Summary:

- Unity Software announced a 25% reduction in headcount and operational changes to refocus on core offerings and improve profitability.

- The restructuring may negatively impact top-line growth and customer retention, but management may be positioning the company as an acquisition target.

- Third party research suggests that future development using Unity’s platform has fallen behind. The same research firm also suggested a drop off in AR/VR applications development.

Eugene Mymrin/Moment via Getty Images

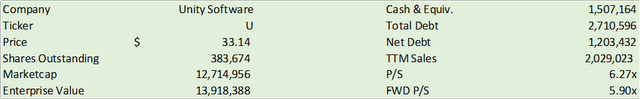

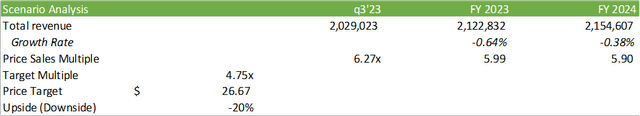

Unity Software (NYSE:U) announced a firm-wide 25% layoff on January 8, 2024, along with the exit of Unity Grow President, Tomer Bar-Zeev, two days later, as James Whitehurst, CEO, seeks to turn around the firm’s stalling organic growth on their developer platform. Much of the restructuring is refocusing the firm away from their ancillary offerings to focus more solely on their core offerings. Though this is a powerful move towards correcting margins in the near-term, I believe this will be detrimental to the firm’s top-line growth and create challenges in retaining their customer base that utilizes those satellite software offerings that may have been unique to their development platform. Despite my negative outlook, I do believe that management might be setting the firm up as an acquisition target. Given my negative outlook for the firm’s growth, I provide U shares a SELL recommendation with a price target of $26.67/share at 4.75x my eFY24 sales estimates.

Operations

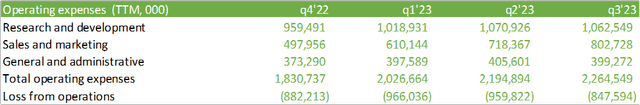

Unity announced a massive 25% cut to their headcount at the start of 2024 as James Whitehurst, newly appointed CEO, seeks to turn the firm back to profitability and growth. Though cost reductions and the restructuring game plan haven’t been fully discussed, Mr. Whitehurst did hint at a few operational changes in his first earnings call with the company on November 9, 2023.

A few of the changes Mr. Whitehurst had discussed included the elimination of less profitable components to the software platform with a refocus on the core platform, the possibility for a headcount reduction, and a reduction of other operating costs such as office space.

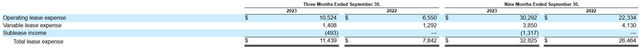

Running down the components, total lease expense net of sublease income was $32,825k for the first 9 months of FY23, likely coming out to around $43mm assuming no changes to lease costs for the duration of the year. This expense is only around 2% of total OPEX, which will in turn have minor effects to overall profitability. Accordingly, Unity has 5.2 years remaining in their lease term, suggesting that the firm will either have to pay to break the lease or find more subletters to take on the remaining space. I believe the latter will prove more challenging as the vacancy rate for office space in the US is nearly 20%, per Moody’s Analytics.

Unity 10-q

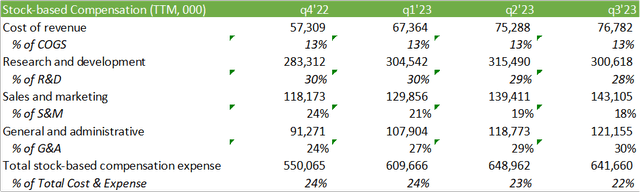

Relating to headcount, 22% of total operating costs are attributable to stock compensation expense. Even cutting the entirety of stock compensation will still lead to an operating loss of $206mm.

Corporate Reports

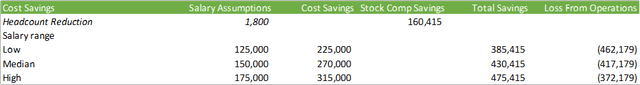

Though the exact personnel and salaries relating to the cuts aren’t disclosed, using data collected by Glassdoor, I will use an aggregate salary range of $125,000-$175,000 given the ranges for staff across software engineering, sales, and administrative range anywhere between $125-$300k/year. According to TechCrunch, the layoff will result in the reduction of 1,800 employees. Baking this baseline compensation into the 25% cut, we can anticipate OPEX savings in the ballpark range of $225-$315mm.

Glassdoor & Corporate Reports

Applying this with the 25% reduction in stock-based compensation, we can presume total savings in the range of $385-$475mm, not inclusive of terminal and restricting expenses.

Corporate Reports

Adding this back to TTM Q3’23 operations will still result in a loss in the range of $372-462mm, holding all else equal. Given my macroeconomic views as laid out below and given Unity’s platform restructuring, I anticipate revenue to retract as various components of their software offerings will be cut.

Corporate Reports

Macroeconomics

One of Unity’s big initiatives is their partnership with Apple (AAPL) in developing the platform for apps development for their Vision Pro on visionOS. Apple’s new Vision Pro comes with a price tag starting at $3,499, around 3.5x the cost of an iPhone Max Pro, and is expected to be released February 2, 2024. UBS analyst David Vogt estimates Apple to ship 400,000 headsets in 2024 while Morgan Stanley analyst Erik Woodring suggested that:

We believe success with the Vision Pro is less about 2024 and more about its longer-term potential.

Erik Woodring, Morgan Stanley

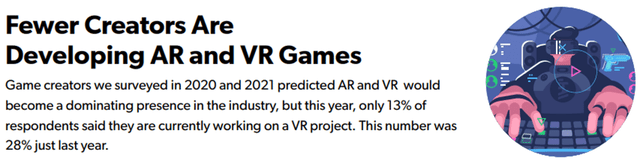

Though I believe it will be challenging to speculate the success of sales for the Vision Pro given the economic cloudiness for 2024, Apple’s 3% decline in revenue may hint into consumer preferences for the near-term. Tying this into Unity, in their 2023 State of Game Development & Design report, Perforce surveyed that only 13% of game developers are creating games for AR/VR when compared to 28% in the previous year.

Perforce

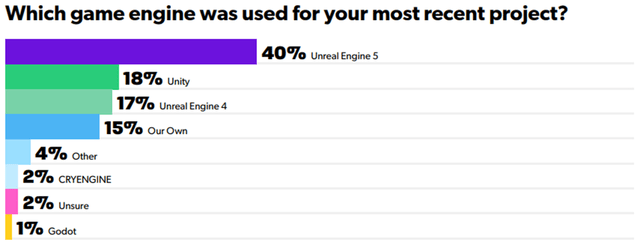

The survey went on to suggest that 23% of the respondents are finding challenges in securing funding for teams and projects for game development. Additionally, the survey also covered which game engines developers are using on their most recent projects. For the 2023 survey, 40% of respondents were using Unreal Engine while 18% were using Unity. This is significantly down from 50% and 33% for Unity for 2022 and 2021, respectively, suggesting a major drop-off from game development with their engine.

Perforce

On January 17, 2024, the Wall Street Journal reported that Apple has recently updated their apps store policy resulting from a lawsuit in which developers will be required to pay a 27% commission if they use an alternative payment method. The Journal went on to state that Apple has issued a request that Epic reimburse $73mm in legal expenses following the suit. This may have some effects on Unity’s monetization platform as well as lead to some potential pullback on future applications development.

Valuation

Corporate Reports

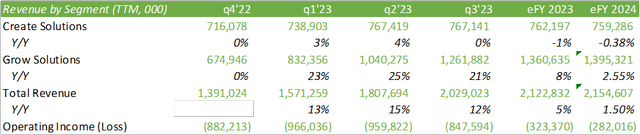

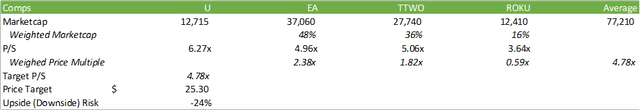

U currently trades at 6.27x trailing sales, well above its peer group. With the challenges presented above, I believe U will experience some downside risk as the firm undergoes its restructuring. Given the financial example above, I don’t believe Unity will achieve profitability in the near-term unless further cost-cutting measures take place.

Corporate Reports

Using my expectations for eFY24 revenue and a 4.75x sales multiple, I provide U shares a SELL recommendation with a price target of $26.67/share.

Corporate Reports

On a tactical basis, $24.80 appears to be the floor for U throughout the stock’s downward trend. Though I do not believe the stock will break through this line of resistance, I do believe the upcycles will become lower and lower as the firm restructures. As alluded to in my previous article covering Unity, I do believe that Mr. Whitehurst is positioning the firm as an acquisition target. Though I don’t believe Apple will be a viable candidate due to antitrust challenges, I do believe a larger software development platform may be in a position to acquire Unity, such as Adobe (ADBE).

TradingView

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.