Summary:

- NextEra Energy has outperformed its peers and indices for over a decade, with an 11.3% five-year average dividend growth rate.

- NEE’s commitment to renewables and storage projects is reflected in its backlog expansion, totaling around 20 gigawatts.

- Despite substantial debt, NEE remains resilient due to Florida’s robust market and strategic focus on solar investments.

pcess609

Introduction

The other day, I covered Duke Energy (DUK), which is my only utility investment. While it carries a 4.5% yield, it has underperformed the market in the past ten years, making it a good yield play but not a great total return investment – at least not on a short-term basis.

In this article, I want to shed some light on NextEra Energy (NYSE:NEE), the renewables-focused regulated utility giant. Headquartered in Florida, it’s the oldest stock-listed utility, as highlighted in the overview below.

Despite its age, the company isn’t boring.

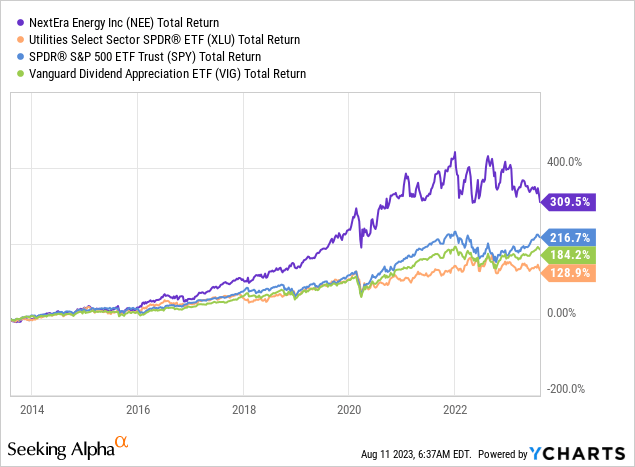

Over the past ten years, NEE shares have outperformed their utility peers, dividend growth stocks, and the S&P 500 by a wide margin.

However, the company is now in a downtrend.

NEE shares are down 18% year-to-date and roughly 25% below their all-time set in early 2022.

While challenges like persistently sticky inflation and the odds of a prolonged hawkish Fed policy are doing a number on stocks with high debt loads and somewhat limited pricing power, it also comes with opportunities.

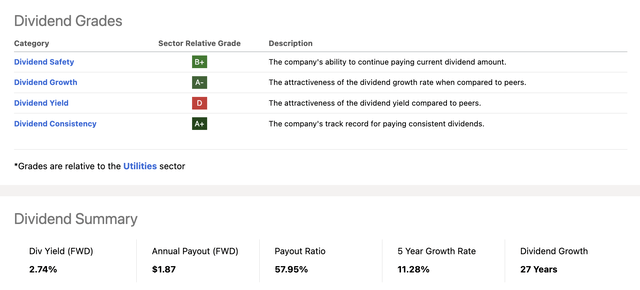

NEE Has A Terrific Dividend

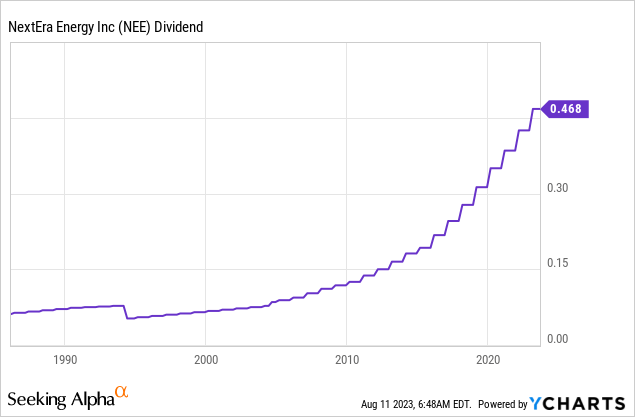

NextEra Energy became a dividend aristocrat in 2021 when it hit its 25th consecutive annual dividend hike.

Currently, the company has 27 consecutive hikes with an 11.3% compounding average dividend growth rate over the past five years.

While its dividend yield of 2.7% is somewhat subdued, it is blowing its peers out of the water when it comes to dividend growth.

Furthermore, the company maintains a 58% payout ratio, which is below the sector median of 66%.

So, when it comes to its dividend scorecard, the only drawdown is its dividend yield. But then again, it comes with higher growth and a lower payout ratio.

In other words, ignoring everything else, buying NEE versus higher-yielding peers depends on one’s own goals.

If investors require income, alternatives are almost an obvious choice. Investors who aren’t dependent on income may want to opt for a stock with a higher total return potential – on top of high, decent dividend growth with fantastic safety and consistency.

NextEra Remains In A Great Spot

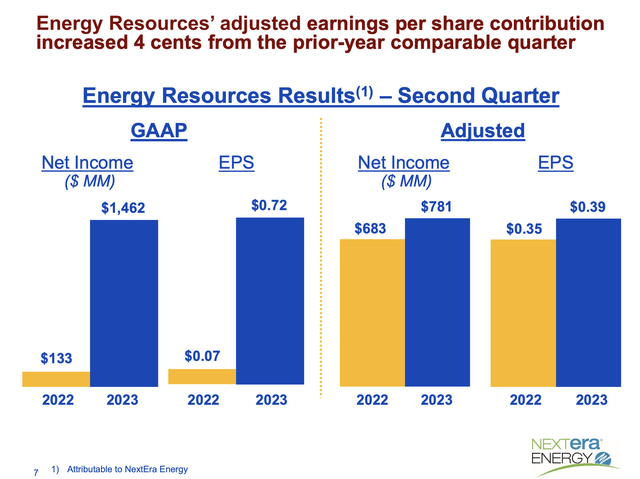

While its stock price may not suggest it, NEE is firing on all cylinders.

In the first quarter, the company achieved a remarkable 14% year-over-year growth rate in adjusted earnings, driven by new investments.

Note that the company saw strong growth despite weather headwinds, which is impressive given how sensitive renewables are to weather headwinds (pun intended).

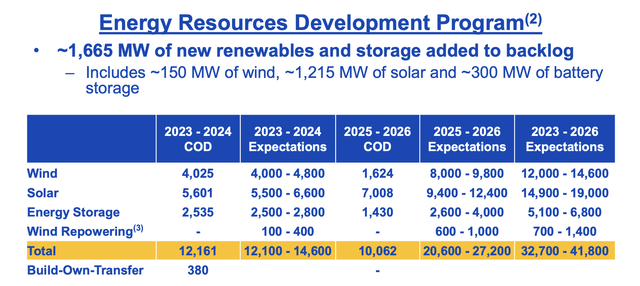

The company’s commitment to renewables and storage projects led to the addition of 1,665 megawatts to its backlog, which now totals around 20 gigawatts.

Despite challenges like commodity price inflation and supply chain disruptions, Energy Resources remains stable, as it believes that its significant pipeline of projects positions it well for meeting customer demand.

NextEra Energy

Additionally, Energy Resources is exploring opportunities in the green hydrogen market, aiming to leverage its renewables expertise to support this emerging industry.

This was also reported by the Wall Street Journal earlier this year.

According to the article:

NextEra now says it sees the potential to invest more than $20 billion in so-called green hydrogen after the passage of the Inflation Reduction Act, which provides significant tax credits for such projects. There is a limited market for green hydrogen currently, and NextEra is hoping the new law, coupled with an increasing push to cut carbon emissions, will simultaneously create supply and demand.

[…] NextEra pledged to invest heavily in hydrogen before the passage of the Inflation Reduction Act. The company last summer set a goal to reduce its greenhouse-gas emissions to near zero by 2045 without using carbon offsets or RECs. The company is planning to build large solar projects and convert many of its gas-fired power plants in Florida to run on hydrogen.

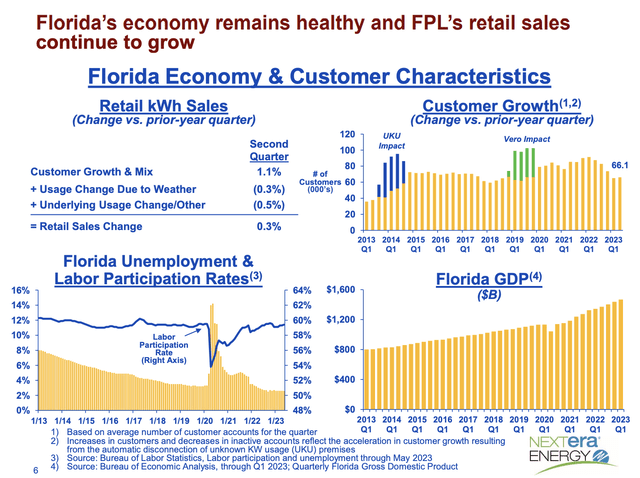

The company also benefits from strong growth in its key market, Florida, where employment and GDP growth are outperforming the nation’s average.

Excluding changes related to weather and usage, the company’s customer base grew by 1.1% in the second quarter (versus 2Q22), which is a fertile foundation for periods when individual power demand rises as well.

To deal with rising demand and investment in renewables, FPL’s (Florida Power & Light) capital expenditures in the second quarter were around $2.5 billion, and the full-year 2023 capital investment is projected to be between $8.5 and $9.5 billion.

FPL’s strategy centers around solar investments, with a goal of adding 3,100 megawatts of solar through 2025.

According to the company (emphasis added):

Over the current four year settlement agreement, we continue to expect FPL with a capital investment of between $32 billion to $34 billion. Of that total, we anticipate investing approximately $10 billion in new solar generation and approximately $14 billion to $16 billion in transmission and distribution infrastructure. We remain confident in our total capital plan through 2025, as our cumulative capital investments of approximately $14 billion through June of 2023 are a little ahead of our original timeline.

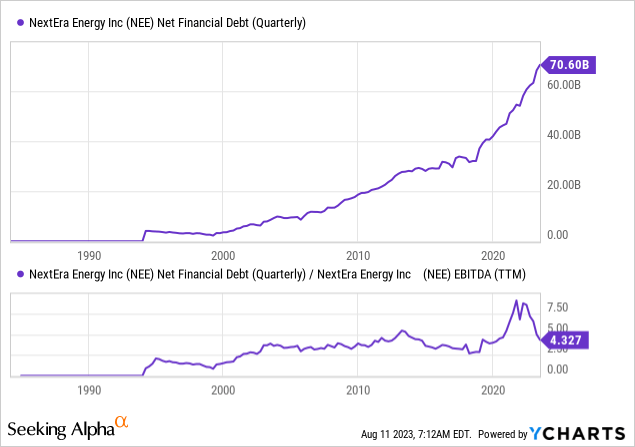

As these investments are expensive, the company’s net financial debt has exploded from $20 billion in 2010 to currently more than $70 billion.

By 2025, net debt is expected to have exceeded $85 billion.

The good news is that NEE isn’t wasting money. Investments in value-adding projects have caused EBITDA to grow consistently, allowing the company to maintain a 4x leverage ratio for roughly 20 years, as seen in the lower part of the chart above.

This is a very healthy leverage ratio, which explains why the company enjoys an A- credit rating. That’s one of the highest ratings in its industry.

Nonetheless, the fact that utilities have a lot of gross debt isn’t helping them in an environment of elevated rates, where borrowing is expected to remain expensive for a while. It’s why utilities usually perform poorly when inflation rises.

In periods of low/falling inflation, NEE’s stock does very well.

- Between 2020 and 2022, its stock price added 40%.

- Between 2011 and 2015, its stock price doubled.

NEE has a healthy balance sheet, and despite high rates, it continues to do well, which is why I believe that weakness offers opportunities.

Valuation

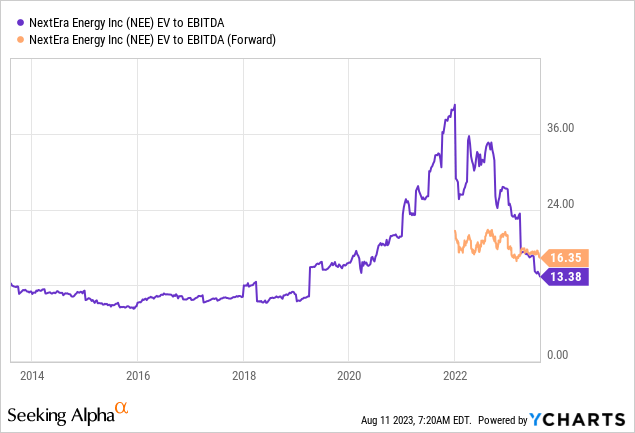

Thanks to the recent stock price decline, NEE’s valuation has come down to earth. The stock is now trading at 16.4x NTM EBITDA, which has erased the entire post-pandemic valuation expansion.

The current consensus stock price target is $91, which is 30% above the current price.

While I do not expect the stock to immediately start an aggressive uptrend, I do agree with this target and believe that NEE is undervalued by at least 30%.

Takeaway

NEE has an impressive track record of outperforming peers and indices for more than a decade, backed by a remarkable 11.3% five-year average dividend growth rate.

While its current dividend yield may seem subdued, its dividend growth potential and low payout ratio set it apart.

NEE’s commitment to renewables and storage projects is evident in its backlog expansion, totaling around 20 gigawatts. Its exploration of the green hydrogen market, supported by tax credits, reflects a forward-looking approach.

Fueled by Florida’s robust market and a strategic focus on solar investments, NEE remains resilient despite its substantial debt.

A healthy leverage ratio and strong credit rating provide a foundation for success.

The recent dip in valuation indicates an undervalued opportunity for investors in NEE.

With a consensus target price of $91, NEE offers the potential for a 30% upside and long-term growth and stability in the sustainable energy sector.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DUK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.