Summary:

- Unity stock skyrockets in a stunning recovery from November lows as risk-seeking investors drive up the value of previously battered and unprofitable stocks.

- Its upcoming earnings release ramps up the pressure on Unity to deliver a knockout performance and offer reassuring guidance following its recent integration with ironSource.

- Missed the boat on buying Unity at its November and January lows? Investors face a crucial question: is it worth jumping into the buying frenzy now?

We Are

Bottom-fishers of Unity Software Inc. (NYSE:U) stock at its recent November and January lows are duly rewarded for anticipating the shift in bearish momentum, which sent U surging.

Accordingly, U stock recovered more than 70% from its January lows through its recent highs. As a result, a near-term consolidation after such a massive uplift should be expected, as Unity is scheduled to report its FQ4 earnings release on February 22.

With U’s short percentage of float still high at 12.5%, we believe some bearish investors could have used the recent recovery to cover their bets. But, despite that, earlier short sellers are still betting against the execution record of CEO John Riccitiello after a disastrous H1’22.

With Unity expected to return to positive free cash flow (FCF) in FQ4, investors have likely anticipated a better-than-expected performance, given the robust recovery.

However, investors must be cautious if they expect U to retake its unsustainable November 2021 highs anytime soon, given its aggressive valuation (FY24 EBITDA: 28x).

Notably, U is still down nearly 85% from its 2021 highs, as unprofitable metaverse stocks were left in ruins after sentiments turned south in 2022. With the market turning its attention toward AI-first stocks recently, could the metaverse vogue return, even as Meta Platforms (META) is using 2023 as the “year of efficiency?“

The world’s leading asset manager, BlackRock (BLK), released a commentary recently, arguing that the metaverse is far from dead. Instead, it accentuates that the metaverse is akin to the “internet of the early 1990s or the smartphone of the early 2000s, stating that it is likely to be big and change people’s daily lives.”

As such, Unity should still be in a prime position to leverage its market leadership in real-time 3D (RT3D) to help developers and partners in gaming and non-gaming verticals capitalize on the massive opportunity.

As a reminder, the company has strong confidence in its non-gaming Digital Twins offering. It was also mentioned no less than 25 times between analysts and management at its Q3 earnings call. Unity stressed:

We released a private alpha of our cloud-based digital twin solution. This platform is designed to enable the end-to-end creation and use of real-time interactive in 3D Digital Twins with capabilities across any industry, all powered by cloud services. (Unity FQ3’22 earnings call)

Despite that, keen investors should also recall that Microsoft laid off its entire “Industrial Metaverse Core team,” which was formed in 2022 to develop “software interfaces” for Azure’s customers across various verticals. With Microsoft focusing on OpenAI’s opportunities and aligning projects with a more robust go-to-market motion, it does call into question whether Unity could benefit significantly from non-gaming momentum in the near term.

We believe Unity’s value proposition is still closely tied to its partnership with game developers. As such, the ironSource integration needs to be closely watched as Unity looks to regain the battered Operate Solutions segment (renamed as Grow) following the integration.

Management highlighted that ironSource’s operating results would be added to Unity’s Q4 performance, contemplated in its guidance provided.

Accordingly, Unity is projected to post revenue growth of 38.3% in FQ4, in line with management’s midpoint guidance. Unity also expects to achieve a $1B annualized adjusted EBITDA run rate by the end of 2024.

However, investors should not misread that Unity expects to report an adjusted EBITDA of $1B in FY24; there’s a critical difference. Accordingly, Wall Street analysts also expect Unity to post an adjusted EBITDA of $517M in FY24, achieving an adjusted EBITDA margin of 19.9%.

Hence, Wall Street has likely baked in solid expectations that the ironSource integration will be critical to Unity’s path toward sustainable profitability, which is also in line with management’s expectations.

However, investors will still need to consider the integration risks that could delay the synergistic benefits if the macro headwinds are worse than anticipated.

As such, investors are encouraged to closely assess management’s guidance for FY23, which could impact the run rate projections on its ironSource integration.

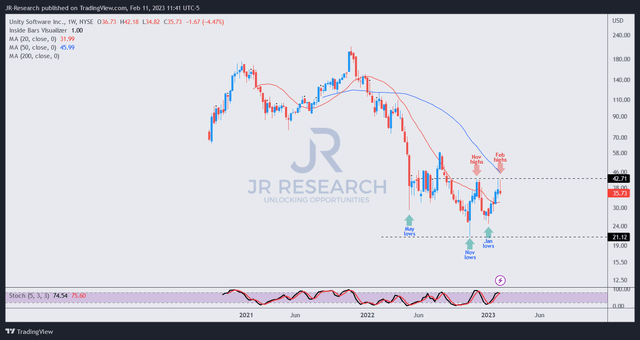

U price chart (weekly) (TradingView)

With the surge in U’s price action, it re-tested its November 2022 highs and saw sellers swarming in before a collapse toward its December lows.

However, we assessed that U had formed a higher low in January, auguring well for its medium-term recovery. In addition, U’s collapse toward its November lows likely forced weak holders to flee, creating a double-bottom bullish reversal set-up after May’s initial lows.

With that in mind and a resurgence of risk-on sentiments in the broad market, we don’t expect November lows to be retaken.

Notwithstanding, a top seems to be forming. As such, investors looking to add more positions should consider waiting for a pullback first before buying.

Rating: Hold (Revise from Speculative Buy).

Note: As with our cautious/speculative ratings, investors must consider appropriate risk management strategies, including pre-defined stop-loss/profit-taking targets, within an appropriate risk exposure.

Disclosure: I/we have a beneficial long position in the shares of META, BLK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!