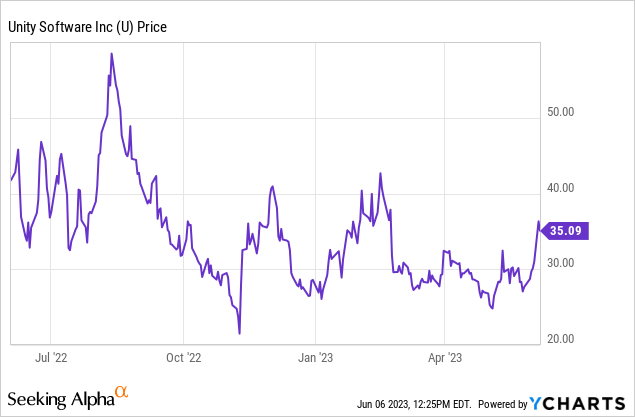

Unity Software Stock Price

It may be hard to believe that U was once one of the highest octane stocks in the market due to its perceived positioning for the metaverse. Even though Meta Platforms (META) has now recovered much of its losses, U has not and remained close to lows. That may soon change due to its partnership with AAPL.

I last covered U in April, where I discussed the company’s misleading growth rate and reiterated my buy rating. Like many tech peers, this is a name which aims to offset near term revenue headwinds with improvements to profitability.

Has Unity Software Become Attractive After the Apple Collaboration?

U stock jumped well into the double-digits after AAPL finally unveiled its long awaited AR/VR Vision Pro headset. The headset will cost $3,500 – far above the prices from the incumbent competitor Meta Platforms – but is likely to see solid demand given AAPL’s name brand. AAPL stated that it was partnering with Unity to bring its apps to its platform – a realization that should not be surprising in hindsight but clearly took Wall Street by surprise. U has seen its growth rates stall amidst a tough macro environment – this newest partnership represents yet another clear and visible source of long-term tailwinds. The best part – Unity Software stock remains highly buyable and has not yet significantly factored in any hype from this partnership.

U Stock Key Metrics

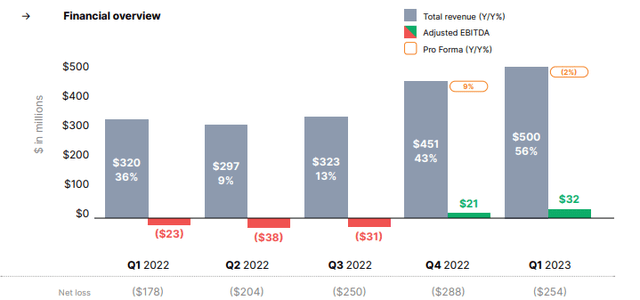

In its most recent quarter, Unity Software delivered 56% YOY growth in revenue to $500 million, outpacing guidance for $480 million. I note that on a pro forma basis, revenue declined 2% YOY. Adjusted EBITDA came in stronger than the $12 million guidance at $32 million.

U saw strength in Create Solutions, with revenue growing 14% YOY to $187 million. On the conference call, management guided for accelerating growth throughout the year due to their price increase and expected acceleration in China.

The bulk of the business in Grow Solutions remains tied to macro headwinds, with revenue declining 9% YOY on a pro-forma basis. Management expressed optimism for accelerated growth over the coming quarters as the company benefits from its acquisition of ironSource, stating that they are

“transitioning the ironSource ads network to the more advanced Unity ML/AI model, and the Unity ad network is adopting ironSource’s bidding models.”

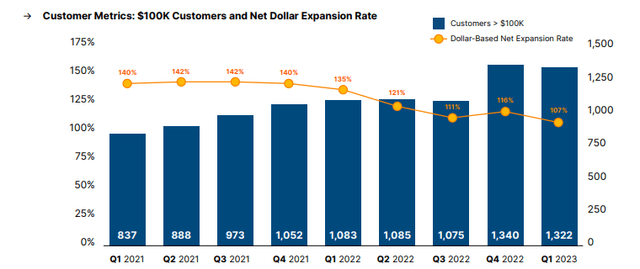

U has seen its dollar-based net retention rate drop considerably from the 140% level seen during the pandemic, as its growth during that period proved unsustainable.

Unity Software ended the quarter with $1.6 billion of cash versus $2.7 billion of debt, as even though the ironSource deal was financed by stock, the company did end up repurchasing quite a bit of stock to offset the dilution.

Management announced yet another round of layoffs, intending to cut approximately 8% of their workforce. This is their third round of layoffs, which in aggregate totaled around 15% of the workforce. Like many tech peers, I view these headcount reductions as being opportunistic and positioning the company to benefit upon an improved macro backdrop.

Management expressed great optimism that AI can boost their business. Management expects developers to use generative AI to construct “first drafts,” then use Unity products to refine them for their specific use cases. Management also expects AI to improve their ability to help customers increase user engagement and find new users.

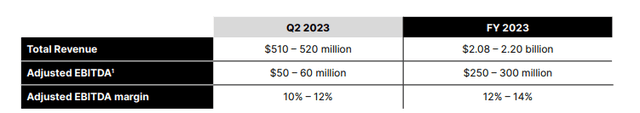

Looking ahead, management has guided for 75% YOY revenue growth to $520 million (8% pro-forma YOY growth). Management is assuming ongoing headwinds in the ad market and that the company can take market share. Management increased the low end or their full year revenue and adjusted EBITDA guidance as well.

Management reiterated their commitment to $1 billion in adjusted EBITDA on a run-rate basis by the end of 2024 (emphasis on run-rate which implies $250 million in adjusted EBITDA in the fourth quarter of 2024).

Is U Stock A Buy, Sell, or Hold?

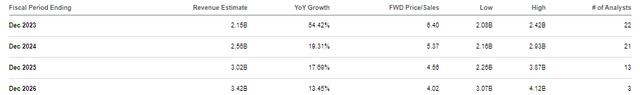

The silver lining of the difficult tape action in the tech sector over the past several years is that once-hyped stocks like Unity Software have undergone a valuation reset. Assuming that U does indeed manage to re-accelerate its revenue growth rate at some point (which seems likely given this newest partnership), the current 6.4x sales multiple looks more than reasonable.

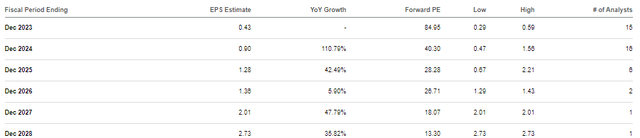

Unity Software stock might not look obviously cheap on an earnings basis, but consensus estimates call for operating leverage to take hold quite quickly. That latter point is a new phenomenon benefitting many tech stocks as a result of widespread cost optimization amidst the tech crash.

Assuming that Unity Software can reach consensus estimates of around 19% forward revenue growth, my estimate for 30% net margins over the long term, and trade at a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see U trading at 8.6x sales or around $53 per share over the next 12 months. If U can return to the 30% growth rate, a level that management has previously stated as being a sustainable medium term growth rate (but has declined to reiterate over the past two earnings calls), then the projected upside increases to as high as $84 per share.

The issue here is thus clearly whether or not the company can accelerate pro-forma growth rates to levels indicated by consensus estimates. I suspect that the needed catalysts here are more obvious than peers due to the low valuation – U simply needs to demonstrate continued acceleration in pro forma revenue growth rates (I suspect even a 15% to 18% rate would be enough) for multiple expansion to eventually take hold and narrow the discount to peers.

This latest partnership with AAPL should go a long way in helping boost that revenue growth rate (though it may take several quarters to ramp up). I note that this partnership with AAPL may help justify a PEG ratio in excess of 1.5x, but I have not incorporated such assumptions due to conservatism.

What are the key risks? Management execution is the most obvious one here. It is always difficult to “right the ship” which in this case means accelerating organic revenue growth. One must wonder how much reliance on a macro recovery is at play here. AI may be an underappreciated risk. Yes, management seems convinced that Unity may be a beneficiary of AI tailwinds, but who’s to say that Unity will not face the same implied headwinds as those faced by freelance writers or English majors? If growth does not accelerate, then the company’s net debt position might lead to financial distress or put further downward pressure on the valuation.

One also mustn’t ignore competition. The Unreal Engine from Epic Games is a serious competitor, which may sometimes be overlooked due to it being a private company.

While Unity Software Inc. may see continued headwinds from the tough macro (largely due to its large exposure to gaming customers), I expect these macro headwinds to subside over time and for the company to continue diversifying outside of the gaming industry. I reiterate my buy rating for Unity Software stock, with this partnership with AAPL being a surprising and welcome near term catalyst.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of U, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.