Summary:

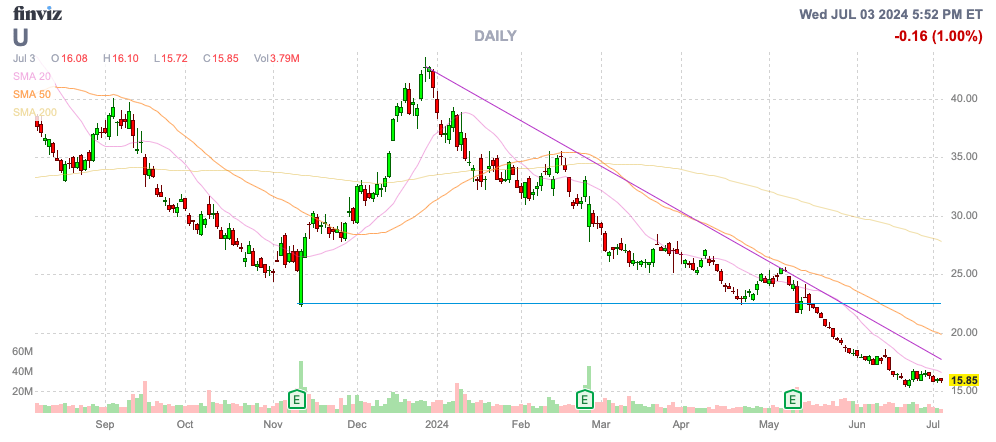

- Unity Software looks set to re-test the all-time lows of $15.23 set following weak Q1 numbers.

- The new CEO, Matthew Bromberg, from Electronic Arts, has yet to outline turnaround plans, setting some risk of a change in plans.

- U stock is relatively cheap at 4x sales, but the business has to return to solid growth to warrant a higher valuation multiple.

sebastianosecondi/iStock via Getty Images

Anytime a stock continues to hit new lows, an investor has to tread cautiously. Unity Software Inc. (NYSE:U) recently traded at all-time lows following another weak quarter in Q1, and the stock appears headed for a test of the $15.23 low on June 21. My investment thesis remains Neutral on the stock, with the new CEO only starting on May 15 due to the potential kitchen sink type quarter coming up.

Source: Finviz

Dumpster Fire

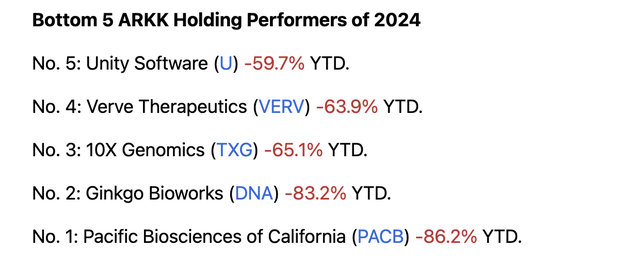

If anyone wants a glimpse of how bad the 1H performance was for Unity Software, one only has to see how the stock was one of the worst performing stocks in the ARK Innovation ETF (ARKK). The ETF had a lot of dogs this year, yet Unity Software still fell into the top 5 losers with a 60% loss.

New CEO Matthew Bromberg comes from Electronic Arts (EA) and previously served as the COO of mobile game developer Zynga. The new CEO has still yet to place his finger on the turnaround business plans of Unity, and a lot of new CEOs like to restructure the business regardless of what an interim CEO of the quality of Jim Whitehurst has already completed.

The maker of the Unity game engine is leaning into AI with the Unity 6 product set to release later this year. In addition, the company has launched and expanded on ad platforms with the integration of data from ironSource Ads, contributing to the opportunity to further monetize advertising with the Unity game engine.

The company had 50% of the top Apple (AAPL) Vision Pro games made with Unity. AR/VR games are a future growth opportunity, but naturally Apple has seen limited headset sales so far due to the device costing in excess of $3,500.

Executive Chairman Jim Whitehurst actually sees the biggest opportunity in the business from the Industry segment, working with corporations. Unity is working in areas from human machine interface to training and sales and marketing to bring real-time 3D to the office place.

On the Q1’24 earnings call, Mr. Whitehurst made the following statement about the opportunity in the Industry segment, topping gaming as follows:

Secondly, I’m not going anywhere. I’m remaining as Executive Chairman. And what I’m really excited about working on is the industry side of the business. I am obviously in an area where I’ve spent a lot of time and I continue to be super excited about the opportunity we have there. I’m probably biased, but I still think that’s a bigger opportunity in the long run than the gaming business.

Naturally, the new CEO comes from the gaming background, so the focus might entirely shift back to gaming. An investor never knows the unpredictable turns of a new CEO.

Looking For The Bottom

A big contributor to the lower stock price is that Unity reported a very confusing Q1 quarter and guided to similar confusing numbers for Q2. The company reported strategic sales of $426 million and guided to only $420 to $425 million in Q2, with an expected dip of 6% to 7%.

The gaming software company guided to revenues of $1.8 billion for the year, which would represent minimal growth of up to 4% YoY. A lot of these sales numbers were technically below consensus, but the real confusing part is that Unity Software provides the total Q1 sales of $460 million, but the company guided to just the strategic revenue level for Q2 and full year.

The company only generated $34 million in revenues from the non-strategic portfolio, which is expected to dip to below $10 million per quarter by year end. Again, corporate turnarounds are difficult due to restructuring actions like these that make comparing financials very difficult.

The ultimate key is that the strategic revenues are targeted to dip during Q2. The stock continues to trend along the bottom due to the combination of weak results and a new unproven CEO.

Unity Software did generate an adjusted EBITDA of $79 million in Q1, up from $29 million last year due to cost actions. The company targets Q2 adjusted EBITDA relatively flat sequentially at $75 to $80 million.

The stock has a market cap of ~$7.5 billion, with diluted share count listed at 478 million shares. At the $1.8 billion revenue target, Unity trades at only 4x sales.

If the company returns to 15%+ sales growth, the stock is exceptionally cheap at 4x sales targets for a high margin software business. If Unity Software meanders with lackluster growth, the stock could actually dip to a multiple of 1x to 2x sales targets.

Unity is already solidly profitable, with a $300+ million adjusted EBITDA target for the year and a consensus EPS estimate of $0.82 turning into $1.05 in 2025.

Takeaway

The key investor takeaway is that the company still has too many questions to bet on the bottom yet. Unity Software has huge potential growth in utilizing AI to build developer tools for games and industry apps, while AR/VR provide another growth opportunity.

For now, investors should continue watching from the sidelines until the new CEO outlines plans and Unity Software shows signs of the turnaround being in place.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market to start July, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.