Summary:

- Unity Software experienced a -16% decline in revenue in q2’24, with a focus on restructuring and new growth initiatives.

- Management is working on improving its ad-revenue segment using machine learning while enhancing its go-to-market strategy.

- Unity faces an uphill battle in reigniting its growth trajectory as management focuses on rekindling customer relationships while increasing platform prices.

BlackJack3D

Unity Software Inc. (NYSE:U) has undergone a lackluster q2’24 earnings release in which revenue continued its decline for both Create and Grow segments for a total decline of -16%. Management is taking strides to turn this company around with a new CEO taking the helm, bringing in new growth initiatives to recreate their ad-revenue segment using machine learning and other dynamic features. Despite the excitement, management restated their eFY24 forecast with a significantly reduced revenue trajectory as the firm grapples with losing non-core customers as a result of the restructuring at the onset of 2024. I believe management is making the right moves to reignite growth; however, I anticipate this will be an uphill battle as the firm faces a challenging macroeconomic environment. I reiterate my SELL recommendation with a price target of $12.72/share at 2.86x eFY25 price/sales.

Unity’s Planned Cuts Won’t Be Enough For Profitability

Unity Software Is Being Refocused And May Be Set Up For A Merger

Unity Operations

Unity is struggling to find direction in this economy. At the onset of CY24, management released a major update to their business strategy, making major cuts to headcount and service offerings in order to improve profitability. This included a massive 25% headcount reduction at a time when the firm’s growth began stalling with GAAP operating and net margins further declining into a deeper loss, as seen in q1’24. Margins have since begun to recover in q2’24 as a result of the restructuring. Fast-forward to Q2’24, management announced their new go-to-market strategy and improvements to their advertisement and create businesses.

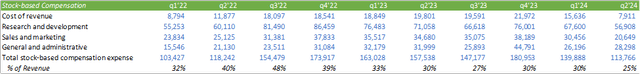

The restructuring so far has yet to churn out a profit; however, the firm has significantly reduced its stock-based compensation as a percentage of total net revenue. I believe the workforce reduction was in part due to bloated employee income packages for which the tech sector is famous. According to TechCrunch, 254 companies have made reductions in the ballpark of 60,000 employees in 2024 alone. Though it isn’t the best news to read, the loosening of employment in the tech industry may allow for employee benefits to reach a reset and allow for firms to bring in new talent with fewer stock-related benefits. If this is the case, Unity’s new growth strategy may maintain a higher level of operating cost and may alleviate some margin pressures. Though I believe it is too early to tell if this feature will trend into future quarters, stock-comp as a percentage of revenue has significantly declined from 30% in q4’23 & q1’24 to 25% in q2’24. Given management’s dismal revenue guidance for e2h24, I believe that management may be jumping the gun in bringing in new headcounts as margins may further compress as a result.

We’re also adding world-class talent to help accelerate this transformation on our ad business.

Their new ad strategy is expected to add additional features as it pertains to AI/ML capabilities, potentially leading to more targeted features and capabilities.

I believe a strong, targeted advertisement platform will be critical for Unity to turn around their growth trajectory. Depending on the types of data Unity collects across its ecosystem, the firm should have the capability of building out a robust service similar to Roku, Inc.’s (ROKU) advertisement platform. The biggest caveat is the opt-in feature on mobile devices in terms of data sharing, making it more challenging to use cross-application data to develop their ML model. Despite this, Unity should be able to leverage their 70% mobile gaming platform market share to create a functional ad-targeting feature. Management believes the mobile advertisement space has a $150b TAM, suggesting Unity serves less than 1% of the total addressable market.

On the create side of the business, Unity is planning to launch Unity 6 this fall. This high-performance platform is expected to improve rendering speeds, provide better workflows for game development, and include AI capabilities.

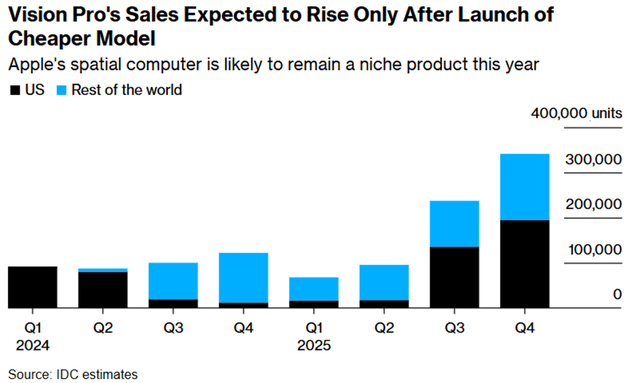

In addition to this, Unity 6 is expected to support further development of applications for the Apple Vision Pro headset. Their partnership with Apple is now running at a little over a year, which, I believe, has provided Unity with lackluster results. Apple boasted over 2,500 native spatial apps and 1.5mm compatible apps for Vision OS on their recent q3’24 earnings call. Despite this excitement, IDC reported that Vision Pro sales aren’t likely to surpass 100,000 units in a quarter and is facing declining sales volumes. This will likely result in fewer than 500,000 units sold in 2024.

I believe these lagging results will put significant pressure on gaming applications specifically developed for Vision Pro as developers may forecast lower returns on invested capital when compared to mobile gaming. In addition to the lower-than-expected adoption of the headset, higher platform costs may also pressure game developers from creating Vision Pro-enabled features that may lead to fewer gaming features for the product.

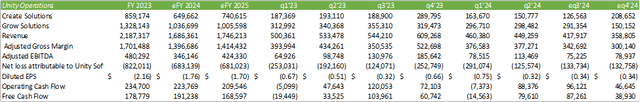

Unity Financials

Unity faced a major decline at the top line with revenue declining -16% on a year-over-year basis. This was largely due to the -22% decline in their create solutions as the firm restructures their offerings to cater to their core customers. Management noted that non-core revenue is expected to further decline in the coming quarters from their current level of $23mm, possibly as a result of retiring customer-specific offerings as I had discussed in previous reports covering Unity.

Guidance for the duration of eFY24 comes as a concern as the firm makes the attempt to rebuild their offerings and regain their growth footing. eFY24 guidance was reduced to $1,680-1,690mm, down from $1760-1,800mm. This will result in a -23% decline from FY23 figures as opposed to an -18% to -20% decline. I believe much of this decline is driven by both the consolidation of feature offerings and the price increase, which may have led customers to elect to migrate to other gaming platforms. Given Unity’s large mobile gaming market share, the firm has more to lose than gain as they reshape the future of their development platform and prices their offerings at market-appropriate levels.

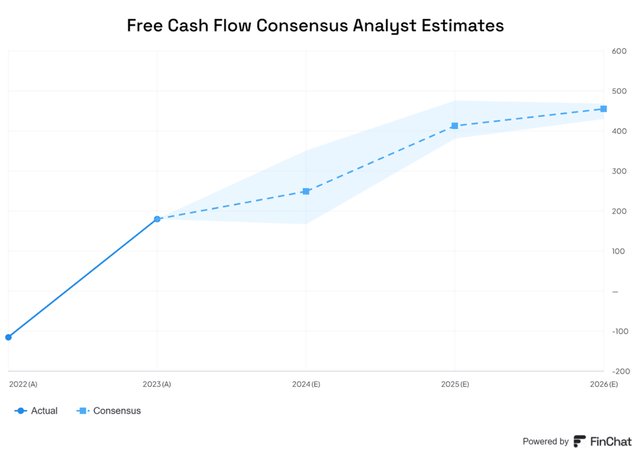

Forecasting the duration of eFY24, I anticipate margins to remain under pressure as a result of the more challenging growth prospect for the firm. In addition to this, I anticipate management may increase their capital investments going into eFY25 as they seek to redevelop Unity’s ad-revenue platform. Compared to consensus forecasts for free cash flow, I anticipate Unity’s cash generation to remain under pressure as a result of these factors. I believe that redeveloping their advertising platform will be a more challenging endeavor than initially anticipated, similar to the challenges faced by Netflix, Inc. (NFLX) who is in a similar position.

In addition to this, I anticipate the broader economy will undergo a contraction and may potentially fall into a recession. If this plays out, marketing budgets may be reduced in order to manage cash positions, resulting in a continued decline in Unity’s Growth segment. For comparison purposes, this thesis is baked into my thesis on Roku in which I expand upon this theory.

I do expect Unity to regain their growth position in their Create segment as the firm rolls out Unity 6 with its respective AI features. If the contraction thesis pans out, I believe gaming developers will seek this tool in order to save on costs as it may help automate some development processes, allowing for fewer headcount to develop a single mobile game. Despite my forecast for modest gross margin improvement in eFY24 as a result of the restructuring and headcount reduction, I do anticipate margins to compress to 81% as a result of the redevelopment process. Operating margins will likely follow suit as management bolsters their go-to-market strategy in order to reinvigorate growth.

Another driving factor behind the modest growth forecast is the challenged handheld device market. Though Apple Inc. (AAPL) is relatively optimistic about reigniting smartphone sales with the iPhone 16, I anticipate a continuation of the flat-to-down market environment as experienced in CY24. In their latest earnings update, QUALCOMM Incorporated (QCOM) noted that chip sales for their handheld segment will likely remain flat throughout the duration of eFY24 given the macro environment. Assuming a consecutive flat year for handheld sales, the growth in mobile gaming may follow suit.

Unity Going Forward

I had previously suggested that Unity may be positioning itself to be acquired in previous reports on Seeking Alpha. Their new Chief Product Officer for Advertising, Mr. Jim Payne, has previously built advertising platforms that inevitably were acquired by Twitter and AppLovin.

It’s hard to tell which company will be in a position to successfully acquire Unity as the mobile gaming platform is meant to be an omni-device platform. This will likely rule out Alphabet Inc. (GOOG), (GOOGL), and Apple from the running as each firm may be faced with a less-than-successful antitrust suit. Microsoft Corporation (MSFT) may find more success given their recent acquisition of Activision Blizzard; however, this may place too much control over the gaming industry under one umbrella. Given the firm’s exposure to the mobile market, this deal could potentially go through at the right price. Given that Jim Whitehurst, the previous interim CEO, was placed as Unity’s Executive Chair of the Board, this makes me believe that the firm is positioning itself to be acquired. Mr. Whitehurst’s appointment as interim CEO was part of my original M&A thesis for Unity.

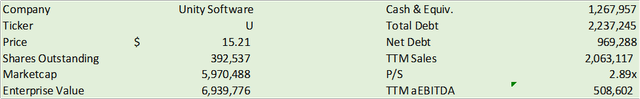

Valuation & Shareholder Value

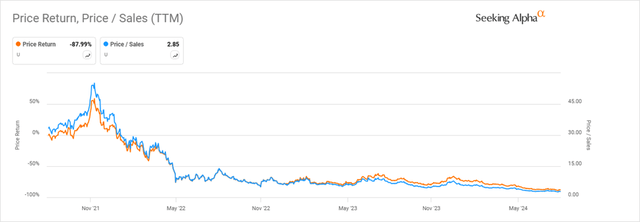

Unity’s valuation has experienced significant pressure in the last year as the firm grapples with reigniting its growth trajectory.

Whether the firm can build renewed excitement across the investor community will require a lot of rebranding and growth, which, I believe, will be a very steep, uphill challenge.

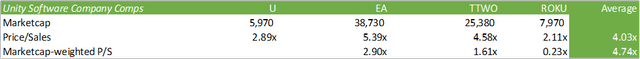

Looking at Unity from a company comps perspective, the gaming platform appears to be significantly undervalued when using a market cap-weighted average price/sales approach. Despite this low valuation, I do not believe the shares will undergo mean reversion until top-line growth returns.

Using an internal valuation method in which I weigh historical trading premiums, I value U shares at $12.72/share, in line with their current trading multiple at 2.86x eFY25 sales. I reiterate my SELL rating for U shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.