Summary:

- Unity’s financial performance remains weak, but the macro environment appears to be stabilizing, and a return to growth is expected later in the year.

- In the short-term, the company needs to monetize the Weta acquisition and realize synergies from the ironSource acquisition.

- Longer-term, Unity’s opportunity is growing, but AI is making outcomes more uncertain. So far, the company appears to be positioning itself for success.

BurKar/iStock via Getty Images

Underneath the surface of the ironSource acquisition, Unity’s (NYSE:U) financial performance continues to be poor. While the macro environment remains weak, it appears to have stabilized, which could help Unity to return to growth later in the year. A large amount of work still needs to be done to monetize the Weta acquisition, realize synergies from the ironSource acquisition and capitalize on the generative AI opportunity. While the near-term is likely to remain turbulent, Unity’s long-term opportunity is growing rapidly, even if AI is making outcomes more uncertain.

Market

Unity’s management team has stated that engagement in gaming is strong and that the ads market has remained stable relative to the second half of 2022. In terms of engagement, post-COVID headwinds appear to have largely dissipated for a range of gaming and social media companies. Ad spend remains weak though, although most companies are suggesting that the market has stabilized in recent months. It is currently still a difficult market as ad inventory is generally in excess of demand, leading to depressed prices.

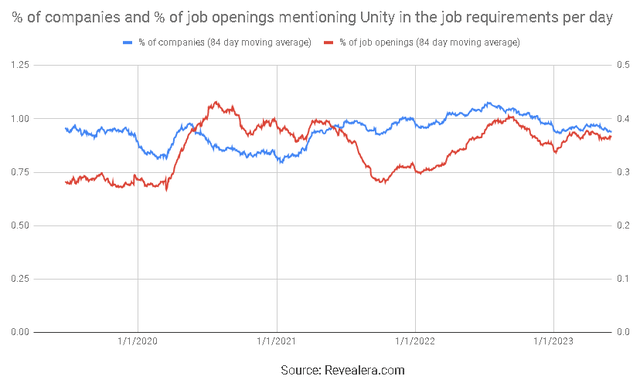

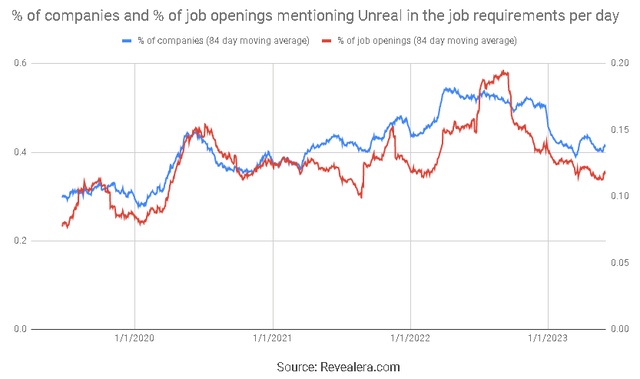

From a game engine perspective, there is no real indication that competitive dynamics are changing. Job openings mentioning Unity in the job requirements continue to be fairly stable. In comparison, job openings mentioning Unreal in the job requirements have fallen off over the past 12 months, although Unreal tends to address a different customer segment.

Figure 1: Job Openings Mentioning Unity in the Job Requirements (source: Revealera.com)

Figure 2: Job Openings Mentioning Unreal in the Job Requirements (source: Revealera.com)

Unity

While Unity faces a difficult macro environment, the important thing for the company at the moment is realizing value from its recent acquisitions, particularly Weta and ironSource. There isn’t really much clarity on how the integration of these companies is going, but Weta tools are expected to be monetized in 2023, and Unity is reportedly making gains in mediation, as the combination of ironSource and Unity is enhancing the performance of both networks.

Performance in the Create segment was weaker in the first quarter, which Unity partly attributed to a decline in Professional Services. Unity is deemphasizing the importance of Professional Services and increasing the utilization of partners like Booz Allen and Capgemini. These partners help customers implement digital twins, with Booz more involved in government projects and Capgemini working across a range of sectors, like energy. Working with partners helps Unity to scale the Create business and allows the company to continue benefitting from high-margin cloud revenue.

Unity recently raised prices, with minimal impact on churn, demonstrating the strength of the company’s competitive position and also potentially indicating that it has further pricing power. These price increases are still flowing through as Unity customers roll onto new contracts. In the future, growth is expected to come from usage more so than seats as Unity believes that there is a lot of potential to add ratable revenue over time as developers start to use more AI tools and build more advanced worlds.

Unity recently launched Unity Industry to support its digital twins business. This is an optimized offering for enterprises, which provides the tools necessary for customers to build and deploy interactive 3D experiences. This includes:

- Unity Enterprise

- Pixyz’s CAD and 3D data ingestion pipelines

- Unity Mars

- Dedicated customer success resources

Unity Poised to Benefit from AI Growth

Unsurprisingly, much of the current discussion around Unity is focused on AI. Generative AI will be a tremendous tailwind for the gaming industry, but also has the potential to shift the basis of competition, something I have written about previously.

At the industry level, AI is unquestionably positive for gaming and real-time 3D experiences. AI will make 3D experiences easier to build and enable new experiences that are not currently possible. This will likely lead to a proliferation of games and potentially adoption.

Unity is developing tools for its Editor that will improve the productivity and capabilities of developers and artists. Unity believes that AI tools will complement rather than replace existing tools and workflows. This involves both deterministic tools and AI tools (natural language). Unity plans on introducing an interface that allows users to switch between traditional tools that are deterministic and have fine controls, and a natural language interface that provides a starting point to build from.

There are already AI tools for generating a wide variety of assets used in games, like 3D models, character animations, dialog and music. It is not really clear that Unity has any advantage in developing these types of AI tools. For example, Ubisoft recently announced its Ghostwriter AI tool which generates phrases for NPCs, freeing up developers to concentrate on higher value work. Mighty Bear Games has developed a tool that transforms rough sketches into assets, which could save artists a significant amount of time.

Even if Unity does not have any advantage in developing AI tools, the company is positioning itself to benefit using the strength of its platform. Unity plans on opening a marketplace for generative AI, allowing Unity to capitalize from advancements in the broader ecosystem.

AI could also enhance the in-game experience in ways that were not possible before. The technology still needs to be fast, efficient, scalable and cost-effective; but could eventually enable things like:

- More realistic NPCs

- Diffusion content as a gameplay mechanism

- Boundary-less user-generated content

Inference in the cloud will likely be expensive though, which could limit adoption of some of these types of capabilities. Unity’s Barracuda package is a lightweight neural network inference library for Unity, that can run on both GPUs and CPUs. At the moment, cross-platform AI work is being done on the server side, which is expensive for customers. Barracuda allows Unity to run inference workloads on device, significantly reducing costs.

Unity believes that it is building a sustainable competitive advantage in AI based on its tools and the nature of its platform:

- Unity Editor – AI tools within the Editor will improve the productivity of creators and abstract away complexity, allowing more people to work as creators.

- Unity Runtime – Unity’s Barracuda inference engine enables inference to occur on device. This allows capabilities like AI-driven NPCs without the cost of cloud compute or latency concerns.

- Data – As one of the largest companies in the space, Unity has access to an enormous amount of data to train its models, much of which is proprietary. This includes training on the underlying code and instructions, making it far more useful than training on just the language or visual output. This data could help Unity to build richer services and capabilities.

At this stage it is difficult to know how generative AI will change the competitive landscape, but there are threats and opportunities for Unity. Unity hasn’t traditionally had a strong position amongst artists, but AI could allow the company to gain a foothold within this user group.

Larger studios that maintain their own game engines now have another vector on which they must compete. Open-source and third-party tools may help to keep them competitive, but it is also possible that Unity and Unreal will become more appealing.

The barrier to entry for independent game development will also likely continue to fall, as the tools of creation are increasingly democratized. This could result in a proliferation of low quality content, which will increase the value of discovery. There could also be an increase in the volume of high quality content, which may make gamers more reluctant to purchase games. Both of these trends could increase the importance of Unity’s Grow business.

Financial Analysis

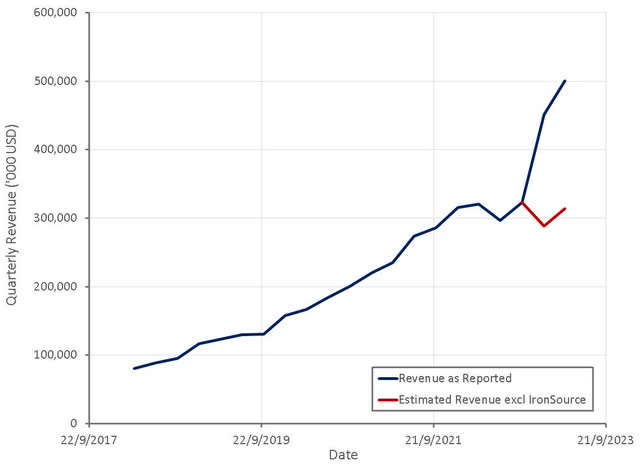

Unity’s revenue increased by 56% YoY in the first quarter, although it was down 2% on a pro-forma basis. Unity is guiding to 72-75% YoY revenue growth in the second quarter, which would be 6-8% on a pro-forma basis. It should be noted that Q2 2022 had monetization issues, and adjusting for this means that revenue is likely to be fairly flat YoY.

Figure 3: Unity Revenue (source: Created by author using data from Unity)

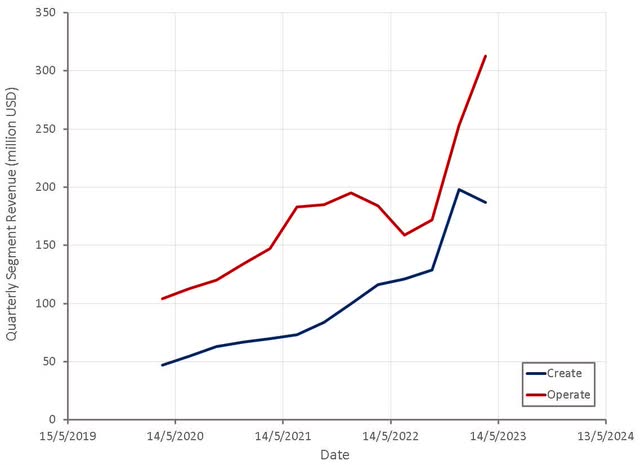

Create Solutions revenue increased by 14% YoY in the first quarter. Excluding Strategic Partnerships revenue was up by 17%. This growth is down somewhat from recent periods, which Unity has attributed to the company moving away from Professional Services and increasing its reliance on partners for project implementation. Churn rates remain low though, and have been improving over time.

Create Solutions revenue is expected to accelerate over the course of 2023 on the back of price increases, adoption of digital twins and acceleration in China. It should be noted though that China’s reopening has been a disappointment in general and that macro uncertainty may cause companies to delay digital transformation projects. Unity is also introducing ratable revenue streams which have yet to really kick in.

The Grow business continues to face headwinds from a weak macro environment, but growth is expected to accelerated throughout the year as synergies are realized between Unity and ironSource. For example, the ironSource ads network is being transitioned to the more advanced Unity ML model, and the Unity ad network is adopting ironSource’s bidding models.

Figure 4: Unity Revenue by Segment (source: Created by author using data from Unity)

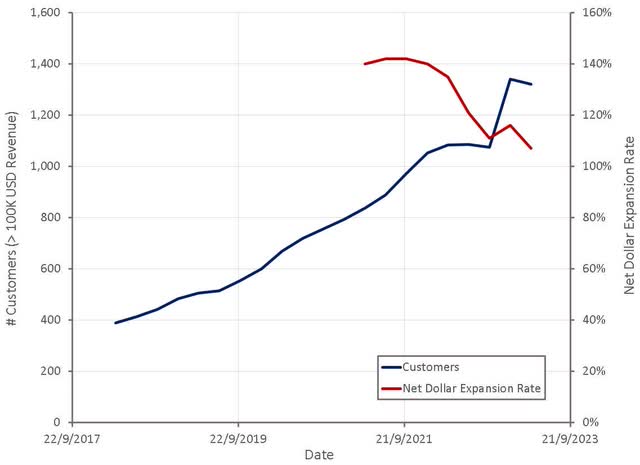

Unity’s large customer count has been flat/falling in recent quarters, although it was temporarily boosted by the ironSource acquisition. This appears to be more a result of consumption headwinds than churn though.

Figure 5: Unity Customers (source: Created by author using data from Unity)

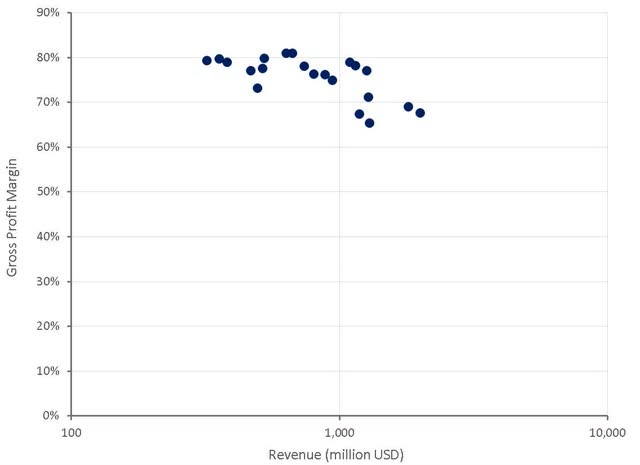

Gross profit margins continue to decline as Unity is currently weighed down by an excessive cost structure. This situation should reverse when the macro environment picks up and the Weta business is monetized.

Figure 6: Unity Gross Profit Margins (source: Created by author using data from Unity)

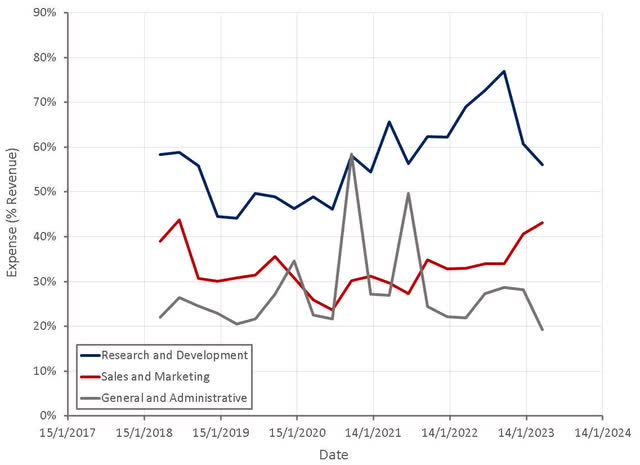

Unity continues to reduce its headcount, recently announcing another 600 layoffs as specific teams are restructured. The company is also reducing the number of managerial layers with the goal of making Unity more agile and efficient. Unity is also rationalizing its real estate footprint.

Multiple rounds of layoffs could indicate that growth continues to disappoint Unity’s management team. It is also possible that layoffs are a natural part of digesting recently acquired companies and realizing cost synergies.

Figure 7: Unity Operating Expenses (source: Created by author using data from Unity)

Valuation

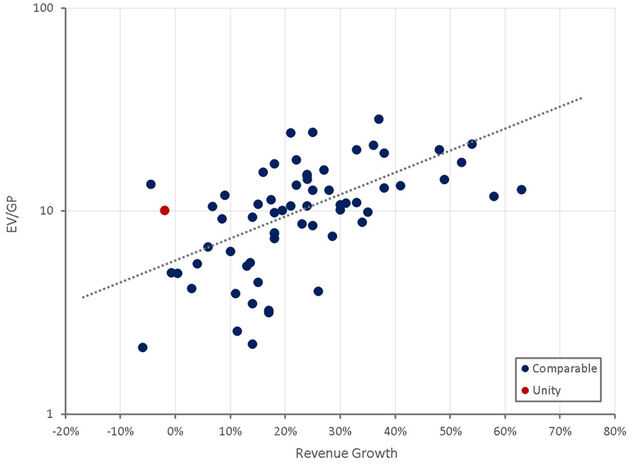

On a relative basis Unity looks about fairly priced, assuming its growth rate normalizes over the next 1-2 years. I believe the company deserves a valuation premium though, due to the large opportunity ahead of it and the limited amount of direct competition. Based on a discounted cash flow analysis I estimate that Unity’s stock is worth approximately 70 USD per share.

In the short-term the macro environment remains a significant risk, and Unity must still demonstrate that it can integrate and realize value from its recent acquisitions.

Figure 8: Unity Relative Valuation (source: Created by author using data from Seeking Alpha)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of U either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.