Summary:

- Unity had a successful 1st quarter, outperforming expectations on both top and bottom growth metrics.

- The gaming industry is set to expand at a rapid pace.

- Unity is leading both in software and monetization.

- However, the stock is overvalued, and the company is still net negative.

Ivan Pantic/E+ via Getty Images

Unity Software (NYSE:U) is a leading cross-platform game engine developer. Their main monetization strategies include advertisements, software, and subscriptions. As a person familiar with C# and the Unity engine, I will offer my views on the future of Unity. In short, I think Unity has a bright future in the long term but is currently overvalued.

Earnings:

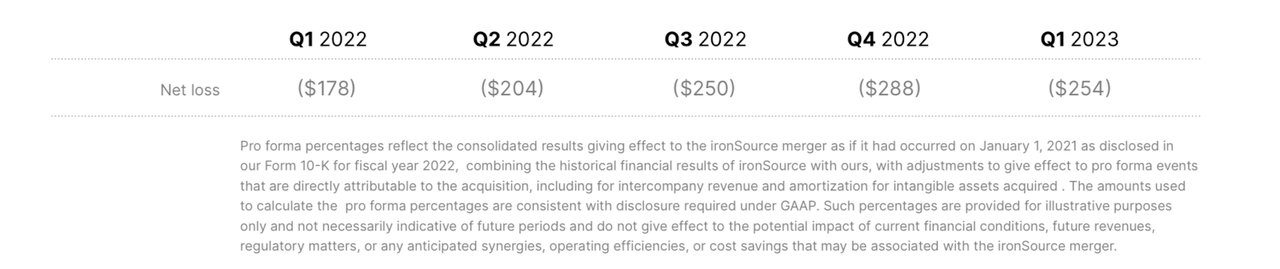

In Q1, Unity generated a revenue of $500 million, representing 56% growth YoY. This exceeded their guidance from the previous quarter by ~$25 million. At the same time, their EBITDA increased to $32 million, compared to -$23 million in the same period last year. However, their GAAP earnings are still a net loss of $254 million, increasing from $178 million last year. Though it should be mentioned their net loss in Q4 last year was $288 million, so there is a small turnaround there.

Overall, the earnings outdid expectations, and the stock was up 10.5% post-market.

Growth Potential:

Subscriptions

Unity is valued for its ease of use and cross-platform abilities. AAA games, such as Genshin Impact, to Indie games, such as Hollow Knight, all run on Unity. “Create Solutions”, as Unity calls their services and partnerships, generated $187 million of the total revenue in Q1, up 14% YoY.

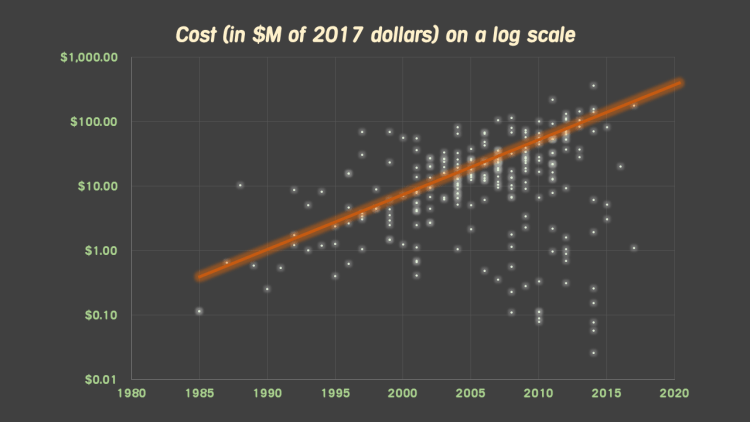

Unity fits right into a growing market, where demand for games seem to keep growing. On the “partnership” side, game budgets keep increasing at an exponential scale to meet the growing standards for quality of games.

Between 1985 and 2005, game budgets increased by about 22 times (venturebeat)

Along with this increased budget, Unity was able to increase subscription price from $2400 to $3000 a year for enterprises in October 2022. Currently, their listing for enterprises is custom, requiring the them to contact Unity for full software package. I think this is a positive change that’ll allow Unity to take advantage of the “inflation” of content creation.

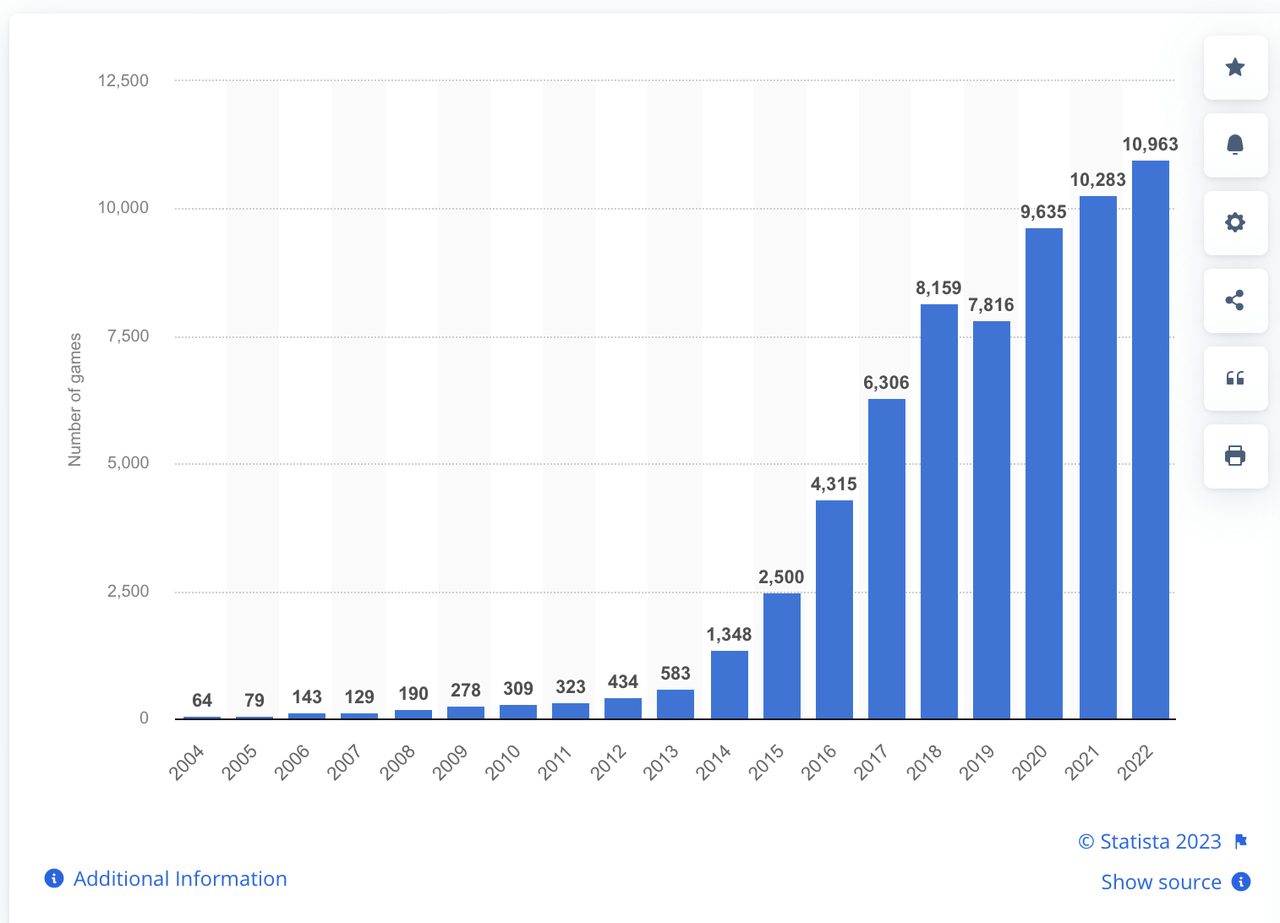

On the Indie side, there is a growing number of games published every year. In 2022, 10,963 new games were uploaded to Steam, compared to 7,816 in 2019. Over the last 3 years, the number of games have increased at around 6%. Remember, this is new game releases, old games will continue to renew their Unity subscriptions.

Number of Steam Games Released (Statista)

I will make a quick disclaimer that these added games will not directly add to Unity’s revenue, since they might not run on Unity or that it was made by the same developers who are already subscribed. From 2018-2023, the number of game developers in the US increased by 6.7%, again, this will not be directly translated into revenue.

Something that’ll be more directly impacted by the growing number of video games is the Unity Asset Store. As the name suggests, The Unity Asset Store allows Unity developers to quickly buy and add assets into the game. Assets ranges from 3D models to scripts to audio files, these models allow developers to build pieces of their game, or even solve bugs efficiently. Unity gets a 30% cut from the store, and a majority of Unity developers will use the assets from the store for their games. When more games are made with Unity, Asset Store revenue will also increase.

Ads

Unity calls it “Grow Solutions” and includes LevelPlay, mediation platform, and Ad Network. Grow Solutions represent $313 million of the revenue, an YoY growth of 101%. As fancy as they sound, it’s just slightly different tools developers use for implementing and optimizing ad monetization into their game. Anytime you touched Google Play Store or App Store game, chances are you’ve seen Unity’s ads.

Many developers will use ads from a variety of sources, such as Unity Ads, Meta, and Google AdMob. Unity Ads are quite easy to implement for both Unity and non-Unity developers, and they have quite a high CPM. This is why a majority of games on the mobile stores have Unity Ads implemented. Since a developer usually wants to have as many networks of ads as possible, there is not a competitive disadvantage in this sense.

The way the ads are played for games with numerous sources is an “auction”. The networks will compete in a bid, in which the highest bid will have their ad played. Unity is transitioning to a more advanced AI model for this purpose. This can help their margins since they can win auctions at lower costs.

Competitors:

Unity Ads is a sustainable model for the company since it doesn’t have much competitive pressure, besides the fact their margins might be hurt from the numerous ad networks. The most competitive pressure comes from their game engines.

Their most notable competitor is Unreal Engine, which comes pre-installed with an advanced graphics engine and is easier-to-use for beginners. While I can write a whole essay on the advantages of the two different engines, I will just conclude by saying that there shouldn’t be any developer who is willing to switch to a whole different engine because Unity/Unreal limits their workflow. Recurring revenue should be high, at least.

On the beginner side, this will be a coin toss. The reason I chose Unity was because of the creative sense of starting from scratch and their large asset store. Either way, I expect both of these engines to remain prominent for years to come, and most beginners wouldn’t subscribe anyways.

Valuation:

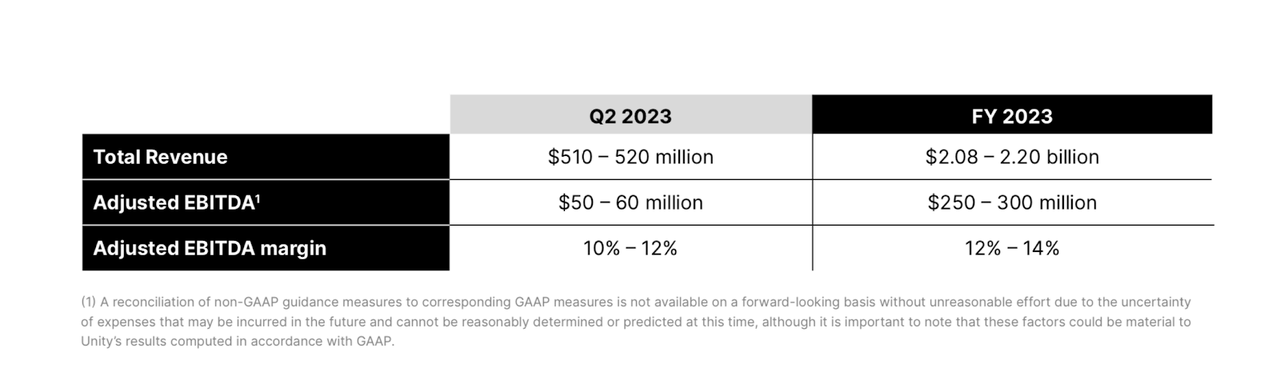

All of the above is very good, revenue growth of 56% is insane, especially for a company that’s been around since 2005. And the fact there are lots to grow into for the company should put the company at a buy, if it wasn’t already so highly valued. In quarter 4, Unity repurchased 42.7 million shares at $35.1 per share. Currently, the stock trades at just under $33. While Unity seems optimistic about its stock, the spending seems reckless to say the least. The company still has not turned profitable, and their revenue is only expected to go up 2%-4% QoQ.

Unity Projected Revenue (Unity)

The management is promising to reduce 8% of their workforce and reducing the number of shares offered. Still, I think the stock is overvalued for a company that has more operating expenses than revenue. Though the company has a healthy amount of cash on hand, the losses still concern me because they did not provide a clear strategy to reach positive GAAP income.

If Unity demonstrates a clear path to income growth, not just revenue growth, in the near term, I might have a more positive outlook for the company. With an unprofitable company like Unity, who has a (GAAP) EPS of -9.74, the margin for error is very tiny, as any underperformance will significantly affect the stock price. Because of this risk, I would hold the stock and wait for better buying opportunities..

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.