Summary:

- I decided to withdraw my sell rating on Unity Software after their recent results exceeded my expectations.

- While there are still concerns about near-term prospects, the stabilization of dollar-based net expansion rates is a positive sign.

- Unity’s revenue growth rates need careful interpretation due to the impact of the IronSource acquisition, suggesting it’s no longer a high-growth company.

- Although Unity projects significant EBITDA by 2024, a substantial portion comprises non-negotiable costs, limiting the stock’s attractiveness.

Михаил Руденко/iStock via Getty Images

Investment Thesis

Unity Software (NYSE:U) delivered a set of results that were not as bad as I predicted. Consequently, I no longer believe it makes sense to keep my sell rating on this stock.

I’m a professional investor. As such, when the facts change, I recognize that it’s important to take a step back and reappraise one’s investment thesis. The successful investor must always be willing to destroy one’s investment thesis and seek out disconfirming evidence.

Accordingly, the outlook for Unity still has some pesky facets that I’m not enthused about, but on balance, there’s enough here for me to withdraw my sell rating on this stock.

Unity Software’s Near-Term Prospects

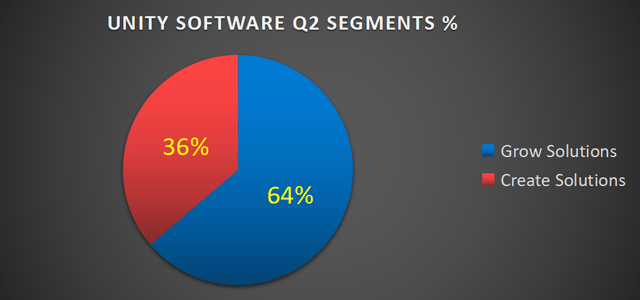

Unity is a real-time 3D platform used by creators to develop interactive experiences. It now has two main divisions, Create Solutions and Grow Solutions.

As you can see above, Unity’s Grow Solutions now make up the vast majority of its operations. This side of its operations has been bolstered by its acquisition of IronSource.

For context, Unity’s Grow Solutions provides the tools to monetize creators’ content. Meanwhile, Unity’s Create Solution provides tools and features to enable developers to design applications.

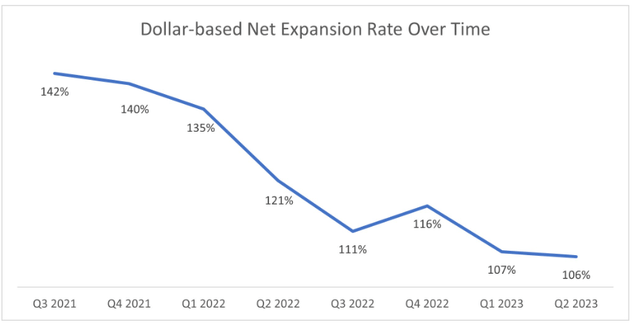

As we headed into the earnings result, I believed that Unity’s dollar-based net expansion rates would continue to drop. Here’s a quote from the earnings call that supports my thought process,

And frankly, I would say, this is still in a what I would call an economic — a challenging economic environment. Some of our game customers are not adding headcount. Some of our sales cycles in industries are still a little bit longer as we need to prove value. China Create market continues to be soft overall. (Unity Software CFO Luis Visoso)

And even though Unity did report a sequential decline in DBNER from last quarter, there’s no doubt that the pace of its sequential dollar-based net decline is getting smaller and appears to be flattening out.

With this context in mind, let’s turn to discussing Unity’s financials.

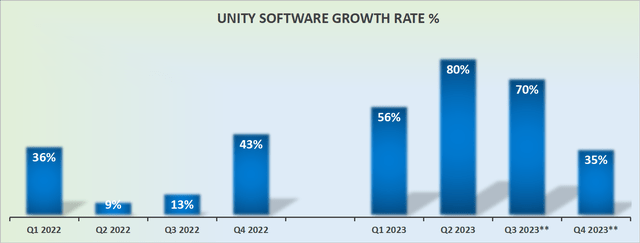

Revenue Growth Rates Require Interpretation

The graphic above points to a company with oozing revenue growth rates. However, keep in mind that in Q4 of last year Unity made its large acquisition of IronSource. This obfuscates its underlying revenue growth rates.

However, helpfully Unity provides its proforma guidance for 2023, and this points to approximately 10% CAGR. This means that Unity is no longer a growth company and investors shouldn’t view it as such.

Despite all its alluring rhetoric of being a disruptor in the gaming industry, readers should keep in mind that this is a 10% CAGR business. And little more. That means that investors will want to see strong profitability emerging from Unity if its $15 billion market valuation is to increase.

Unity’s Profit Potential is Modest At Best

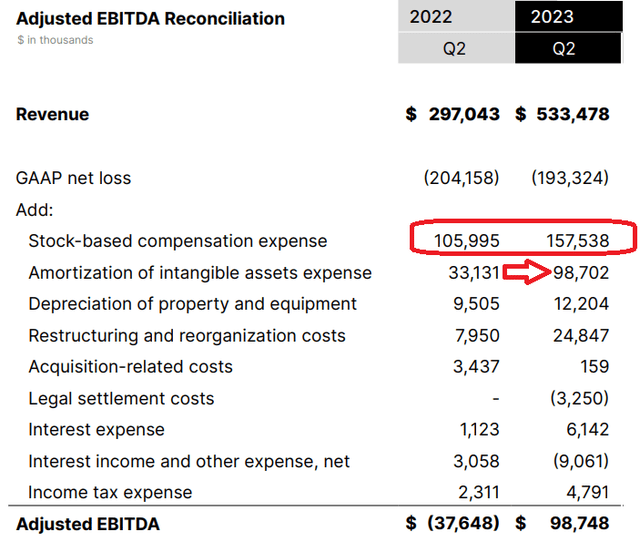

We are over halfway through 2023 and Unity has ample visibility into its year-end. At this juncture, Unity has upwards revised its EBITDA profile from $300 million to $340 million.

Even if Unity ends up delivering around $360 million of EBITDA in 2023, that’s not going to support its market cap. This would mean that investors are paying more than 40x this year’s EBITDA for a business that, despite its alluring rhetoric, is growing at approximately 10% CAGR on the top line.

How should investors think about 2024? Looking ahead to 2024, Unity declares that it can get to $1 billion of annualized EBITDA by the end of 2024.

On the one hand, that would clearly support its market cap valuation. This leaves Unity priced at 16x next year’s EBITDA. A very fair entry point, particularly for bulls.

On the other hand, consider this:

The vast majority of Unity’s EBITDA is made up of add-backs that are non-negotiable costs. For instance, management’s stock-based compensation will never go away. Or consider its amortization of intangibles that increased 3-fold, undoubtedly due to a write-down associated with its IronSource acquisition.

My argument is thus, there’s no need to be bearish on Unity, but the stock isn’t all that attractive either.

The Bottom Line

After analyzing Unity Software’s recent performance, I, as a professional investor, initially believed the results would be worse than they turned out to be. Consequently, I have decided to withdraw my sell rating on the stock.

While there are still some concerns about Unity’s near-term prospects, particularly in light of economic challenges, the company’s dollar-based net expansion rates are showing signs of stabilization.

Unity’s revenue growth rates, while impressive, need to be interpreted with caution due to its acquisition of IronSource. The proforma guidance indicates a 10% CAGR, suggesting it’s no longer a high-growth company.

Profit potential seems modest at best, and while the company projects significant EBITDA by 2024, a substantial portion of it comprises non-negotiable costs.

Overall, I don’t see a need to be overly bearish on Unity, but the stock’s attractiveness remains limited.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.