Summary:

- Unity Software provides tools for 3D content creation used across gaming and non-gaming industries like automotive and healthcare.

- The company faces stiff competition from Epic Games in gaming and Autodesk in industrial sectors.

- Recent strategic missteps, including a controversial fee structure, have alienated key customers, particularly indie developers.

- Unity’s revenues are declining, and its workforce was cut by 25% earlier this year to address financial issues. Meanwhile, Unity’s stock is not yet “cheap” by most standards.

- I recommend selling Unity stock unless significant operational improvements or market expansions materialize.

Kathrin Ziegler/DigitalVision via Getty Images

Unity Software Inc. (NYSE:U) develops a platform for creating and monetizing real-time 3D content that is primarily utilized for gaming and various other industries. Some well-known games built using Unity’s platform include “Pokémon Go” and “Among Us.” The company makes money by selling software subscriptions for development tools (“Create Solutions”), in-app advertising services, and game monetization solutions (“Grow Solutions”). Unity primarily competes with Epic Games’ Unreal Engine and faces less direct competition from Amazon.com, Inc.’s (AMZN) Lumberyard, CryEngine, and Autodesk’s 3D software. According to Verified Market Research, the game development software market is expected to grow at a CAGR of 10% to reach $2.75 billion by 2031. Unity is also making efforts to expand their market outside of gaming. For instance, Unity teamed up with Audi to create virtual car prototypes. In healthcare, Unity collaborates with Rady Children’s Hospital to create real-time 3D content for medical training. These are examples of Unity applications in the “industry.” Within this market of non-gaming 3D applications, Unity competes with companies like Autodesk (architecture, engineering, and construction), Dassault Systèmes (automotive and aerospace), PTC (industrial design and augmented reality applications in manufacturing), and Siemens (product lifecycle management and 3D visualization). In all of these specific industrial applications, Unity’s competitors can be argued to be the market leaders. The most obvious example is Autodesk’s widespread use in architecture, engineering, and construction, with well-known tools such as AutoCAD and Revit. For context, AutoCAD was initially released in 1982. In the 2010s, Unity dabbled in industrial applications with film and automotive projects. It was not until April 2023 that Unity introduced “Unity Industry” to market its Unity Editor to industry customers.

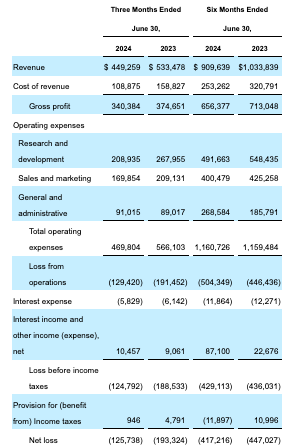

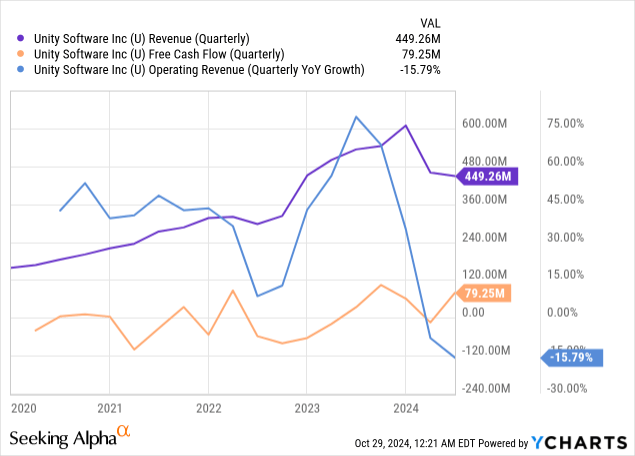

In Q2, Unity’s revenue dropped 16% YoY to $449 million (FCF margin of 17.72%). This drop was associated with an underperformance in Grow Solutions. Meanwhile, Unity’s Create Solutions continues to face stiff competition from Epic Games. Epic’s Unreal Engine is widely considered superior in graphics, making it popular among AAA games (in particular, on PC and console) that are graphically intensive projects and is making headway in the mobile space, which is Unity’s strength. The fact that Epic’s Unreal Engine brought Fortnite, a game that was first released for consoles and PCs, to mobile platforms despite its demanding graphics requirements, is an example of the company’s advancement in mobile gaming.

Unity’s revenues have also been impacted by leadership changes, restructuring expenses, and strategic setbacks. Unity announced in September 2023 a pay-per-download strategy that would impose a fixed fee on developers each time a game built with Unity’s software was installed. This was believed to disproportionately affect smaller or indie developers, as games that are downloaded many times may not procure sufficient revenues to cover Unity’s runtime fee. This was supposed to start in January 2024, but there was so much backlash from developer customers that the company issued an apology and made adjustments just a few weeks later. This likely pushed many of Unity’s key and loyal customers (smaller or indie developers) away. This has, undoubtedly, had an impact on revenues. Earlier this year, Unity announced its intention to cut a whopping 25% of its staff and made executive changes (including the departure of CFO Visoso). Its staff reduction was, supposedly, intended to reduce “the number of things we are doing in order to focus on our core business and drive our long-term success and profitability.” If I learned anything in business school, it’s that you don’t cut a large portion of your staff to “drive long-term success.” In my opinion, this is the move a declining business makes to cut costs and improve short-term profitability.

Unity’s strategic focus in Q2 was on the upcoming release of Unity 6 (“faster rendering and lighting capabilities, end-to-end workflows for building, testing, and running multiplayer games, extended AI capabilities, and deeper support for growing platforms like mobile web and spatial computing”), as well as its mobile advertising efforts. However, Unity faces stiff competition from several major players in the market, including AppLovin, Google AdMob, and Facebook Audience Network.

Unity reports Q3 earnings on 11/6 (post-market). The revenue estimate is $427.58 million, and the EPS GAAP estimate is -$0.39. In Q2, Unity lowered its full-year revenue guidance from “$1,760 to $1,800 million” to “$1,680 to $1,690 million” for their “strategic portfolio” due primarily to “a more cautious approach to the recovery in our Grow Solutions business, where investments in fundamental product enhancements will take some time to manifest in sustainable increased performance.”

Valuation Assumption Analysis Model: Forecasting Growth and Return Expectations

I believe markets are generally efficient, making it crucial to understand the assumptions driving a stock’s valuation. By identifying these assumptions, we can assess whether they are realistic and evaluate how key factors can affect future returns.

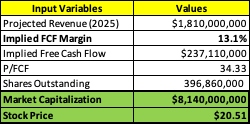

Based on the current metrics and estimates, the market appears to be assuming the following for 2025:

Author

The FCF margin of 13.1% is implied by U’s current P/FCF, market capitalization, and consensus revenue estimate for 2025.

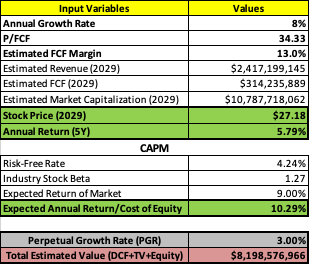

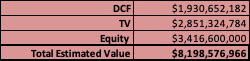

The data below represent what, I believe, are the market’s implicit expectations for revenue growth and FCF margins based on U’s current valuation.

Author

Author

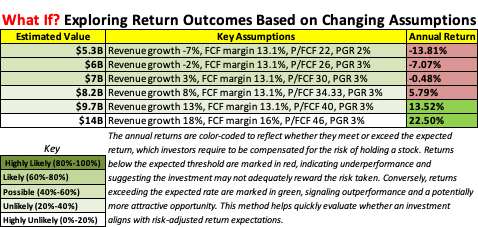

I believe these implicit expectations are overly optimistic for the reasons stated above, as well as Unity’s rapidly declining revenues in fiercely competitive markets where they appear to lack an edge.

Here is how the estimated values and returns appear based on changes to key metrics like growth rate.

Author

Financial Health

As of June 30, Unity reported having $1.267 billion in cash and cash equivalents. Total current assets were $1.984 billion, while total current liabilities were $841.542 million. This indicates a current ratio of just over 2.0, which implies Unity can reasonably cover any short-term obligations. Unity does owe $2.237 billion in convertible notes.

Unity reports net losses on a consistent basis.

Seeking Alpha

Here’s a look at some key trends during the past few years:

U Stock: Unrealistic Expectations and Structural Issues Weigh on Unity’s Future

Unity is experiencing a rapid decline in revenues, and their response has been to cut a quarter of its workforce. Within the game software development market, Unity faces intense competition from Epic. Due to strategic mishaps, Unity has pushed away its own key customers (e.g., smaller developers). Outside of gaming, Unity’s foray into industrials and mobile advertising is not likely to become strengths, especially in the context of a competitive landscape with established and much larger companies. Despite its stock declining 50% YTD, Unity is not yet cheap according to underlying metrics like EV/EBITDA (25.54 versus sector median of 14.9). In fact, judging from my DCF analysis, Unity’s current valuation implies 8% annual revenue growth, which appears optimistic. Subsequently, if Unity does not turn things around, and fast, I think its stock could be subject to much more downside. In conclusion, Unity’s valuation, in my view, has not yet represented these realities. As such, Unity is a “sell.”

Risks to my “sell” recommendation include the possibility that Unity will turn things around. Last year, the company experienced 57% YoY revenue growth. In fact, this type of growth has been occurring since 2019. As I explain in my “What If?” simulation, in the (unlikely) scenario in which Unity achieves 18% sustained annual revenue growth, annual stock returns for investors could easily exceed 20%. Importantly, I may be underestimating Unity’s revenue potential outside of gaming. Industrial and advertising applications are multibillion-dollar markets, and if Unity can find a niche, it could result in significant revenue growth. Finally, I may be underestimating Unity’s efforts to improve operational efficiencies, which could increase their FCF margin and boost their estimated value.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content and should not be viewed as an exhaustive analysis of the featured company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions presented are based on the author's analysis and reflect a probabilistic approach, not absolute certainty. Efforts have been made to ensure the information's accuracy, but inadvertent errors may occur. Readers are advised to independently verify the information and conduct their own research. Investing in stocks involves inherent volatility, risk, and speculative elements. Before making any investment decisions, it is crucial for readers to conduct thorough research and assess their financial circumstances. The author is not liable for any financial losses incurred as a result of using or relying on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.