Summary:

- Unity Software Inc. guided to weak numbers in 2024 after a period of strong growth.

- The company is undergoing a reset and still has an interim CEO, making investment views difficult, though the current retest of the $25 bottom might appeal to traders.

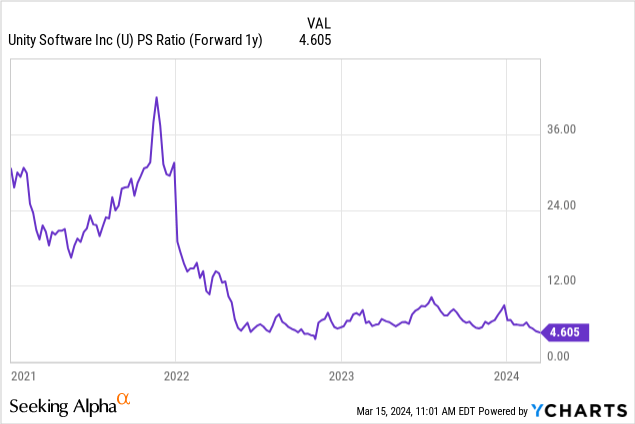

- The stock trades at 5x forward sales, not exactly cheap for a company with no growth during a reset.

atakan

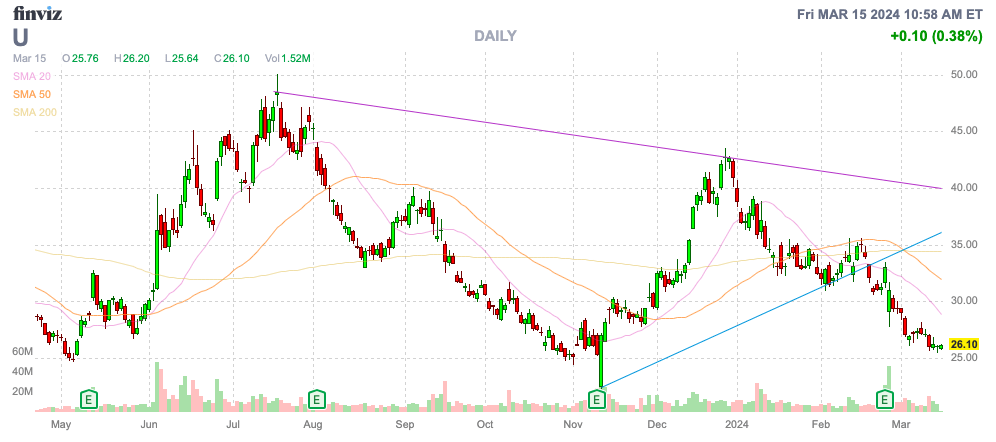

After years of strong growth, Unity Software Inc. (NYSE:U) guided to weak numbers in 2024. The game creation platform is resetting the business this year and still has an interim CEO in place, making a bullish investment view difficult. My investment thesis is more Neutral on the stock, though investors can look at starting initial positions at the current double bottom prices.

Source: Finviz

Big Reset

Unity Software was a $200 stock back in 2021, when gaming demand soared during Covid shutdowns. The company continued to boost revenues through 2023 in part due to the acquisition of IronSource, though the stock plunged in the process and now barely trades above $25.

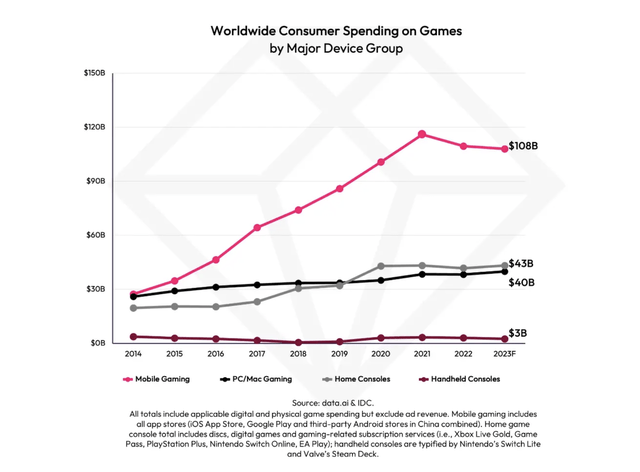

The software company claims to be the gaming engine of 69% of the top mobile games. The gaming market remains a major growth driver, but the market has faced a tough period in 2023 after the big jump during Covid to the peak in 2021.

Going back to at least early October, Unity Software has been a dumpster fire. CEO John Riccitiello announced his retirement, effective immediately, while the company maintained guidance for Q3’23 without confirming full-year guidance.

The company ended up missing Q3 targets by $5 million, though revenue grew nearly 69% to $544 million due to IronSource revenues. Interim CEO James Whitehurst, former RedHat CEO, hinted at the opportunity ahead and the potential restructuring needed to fix the business:

We have a significant opportunity to accelerate revenue growth, improve profitability metrics and increase free cash flow generation going forward,” Whitehurst said in a statement. “However, we are currently doing too much, we are not achieving the synergies that exist across our portfolio, and we are not executing to our full potential. We aim to address these opportunities to emerge as a leaner, more agile and faster growing company. We will share specifics as plans are finalized over the next few months.

Ultimately, Unity Software reported headline Q4’23 numbers that appeared positive until digging into the quarterly details. Excluding the Weta FX transaction, revenue would have been $510 million, down -2% YoY on a pro-forma basis.

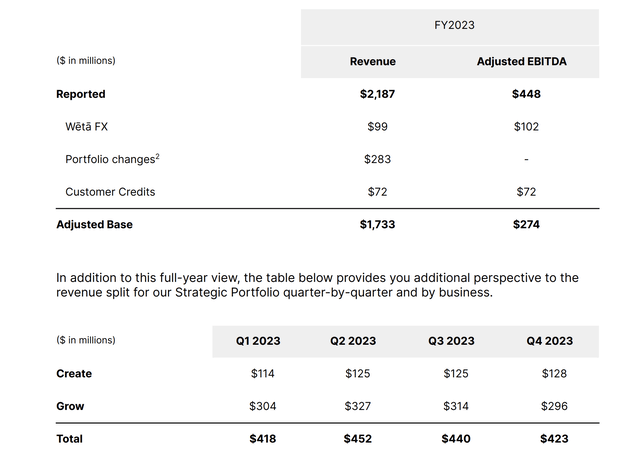

As part of the reset, the Professional Services business will be limited to a few selected strategic engagements. These businesses delivered $283 million in revenue in 2023 and operated at a significant adjusted EBITDA loss.

Unity Software provided these pro-forma numbers for the reset business. The company would’ve reported 2023 revenues of only $1.73 billion with adjusted EBITDA of $274 million ending the year with quarterly revenue of $423 million in Q4’23.

Source: Unity Software Q4’23 shareholder letter

The guidance for Q1 ’24 revenues isn’t helpful to a bullish thesis. Management forecast sales of only $415 to $420 million suggesting revenues of the core business are in decline and peaked last Q2 ’23 at $452 million.

Typically, a company that resets the business makes a move to focus on a segment growing at a substantial clip while removing a lagging business. Unity Software projects returning to growth, but the company still has Jim Whitehurst as the interim CEO.

Unity Software did guided to 2024 revenues of $1.76 to $1.80 billion suggesting a limited return to growth as the year progresses. The company is focused on a more select portfolio, but not necessarily one with prime growth rates.

The company officially slashed 25% of the workforce in January with the eliminated of 1,800 employee roles. The cost cuts are estimated to save $250 million in annual operating expenses leading to the guidance for adjusted EBITDA to jump from the $400+ million range from the $274 million for the strategic portfolio in 2023, though this measurement is down from the $448 million produced in 2023.

Unity Software hopes to reignite growth via new product offerings, including generative AI solutions. The hope is by eliminating some distracting business initiatives, the company can focus on the core products and improve development.

Reasonable Value

While Unity Software has collapsed nearly 90% from the all-time highs to only $26 now, the stock isn’t exactly cheap. Unity still trades at nearly 5x forward revenue estimates.

The big unknown is what type of growth the company can generate during the reset period and whether a new CEO will disrupt the restructuring process. Not to mention, the massive 25% employee reduction can be very disruptive to the business progress in returning to growth.

The stock trades right around strong support around $25, so aggressive investors bullish on the reset can start building a portion here. The risk still exists the company struggles to reignite growth and a new CEO could disrupt any progress with plans differing from those implemented by the interim CEO.

Takeaway

The key investor takeaway is that Unity Software Inc. stock trades at a reasonable valuation for a stock with 10%+ growth, but the company is in the middle of a messy reset. Unity Software doesn’t even have a new CEO yet, making aggressive investing risky at this point.

Investors should watch the stock from the sidelines for now, though a trader might find the re-test of the $25 lows as an interesting entry point ahead of any turnaround.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.