Summary:

- Unity Software has undergone significant changes, including the departure of its ex-CEO and a focus on organizational reset.

- The company’s weak performance and lack of guidance have led to a sharp decline in investor confidence.

- I assessed the collapse in early November has likely led to U reaching peak pessimism.

- I argue why it has cleared the deck for investors looking to buy more. Therefore, it’s time for Unity holders to consider doubling down.

D-Keine

It has been an eventful two months since I last updated Unity Software Inc. (NYSE:U) investors in mid-September. The debacle surrounding the company’s disastrous launch of its runtime fee led to the departure of its ex-CEO, John Riccitiello, from all leadership roles. The new team, under the leadership of Interim CEO James M. Whitehurst, clarified that the “revenue softness” attributed to the runtime fee introduction is “now largely behind the company.”

Despite that, the real-time 3D and gaming engine leader didn’t provide guidance for the fourth quarter or FQ4, leading to a sharp selloff in U in early November 2023. However, I assessed the collapse as a possible deck-clearing event, forcing peak pessimism and attracting dip buyers who pounded on the plunge in U.

Unity sellers have since lost significant momentum, suggesting that the company can focus on an organizational reset, helping it overcome its recent challenges.

Whitehurst has laid out clearly in Unity’s third-quarter earnings scorecard that the company was too distracted under the previous CEO. Such introspection is likely appreciated by investors, anticipating management to do the right thing, helping the company to get back on track.

While the company was focused on improving its profitability profile under Riccitiello, the numerous M&As have led to a backlash among investors, as seen in the weak performance of U relative to its software peers and the S&P 500 (SPX) (SPY). Accordingly, U posted a 1Y total return of -14.3% as it struggles for traction. Therefore, the departure of Riccitiello is likely welcomed by investors, although I expect U to remain in the penalty box for some time.

Management stressed that the company doesn’t anticipate significant changes to its adjusted EBITDA trajectory as it looks to shed less/unprofitable business segments. Also, the company will focus on cutting costs as it looks to streamline its operations to deliver improved operating leverage. Despite that, management hasn’t provided concrete action plans to investors. In addition, a lack of clear forward guidance suggests investors have likely incorporated significant uncertainties into its valuation as they await management’s next update in early 2024.

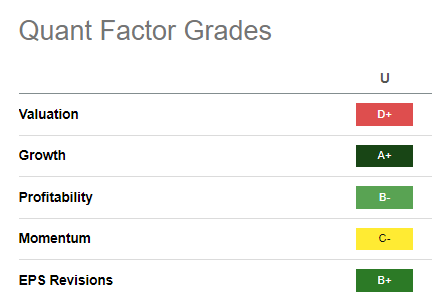

U Quant Grades (Seeking Alpha)

U is still priced at a premium (“D+ valuation grade) for its best-in-class growth potential (“A+” growth grade). Therefore, I believe much is at stake for Unity to deliver its updated strategies to reignite its growth strategies while gaining focus to improve its profitability.

Despite that, its positive profitability metrics (“B-” grade) suggest Unity has some space to work on its execution unless management stuns investors with a sharply lowered adjusted EBITDA guidance moving ahead. While that remains a possible risk factor, the company’s assurance at its Q3 earnings call suggests it’s not expected to be the base case, as Unity looks to shed less or unprofitable opportunities.

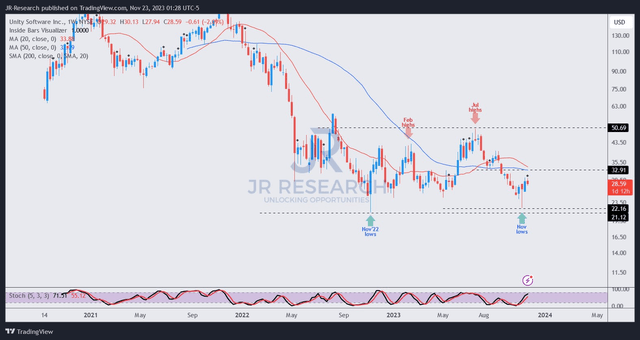

U price chart (weekly) (TradingView)

Furthermore, U’s price action suggests buyers returned aggressively in early November 2023 to defend against the collapse as sellers attempted to force a capitulation.

As a result, U’s November 2022 low ($21 level) was held firmly by dip buyers, suggesting U doesn’t seem likely to break further below that level.

Therefore, I assessed that an even better opportunity for investors looking to add U has arrived, as the reset that occurred in November should set the stage for U’s recovery. Investors have likely baked in a pessimistic scenario, reflecting the execution risks from management’s reset intentions. As long as Unity doesn’t deliver a much worse guidance than anticipated, U’s $21 support zone should hold robustly.

Rating: Upgraded to Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!