Summary:

- Tesla’s stock price may not fully reflect the company’s exceptional execution and operational achievements.

- The potential for further immediate price appreciation is limited due to the strong execution already factored into the stock price.

- Temporary production halts and increasing operating expenses could impact near-term revenue and profitability.

- Tesla’s optimistic outlook for volume growth prompts a stock price of min $290 (Providing investors ~20% upside from current trading price).

Blue Planet Studio

Investment Thesis:

Tesla’s stock price doesn’t fully reflect its exceptional execution.

Despite Tesla’s consistent success in various aspects of its business, including vehicle deliveries, technological innovation, and expanding market share, in my opinion, the stock price might not yet fully reflect these accomplishments.

Taking a positive outlook on the growth trajectory of the electric vehicle market, in this article, I am going to delve into the best-case scenario. This involves envisioning a future where electric vehicles experience rapid and widespread adoption across global markets. In this optimistic view, Tesla could potentially benefit significantly from being a frontrunner in the EV industry.

Furthermore, Tesla’s ongoing commitment to innovation, expansion of its product lineup, and potentially successful launches of highly anticipated models like the Cybertruck and affordable electric vehicles could contribute to robust growth in both sales volume and profitability.

Before diving into the best-case scenario – Let’s break down some of the reasons for the recent stock’s sluggish performance in detail:

- Strong Share Performance Already Priced In: The recent significant rise in Tesla’s share price is believed to already incorporate the positive response in demand that followed the company’s price cuts, as well as the successful execution in the year 2024. This means that the market has already reacted to these positive developments, leaving less room for further immediate price appreciation.

- Validation of Pricing Strategy: The company’s second-quarter results provided evidence that its pricing strategy is working. Despite a decrease in average selling prices by $900 per car from the previous quarter, the auto gross margin only experienced a minor decline of $400 per car, indicating a successful execution of the strategy.

- Limited Upside Risk: Due to the strong execution already factored into the stock price, the potential for upside risk to consensus estimates appears restricted. This suggests that the current share price adequately reflects the positive outlook, leaving less room for substantial stock price growth in the near term.

- Temporary Production Halts: The anticipated decline in deliveries for the third quarter, attributed to temporary production halts, may impact near-term revenue and growth prospects.

- Increasing Operating Expenses: The company’s rising operating expenses, driven by projects such as the Cybertruck and Dojo, could impact profitability in the short term.

- Margin Progress and Autonomy: Any notable improvement in margins is heavily reliant on advancements in autonomous driving technology. However, expecting significant progress in this area within the next 12 months might be overly optimistic, given the complexities and challenges associated with achieving full autonomy.

- Balanced Risk/Reward: While Tesla maintains a leading position in the global electric and autonomous mobility race, considering the potential risks and rewards over a 1-year period, the overall outlook appears balanced.

Taking these factors into account, the decision to downgrade to a “Neutral” rating reflects the assessment that much of the positive developments and execution are already priced into the stock, limiting the potential for significant short-term gains. However, it’s important to remember that market dynamics are futile, and investors should stay updated on the company’s performance and any new developments that could influence its trajectory.

Let’s delve deeper into each of the points for a more comprehensive understanding:

Auto Gross Margin: Tesla’s auto gross margin (excluding credits) at 18.1% indicates that the company has been able to improve its profitability on each car sold. This improvement is attributed to better cost management and operational efficiencies. The $500 per car improvement in COGS suggests that Tesla has been successful in controlling production costs, which is crucial for maintaining healthy margins.

Operating Expenses (Opex) Increase: The unexpected $0.3 billion increase in operating expenses can impact Tesla’s bottom line. Opex includes costs related to research and development, sales and marketing, and general administrative expenses. Such an increase can reduce profitability, especially when it outpaces revenue growth or gross margin expansion. It’s important to analyze the reasons behind this uptick in operating expenses to understand its potential implications on the company’s financial health.

Free Cash Flow (FCF): Tesla’s free cash flow of $1.0 billion, lower than consensus estimates, can be attributed to higher working capital requirements. Working capital includes elements like accounts receivable, inventory, and accounts payable. When these components fluctuate, they can affect a company’s ability to generate cash. Understanding the specific reasons for the increase in working capital is crucial for evaluating the sustainability of Tesla’s cash flow generation.

2023 Deliveries Confirmation: Tesla’s confirmation of the projected 1.8 million deliveries for 2023 is significant, especially given the company’s history of delivering on its promises. However, the mention of Q3 production cuts indicates that achieving this target might involve certain fluctuations in production and deliveries throughout the year. These production adjustments could be due to factors like supply chain challenges, component availability, or operational adjustments.

Impact on 2023 Earnings: Despite the variations in margins, expenses, and production plans, the overall earnings outlook for 2023 has remained relatively stable. This suggests that the company’s internal expectations for growth and profitability for the full year have not significantly changed based on the results and developments reported.

Future Roadmap: Cybertruck, Affordable platform, Autonomy

Let’s go into more detail about each of the points in Tesla’s roadmap:

Cybertruck: Tesla’s plan to start delivering the Cybertruck by the end of the current year signifies a significant step for the company. The year 2024 is projected to be a ramp-up phase for Cybertruck production. This model marks Tesla’s entry into the electric pickup truck market, which has substantial potential in terms of both sales volume and profitability. The anticipated dilutive impact on gross margins in 2023 and 2024 could be due to initial production challenges and investments in manufacturing and supply chain for this unique vehicle design. However, the expectation of gross margin improvement starting from 2025 suggests that Tesla aims to optimize its production processes and achieve economies of scale over time.

Affordable Platform (~$25k Car): The speculation surrounding Tesla’s intention to introduce an affordable electric vehicle platform priced around $25,000 is significant. If realized, this move could democratize electric mobility and broaden Tesla’s customer base. This model’s unveiling in the next year, with production targeted for 2025, signals Tesla’s commitment to expanding its market presence. Entering the more affordable price range is a strategic decision that aligns with Tesla’s mission to accelerate the world’s transition to sustainable energy.

Autonomy Focus: Tesla’s emphasis on autonomy, particularly Full Self-Driving (FSD), represents a bold vision for the future of transportation. Achieving full autonomy would mean vehicles can operate safely without human intervention in various conditions. While Tesla has made remarkable progress in autonomous technology, achieving full autonomy remains a complex challenge. The company’s iterative approach to improving its Autopilot and FSD features underscores the incremental nature of this journey. Advancements like Navigate on Autopilot, Autosteer, and Summon are steps toward this larger goal.

Dojo Supercomputer: Tesla’s introduction of the Dojo supercomputer reflects the company’s determination to leverage cutting-edge technology to accelerate its autonomous driving capabilities. Dojo’s immense processing power can process vast amounts of data, enhancing Tesla’s ability to refine its neural network algorithms for self-driving. The supercomputer could significantly accelerate the training and development of FSD systems, enabling more rapid improvements in autonomous features and safety.

Long-Term Autonomy Perspective: Achieving full autonomy is a multi-dimensional challenge that extends beyond technical aspects. Regulatory approval, public acceptance, safety validations, and real-world testing are all integral components of this process. The potential financial upside of full autonomy is substantial. Tesla’s vehicles could transform into autonomous robotaxis, generating revenue for their owners when they’re not in use. However, given the complexity and regulatory considerations, this transition is expected to take several years to fully materialize.

Key question every long-term investor should ask themselves:

1. Can Tesla achieve its projected 50% volume Compound Annual Growth Rate (CAGR)?

2023: It is expected that Tesla will successfully achieve its delivery target of 1.8 million vehicles in 2023. This aligns with current market projections and reflects the company’s strong operational performance.

2024: Attaining a 50% growth in 2024 to meet the volume CAGR target hinges on the smooth and timely ramp-up of the Cybertruck, contributing around 45% of the growth. The execution of this ramp-up is uncertain due to the complexity of such endeavors within a tight timeframe.

2025: The introduction of a new affordable platform signifies a transformative phase for Tesla and the industry. Enabling the creation of a global $25,000 mass-market electric vehicle, this platform sets the stage for Tesla to potentially fulfill its 50% volume CAGR target beyond 2025.

2. Will Tesla maintain its leadership in technology, scale, and profitability compared to competitors?

Except for BYD (OTCPK:BYDDF), no other major automaker appears to rival Tesla’s cost structure and comprehensive vertical integration. This strategic positioning allows Tesla to capture market share from traditional internal combustion engine (ICE) vehicles and offer competitive pricing, all while generating positive Free Cash Flow (FCF) sufficient to cover growth capital investments. The long-term outlook suggests Tesla’s potential ascension to one of the world’s largest Original Equipment Manufacturers (OEMs) by 2030, accompanied by notable profitability and market share.

3. Is Tesla on track to achieve full autonomy within the next 12 months?

Achieving full autonomy within the next 12 months is unlikely for Tesla. Despite having an advantageous position to leverage AI capabilities with its purpose-built supercomputer, Dojo, the journey toward Full Self-Driving (FSD) is expected to continue with multiple iterations over the coming years. The realization of full autonomy will likely commence in North America and is anticipated to be a gradual process before it substantially influences Tesla’s financial landscape.

Valuations:

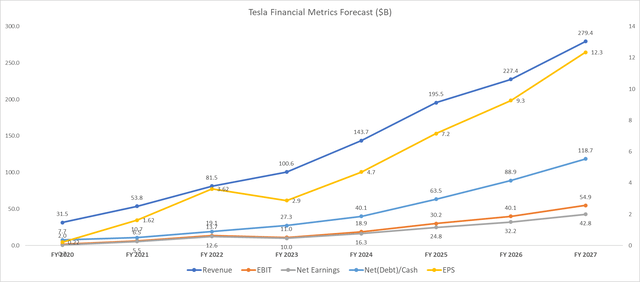

Relying on comprehensive Electric Vehicle (EV) teardowns, I have a strong level of confidence in Tesla’s sustained technological and cost leadership within the industry. I anticipate that Tesla will emerge as the frontrunner, potentially even the sole global Original Equipment Manufacturer (OEM), that can achieve profitability within the affordable EV segment, starting from 2025 and onwards.

In summary, the outcomes of extensive EV teardowns lend robust support to Tesla’s continued dominance in technology and cost efficiency. The company’s potential to generate profits in the affordable EV segment, the recognition of its technological leadership among consumers, and the evolving competitive landscape all contribute to a comprehensive perspective on Tesla’s position within the global EV market.

Additionally, the market’s valuation multiples for Tesla have become more demanding, with a Price-to-Earnings ratio of around 60X projected earnings for 2024.

Company Data and author forecast

| Tesla Fully Connected Fleet Value in 2030 | ||

| Base Case | Best Case | |

| Tesla Cars sold globally (MM) | 39.7 | 59.7 |

| Annual Software Rev per car($) | 1,000 | 1,500 |

| Software Contribution Margin | 80% | 80% |

| Software Operating Margin ($MM) | 31,760 | 71,640 |

| Capitalization Factor | 6.5 | 7.2 |

| Discounted Value ($MM) | 206,440 | 515,808 |

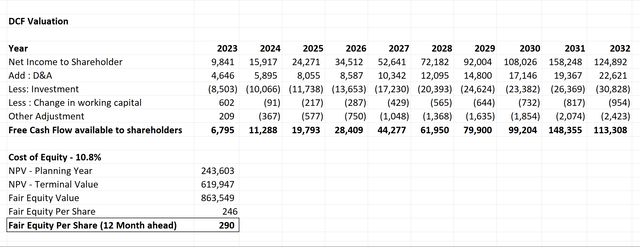

Using Discounted Cash Flow (DCF) model and incorporating improved visibility into the price elasticity of demand led to an upward adjustment in projected post-2025 volume growth. This more optimistic outlook for volume growth prompts a stock price of min $290 (Providing investors ~20% upside from current trading price)

Conclusion:

Tesla’s roadmap involves a range of ambitious initiatives, from introducing groundbreaking vehicles like the Cybertruck and affordable platform to advancing autonomous capabilities with the Dojo supercomputer. While these endeavors offer great potential, it’s important to acknowledge that they come with challenges and uncertainties, and their ultimate impact on Tesla’s trajectory will be influenced by various internal and external factors over time.

However, it’s essential to note that I maintain a positive stance on Tesla’s long-term prospects, acknowledging that the stock offers a substantial opportunity over an extended horizon. The recent performance of Tesla’s shares has not adequately accounted for the success of Tesla’s pricing strategy, which resulted in a robust response in demand and a moderate decline in margins.

Risk Statement:

My valuation target is derived from a Discounted Cash Flow analysis. A notable concern revolves around the broader deceleration in the global economy and discretionary spending, which poses a substantial risk to automotive manufacturing and subsequently impacts TSLA stock. Additionally, there are significant risks tied to the pace of electric vehicle adoption, the potential inability to meet targets for battery cost reduction and performance enhancements, and vulnerabilities in the supply chain concerning battery active materials such as cobalt and nickel. The company’s capability to swiftly expand production capacity, shifts in electric vehicle regulations (particularly in major markets like China, the US, and Europe), the potential for warranty-related issues, and an elevated level of general execution risk are all additional major factors that could impact the outlook for TSLA stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.