Summary:

- Unity Software is facing stock price volatility due to uncertainty surrounding its corporate strategy and new management.

- The company plans to focus on core game creation and expand into real-time 3D content, offering long-term growth potential.

- Initiating coverage with a speculative buy, as short-term volatility is expected due to momentum factors.

- My analysis specializes in identifying companies that are experiencing growth at a reasonable price. Rating systems don’t consider time horizons or investment strategies. My articles aim to inform, not to make decisions.

Jose Luis Pelaez Inc/DigitalVision via Getty Images

Investment Thesis

Unity Software (NYSE:U) provides a powerful platform for creators to build interactive content across various devices. Their suite includes Create Solutions for development and Grow solutions for user engagement and monetization.

2024 has been a challenging year for Unity. Despite exceeding revenue expectations by 200% in Q1, the stock price has plummeted 53% YTD as it continues to hit new all-time lows. A restructuring plan at the begging of the year that included workforce reduction aimed at cost-cutting and improved Q1 guidance initially pleased investors, but lingering concerns have kept the stock volatile.

In a bid to streamline operations and focus on core products, Unity reconfirmed during their last earnings call, it will exit certain business areas. I believe this will be sharpening their focus by exiting their hardware components for multiplayer games and limit its professional services unit. This business, while contributing $283 million in revenue last year, operated at a loss. The restructuring began in Q4 and should be completed by the end of the current fiscal year.

Unity believes this focus will strengthen their core video game creation products and position them for long-term success. The company also implemented a 25% workforce reduction and additional cost-cutting measures to save $250 million annually. This focus on efficiency is expected to fuel revenue growth in the latter half of 2024, according to their CFO in the Q4 earnings call:

The unfortunate consequence of this first phase is that we had to let go of about 25% of our colleagues. That’s super hard. These employees made many, many contributions to Unity and helped customers achieve their goals. We thank them for all their work and are really sad to see them go.

The company projects core business revenue between $1.76 billion and $1.8 billion for 2024, down from $2.2 billion in 2023. While overall revenue may decline, the focus on core products and cost-cutting efforts aim to improve profitability. I believe the next earnings call will be crucial and should be monitored for insights into future earnings expectations and the response of the stock price.

Now what’s exciting is actually the second phase of the reset. This is about reigniting revenue growth with healthy financials. And the good news is that that starts this year. We expect revenue growth to accelerate in the second half of 2024, and maintain attractive levels of revenue growth thereafter while maintaining and extending our profitability.

Overall, I believe the new CEO is the right person for the job, as he has a strategic plan to prioritize the company’s core video game creation business. While there seems to be short-term adjustments, this focus has the potential to position Unity for long-term growth. For this reason, I am inclined to start coverage of unity with a speculative Buy.

Management Evaluation

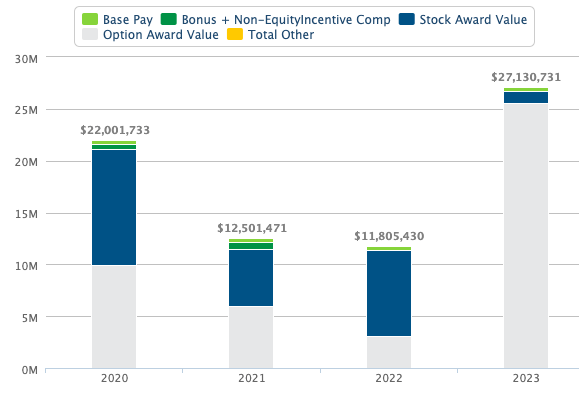

Gaming industry veteran Matthew Bromberg brings over 20 years of experience leading successful mobile and cross-platform game development. At Zynga (TTWO), he served as COO, spearheading the company’s turnaround. He managed Zynga’s global game studios, overseeing product development, design, technology, data, and analytics. Prior to that, Bromberg held leadership roles at Electronic Arts (EA), where he was instrumental in scaling their mobile division and led international teams that built popular games across all genres. He is replacing former CEO John Riccietello, who had to step down due to an abrupt change in licensing fees that resulted in paying customers’ outcry. I believe Bromberg has the experience needed to lead the company for long-term success. Riccietello salary trend is below and most of his comp was in the form of a stock award.

salary.com

According to SEC filings, the new CEO will net an annual base comp of $850,000, a target bonus of 100% of this salary, a sign-on bonus worth $2 million. He will also be compensated with stock awards of 1,036,055 RSU and once equity awards are approved in 2025 he would be targeting $10 million with at least half of that in RSU. I believe this form of compensation weighed heavily to RSU has a high alignment ratio to the long-term success of the company.

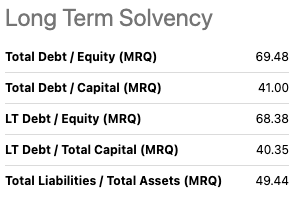

Unity appointed Luis Visoso as CFO in 2021. Visoso brings a wealth of experience honed at Amazon Web Services (AMZN) and Amazon Worldwide Consumer, where he served as CFO and also held executive positions at Palo Alto Networks (PANW). I believe he will be key to the future success of the company and since he was brought over when Riccietello was CEO, I am not sure if he will stay around as the restructuring takes place. However, he has maintained a positive equity in the balance sheet and debt levels seem under control.

seekingalpha

Overall, I believe the new Unity Software team seems committed to be the company’s long-term success, as evidence by Bromberg’s alignment, despite the low employee sentiment on Glassdoor. Further, I believe the new management has a lot to prove, including lifting the company’s revenues and turning to profitability on an EPS basis. Considering all the factors and taking a positive attitude towards Bromberg new strategic plan, I am inclined to give the new team a “Meets expectations”.

Glassdoor

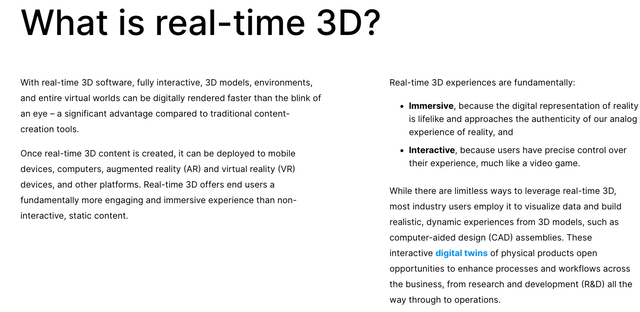

Corporate Strategy

Unity’s strategy goes beyond just game development. They want to be the leader in real-time 3D content creation tools. This means expanding their software to be used for things like architectural design, VR experiences, and even non-game solutions. By offering a versatile platform with strong 2D and 3D capabilities, they aim to attract creators from various fields and grow their market share. I believe as the new management aims to grow their revenue, diversifying away from video games will be part of their core strategy. However, Unity must compete with specialized companies like Autodesk (ADSK) and VR simulations like Unreal Engines (Private) while maintaining its game development dominance.

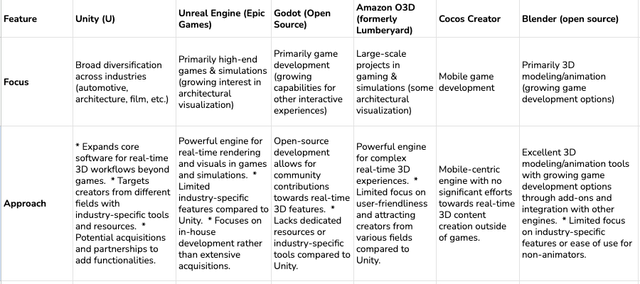

I have created the table below comparing Unity current strategy to some of it current competitors:

|

Unity Software |

Unreal Engine (Epic Games) |

Godot (open source) |

Amazon O3DE |

Cocos Creator |

||||||||||||

|

Market Share |

High (leader in game development engines) |

High (Strong presence in high-end games) |

Low (growing market share) |

Low |

Moderate (Mobile game development) |

|||||||||||

|

Corporate Strategy |

Focus on expanding beyond gaming into real-time 3D content creation |

Competing with Unity for high-end game development |

Opens source, community-driven development |

Caters to large-scale projects and simulations |

Focus on mobile game development with a user-friendly interface |

|||||||||||

|

Disadvantages |

Royalty fees for high revenue earners, complex for beginners |

High learning curve, licensing costs |

Limited built-in features compared to commercial options |

Less user-friendly than Unity or Unreal |

Limited to 2D mobile games |

|||||||||||

|

Advantages |

User-friendly, large asset store, strong 2D & 3D capabilities |

Powerful engine for high-end graphics, large user base |

Free and open-source, growing feature set |

Powerful for large-scale projects, cloud support |

Ideal for mobile games, large community |

Source: From companies’ website, presentations, Seeking Alpha

Unity is continuously developing its software to go beyond just game development. Their engine now supports features well suited for tasks like architectural design, product visualization, and VR experiences. They are actively targeting creators from various fields by showcasing real-time 3D use cases in industries like automotive, manufacturing, and film.

Unity has a history of acquiring or partnering with companies specializing in real-time 3D technologies. This allows them to integrate new functionalities and broaden their reach. I have created the following table to highlight Unity efforts versus that of its main competitors, including Blender, a free and open source 3D software tool.

From the table above, Unity real-time 3D edge lies in its broad approach. Unlike competitors focusing on specific niches, Unity actively targets diverse industries with dedicated tools and resources. Their platform is more user-friendly, and they have an extensive asset store to attract a wider range of creators. While not open source like Blender or Godot, Unity fosters collaboration through acquisitions and partnerships, accelerating innovation. I believe this versatility positions them as a one-stop shop for real-time creations across various industries.

Valuation

Unity Software currently trades at around $19, and it has been a negative momentum, hitting all-time lows and declining around -53% YTD.

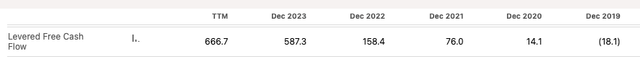

Employing a conservative 11% discount rate (r). This represents a hurdle rate that an investor expects to receive, considering time value and inherent risk of that investment. To calculate it, I used a 5% rate for time value in addition to a 6% average market premium.

Then, using a simple 10-year two staged DCF calculator and I reversed the formula to obtain its implied FCF growth rate which is around 26%.

$19 = sum^10 FCF (1 + “X”) / 1+r) + TV FCF (1+g) / (1+r)

*I added Book Value in the calculation

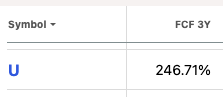

That is, the market currently anticipates Unity’s FCF to grow at 26% this year. However, there are no expectation for future growth on FCF on Seeking alpha that I can use for comparison. Therefore, I will be looking at the trend for FCF growth which has been positive:

The FCF growth trend has been increasing and is not due to the restructuring plan that is taking place now, FCF growth has been 246% over the last 3 years.

seekingalpha

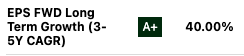

However, I will use a more normalized growth rate and use the expected EPS growth as a more normalized long-term growth in future FCF:

seekingalpha

This 15% increase in revenue is just a gauge as it does not reflect other factors like capital expenditures and cash generation. Therefore, I believe at 26% the current price already reflects all the risks and find the company fairly valued but with negative momentum due to all the uncertainty with the new strategic plan.

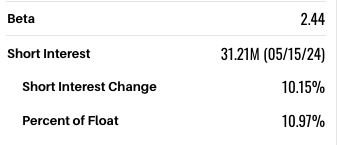

Technical Analysis

The stock price has negative momentum and seems to be hitting all-time lows. However, the company expected growth rates as described above are already reflecting most of the uncertainty. Also, short interest seems to be high and for this reason, I believe the stock might continue to see negative momentum; however, I will make a tactical speculative buy as I believe in the long-term story for now. I will wait for more information on their revenue plan in the next earnings call.

Next earnings report is estimated to be August 2nd.

Barrons

Takeaway

Unity faces a challenge, stock price volatility due to the elevated uncertainty in the company current corporate strategy. The company leads the game development engines market. New CEO Bromberg has a plan to focus on core game creation and expand into real-time 3D content (think VR, architecture). This diversification offers long-term growth but faces competition. While the current price reflects some risk, short-term volatility is likely. I am starting coverage with a tactical speculative buy. I will also monitor Unity next earnings call for more info on their revenue plan details.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of U either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.