Summary:

- Unity’s valuation at 13 times next year’s EBITDA is heavily adjusted and does not reflect the company’s low free cash flow.

- The company’s revenue growth rates are struggling to gain traction.

- The company has a history of diluting its shareholder base, which diminishes the attractiveness of this stock for me.

INchendio/E+ via Getty Images

Investment Thesis

I appear to be one of the few investors who sees Unity Software (NYSE:U) for what it is, a stock to be avoided.

The business doesn’t appear to be overly expensive. After all, as its stock continues to slide lower, it becomes increasingly enticing for investors eager to buy the dip and get this fallen angel on the cheap.

What’s more, Unity appears cheaply valued at 13x next year’s EBITDA, thereby supporting the argument that it’s cheap. Meanwhile, I argue that this EBITDA figure is high on adjustments and low on free cash flow.

Rapid Recap

Back in February, as we headed into Unity’s Q4 earnings results, I said,

While the forward EBITDA multiple seems reasonable at around 14x, the uncertainties facing Unity’s stock provide investors with an unfavorable risk reward.

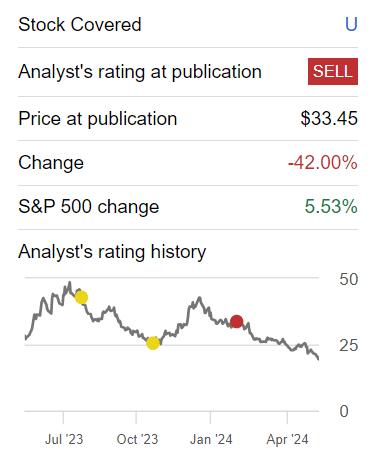

Since then, the stock has moved lower by 40%, while the S&P500 rages on, and is up 5% in the same period.

Author’s work on U

And now, as we look ahead, I’m once more reaffirming that Unity Technology is a stock to be avoided.

Unity Software’s Near-Term Prospects

Unity Software creates software tools for developing video games and other interactive content. Their main product is the Unity engine, a powerful platform that developers use to build and run games. Think of it as a toolkit that provides everything needed to create a game, from graphics and physics to sound and networking.

Unity’s software is used by game developers to create both 2D and 3D games that can run on various devices like mobile phones.

In addition to game development, Unity also offers tools for monetization, which help developers make money from their games through ads and in-game purchases. Unity is essential for many developers because it simplifies the complex process of game creation and helps them reach a wide audience across different platforms.

Unity is a bit like AppLovin (APP) a stock that I’ve been actively recommending for a while, only that Unity is not quite as successful as AppLovin. For those who have been following the Unity/AppLovin story, this sentence turns out to be rather ironic.

Next, Unity faces further headwinds. One significant headwind is the recent customer dissatisfaction related to the runtime fee, which created turbulence at the end of the previous year. Although the situation is improving, as indicated by more productive conversations with large customers, the residual impact of this dissatisfaction is likely to affect customer relationships.

Another headwind for Unity is the ongoing integration challenges of its data science and engineering capabilities post the ironSource merger. This integration aims to enhance their monetization solutions and leverage extensive data more effectively, but this process is more complex than it appeared at the onset.

Given this background, let’s now discuss its fundamentals.

Revenue Growth Rates Struggle for Traction

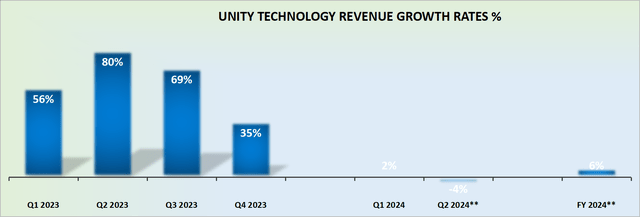

U revenue growth rates

The graphic above shows Unity’s consolidated revenues for 2023, whereas for 2024 the graphic focuses on its strategic portfolio. The strategic portfolio is Unity’s attempt at refocusing its business and cutting away investment from non-core operations.

One way or another, I believe the message is clear, Unity Software, a supposedly highly innovative company that targets the mobile gaming industry, is failing to gain traction.

Now, to be clear, in the same way as no business ever grows in a straight line, most businesses don’t fail in a straight line.

Along the way, Unity will have the occasional good quarter. But this should not detract away from the fact that Unity today operates as a shadow of its former self.

With this context in mind, let’s now delve into its valuation.

U Stock Valuation — 13x EBITDA

Unity is expected to exit 2024 with at least 25% non-GAAP EBITDA margins. If we presume that Unity is able to grow next year by approximately 15% on its top line, a figure that is undoubtedly aggressive, this would put Unity’s top line on a path toward $2.1 billion in revenues.

Furthermore, if we presume that Unity succeeds in expanding its non-GAAP EBITDA margins by 300 basis points, this puts Unity on a path towards $590 million of EBITDA.

This leaves Unity priced at 13x forward EBITDA, a figure that doesn’t strike one as particularly shocking. However, context matters.

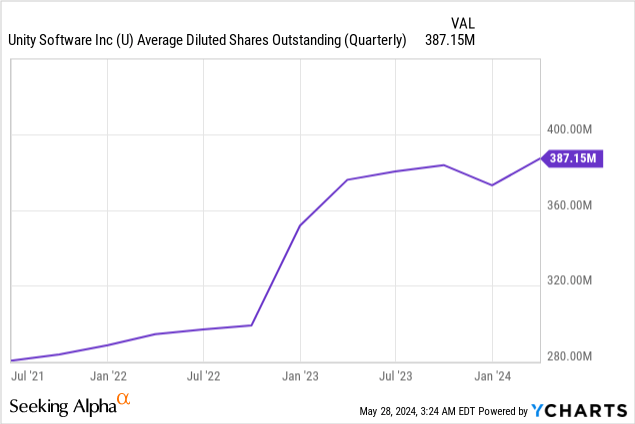

For one, Unity doesn’t have too much issue with diluting its shareholder base. To support this argument, consider the graphic that follows.

Secondly, Unity’s balance sheet is already stretched and inflexible.

More specifically, Unity’s balance sheet carries $2.2 billion of convertible notes, against $1.2 billion of cash. In other words, there’s already $1 billion of net debt, which for a company with a market cap of less than $8 billion, means that aside from paying for its market cap, investors are also having to stomach 12.5% of debt.

And to compound matters further, Unity is one of those businesses that reports very high EBITDA figures, but rather lacking free cash flow conversion.

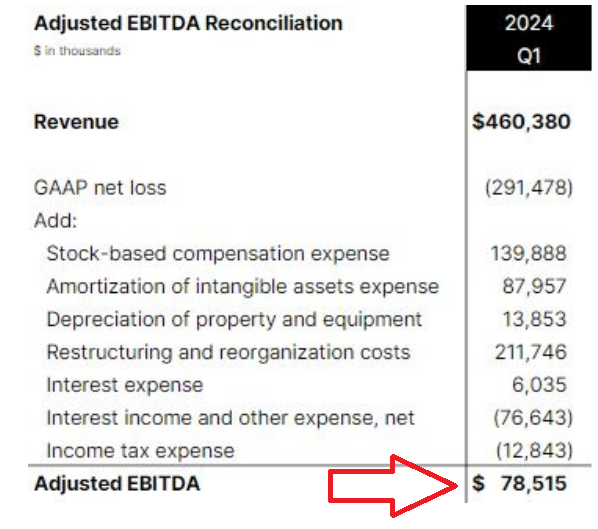

Unity’s Q1 2024

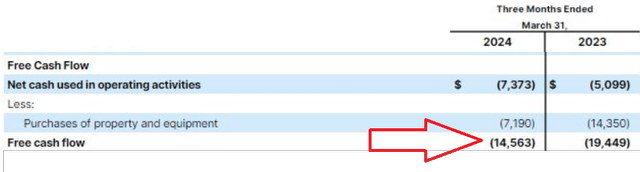

As you can see from the red arrow above, Unity’s Q1 2024 reported approximately $79 million of adjusted EBITDA. However, this translated into approximately $15 million of negative free cash flow.

Unity’s Q1 2024

In summary, I believe that this stock is still too expensive for what it offers investors.

The Bottom Line

Given Unity Technologies’ current financial situation and valuation, I believe it is advisable to avoid investing in this stock.

Despite appearing to be reasonably priced at 13 times next year’s EBITDA, this figure is heavily adjusted and does not reflect the company’s low free cash flow conversion.

Unity’s revenue growth rates are struggling, and the company is facing significant headwinds, including customer dissatisfaction and integration challenges from the ironSource merger. Additionally, Unity’s balance sheet is stretched, with $2.2 billion in convertible notes, creating financial inflexibility.

Also, for me, a red flag is Unity’s history of diluting its shareholder base. Overall, Unity Technologies is a stock to avoid.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Michael is long APP. Deep Value Returns recommends APP.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.