Summary:

- In a recessionary environment, new customers are likely to choose Unreal Engine over Unity.

- The growth trajectory for Create Solutions keeps deteriorating, and the organic outlook for 4Q22 was $4M short the consensus.

- The latest price action, driven by a combination of buybacks and short-squeeze, is likely to be over.

Sundry Photography

Competition and Recession

In my most recent article on Unity Software (NYSE:U), I stated that competition, especially from Unreal Engine (Epic Games), is one of the key investment risks investors should consider before investing even a dime into the company.

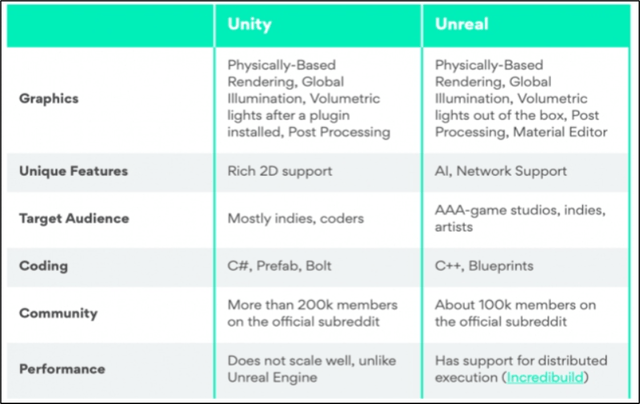

Both Unity and Unreal Engine have outstanding, and I would say comparable engines for content creation.

However, doing some research, I found that Unity seems to have an edge for Mac users since Unreal’s Nanite (is not supported), Lumen (it’s buggy), and Quixel make the engine crash.

Yet, Unreal Engine seems to be the preferred engine, but why?

To find the answer, one of the obvious things to do may be to check what kind of technology or additional feature Unreal may have over Unity. But, for me, the answer doesn’t lie within the technicalities but within the business model itself. It is the business model that I believe may take the market share away from Unity to give it to Unreal Engine.

Unity (Create Solutions)- Subscription revenue model: Unity offers its tools for developing real-time 2D and 3D content based on a subscription revenue model. A great model for investors since it represents a highly predictable and recurring revenue stream, but not that much for content creators that are looking to keep upfront costs relatively low. On top of that, the Company made a price hike (~ +19% on average) at the end of 2Q22 within its Unity Pro, Unity Enterprise, and Unity Industrial Collection offerings:

We raised the price between 13% and 25% across these offerings, the first significant price change in three years.

..There was literally no resistance to the price increases. They felt the value was there.

The value may be there, but the number of customers contributing more than $100,000 of Revenue in the TTM fell by 0.9% MoM (from 1,085 to 1,075).

Unreal Engine – Free (almost): Unreal Engine is free to use, so there is not any upfront cost to use the engine and start creating content. In fact, as stated on their website:

Unreal Engine is free to use for creating linear content like films, and for custom and internal projects. It’s also free in many cases for game development-a 5% royalty only kicks in if and when your title earns over $1 million USD.

This means that many small-medium content creators are likely to choose Unreal Engine, especially in a recessionary environment, as their engine of choice because failing here is free. But what about the big boys (i.e., big gaming studios)? Well, also here the Unreal Engine seems to be a winner. In particular, according to Kaizen technical director Philip Crabtree:

I’ve used Unity a lot, and I think it’s really optimized for small-scale games. Unreal is better at the scope. It’s a very robust engine for dealing with large scenes, with a lot of actors. It’s got a lot of tools out of the box, so if you want to do things like level streaming you can pretty much just do that.

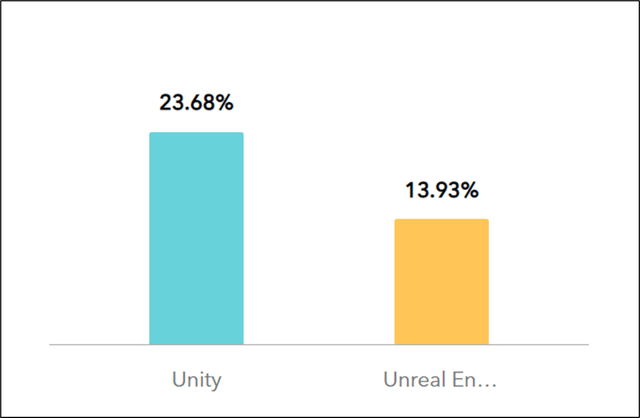

However, according to Slintel, Unity has a much bigger market share than Unreal Engine (~ 24% vs ~ 14%) in the Game Development category.

Having said that, I believe that new customers are likely to choose Unreal Engine over Unity’s platform, especially in a recessionary environment where “cut cost” is the mainstream theme. But that is not the only bad news for Unity. In fact, as you know, the company’s Create Solutions and Operate Solutions are two complementary solutions, with the former driving the adoption of the second one. If Create Solutions start to lose ground, the damage will spread to Operate Solutions, where the current softness in the ad market is already starting to do its job.

3Q22 Results Overview

Personally, I believe that the 3Q22 results were ugly.

In fact, the growth trajectory for Create Solutions keeps deteriorating (~ +6% QoQ) and the seasonality that we saw over the last 2 years in the third quarter doesn’t seem to be there.

On the other side, Operate Solutions showed positive growth on the QoQ basis (~ 8%) but a negative one on the YoY basis (~ -7%). But don’t get too excited, as a potential recession is likely to magnify the hit of the current softness in the ad market. As stated during the last earnings call:

When we talk with our advertisers, the sense we get is clearly one of caution and reticence to commit to the aggressive campaign spends that would crowd out competition at the bid and elevate CPMs.

Having said that, I personally believe that the real asset is the Create Solutions and not the Operate one. Overall, both the top-line growth (+12.8% YoY), as well as business marginality (gross margin 1Q22 was 70.7% vs 65.3% in 3Q22), are under pressure.

Turning the attention to the outlook, the guidance provided for the 4Q22 was below expectations. The ex-merge consensus for the FY was $1.3B – $1.35B vs the current of $1.365B (+65M) – $1.385B (+$35M). Assuming that the outlook increase is ironSource driven, the 4Q22 outlook of $425M – $445M, once we take out that increase leads to an organic outlook of $360M – $410M or the average of $385M which is $4M short the consensus.

Final Remarks

Now, many of you are wondering what is going on with Unity’s share price. Why is it up almost 100% over the last 30 days? Well, the short answer, in my opinion, is a combination of buybacks and short squeezes. Exactly buybacks:

In connection with the completion of the acquisition of ironSource on November 7, 2022, we completed the sale and issuance of $1.0 billion in aggregate principal amount of our 2.0% convertible senior notes due in 2027 …. The proceeds from the issuance and sale of the 2027 Notes are expected to be used to partially fund a plan to repurchase of up to $2.5 billion of shares of our common stock pursuant to our previously announced stock repurchase program.

I believe that the buyback program is likely to be over with the bears taking the ground yet again.

Overall, I rate shares as a Sell, with the previously stated price target of $21.05/share.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.