Summary:

- U’s prospects remain highly speculative going into FQ2’24 earnings call in August 2024, as the stock continues to lose much of its value.

- Despite the mixed FQ1’24 performance and underwhelming FQ2’24 guidance, the management remains confident about its FY2024 guidance.

- The new CEO is also notably experienced in gaming management, with it potentially bringing forth a clean slate and renewed faith amongst market analysts/ gaming developers.

- While short interest has moderated, it is undeniable that the stock may remain volatile moving forward, for so long that a bottom has yet to be found and the business’ performance metrics disappoint.

- However, we believe that the U stock looks relatively cheap here, with it offering a speculative growth play, assuming a successful turnaround ahead.

adventtr

U’s Investment Thesis Remains Speculative

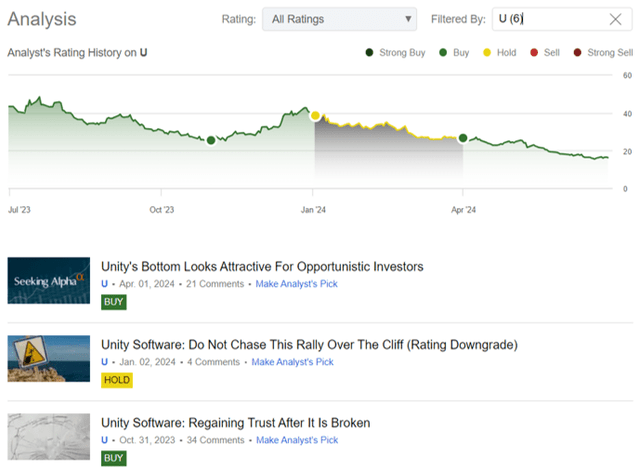

We previously covered Unity Software Inc. (NYSE:U) in April 2024, discussing why the stock remained speculative in the intermediate term, with it uncertain if the business reset might be successful in boosting its top/bottom lines while convincing developers to return.

However, with the stock seemingly well supported at $26s, it appeared that there might be an improved margin of safety for those looking to add, for so long that the portfolio was sized according to their risk appetite.

Author’s Rating

Seeking Alpha

Since then, the U stock has already lost -39.1% of its value, well underperforming the wider market at +3.8%, as it further retraces below our original fair value estimate of $20.10.

While short interest has moderated from the previous article at 12.87% to 8.56% at the time of writing, it is undeniable that the stock may remain volatile moving forward, for so long that a bottom has yet to be found and the business’ performance metrics disappoint.

At the same time, we will be highlighting a few metrics to look out for in the upcoming FQ2’24 earnings call on August 07, 2024, with it underscoring the health of its businesses along with near-term prospects.

1. The Reiterated FY2024 Guidance Appears Overly Optimistic

For context, U has reiterated their FY2024 strategic revenue guidance of $1.78B (+2.8% YoY) and overall adj EBITDA of $412.5M (+50.5% YoY) at the midpoint in the previous FQ1’24 earnings call.

Even so, we are uncertain how the company aims to achieve this feat, with FQ1’24 only bringing forth strategic revenues of $426M (+2% YoY) and overall adj EBITDA of $78.51M (+172.4% YoY) as the management guides underwhelming FQ2’24 numbers of $422.5M (-0.8% QoQ/ +1% YoY) and $77.5M (-1.2% QoQ/ NA) at the midpoint, respectively.

From these numbers, it appears that the U management is very confident about delivering a heavier top/ bottom line weightage in H2’24, with FQ3’24 and FQ4’24 requiring the minimal quarterly strategic revenue contribution of $465.75M (+10.2% QoQ) and overall adj EBITDA contribution of $128.24M (+65.4% QoQ) to hit the rather ambitious FY2024 guidance.

While the management has guided intensified efforts “to accelerating revenue growth while operating at attractive profit and cash flow margins,” there has been no clear strategies in driving near-term monetization.

While the AdMob integration is last announced in March 2024, there has been no further news offered on the beta platform, with it remaining to be seen if U may be able to grow its advertising opportunities in the near term.

At the same time, while the Support for Apple Vision Pro has already been made available since January 2024, there has been minimal boost on U’s top/ bottom-lines with the AR adoption being relatively slow attributed to the high price tag.

It is unsurprising then that Apple (AAPL) has opted to suspend development for the next-gen high-end AR, while focusing on launching affordable models by the end of 2025 instead.

As a result of these uncertainties, we believe that readers may want to monitor U’s upcoming FQ2’24 performance closely, since we believe that the management needs to deliver three consistent beat and raise performances to match the ambitious FY2024 guidance.

Otherwise, we may see a painful miss, with the potentially lowered FY2024 guidance likely to bring forth more stock price corrections.

2. New Management Team Appears Promising

By May 2024, U has announced new leadership, Matt Bromberg, who used to be a COO at Zynga, a game developer and publisher company, between August 2016 to November 2021.

It was important to note that he was part of the management team that took Zynga from a company boasting $2.09B in market cap in August 2016 to a $12.7B acquisition by Take-Two in May 2022.

Readers may also want to note that Matt Bromberg has previously “held various leadership roles at Electronic Arts, including Senior Vice President of Strategy and Operations of the company’s mobile division and Group General Manager for all BioWare studios worldwide.”

These experiences imply the new CEO’s familiarity with gaming companies’ operations, with it likely to be extremely valuable as he tries to turnaround the ship and reshape the market/ game developers’ pessimistic sentiments surrounding the previous price debacle.

While it is uncertain if the new CEO may be successful, we believe that it allows U to re-start on a clean slate, significantly aided by the correction observed in its stock valuations and prices, to be discussed in the next section.

3. The Recent Plunge Triggers An Even More Attractive Entry Point

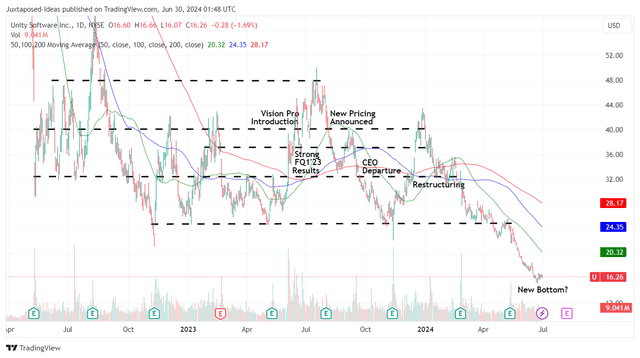

U 2Y Stock Price

Trading View

For now, U has continued to lose much of its value after breaching the support levels of $26s, while trading below its 50/ 100/ 200 day moving averages.

For context, we had offered a fair value estimate of $20.10 in our last article, based on the FY2023 strategic portfolio adj EBITDA per share of $0.71 (+543.7% YoY) and the FWD EV/EBITDA of 28.37x. This is on top of the long-term price target of $51.60, based on the consensus FY2026 adj EBITDA per share estimates of $1.82.

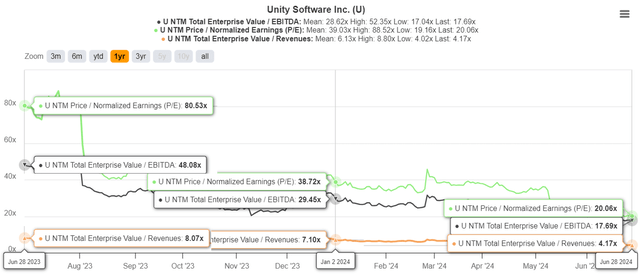

U Valuations

Seeking Alpha

With U’s FWD EV/ EBITDA valuations declining drastically to 18.83x and FWD P/E valuations to 19.89x, compared to the previous article at 28.37x/ 37.95x and 1Y mean of 28.62x/ 39.03x, it is apparent that the stock may remain volatile moving forward, with our previous price targets voided.

The same has also been observed in its LTM EV/ Sales of 4.17x, compared to the previous article at 6.49x and 1Y mean of 6.13x.

Interestingly, the LTM EV/ Sales of 4.17x makes the U stock appear more attractive, with it nearing its direct competitor, Epic’s approximate FY2023 EV/ Sales of 4x, based DIS’s latest $1.5B investment, estimated enterprise value of $22.5B, and estimated $5.62B in 2023 gross revenues.

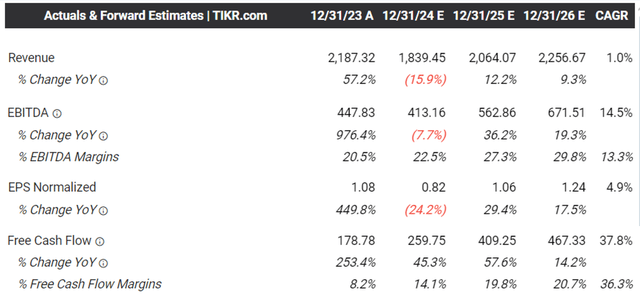

The Consensus Forward Estimates

Seeking Alpha

This is especially since U is expected to chart a normalized top/ bottom-line growth at an improved CAGR of +10.8%/ +27.5% between FY2024 and FY2026, after most of the non-strategic revenues are phased out.

This rate of growth does not pale in comparison to Epic’s projected top-line growth at a CAGR of +3.3% over the same period of time, implying that U is notably cheap for the accelerated top-line growth prospects, with FY2024 being a temporal albeit painful trough year.

So, Is U Stock A Buy, Sell, or Hold?

Well, this is a hard question to answer indeed, since there appears to be minimal bullish support observed thus far, as U enters uncharted territory with no historical indicators to rely on.

On the one hand, while the stock has seemingly bounced at $15.50s by June 20, 2024, it is uncertain how it may fare entering the FQ2’24 earnings call on August 07, 2024.

With the macroeconomic outlook still uncertain, the Fed yet to pivot, and the McClellan Volume Summation Index pointing to extreme fear sentiments in stock market, we may see the U stock further declining before finding a new bottom.

On the other hand, the consensus FQ2’24 (overall) revenue estimates appear to be relatively reasonable at $441.37M (-4.1% QoQ/ -17.2% YoY), allowing the U management to deliver a top/ bottom-line beat as it has in FQ1’24.

We must also highlight that despite the recent debacle, the company remains profitable on an adj EBITDA basis while reporting a stable balance sheet health.

Combined with the new management team and updated pricing models for the Unity 6, we believe that the U stock looks relatively cheap as it currently trades below our fair value estimates of $20.10, with it offering a speculative growth play.

The risk/ reward ratio is skewed to the attractive indeed, assuming a successful turnaround in market/ game developer sentiments as discussed above, which is why we are maintaining our speculative Buy rating.

Naturally, this Buy rating comes with the caveat that portfolios are sized appropriately according to individual investors’ risk appetite and portfolio allocation.

At the same time, it is uncertain when U’s reversal may occur, with the stock only suitable for those with long-term investing trajectory. Patience may be more prudent in the intermediate term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.