Summary:

- The company keeps losing customers, on an organic basis, for the second quarter in a row.

- The company is unlikely to meet its top-line targets due to the potential challenges the company will need to face in the near term.

- I maintain the SELL rating with the previously provided fair value of $20.15/share.

Author’s Estimates

4Q22 Results Overview

After the bell on Wednesday, Unity Software (NYSE:U) (“the company”) reported the Q4 2022 fiscal results. The market reacted with shares falling ~ 16% in response to such developments.

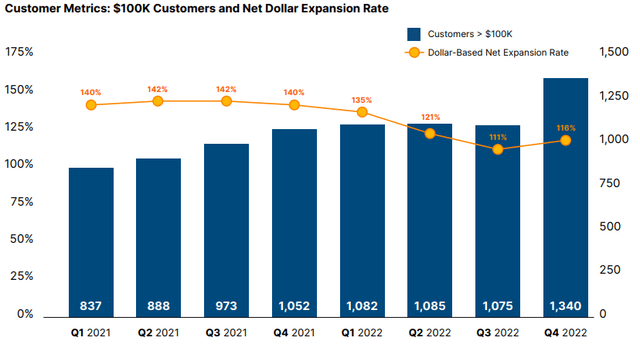

For Q4, revenues came in at $451M, up ~ 42.8% over the prior year (important to remember that now the company’s top-line incorporates the ironSource revenue). The consensus was $437.8M, hence, a beat on both the street estimates by ~ $13M as well as the company’s upper bound guidance of $445M. However, the top-line positive result also has a dark side: the number of customers contributing more than $100,000 of Revenue in the TTM. In the chart below, you can see the overall trend.

Unity Software Investors Letter

Now, let’s take a closer look at the 4Q22 number. We can find out that organically the company lost 18 customers ( ~ -1.8%), which should be labeled with a yellow flag in my opinion since it is the second consecutive quarter that the company keeps losing customers (in 3Q22 it lost 10 customers, or ~ -0.8% ).

On the other side, the bottom line resulted well below the market consensus, with the 4Q22 GAAP EPS of -$0.82 (4Q22 net margin is at ~ -64.2%), and a huge miss on street estimates of -$0.44 (and also worse than what I personally expected). Profitability is a very pain point, and the management seems to be aware of it. In fact, as stated during the 4Q22 earnings call:

We’re taking very clear actions to improve profitability. And this includes things like the elimination of close to 300 roles that we announced before being very selective in any future new hires …. And that frankly includes reducing the number of shares that we grant as part of compensation.

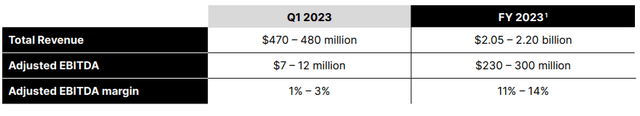

However, the negative sentiment came due to the well-below-consensus top-line guidance for 1Q23 and in-line for FY23 (and I should say also hard to reconcile, on a dollar basis, 1Q23 EBITDA guidance with FY23 EBITDA guidance).

Unity Software Investors Letter

In my opinion, I believe that the FY23 outlook is quite aggressive, and based on both micro and macro trends, I do not expect the company to meet it. I do believe so for two reasons:

First, the “Grow” segment (previously “Operate”) will be under pressure for the whole of FY23 and likely 1Q24, and after the ironSource acquisition, the company is even more exposed to the advertising market that is significantly under pressure due to both the business cycle we are in as well as high competition.

While we are not forecasting a recovery in the in-game ads market in 2023, we believe it is possible when the economy improves

Second, the top-line assumption is based on three drivers: pricing (the last significant increase in pricing was in 2Q22 when the company raised the price between 13% and 25% across Unity Pro, Unity Enterprise, and Unity Industrial Collection offerings), China, and digital twins. Among those, one of the key drivers used for the FY2023 top-line guidance is growth in China (that currently accounts for ~ 13.0%), that in my opinion may under-deliver especially due to worsening relationships between the U.S. and China, the China crackdown on the gaming industry, and due to the overall gaming market being in contraction.

Valuation Update & Final Remarks

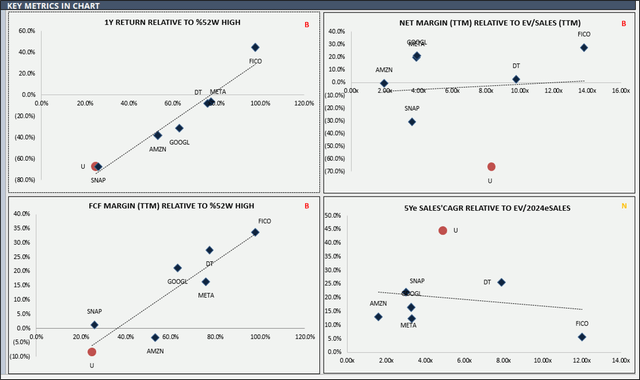

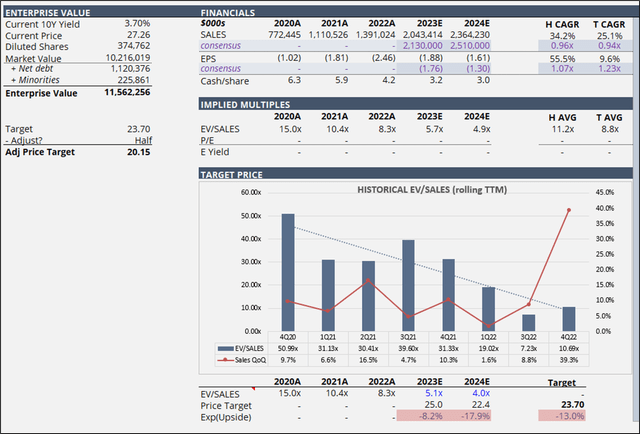

Currently, the company is trading at an EV/SALES of ~8.31x TTM, which represents a premium relative to the peer’s median EV/SALES of ~3.89x TTM. Following the 4Q22 results, the IronSource acquisition, and the FY23 outlook, I revisited my expectations for the year ahead.

Author’s Estimates Author’s Estimates

As you can see from the above chart, I raised the target from the previously provided fair value of $21.05/share to the new fair value of $23.7/share driven by an improvement in the fundamentals. However, I still don’t expect the company to be profitable on a GAAP basis.

Overall, I maintain the SELL rating with the new fair value of $20.15/share (the previously updated fair value adjusted for the business cycle factor), which would represent a 26.1% downside from the current price of $27.26. Having said that, for a risk-tolerant investor, the company may not be a good investment given the high realized volatility as well as the company’s operating performance, that on a GAAP basis is unprofitable.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.