Summary:

- Unity Software has continued to demonstrate improving fundamentals, despite a more challenging macro environment.

- Management has discussed their conservative approach to 2023 guidance, and have historically beaten their expectations.

- Despite the significant pullback from all-time highs, the stock’s current valuation appears to be pricing in solid fundamental performance over the next 18+ months.

Huber & Starke

Unity Software (NYSE:U) recently turned the corner on profitability and while the company is set up nicely for solid revenue growth and margin expansion, the stock is currently priced for success.

Management utilized a conservative approach to their guidance this year, which should give investors some level of comfort as we continue to experience a challenging macro environment. The company also has a history of beating their expectations, so as long as the bar was set low enough to start the year, I don’t believe there is a ton of downside risk to estimates.

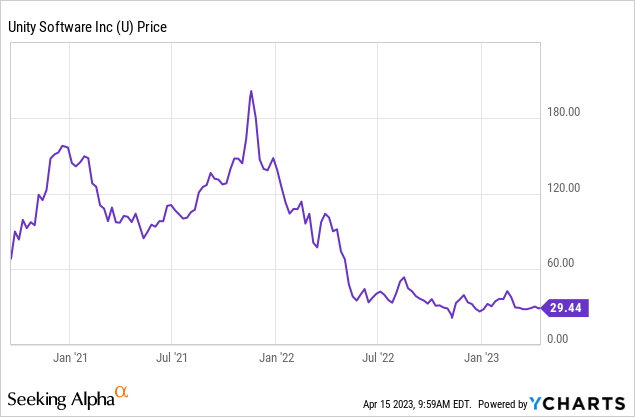

While online advertising will likely remain pressured in a challenging macro, the company’s stock has already pulled back 85% from all-time highs. This pullback is a little misleading, as many investors piled into the name in 2021 given the company’s exposure to the metaverse and the rise in FOMO (fear of missing out) encouraged aggressive buying behaviors.

However, the stock has currently retracted back under $30 and with valuation ~6x forward revenue and ~50x forward adjusted EBITDA, I believe the stock is currently pricing in strong fundamentals for the next 18+ months. Even in my 2024 scenario, the stock is trading ~29x 2024 adjusted EBITDA, which seems fairly valued as long as the company can continue to execute on their growth and profitability targets.

For now, I remain on the sidelines though believe the stock could become more attractive if we saw a pullback below $25.

Financial Review and Guidance

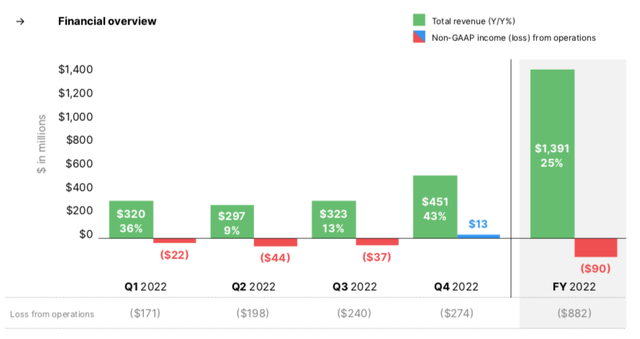

During the past quarter, revenue grew 43% yoy to $451 million, which handily beat expectations for $438 million. While part of this revenue beat can be attributed to the company’s recent acquisition of ironSource, the 43% yoy growth is still very strong despite the more challenging macro environment.

The company also announced a change to their financial reporting, including a Create Solutions segment, which includes the Unity gaming Services, and Strategic Operations.

What’s even more impressive than their better than expected revenue growth is the company achieving non-GAAP operating profitability for the first time in company history. Operating margin during the quarter came in at 3%, which was at the high-end of the company’s guidance.

While this does not seem like a major achievement for most companies, Unity has been on a journey to deliver improved profitability, and management noted their confidence in this trend continuing going forward.

We are committed to improve profitability and cash flow generation in 2023.

We have made adjustments to our cost structure and have a strong cost program in place to improve margins.

Additional details on guidance are included later on, but I believe the company remains on a positive path towards improved profitability. In the current macro environment, investors have quickly shifted their preference towards profitable companies in fear of a potential recession. And while Unity still has some room to go in terms of full-year profitability, they are taking the appropriate steps required to “check” off this box in the near-term.

While core trends appear to be holding in better than expected, the company also repurchased a massive 42.7 million shares during the quarter, for $1.5 billion, leaving the company with ~$1 billion remaining on their current repurchase authorization. Given the company’s lack of profitability and ongoing cash burn, I partially question the thought process behind this strategy. Even with the stock’s pullback over the past year, it certainly does not screen as “cheap” and that makes the massive share repurchase even more questionable, in my humble opinion. I believe investors will continue to watch how Unity approaches their capital allocation, as excessive repurchases can be a negative when the company consistently loses money and experiences share dilution from excessive stock based compensation.

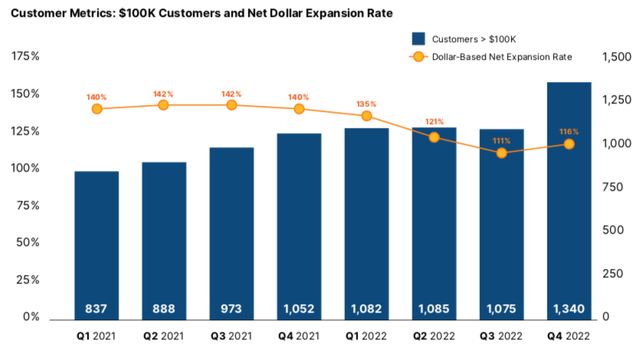

On a positive note, the company’s dollar-based net expansion are saw some improvement in the most recent quarter. Looking back to 2021, this metric was consistently 140%+, but the more challenging macro environment has caused this metric to quite materially pullback. Unity is not alone when it comes to lower net expansion rates, as companies across the technology industry have seen less expansion activity from their customers.

It was encouraging to see this metric slightly improve in Q4 to 116%, and I believe as long as this metrics can remain 115%+, then investors should continue to feel comfortable in the company’s revenue trajectory.

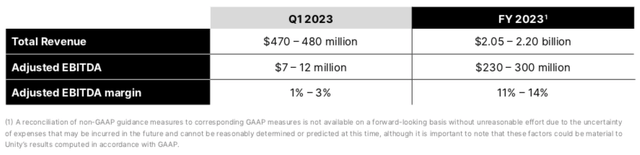

For Q1, the company’s revenue guidance of $470-480 million was below expectations for $525 million. However, the company is guiding to positive adjusted EBITDA margin of 1-3%.

For the full-year, the company guided revenue to $2.05-2.20 billion, and while the midpoint was slightly below expectations for $2.17 billion, management discussed how they took a conservative approach to start the year.

It is hard to predict how the markets will evolve in the current economic environment. Most economies are soft, some in recession.

Within Create Solutions, we expect to see continued growth in 2023. The gaming industry continues to build and launch games at a level similar to last year, and their consumers are engaging well with their content. In industries, we see increased interest in Unity’s technologies as real-time digital twins are a critical part of our customer’s future.

Within Growth Solution we expect the in-game ads market in 2023 to remain stable versus trends we have seen in recent quarters starting in Q3 2022. This translates to the overall in-game ads market to contract by approximately 10% as compared to an uneven 2022.

While we are not forecasting a recovery in the in-game ads market in 2023, we believe it is possible when the economy improves.

Importantly, the company is not forecasting a recovery for in-game ads during 2023, which I believe sets them up for potential beat-and-raise quarters, assuming the macro environment does not further deteriorate. It’s also worth noting that management has developed a history of beating their guidance, and while the volatile macro can increase uncertainty, it appears that the company has put out a prudent guidance they are confident in achieving.

Longer-term, the company expects to achieve $1 billion of adjusted EBITDA run-rate by the end of 2024. Remember, 2023 adjusted EBITDA guidance is $230-300 million, and while the $1 billion run-rate would be a big step-up, the company continues to operate efficiently and has continued room to expand.

Valuation

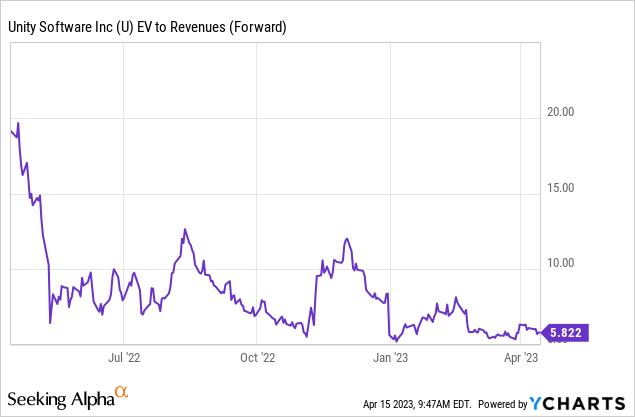

Valuation can be a little tricky here for several reasons.

First, the company is still integrating their recent acquisition of ironSource, so the current growth rates are not entirely organic and the headline reported growth numbers are not all organic. While this will normalize over time, the challenging macro is also causing some pressure on overall growth.

Second, the company has just started to turn the corner on profitability. Historically, investors would have to use a revenue multiple in order to value Unity, because their path towards profitability was not clear a few years ago.

Third, while the company has talked about a $1 billion of adjusted EBITDA run-rate by the end of 2024, this is still 18+ months out and there is a lot that can change during that time. Yes, I believe the company has the operational rigor to achieve this target, but I would not consider it a “lay-up” and there is a lot of work to do between now and then.

Unity currently trades just under 6x forward revenue, which appears to be fairly valued, all things considered.

The company currently has a market cap of $11.0 billion and with ~$1.2 billion of net debt, their enterprise value is ~$13.2 billion. Using the company’s 2023 adjusted EBITDA guidance of $230-300 million, this implies a 2023 adjusted EBITDA multiple of ~50x. Yes, this is very high, but considering the company just crossed into profitability and should see material improvements in 2024, this multiple is not completely accurate.

For 2024, consensus (per Yahoo Finance) currently expects ~$2.55 billion in revenue, and assuming adjusted EBITDA margins expand to ~15-20% in 2024 (from the 2023 guidance of 11-14%), this could imply 2024 adjusted EBITDA of ~$385-510 million. This inherently implies the company is trading at ~29x my 2024 adjusted EBITDA estimate, which seems fairly valued given the current volatile macro we are experiencing.

For now, I remain on the sidelines given the company’s need to execute on their stated growth and profitability targets. If the macro were to improve, I believe Unity could see an immediate benefit and would not be surprised to see the stock rise.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.