Summary:

- Unity’s stock price could continue to be volatile in the short-term due to the macro environment and the ongoing integration of several large acquisitions.

- Unity has a large market opportunity and should generate reasonable margins in time, which is not currently reflected in the stock price.

- Buybacks and progress towards free cash flow and operating profitability should be supportive of the stock price.

mikkelwilliam

Unity (NYSE:U) has had a difficult 12 months due to headwinds in the mobile gaming market along with company specific issues. The acquisition of Weta’s tools, pipeline and engineering talent has also added significantly to Unity’s cost base without contributing to revenue. Companies with losses were severely punished in 2022, and Unity was no exception. Continued growth, progress towards profitability and a more modest valuation should lead to a far better 2023 for Unity’s stock.

Unity’s Create segment continues to shine, with Digital Twins and Artistry in particular performing well. Within the construction industry, Tilbury Douglas just launched Connect Configurator, a web-based application used to accelerate the design process in the construction industry. Connection Configurator allows more detailed designs earlier in projects, which improves decision-making and reduces delays and rework.

Another example is Orlando Economic Partnership’s 3D regional Digital Twins. Data is being combined from 80 different existing sources, over an 800 square mile region to create digital twins that provide companies with a better understanding of the region, infrastructure and demographics.

Unity’s collaboration tools are also driving growth within the Create segment, with the ARR of Create Anywhere businesses increasing by over 100% YoY. Unity also now has 25 Create Anywhere customers that are contributing over 100,000 USD ARR and SyncSketch is becoming a widely used collaboration tool for creators in the media and entertainment industry.

After Unity’s acquisition of ironSource, the Operate segment has now become Grow. Unity LevelPlay is one of the best mediation platforms, and Unity also now has a leading game publisher (Supersonic) and three ad networks (Unity Ads, ironSource and Tapjoy). LevelPlay offers creators access to a combined global network with more than three billion monthly active users. LevelPlay will have plug-in integration to the Unity Editor, and should provide better performance for the Unity Ads and ironSource ads networks. If the integration of ironSource goes smoothly, LevelPlay could be a meaningful tailwind for Unity going forward.

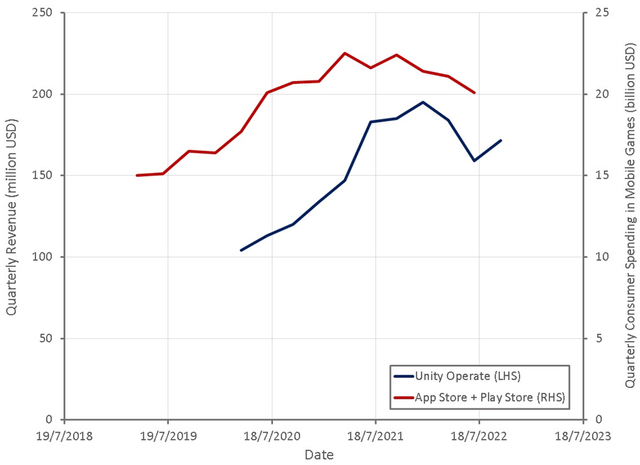

Performance challenges in the Operate segment are now in the rear-view mirror, with Operate returning to sequential growth in the third quarter. Despite this, headwinds remain in the ad industry due to economic concerns. Unity estimates that in-game ads growth was approximately 10% YoY in Q2, slowing to low single digits in Q3, and they project no growth YoY in Q4. Discussions with advertisers are indicating ongoing caution and a reluctance to drive CPMs higher. In addition to the weak ad market, player engagement is normalizing from the pandemic induced highs of 2020 and 2021. Despite this, Unity’s DAUs were up YoY in Q3. Unity’s net dollar expansion rate has declined to 111%, driven by problems in the operating business. This decline is unlikely to be permanent though, and expansion rates should be higher in 2023, in part due to easy comparable periods in 2022.

Figure 1: Consumer Mobile Game Spending (source: Created by author using data from Unity and Sensor Tower)

Unity recently announced price increases across Unity Pro, Unity Enterprise and Unity Industrial Collection offerings. Prices were raised between 13% and 25% across these solutions, Unity’s first significant price change in three years. Functionality was also added to these offerings to support the price increases. While price increases are not currently an important part of the Unity story, the game engine market is likely to remain a duopoly with cumulative R&D creating an insurmountable barrier to entry. As the market matures, price increases are likely to drive more revenue growth than currently expected, with users having little recourse due to lock-in.

Unity’s acquisition of ironSource was completed on November 7, 2022, and hence ironSource will begin contributing to Unity’s financials in the fourth quarter. Revenue is expected to be between 425 and 445 million USD in the fourth quarter, an increase of 35-41% YoY. Create is expected to perform strongly, while guidance for Operate is conservative as there had been no typical seasonal rise in CPMs at the time that third quarter results were presented.

It will be interesting to see whether Create’s rapid growth continues in 2023, given the weakness observed across much of the software industry. While Unity’s Create business likely faces different demand drivers to many software companies, digital transformation generally appears to be an area targeted by budget tightening.

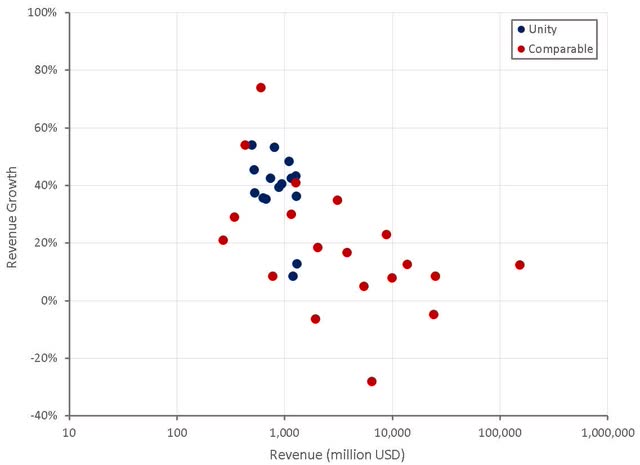

Figure 2: Unity Revenue Growth (source: Created by author using data from company reports)

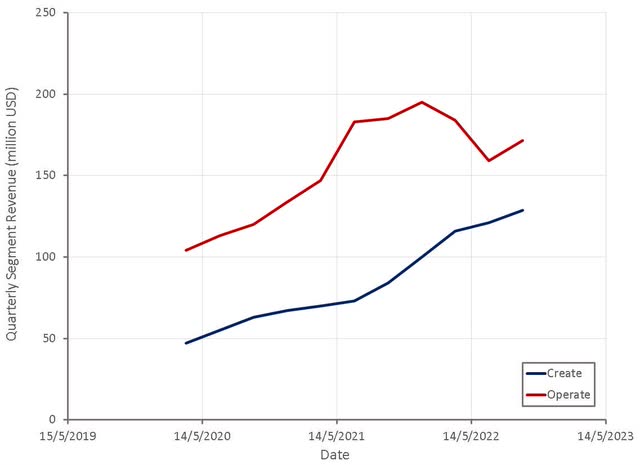

Figure 3: Unity Segment Revenue (source: Created by author using data from Unity)

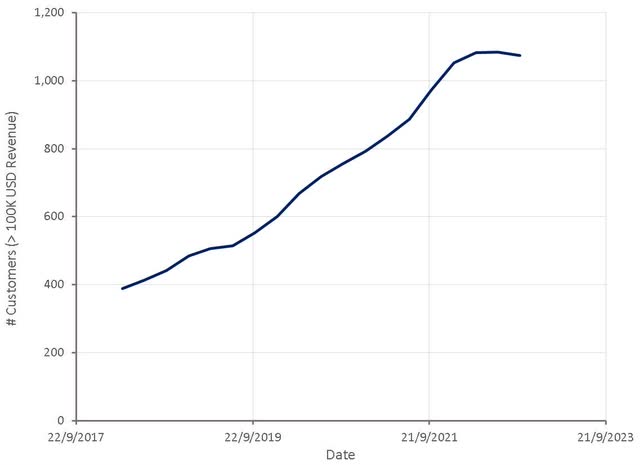

Growth of Unity’s large customer count has stalled in recent quarters and declined sequentially in the third quarter. This is somewhat concerning as extremely low churn amongst this group of customers is one of the most appealing parts of Unity’s business. It is likely that this flatlining is the result of a weak ad market and problems within the Operate business reducing spend, rather than outright customer losses though.

Figure 4: Unity Large Customer Count (source: Created by author using data from Unity)

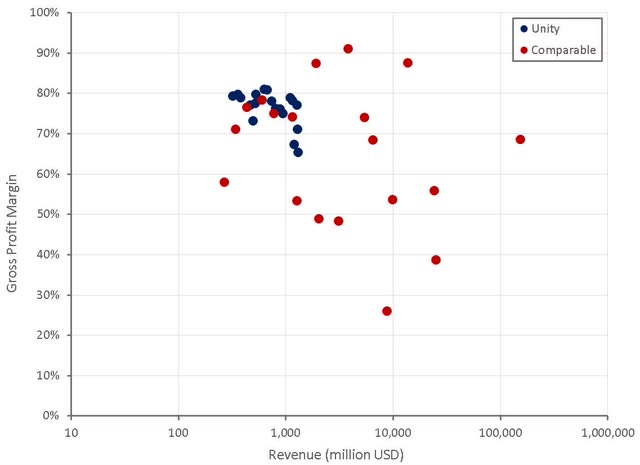

Unity’s gross profit margins have declined significantly over the past few quarters, which is mainly the result of a lower contribution from the high margin monetization business as well as the additional cost of Weta engineers. Growth in the Operate business and monetization of Weta’s tools should reverse this situation in time.

Unity’s financials are likely to change substantially going forward due to the impact of ironSource. ironSource has a relatively high margin business though, and hence the impact should be positive, particularly as synergies begin to be realized in 2023.

Figure 5: Unity Gross Profit Margins (source: Created by author using data from company reports)

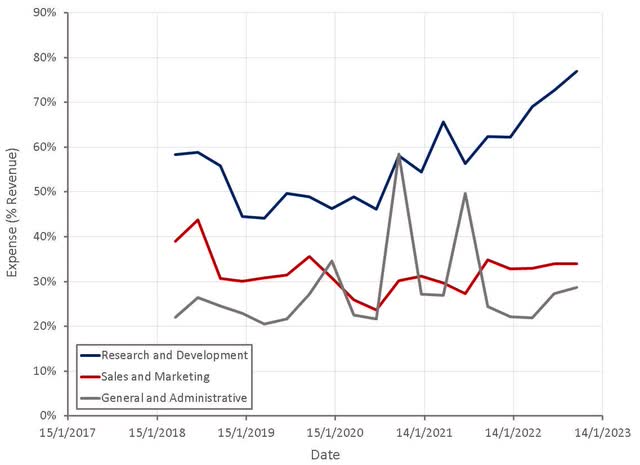

Unity’s operating expenses continue to be elevated, driven largely by R&D investments. Much of this is in the form of SBC though and hence Unity’s cash outflows remain modest. Unity expects to significantly over deliver against their 100 million USD cost savings plan, although the full benefit of this may not be apparent while pressure remains on the topline.

Figure 6: Unity Operating Expenses (source: Created by author using data from Unity)

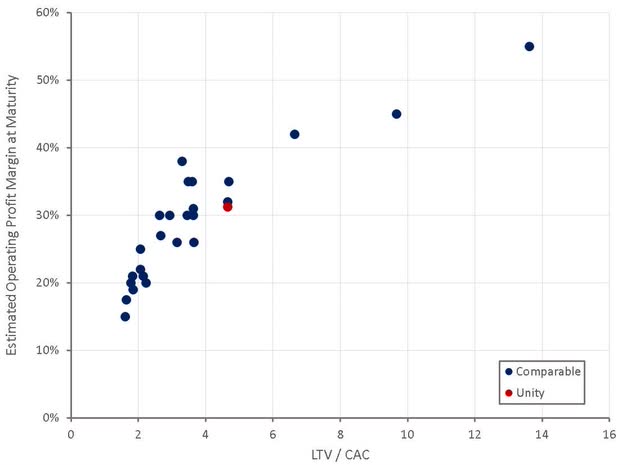

Unity’s current losses are clearly the result of investments in the future of their platform rather than due to problems with the business. Capitalizing a portion of R&D and sales and marketing expenses, to better reflect the nature of their business, indicates that Unity should have operating profit margins in the 20-30% range.

Based on an estimate of Unity’s LTV/CAC ratio, it would by reasonable to expect Unity to end up with operating profit margins around 30%. There is uncertainty with this calculation as Unity only gives a customer count and retention numbers for their large customers. It is reasonable to expect Unity’s margins to fall at the low-end of the range projected by this metric due to the importance of R&D to the business. This is an expense that will likely be perpetually elevated so that Unity’s engine remains competitive with the Unreal engine.

Figure 7: Unity LTV/CAC Ratio (source: Created by author using data from company reports)

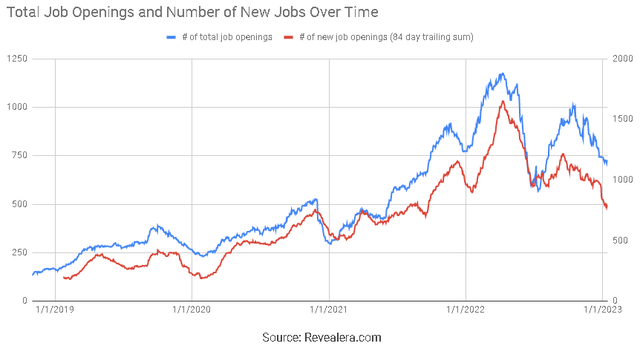

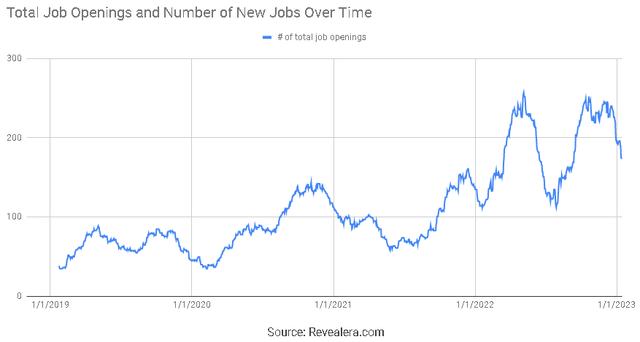

Job openings at Unity continue to fall, which is not surprising given known revenue headwinds and an increased focus on costs. This decline doesn’t appear to be a cause for concern as the number of job openings remain above pre-2021 levels. A steadier increase in headcount will be an important contributor to operating leverage going forward.

Figure 8: Unity Job Openings (source: Revealera.com)

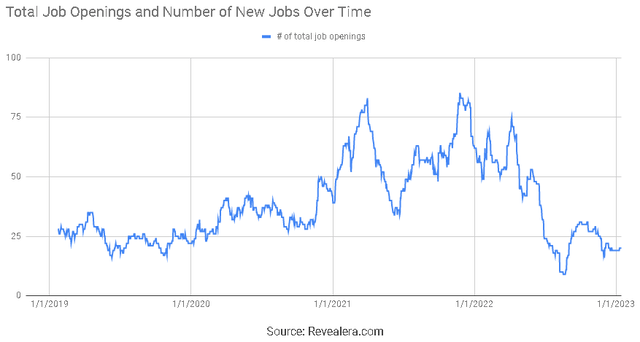

The decline in job openings was concentrated in sales in the first half of 2022, but now appears to largely be within engineering. While R&D that builds on the capabilities of Unity’s platform is positive, as it will lead to future revenue growth and strengthens the company’s competitive position, Unity must rein in these expenses at some point in time.

Figure 9: Unity Engineering Job Openings (source: Revealera.com)

Figure 10: Unity Sales Job Openings (source: Revealera.com)

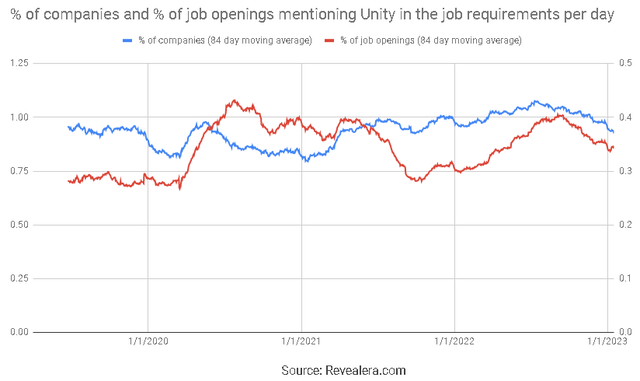

The number of job openings mentioning Unity in the job requirements has been fairly steady over the past 3-4 years. Given the ubiquity of Unity’s services at this point in time, it is probably not reasonable to expect this figure to change significantly.

Figure 11: Job Openings Mentioning Unity in the Job Requirements (source: Revealera.com)

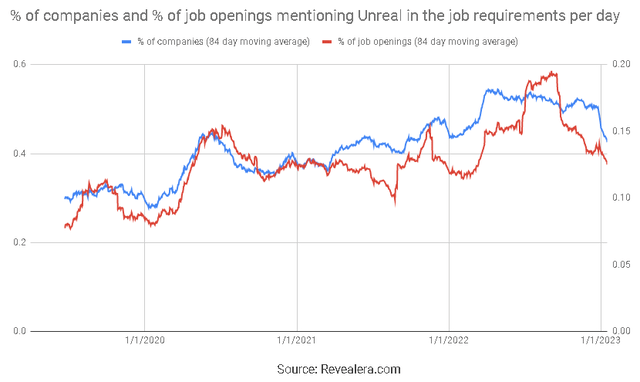

In comparison the number of job openings mentioning Unreal in the job requirements has trended upwards over the past 3-4 years, indicating growing adoption of the Unreal Engine, albeit off a lower base. The core markets for these two game engines has been different in the past, but Unity’s acquisition of Weta was clearly a strategy to reach parity with the Unreal engine in terms of capabilities.

Figure 12: Job Openings Mentioning Unreal in the Job Requirements (source: Revealera.com)

Based on a discounted cash flow analysis I estimate that Unity’s stock is worth approximately 95 USD per share. This type of price is unlikely to be realized in the near term though, due to continued revenue headwinds and ongoing R&D investments. At some point the demand environment will improve though and the cash generating potential of Unity’s business will be better appreciated, and when this occurs the share price should move significantly higher. In the meantime, Unity’s Board has approved a 2.5 billion USD share buyback program, which will be executed when management believes it is appropriate. This should help to support the share price and will create value for shareholders given the current undervaluation. The short-term may continue to be volatile, but with inflation dropping and growth about to become scarce again, Unity is likely to begin appealing to investors again over the next 12-18 months.

Figure 13: Unity EV/S Multiple (source: Seeking Alpha)

Disclosure: I/we have a beneficial long position in the shares of U either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.