Summary:

- The video game industry, valued at $273 billion, is projected to reach $664 billion by 2033, driven by cultural and demographic shifts.

- Unity Software faced a rough 2023, with PR problems that caused their CEO to resign.

- Unity’s restructuring, which cost $201 million and was finalized in June 2024, included significant layoffs in 2023 and 2024. The aim was to reset the company.

- The crisis led Unity’s CEO to attempt a reset with new product launches, an AI-powered assistant service, and a smaller structure due to layoffs.

- A strong balance sheet and decent margins showcase the possibility of a turnaround if the product launches prove successful and the company’s reputation is restored.

PonyWang

Investment Thesis:

Unity Software Inc. (NYSE:U) Has a strong balance sheet and recently launched a well-received product with AI, yet the lack of positive earnings growth and damaged reputation paint a complex situation for the company. I believe the turnaround could be starting but not in full effect until sales and the company’s standing improve.

Videogame Industry

From its humble beginnings in 1958, when physicists at Brookhaven National Laboratory created the first video game, tennis for two, a small point in the screen moving from one end to the other, it is now roughly $273b. It could potentially reach $664 billion by 2033.

There is a cultural and demographic shift, with 77% of millennials playing video games and using them as their main form of entertainment, unlike previous generations, who used TV or radio.

It is clear the videogame industry is here to stay and will continue to grow, especially as the global economy expands and more people join the middle-class ranks, giving them access to more time and cash to spend on entertainment.

Unity’s Website

This is a truly global and globalized industry, with teams of developers scattered worldwide but using similar tools to develop video games, and such tools are the videogame engines like Unity, Unreal, or Godot.

They bridge the many different skills and allow teams to fast-track the development of their projects. In the past, it would have taken years to develop an engine and, later, a game, effectively creating a barrier that prevented many smaller projects from coming to fruition.

With Unity, skilled developers are easier to find and train thanks to the widespread use of the platform, which creates a better, more efficient industry.

U’s Market Dominance

Unity Software holds 70% of the mobile game engine market, a fast-growing $90 billion industry, and 38% of the broader video game market. This is a result of the long history of U in the market, as it was founded in 2005. It’s ease of use compared to its alternatives and especially powerful tools for 2D and 3D games make it an attractive alternative for video game creation.

Unity’s Website

U is not simply a software program with a license cost and subscription tiers; it’s an ecosystem with its own marketplace for ready-made assets and tools.

As such, it represents much more than simple software, especially considering its longevity in the industry and usage in thousands of videogame projects.

I believe Unity could continue to build up a moat. The recent restructuring and new product launch, combined with learning from the most recent errors, could potentially improve Unity’s already dominant position and grow not only from the broader industry growth but also from increasing market share it.

Unity’s 2023 Runtime Fee Blunder

In May 2023, Unity went ahead with what’s considered a widely disastrous move: Changing their fee structure to charge videogame developers for every install above a threshold, ranging from $0.01 to $0.20 depending on the version of Unity used, revenue generated, and number of installs.

The real damage to the relationship between U and game developers didn’t come from the fee structure but from the change being retroactive. This means that games launched under the previous flat fee structure would now have to pay for installs.

This was especially problematic for smaller indie studios whose games were downloaded thousands or millions of times at low prices or even free promotions and could potentially find themselves deep in debt to Unity.

While the decision could be justified from a business perspective (it would have brought in strong cash flows), the retroactive and heavy-handed aspect of changing an existing business relationship so suddenly caused a hard hit to Unity’s reputation and widespread condemnation from developers.

The crisis and PR hit brought by this finally culminated in the CEO stepping down in October 2023.

Restructuring And Layoffs

Unity went ahead with layoffs in 2023 and 2024 with an overarching plan to “reset” the company.

The job cuts meant 25% of its workforce would be fired in early 2024, after three other rounds of layoffs that saw 1100 jobs cut in 2023.

This restructuring came with a cost of $201M and was finalized in June 2024, according to their last quarterly report.

Videogame Industry Engines

We are seeing a trend where game developers ditch their in-house game engines for one of the more popular choices: Unity, Unreal, or Godot.

Once, the in-house proprietary game engines were a source of pride and business advantage, allowing for a deeply customized and finely tuned framework for developing games.

However, the costs and time involved in creating, maintaining, and updating game engines proved too much to handle, and industry titans like CD Project Red and Halo Studios switched to Unreal.

The benefits of this are especially notorious for cutting workforce costs, as training staff into proprietary engines takes time, and nothing guarantees long-term employee loyalty in the volatile videogame industry.

Having a few big game engines in the market instead makes for a more dynamic human resources situation, as new hires would require much less training if they are already experienced with the engine used by the developer.

This also makes for greater specialization, putting the weight of developing new tools and improving game engines on the software companies that make them instead of the developers, who can now focus entirely on making the best possible video game.

Unity And The Rise Of The Indie Developers

Unity has a clear advantage over all other game engines: It has the softest learning curve, which means that time and money-strapped game developers naturally choose Unity Software.

This is a prime source of growth for U, as the Indie Game Industry is a fast-growing and exciting market sector.

Unity’s Website

Indie games offer freedom of expression, creativity, and boundary-pushing appeal that their bigger and richer corporate cousins do not, which makes them attractive to a myriad of different consumers.

Here is a clear path to continued growth for Unity: continue being the easiest alternative to use, rebuild the trust of game developers, and keep innovating to grow alongside the growing video game industry.

New Engine, New Company, New AI

A big part of what makes the reset button on U is that parallel to the cutting in staff numbers, change in CEO, and aborting the disliked runtime fees was the launch of a new and improved product.

The new CEO has also declared that Unity is taking seriously its change as a company.

That product also came with AI support in Muse, a subscription-based generative AI tool and assistant that aims to help projects save time.

Unity’s Website

The new AI tool can chat like a virtual assistant inside the software, giving personalized answers based on the current project and also generating sprites, editing images, animating models, and enhancing models.

A subscription-based model for AI will also help diversify cash flows and add more value to U’s business proposition, potentially bringing more developers into the ecosystem.

A new engine, Unity 6, was recently launched on October 17 and has received positive reviews, citing improved performance and stability.

I believe these are all positive signs of a bullish turnaround for this beaten-down stock.

Unity Software Earnings

U has had problems with earnings in the past; in fact, that’s probably the main reason that pushed management into the unpopular attempt at changing fees.

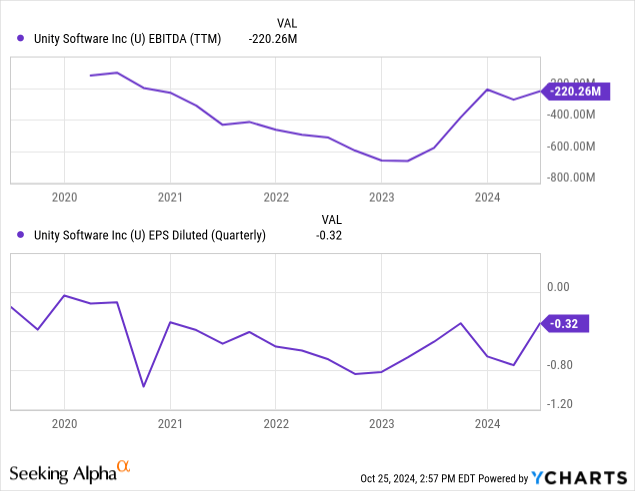

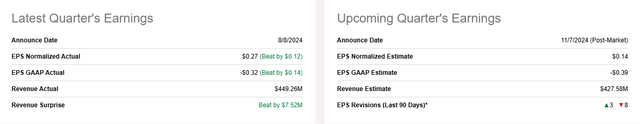

In fact, current EPS Diluted (Quarterly) is $-0.32, and EBITDA (TTM) is $-220.26 million, with Revenue at $426 million and GAAP Net Loss for Q2 of $126 million.

This is a situation of a company that was in a deep business downturn, a situation that propitiated a bad business decision in the form of the previously mentioned Runtime fees.

On the positive side, it did beat estimates with a $0.27 EPS Normalized Actual vs. an estimate of $0.15.

Seeking Alpha Premium

I believe the situation is really now dependent on the success of the new product launches of Unity 6 and Muse AI.

There is still opportunity for bullish upside, if sales can improve, pushed on by positive reviews of those new products.

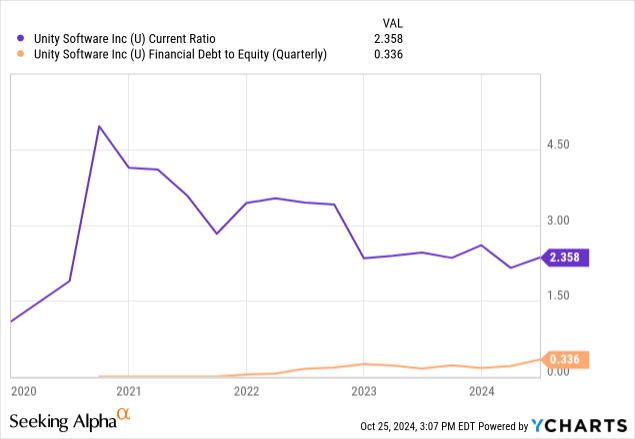

Balance Sheet Of U

Here, Unity shows a strong position, with a Current Ratio of $2.358, showing a robust capacity to cover short-term obligations and a Financial Debt to Equity Quarterly Ratio of $0.336, showcasing how U is not a leveraged company.

These will be reasonable bases for any bullish thesis. Unity can survive quite well while PR relations are repaired and product sales materialize.

While this is a strong point per se, it also helps establish a financial base from which any bullish thesis for increased growth can expand.

I rate this a very good point.

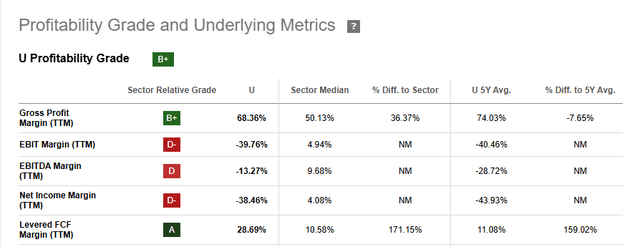

Unity Software Profit Margins

Here is a mixed bag for Unity Software Inc., with a few negative margins like EBIT and EBITDA and other positive ones like Gross Profit Margin of 68.36% and Levered FCF Margin of 28.69%, both above the sector median.

Seeking Alpha Premium

It also boasts $3.21 cash per share, which, for a company that has suffered so much in recent times, is proof of financial strength.

As we can see, the issue does not lie in the bottom line, which has a strong capacity for creating cash flow after meeting financial obligations (this is, of course, in line with the previous lack of heavy debt).

The main problem for U continues to be a downturn in sales and a damaged reputation, choking up potential growth.

Competition In The Video Game Engine Industry

The main risk for Unity is a continued expansion in other game engines’ market share. Unreal holds a comfortable 16.45% of the market (Unreal is owned by Epic Games, a private company). Another new competitor is the free and open-source Godot, which threatened Unity’s dominance in the smaller developers sector.

The situation showcases a two-front war for Unity, with Unreal as a larger, more complex alternative for bigger and better graphic projects, while Godot offers itself as a low-cost, easy-to-use alternative for indie projects.

How will this affect U? The answer lies in how well developers react to Unity 6 and its AI tools.

Also, Unity Software has made inroads into other projects, such as customer experiences created with Unity for Audi and Diageo and 3D modeling for pediatric care; this is an excellent sign that U is attempting to broaden its market horizons using its powerful tools.

Conclusion

Based on the solid balance sheet, combined with new product launches and decent margins, the situation is more positive than negative. Yet the lack of continued growth in earnings makes this a mixed bag. The company’s reputation needs to improve in order to make the necessary increases in the top line. I rate it as HOLD.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in U, over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.