Summary:

- The backlash on U’s previous pricing debacle has been reflected in its impacted Create Solutions revenue, with a notable slowdown in its new contract signings and renewals.

- The ongoing conflict in Israel has also affected a significant portion of its Grow Solutions, naturally triggering the miss in its top line in FQ3’23.

- U’s bottom line growth may accelerate ahead, thanks to the ongoing margin improvement, cost optimizations, and restructuring, contributing to the stock’s rally thus far.

- However, we believe that there is a minimal margin of safety at these levels, with it trading way above its fair value of $28.

- Combined with the elevated short interest, we prefer to downgrade the U stock as a Hold here despite our conviction surrounding its long-term prospects.

Neme Jimenez

We previously covered Unity Software Inc. (NYSE:U) in October 2023, discussing the massive backlash after the mismanaged Create subscription pricing update and the subsequent departure of its CEO.

This had triggered the stock’s drastic correction then, with us maintaining our speculative Buy rating attributed to the long-term tailwinds from the Apple (AAPL) Vision Pro partnership.

In this article, we shall discuss why we are downgrading the U stock as a Hold, thanks to the eyewatering +58.2% rally since the recent October 2023 bottom.

While we remain optimistic about its long-term prospects, we believe that there is a minimal margin of safety here, with the stock trading well above its fair value and pulling forward much of its long-term upside potential.

U’s Reversal Remains Highly Possible, Albeit With Minimal Margin Of Safety Here

For now, U has reported a bottom line beat in its FQ3’23 earnings call, with revenues of $544.21M (+2% QoQ/ +68.5% YoY) and adj EBITDA of $130.97M (+32.6% QoQ/ +520.18% YoY), exceeding the previous adj EBITDA guidance of $95M at the midpoint.

Part of the top-line miss is attributed to the impacted Grow Solution sales of $355.31M (+4.3% QoQ/ +165.7% YoY from the ironSource merger), with “a significant portion of its Grow Solutions operation in Israel adversely affected from the ongoing geopolitical instability and militarization.”

At the same time, U reported an impacted Create Solutions revenue of $188.9M (-2.1% QoQ/ inline YoY), attributed to the slowdown in new contract signings and renewals from the boycott after the changes in its new pricing model in September 12, 2023.

Despite so, we do not expect a drastic decline in its top-line in the near-term, since the company continues to report a decent remaining performance obligation of $566.1M (-9.2% QoQ/ -2.5% YoY) extending over the coming five years.

For now, U’s bottom line beat is mostly attributed to the company’s expanding gross margins of 72.2% (+1.4 points QoQ/ +6.9 YoY) and operational cost optimization on a QoQ basis to $520.26M (-4.3% QoQ/ +15.4% YoY), implying its increasingly improving scale of operations.

Godot’s Funding Growth

Godot

On the one hand, we believe that there is an upper limit to how much the U management may be able to optimize costs, since it remains to be seen if FQ4’23 may be able to bring forth normalized contract signings/ renewals.

If anything, the early signs prove to be somewhat worrying, attributed to the doubling in Godot’s (U’s direct competitor aside from Unreal) monthly Development Fund over the past three months, from €25.59K in September 12, 2023 to €54.66K by December 31, 2023.

Most importantly, readers must note the massive jump by over 1K in its monthly contributing members and the 7 additional sponsors at the same time, suggesting the accelerating support for Godot’s open-sourced gaming development platform.

One-Time Donation from Re-Logic

X

This is on top of the sizeable one-time $100K donation from Re-Logic, the game developer/ publisher of the game Terraria, in September 20, 2023 and a recurring monthly $1K sponsorship moving forward.

This is attributed to the supposed “loss of a formerly-leading and user-friendly game engine to the dark forces that negatively impact so much of the gaming industry.”

These developments imply that the burnt bridges may be extremely hard to mend indeed, despite the new U management’s best efforts.

On the other hand, while it remains to be seen if the departing game developers may be convinced about the updated royalty program, the new U management is highly committed to turn things around indeed.

This may be observed in the renewed efforts to re-establish competitive advantage/ re-engaging developers while optimizing operational costs (to be further discussed below), which may eventually contribute to its long-term top/ bottom line performance.

U’s game engine remains the market leader in the industry as well, with Godot’s offerings mostly suitable for 2D games whereas the former’s are geared towards both 2D and 3D games.

In addition, the former’s intuitive user interface and wide range of native support features/ asset stores have proven to be highly useful for video game developers and designers alike.

Therefore, while Godot may have received immense donations during U’s recent debacle, there is a reason why the latter’s game engine offerings remain highly sticky, especially aided by the long lead time of up to five years to develop a PC/ console game.

Lastly, readers must not forget U’s massive H2’24 tailwinds arising from AAPL’s Vision Pro platform and Disney’s (DIS) Metaverse dreams, with the gaming platform likely to be a major player in the growing global market size of up to $626.65B by 2030.

Therefore, for so long that the U team continues to deliver on its promises and rebuild confidence in the gaming industry, we believe that its reversal may gradually occur in the future, with the mismanagement issue a thing of the past.

U Is Inherently Expensive Here

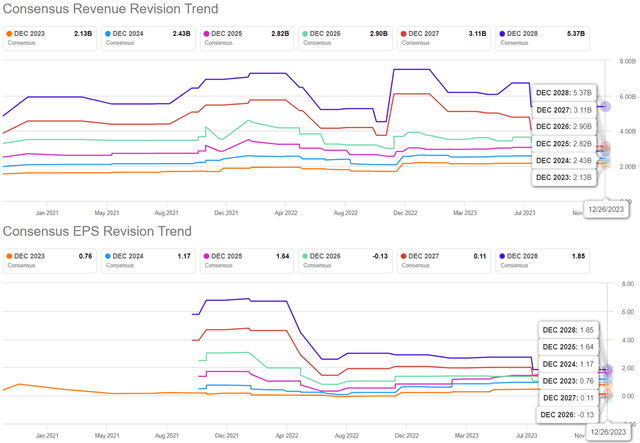

The Consensus Forward Estimates

Tikr Terminal

For now, the consensus has moderately lowered their top-line estimates, with U expected to generate a decelerating top line CAGR of +26.6% through FY2025, compared to the previous September 2023 estimates of +30.4% and historical top-line CAGR of +36.9% between FY2019 and FY2022.

However, while this may be well balanced by the management’s aggressive cost optimizations, with the company expected to sustain the previous projected EPS growth at a CAGR of +74.25% through FY2025, we believe that these numbers do not warrant the massive upward rerating in its FWD valuations.

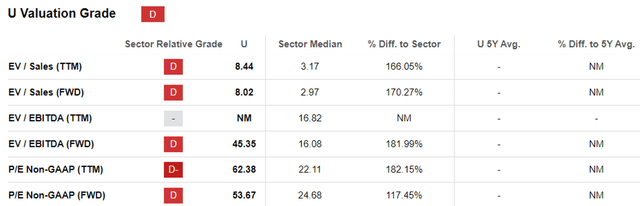

U Valuations

Seeking Alpha

For now, the U stock is trading at an eye-watering FWD EV/ Sales valuation of 8.02x and FWD EV/ EBITDA valuation of 45.35x, compared to the previous 5.19x/ 33.45x and sector median of 2.97x/ 16.08x, respectively.

While the management has committed to cost optimization efforts, it remains to be seen how much may actually flow into its bottom line, since the layoffs only affect 265 positions, or the equivalent 3.8% of its 7.7K strong workforce as of 2022.

While there is no detailed information surrounding U’s office footprints, we do not expect the closure of 14 locations to drastically reduce its operating leases as well.

For context, the company reports up to $45.72M in annualized leases expenses (+3% QoQ/ +45.7% YoY) and up to $149.88M in total operating lease liabilities by the latest quarter (-7.6% QoQ/ +43.2% YoY), with a weighted-average remaining lease term of 5.2 years.

With most of the costs/ accounting amendments likely to be incurred in FQ4’23 and FQ1’24, it may be better to observe its upcoming quarterly results before making any decisions.

So, Is U Stock A Buy, Sell, or Hold?

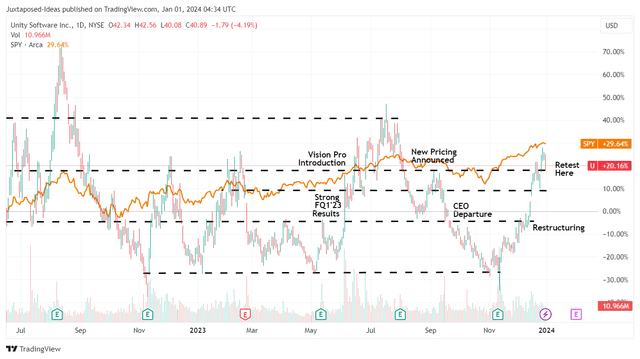

U 1Y Stock Price

Trading View

For now, the restructuring news has been overwhelmingly welcomed by Mr. Market, with U rapidly breaking out of the 50/ 100/ 200 day moving averages since the October 2023 bottom, further aided by the lifted market sentiments from the cooling inflation and the increased likelihood of a Fed pivot in Q1’24.

Unfortunately, we believe that the stock has pulled forward much of its upside potential here, with it trading above its fair value of $28, based on the LTM EV/ EBITDA mean of 33x and our previous FY2023 adj EBITDA per share projection of $0.84 (+400% YoY).

U has also stalled at the $40s over the past two weeks, with the stock seemingly forming a head and shoulder pattern after failing to break out of $42s, potentially signaling a moderate pullback to its previous support level of $37.

Lastly, the combination of a potential profit taking and the short interest of 10.99% imply that the stock may remain volatile for a little longer, worsened by the extreme greed index in the stock market.

While we remain bullish about its long-term prospects, we prefer to err on the side of caution and re-rate the U stock as a Hold here, due to the minimal margin of safety at current levels.

Do not chase this rally over the cliff.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.