Summary:

- Unity Software is the leading 2D-3D video game software development company.

- The stock has been severely punished since its highs (-85%) due to various endogenous and exogenous factors.

- In my view, all these elements are short-term noise and Unity will manage to go through all these challenges.

- Unity’s sector secular growth trends opportunities, focus on outside gaming industries and advertising segment will be key in the near future.

gorodenkoff/iStock via Getty Images

Investment Thesis

Unity Software (NYSE:U) has been severely punished in 2022, a year characterized by a tough macroeconomic context. In my view, the company’s quality and potential are strongly misunderstood by the market. Currently, the short-term noise linked to the Fed Hawkishnesh, the recent fusion with IronSource (which raises concerns) , and data-related issues linked to Apple’s (AAPL) change in its Identifier for Advertisers policy (IDFA) are unclipping all the major assets and potential this company has. I expect the firm, supported by strong tailwinds inside and outside the video game industry, to capitalize on its leading position and product to win market shares while going through all the challenges it is currently facing. I initiate coverage on U with a Buy rating and a target price of $35.

Company Presentation

Founded in 2004, Unity Software is a leading video game software development company based in San Francisco. According to Gamedesign, the firm is one of the major players in the licensed game engine industry. Through its platform, Unity Software solutions provide graphic tools to create, run, and monetize real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. Unity has a strong reputation. Referring to Unity’s 2021 Gaming Report, 94 of the Top 100 development studios (ranked made by looking at global revenues) are Unity customers. Its original goal is to make video game development faster and more accessible. Aside from that, Unity’s platform currently employs a set of diversified use cases that go beyond gaming. The company is trying to position itself as a comprehensive AR/VR platform to build any sort of virtual reality and benefit from a large diversity of clients ranging from small developers to major institutions.

Famous games developed with Unity engine (Unity Software) Major Clients Outside Video-Games Industry (Bloomberg)

Unity’s Business Model

Unity’s business model is divided into 3 segments:

Create solutions: through this segment, Unity customers can create and develop video games with Unity Engine. It is based on a subscription model. In a logic of market penetration, users can use it for free in the case they are generating less than $100k with it. Otherwise, they’ll have an annual 5% commission to pay. This segment represents 40% of Unity’s revenues.

Operate solutions: through this segment, Unity provides additional add-ons and plug-ins for example to allow the creation of an in-game vocal chat, additional graphic tools, and kits… It is important to note that the operating solutions products provided by Unity can be combined with some other solutions of other competitors thus allowing synergies and giving more flexibility to the customer.

Unity ads: gives the tools and analytics whether developers want to start creating in-app ads, IAPs (in-app purchases), or market their app to a potential audience. This segment relies on a Win-Win model. Indeed, the more a game is popular the more external advertisement shared on this game and about the game will generate revenues for both the developer and Unity.

These two last segments generate 60% of Unity’s revenues and are also based on a subscription model.

Price Performance

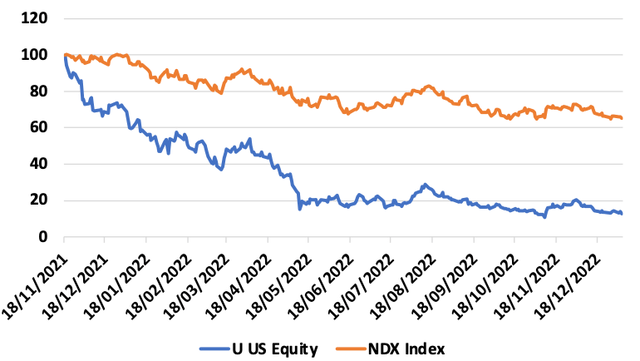

Unity Software’s price performance has been impressive since its IPO. Indeed, from 09/17/2020 to 11/18/2021, the stock rallied from $50 to $201 generating a 286% return vs 50% for the Nasdaq 100 (NDX) creating at that period a 236% alpha. However, since then the stock is down -85% vs -33% for the NDX.

Four major reasons explain in my view this disastrous price performance since all time high:

- The firm is not yet profitable and has benefited from both the dovish Fed policy with low-interest rates/huge Quantitative Easing during the Covid period and the Metaverse hype driven by Facebook (META) rebranding into Meta. As the hype faded and the Fed turned hawkish, both factors put continuous pressure on valuation.

- Recessions fears leading investors to doubt due to the cyclicality of Tech. stocks.3.

- What I call the “Apple slap” which strongly impacted Q1 2022 as the stocks dropped 37%.4.

- IronSource M&A sentiment that is mitigated

Let’s discuss these last two elements to have an understanding of the overall context surrounding Unity.

The “Apple Slap”

Last May 2022, Unity’s shares lost more than a third of their value when executives announced quarterly and annual revenue lower than Wall Street expectations. This was mainly due to a hard hit taken by the firm from Apple’s IDFA changes which already had a huge impact on firms like Facebook (FB) or Snapchat (SNAP) previously. In Unity’s case, it appeared that the firm’s solutions used to advertise creator content and identify customer tastes were not working anymore. Thus, customers were spending less because of inaccuracies making it impossible for them to track user behavior. Then, Unity tried to use ad models that didn’t rely on data from Apple. Instead, they are now using data from an end user’s engagement and platform performance data. However, when this change came out, customers realized that this tool was not on point and thus many were very disappointed. This fact impacted Unity’s overall revenue growth which stands at 24% for the Year 2022 vs 44% for the previous year and an average growth of 43% for the last 3 years with growth standing above 40% all the years.

IronSource Buyout: A Surprising And Unexpected Reaction

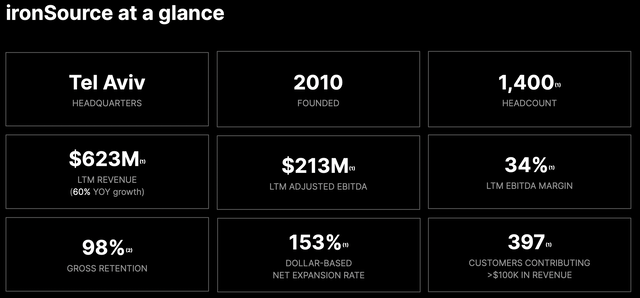

After this disappointment, last summer, Unity announced the takeover of IronSource (IS), a software company that focuses on developing technologies for app monetization and distribution, with its core products focused on the app economy.

According to BusinessWire:

This deal was made in an all-stock $4.4 billion merger representing a 74% premium to the 30-day average exchange ratio.

Note that IronSource is famous for its Supersonic products: a top-tier game publishing service that has seen significant growth momentum in the past two years.

According to Barrons:

The two groups announced that they have reached a definitive agreement under which IronSource will become a wholly-owned subsidiary of Unity in a deal that will see each share of IronSource exchanged for 0.1089 shares of its new parent. Unity stockholders will own almost 74% of the combined company following the merger.

After Unity’s offer, an IronSource’s major competitor, AppLovin (APP), also made an offer to acquire Unity for the amount of $17.5 billion, representing at that time a 17% premium. This offer has been declined by Unity several days after. In a CNBC interview, management answered that this acquisition “would not be in the best interest of Unity Shareholders.”

I tend to agree with them.

Referring to Hc Games, if the acquisition of Unity took place, Unity would have owned “55% of the combined company’s outstanding shares, representing about 49% of the voting rights”. In other terms, it means that Applovin would almost be selling itself to Unity, and not the opposite. This method is meaningful to me and characteristic of a competitor trying to react as quickly as possible to a “red alert”.

Going back to the Unity merger with IS, it has been particularly not appreciated by shareholders based on the performance since this announcement. Such a deal implies dilution, potential overpaying for a company that is targeting the very competitive advertising market… However, when focusing on such a Company and such an Industry, we have to look at the larger picture.

Let’s now dive into Unity catalysts.

Global Catalysts

In my view, it is now becoming quite clear that the emergence of augmented and virtual reality (AR and VR) will remain a secular trend for gaming and other companies looking to incorporate 3D experiences into their platforms and process, which bodes well for Unity’s core gaming-engine business in the medium to long term.

Tailwinds Inside and Outside Gaming

In this market, the size and growth potential are huge.

Indeed, the size of the AR/VR market has been growing rapidly in recent years and I expect it to continue growing in the coming years. According to Yahoo Finance, this market was valued at around $18.8 billion in 2020 and is expected to grow at a CAGR of around 48.3.% during the forecast period (2021-2030).

Gaming is a major contributor to the AR/VR market and accounts for a significant portion of revenues. According to a report made by Mordor Intelligence, gaming accounted for more than half of the AR/VR market revenue in 2020, with a market share of around 55%. The report also estimates that the gaming segment will continue to dominate the market in the upcoming years, with an expected market share of around 48% in 2030. As the global video games market is expected to be a $600 billion market in 2030, it means that AR/VR will represent 1/6 of the industry. To put things in perspective, it would represent ½ of the size of the current global video games market which reached a size of $200 billion in 2022.

Outside of gaming virtual reality and augmented reality use are expected to represent 52% of this $215 billion market. Here again, Unity is set to become a key player.

Tailwinds and opportunities in this segment are massive with a wide and diversified range of applications outside of video games. Here are a few examples of AR/VR use cases:

Education: Can be used to create immersive learning experiences and can be particularly effective in fields such as science, technology, engineering, and mathematics.

Healthcare: Can be used to train medical professionals, assist with surgeries, and provide therapy to patients.

Retail: Can be used to enhance the shopping experience by allowing customers to virtually try on clothes or see how furniture would look in their home.

Military: Can be used to train military personnel for a variety of scenarios, including combat, disaster response, and peacekeeping operations.

Architecture and construction: Can be used to visualize and design buildings and other structures, and to assist with construction and maintenance.

Entertainment: In addition to video games, VR and AR can be used to create immersive experiences such as concerts, movies, and theme park attractions.

Industrial training: Can be used to train employees in industries such as manufacturing, oil and gas, and aviation, without the need for expensive and potentially dangerous physical training.

These are just a few examples, and the potential applications of VR and AR are constantly expanding as technology continues to evolve.

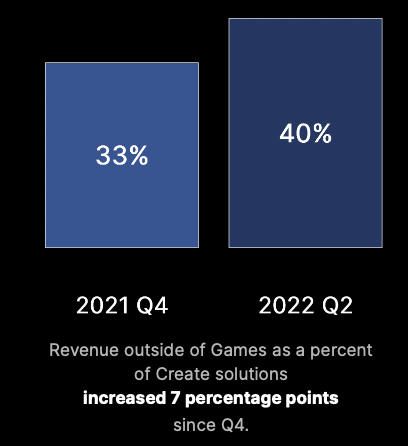

The shift from a pure gaming company to a more diversified firm is key as it will make Unity even more resilient and grow at a very strong pace. The acceleration of Unity businesses outside of games is clear. This segment represented 40% of creating solutions in Q4 2021 vs 33% in Q2 2022.

At the end of 2023, I expect revenues outside of gaming to represent 50% of create solutions in 2023. This makes sense to me as Management aims to balance its two create solution segments. This growth is clear and is being pushed by the rock-solid reputation Unity is building with major institutions partnerships such as the last one with U.S. army in August 2022.

Outside Gaming Growth is Strong (Unity Software)

The IronSource Synergy is Under-Appreciated

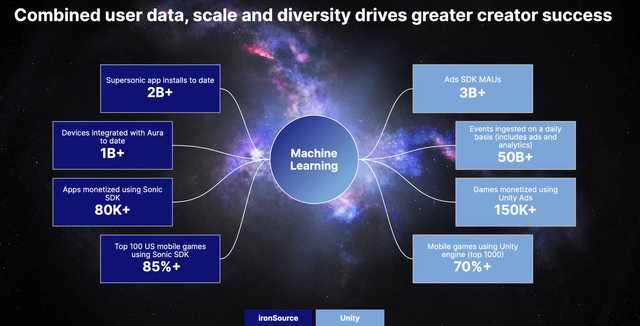

Monetization and advertising are critical to creator success. Performance-based ads in particular are central to the gaming ecosystem and I believe they will continue to grow.

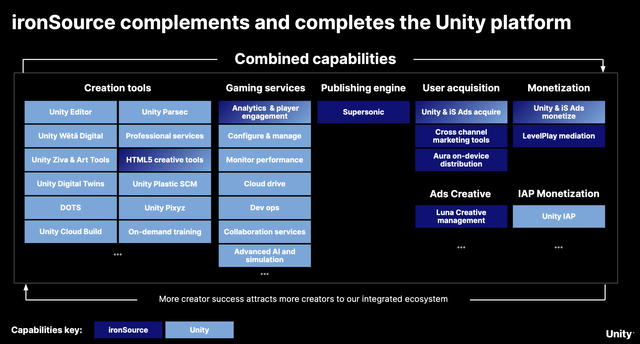

This merger leads to the creation of the first platform providing developers with a strong end-to-end solution that allows creators to develop, publish, run, monetize and grow live games and real-time 3D content seamlessly. IronSource Supersonic product combined with Unity’s substantial market share in the mobile game engine will benefit Supersonic’s reach (more genres) and quality of services (helping developers achieve better commercial success). I expect the combined entity to take incremental share from its competitors such as Voodoo and AppLovin, in a very fragmented and competitive market.

This deal is also very appealing as it will allow cost synergies and a strong network effect that will benefit both actors. For example, this deal will also allow Unity to capitalize on IronSource’s network which was composed of popular names such as King, Zynga, Orange, Calm, Weatherbug, and Freeplay… and thus offer to its old, but also its new customers a complete set of services.

According to Unity’s forecast, IronSource is expected to generate $250M. in Ebitda next year, facilitating Unity’s path to profitability and for good reason, I expect Unity to be profitable and FCF positive as soon as next year.

As shown by the major problem Unity encountered with Apple, ads are a data-driven scale business and IronSource was the perfect target to help Unity to scale. This segment is highly profitable and fast-growing. I believe the IS-U merger will provide a better fit with a more balanced division between ad tech and content creation tools in the combined entity. Together Unity and IronSource will provide more scale to empower creators.

Furthermore, In the wake of Apple’s IDFA changes, I expect advertisers to look for new alternatives aside from Meta and Google and allocate ad budgets to more publishers which is a very positive catalyst after the IS-U merger.

Below you can have a look at what the IS merger would bring to Unity’s whether in operational or financial terms:

Unity Software Unity Software Unity Software

Should the operate solutions still be impacted, I expect the create solution to play the role of a shock absorber, especially in an inflationist environment where this segment role is key. Usually, AAA games and video games in general, are developed using an in-house engine. However, nowadays, more and more video game developers are turning to the ready-made engine instead, to optimize their costs. I expect this trend to strongly benefit Unity whether in the short, medium, and long term.

Financials and Valuation

Let’s have a look at Unity financial position. I choose several peers to compute this valuation. However, there are very few actors that are operating both inside and outside the video game industry.

Unreal Engine, Unity biggest competitor does so but it is currently not listed.

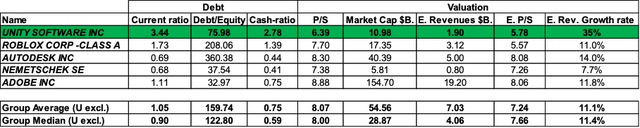

In this sense, I choose Roblox (RBLX) from the video game industry, Autodesk (ADSK), Nemetschek (OTC:NEMTF), and Adobe (ADBE) which are specialized in 3D design for various industries outside video games.

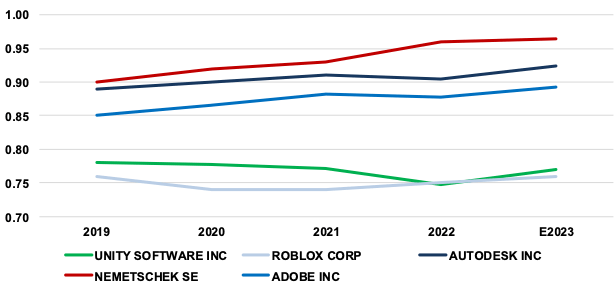

Peers Margins Evolution (Bloomberg)

Having a look at margins, Unity and its peers are characterized by very strong margins that are all above 70%. However, Unity seems to be at the bottom of this list with margins stable at 77% while its peers’ average for the period stands at 85%.

Is it worrying?

In my view not at all. It is explainable by the fact that Unity operates in the video game sector where margins are high but still lower than what you can find outside video games. Thus, I expect Unity margins to improve in the near future as management promotes out-side video game products and advertising.

Created by author using data from Bloomberg

In the current tough macroeconomic environment, we have to look at financially rock-solid companies. On the debt level that is the case for Unity. The firm’s Current ratio stands at 3.44 (1st position in the ranking) vs a group average of only 1.05. The higher the current ratio is, the more a firm is capable to pay off its debt. Looking at debt to Equity, this ratio is pretty high for all the peers even for Adobe even if it is the lowest of the list at 33%. Here Unity’s Debt / Equity ratio stands at 75% (3rd position in the ranking) while the Group Median stands at 122.80.% In our case, it is a good ratio for Unity as it means that the firm has $0.75 of debt for every $1 of Equity which is reasonable for a Software/Tech company. Unity’s cash ratio stands at 2.78 (1st position in the ranking) meaning that Unity is the best positioned compared to its peers to face its short-term liabilities.

To compute my Valuation, I use the P/S ratio as Unity is not yet profitable. Currently, the firm trades at a 26% discount compared to its peers which are unjustified in my view given growth prospects. When looking at next year’s revenues, I expect a 35% growth rate vs 11.1 % for the industry average. I justify such growth rate by the youth and the dynamism of Unity which is targeting segments that are growing at faster rates than its peers. With such a growth rate, I also expect the data-oriented problem that Unity faced last year to be almost over thanks to the IS acquisition. Such a growth rate leads us to a $1.90 billion revenue implying with the current market cap a 5.78 P/S vs a 7.24 P/S for its competitors.

Such valuation implies a 32% discount for Unity. I expect the firm to close this Valuation Gap in 2023. For This reason, I initiate a buy rating with a Target Price of $35.64.

Note that it is my most conservative target price based only on a fundamental value analysis. Should the Fed Pivot next year, Unity’s return might be way more impressive.

Risks

As we are used to say, “high risk, high reward”. Unity doesn’t escape the rule. Being a tech stock is hard in those times. Should the Fed be Hawkish for a longer period than anticipated, this would keep the valuation under pressure. The Forex risk is also important to consider, as 70% of Unity revenues come outside the U.S. Finally, we should consider synergies inefficiency with IronSource and the risk of failure to penetrate the competitive and fragmented advertising market.

Conclusion

To conclude, I believe that Unity Software stock has been unfairly punished in 2022 giving us an opportunity on the short, medium, and long-term horizon. Initially operating in the video game segment, the firm is capitalizing on its leading position to acquire new firms (cf. IronSource) to extend and perfect its offer. Expected to become profitable as soon as next year, to grow at a double-digit rate for the upcoming 5 years, and to have a healthy balance sheet, I find the actual discount unjustified. Supported by secular tailwinds, I believe that the management will reach its objectives in terms of revenue segmentation across industries and synergies through M&A allowing the firm to become more resilient, diversified, and thus even more attractive. I expect a 32% upside for 2023 and initiate on Unity with a Buy rating with a target price of $35 being my most conservative target if the Fed remains Hawkish.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.