Summary:

- Uncertainty regarding Unity’s prospects is currently elevated due to the change in management, backlash against runtime fees and expected exit from certain businesses.

- These changes could create a more focused organization with improved profitability.

- While Unity’s stock is attractively priced given its potential, the company must demonstrate it can execute and capitalize on that opportunity.

mikkelwilliam/iStock via Getty Images

The furor surrounding Unity Software’s (NYSE:U) runtime fee, and the company’s subsequent poor third quarter results, appear to have been the catalyst for a shakeup at the company. With a new CEO in place, Unity appears to be doubling down on its pursuit of profitability, which will likely mean exiting some businesses in order to create a more focused organization. At this stage it is still unclear what this will mean though.

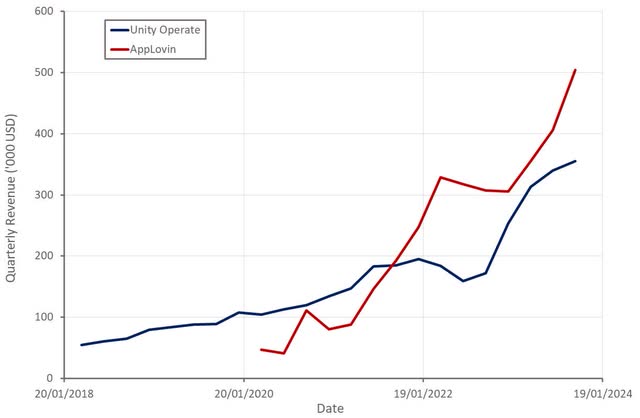

I had previously expected a more constructive demand environment and synergies from the ironSource merger to contribute to an acceleration in Grow Solutions growth, particularly given reasonably easy comparison periods. The relatively poor performance of this business, especially compared to AppLovin (APP), suggests that there are issues.

The lack of fourth quarter guidance and the backlash against the runtime fee has created significant uncertainty, which now must be weighed against the potential of a leaner and more focused Unity. While Unity is still attractively priced, the company clearly has issues which will take time to be resolved, meaning the stock price may remain depressed for an extended period of time.

Runtime Fee

Unity introduced runtime fees on the Editor at the end of the September, which was not well received by the developer community. This move was not necessarily surprising, as Unity had latent pricing power which it was obviously going to leverage at some point. The move was poorly handled though, with developers taken aback by both the sudden nature and the structure of the change. Particular points of contention included:

- The per install fee

- The retroactive nature of the fee

- Lack of clarity regarding how installs would be measured

- Potential punishment of growth in low LTV countries

Unity subsequently altered the runtime fee in attempt to address developer concerns and reduce the backlash against the company. As part of this, Unity:

- Eliminated the runtime fee for personal users

- Offered revenue sharing as an alternative for other users

- Will not apply the per-install fee retroactively

- Raised the revenue ceiling on personal accounts

The runtime fee is clearly not going away as Unity pursues profitability and tries to better align its revenues with the value it provides developers, but the long-term impact of this change remains to be seen.

CEO Exit

The outrage caused by the introduction of the runtime fee and the lack of consultation with developers prior to its introduction was potentially a precipitating factor in Unity replacing John Riccitiello as CEO. James Whitehurst was appointed interim CEO in October, with the Board concurrently commencing a CEO search process to identify a permanent CEO. Whitehurst was CEO of Red Hat from 2008 to 2020 and was with IBM after its acquisition of Red Hat.

Restructuring

Whitehurst wants to make Unity a more focused company, which is potentially a directive from large investors. While the company is likely to exit some activities, there is currently no specifics available. Actions will also include a reduction in force and a reduction in office locations. The company is set to act aggressively, stating that changes are expected to be completed by the end of Q1.

Management commentary suggests the company will continue to provide a platform that spans the design, operation and monetization of 3D content. While Unity has suggested that expected synergies are not currently being realized across its portfolio, the company believes that the combination of Unity and ironSource provides it with the necessary assets. It is possible that Unity will choose to abandon some of ironSource’s more peripheral solutions though.

Unity also recently chose to highlight the importance of its technology to enterprises, suggesting that this part of the business will remain a priority. Little has been said about the Weta acquisition of late though, which raises the specter of this business being sold off. This would be extremely disappointing as Weta expands Unity’s business towards artists and dramatically increases the company’s addressable market. Unity did recently announce a new Unity Weta tools division, and high-end artist tools should be a growth driver going forward.

Product Innovation

Unity has made significant investments in product development over the past few years, although this is yet to really be reflected in the company’s financial performance. With a range of AI tools now reaching the market and Weta tools set to make an impact in 2024, this should soon begin to change.

Early access to Unity Muse, a suite of AI assisted content creation tools, is now available. This appears to be a fairly nascent effort with little substance at this stage though. Unity Muse Chat is one of the first tools available and it acts as a chat interface to accelerate troubleshooting and accessing information. Muse Sprite can be used to generate 2D sprites and Muse Texture to generate high-quality 2D and 3D ready textures. Over time Unity plans on adding functionality to make it easier to create assets and animations with just a text prompt or a sketch. Future releases are set to include:

- Muse Animate – allows developers to set characters in motion without code

- Muse Behavior – lets developers set up character interactions

- Muse Sketch – 3D canvas for rapid prototyping and team collaboration

Muse is available for 30 USD per month as a standalone product.

Unity Sentis is now in open beta and is expected to be made generally available with the release of Unity 6 in 2024. Unity Sentis is a cross-platform runtime inference engine that allows creators to deploy neural networks across any platform supported by Unity. This should help developers to create experiences that are more engaging, interactive and dynamic, while minimizing cloud compute costs and latency. Sentis will also drive consumption revenue and could help Unity to improve its expansion rate.

Financial Analysis

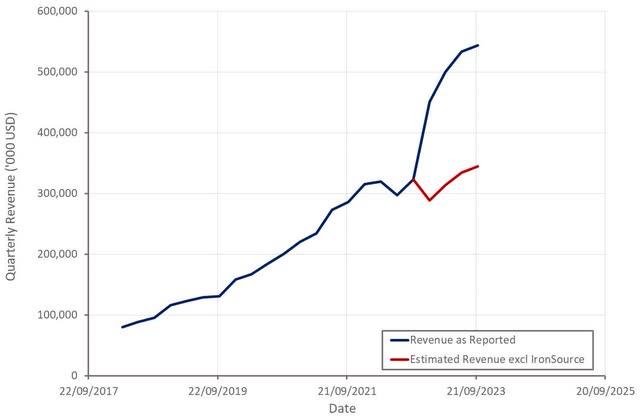

Unity’s third quarter revenue was 544 million USD, a 69% increase YoY, or 8% on a pro-forma basis. Create Solutions revenue was flat YoY, although core subscriptions were up 19% excluding China. Soft Create Solutions results were primarily due to Unity Game Services, China (government restrictions on gaming) and Unity’s shift away from Professional Services.

Grow Solutions revenue increased 166% YoY, or 12% on a pro-forma basis. While Unity believes that it is gaining share in a relatively flat market, these results are disappointing given the easy comparison period and expected synergies from the ironSource acquisition. Grow Solutions growth appears particularly poor when compared to the recent performance of AppLovin’s software business.

Figure 1: Unity Operate Revenue (source: Created by author using data from company reports)

Unity also chose to pull guidance for the year, which could suggest weakness and has added to the uncertainty surrounding the company. The company’s CEO suggested that this is because Unity is currently focused on executing the restructuring as quickly as possible and he doesn’t want anything to interfere with this. Unity stated that there was some softness at the end of October though, related to the runtime fee introduction, but this is now mostly behind the company. Unity continues to believe that the runtime fee will be accretive in 2024 as customers adopt new releases.

Figure 2: Unity Revenue (source: Created by author using data from Unity)

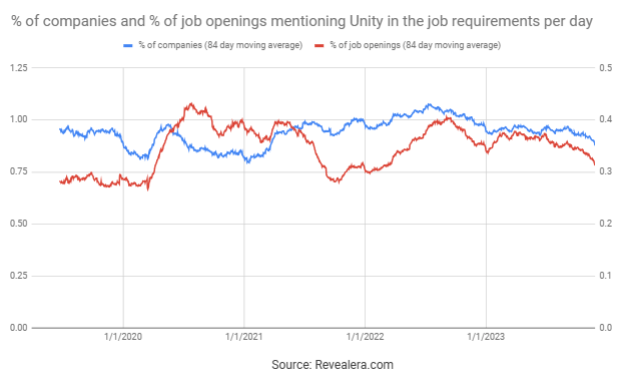

The number of job openings mentioning Unity in the job requirements has been fairly flat over the past 12 months, although has begun to fall away sharply in recent weeks. This is potentially concerning given the negative publicity the introduction of runtime fees caused. While this should be monitored, Epic’s Unreal Engine has seen broadly similar trends in over the past month.

Figure 3: Job Openings Mentioning Unity in the Job Requirements (source: Revealera.com)

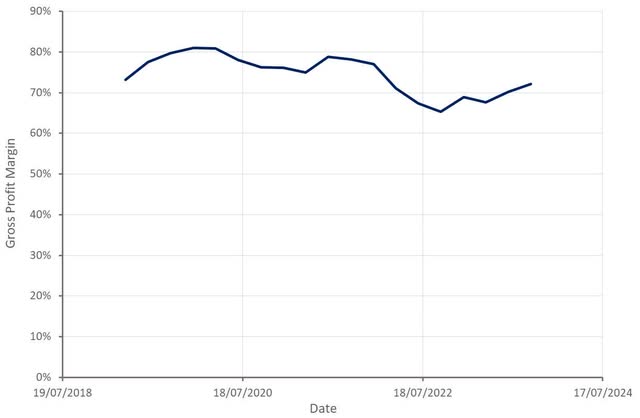

Unity’s profitability continues to improve rapidly on the back of modest growth and a strong focus on costs. The company is already beginning to generate solid free cash flows and with further cost cutting expected, Unity should soon be profitable.

Figure 4: Unity Gross Profit Margin (source: Created by author using data from Unity)

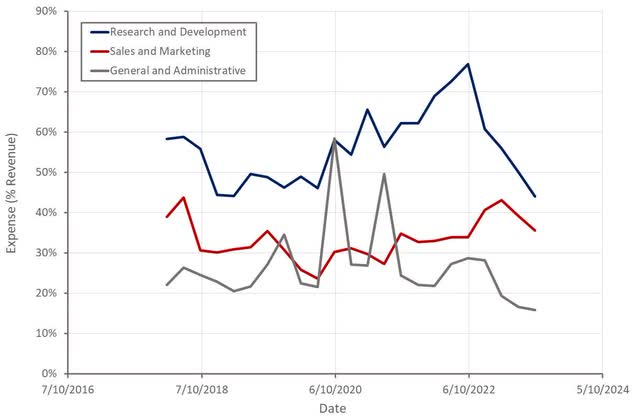

Figure 5: Unity Operating Expenses (source: Created by author using data from Unity)

Conclusion

After a spate of acquisitions in 2021 and 2022, and relatively poor results over the past 18 months, Unity is now at a crossroad. The introduction of runtime fees was poorly handled, and the change of CEO suggests the company’s problems go beyond macro headwinds. Unity’s core business continues to have enormous potential, and the introduction of artist tools and more AI tools should help the company to realize some of this potential. Unity still needs to demonstrate that it can execute though.

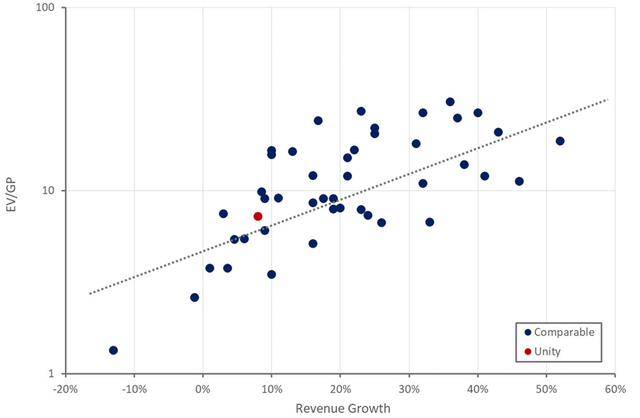

Figure 6: Unity Relative Valuation (source: Created by author using data from Seeking Alpha)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of U either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.