Summary:

- Unity Technologies is gaining momentum with operational changes, product innovations, and AI-enhanced advertising, expanding into non-gaming sectors like virtual reality training and simulation.

- Despite holding $800 million in net debt, Unity’s projected free cash flow for 2024 and 2025 makes its valuation of 31x forward free cash flow appealing.

- Key risks include potential struggles in regaining revenue traction, competition from Unreal Engine, and recovering strained customer relationships.

- Unity’s growth prospects are promising, driven by Unity 6 and AI advancements, but challenges in market share and customer trust remain critical factors.

FG Trade/E+ via Getty Images

Investment Thesis

Unity Software (NYSE:U) is a stock that I’ve been bearish on for a long while. But now that my bearish thesis has played out, I don’t believe it sensible to remain bearish.

Not only do I see the risk-reward a lot more balanced, but I actually can see a path for where investors rally behind this stock.

Basically, at $20 per share, it could go either way, as I estimate that Unity is priced at 31x next year’s free cash flow. Even though I continue to see blemishes in this bull case, I believe a neutral rating makes more sense at this juncture.

Rapid Recap

Back in May, I said in my analysis,

I appear to be one of the few investors who sees Unity Software for what it is, a stock to be avoided.

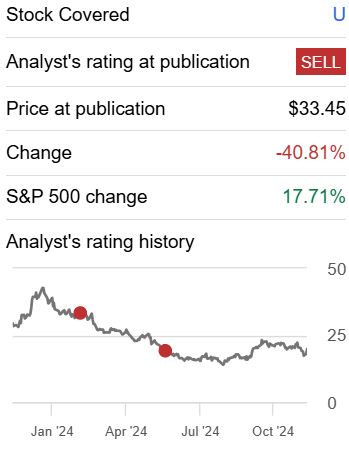

Author’s work on U

As you can see above, my sell ratings have been directionally right. Even though there’s been a very strong bull market for tech stocks, which appears to carry all the boats higher, but not Unity.

Unity’s Near-Term Prospects

Unity Technologies is a platform for creating and managing interactive 3D content for the gaming industry.

Its tools allow developers to handle the entire lifecycle of a game or 3D project from prototyping and design to live operations, user acquisition, and monetization.

Unity’s value proposition lies in offering a unified platform that integrates advanced features, as well as advertising insights. These capabilities empower creators to maximize the economic value of their projects.

Additionally, the company is leveraging AI to enhance its advertising and monetization capabilities, which could potentially lead to improved results. Therefore, as Unity optimizes its offerings, it anticipates growing faster than the mobile gaming industry while expanding into broader markets.

Given this background, let’s now discuss its fundamentals.

Revenue Growth Rates Should Improve in 2025

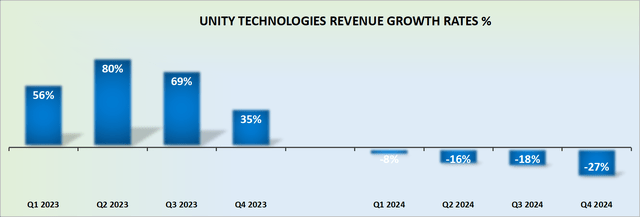

U revenue growth rates

The graphic above shows Unity’s consolidated revenues for 2023, whereas for 2024 the graphic focuses on its strategic portfolio. The strategic portfolio is Unity’s attempt at refocusing its business and cutting away investment from non-core operations.

Nonetheless, one way or another, Unity is delivering very poor growth rates right now. But this, I argue, is now old news. What matters for investors is what 2025 will look like?

And while it’s too early to make a prediction of how things will unfold, I also start to believe that a lot of bad news is now starting to be priced in.

What’s more, it appears possible, at least from the earnings call, to start to buy into the idea that through price increases, Unity could see more than +5% topline growth in 2025.

And given where investors’ expectations are, this could be a good base to move higher.

U Stock Valuation – 31x Forward Free Cash Flow

As an Inflection investor, I like to back companies with strong balance sheets. For its part, not only is Unity’s balance sheet not strong, but in fact, it holds approximately $800 million of net debt.

This means that 10% of its market cap is made up of debt. For me, generally speaking, this is an easy pass. Although, I have been known to make exceptions. For example, most recently, with SuperMicro (SMCI) which holds about 20% of its market cap as net debt.

Furthermore, for the 9 months of 2024, Unity’s adjusted EBITDA was $284 million. And this translated into $168 million of clean free cash flow, once we account for its capitalization of intangibles. This means that it’s possible that Unity could make around $230 million of clean free cash flow in 2024.

What’s more, if we presume that in 2025, Unity’s revenue grows by around 5%, and its operating margin will improve further, it’s possible that Unity’s free cash flow could reach $260 million.

This would put the stock priced at 31x next year’s free cash flow. That’s not that expensive, and I could easily see investors get behind this name.

Key Investment Risks

The main risk here is that Unity’s offering struggles to regain traction and grow its revenues. If it does that, its revenues could shrink further, and it will be increasingly challenging to grow its free cash flow profile. Altogether, this would leave the stock too stretched, and the stock could tumble further.

Furthermore, despite its prospects, Unity faces challenges, including recovering from strained customer relationships due to its now-repealed run time fee policy. Restoring trust amongst its customer base could take time.

Also, Unity’s main competitor, Unreal Engine by Epic Games (PRIVATE), offers high-end graphical capabilities, creating stiff competition for market share. How this unfolds and weighs on Unity’s prospects remains to be seen.

The Bottom Line

Looking back, my bearish stance on Unity Software has largely been validated, yet I now find myself shifting to a more neutral outlook.

While risks remain, such as its financial leverage, customer trust issues, and intense competition; Unity’s valuation at 31x forward free cash flow leaves room for optimism if growth re-accelerates.

At $20 per share, the risk-reward appears balanced, and I’m open to the possibility of investors finding renewed confidence in this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.