Summary:

- Medtronic is a leading healthcare technology company specializing in devices to treat prevalent illnesses such as diabetes, cardiovascular disease, and neurological disorders.

- The aging population in countries like South Korea, Japan, Italy, Greece, and Germany is driving increased demand for pacemakers and other Medtronic products.

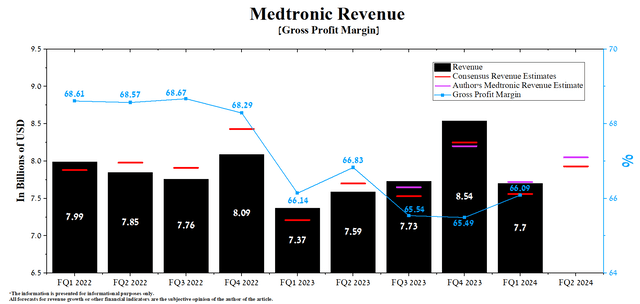

- Medtronic’s revenue was $7.7 billion in the first quarter of fiscal 2024, an increase of 4.5% year-over-year.

- On the other hand, Medtronic’s non-GAAP (TTM) P/E is 14.65x, which is 20.46% lower than the sector average and 29.9% lower than the average over the past five years.

- We initiate our coverage of Medtronic with an “outperform” rating for the next 12 months.

Kateryna Novikova/iStock via Getty Images

Medtronic (NYSE:MDT) is a leading healthcare technology company headquartered in Dublin and has been a key player in the development and commercialization of devices to treat prevalent illnesses such as diabetes, cardiovascular disease, and neurological disorders for decades. The company has an extensive product portfolio, including pacemakers, insulin pumps, cardioverter defibrillators, transcatheter pulmonary valves, electrosurgical equipment, wound closure materials, and more.

Considering the relatively rapid aging rate of the population of many countries, including South Korea, Japan, Italy, Greece, and Germany, this inevitably entails an increase in the percentage of people with various heart ailments. Ultimately, this leads to continued high demand for pacemakers and other Medtronic products, partly thanks to its aggressive R&D policy. As a result, this allows the company to launch increasingly effective devices and systems for treating heart failure, heart rhythm disorders, and heart valve diseases.

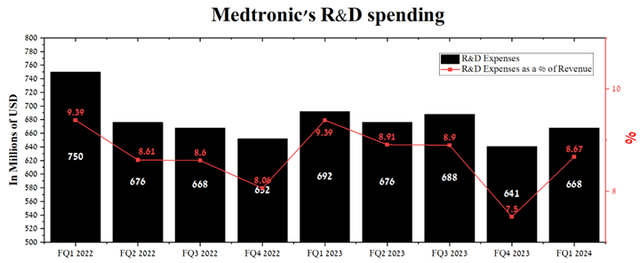

Medtronic’s R&D spending totaled $668 million for the first quarter of fiscal 2024, an increase of 4.2% compared to the previous quarter. Despite the spin-off of the Renal Care Solutions business into a separate company called Mozarc Medical, the expense increase was also due to increased investment in developing next-generation devices for treating and diagnosing type 1 and type 2 diabetes.

Author’s elaboration, based on Seeking Alpha

In addition, we believe that Medtronic’s gem is its Neuroscience segment. Its portfolio includes spinal implants, robotic guidance systems, implants used in the treatment of the spine, and various neurological diseases. The increase in sales of this segment of the company from year to year plays a crucial role in contributing to its dividend growth. Medtronic’s management has been boosting its dividend payouts for forty-six years, making it a favored choice among conservative investors.

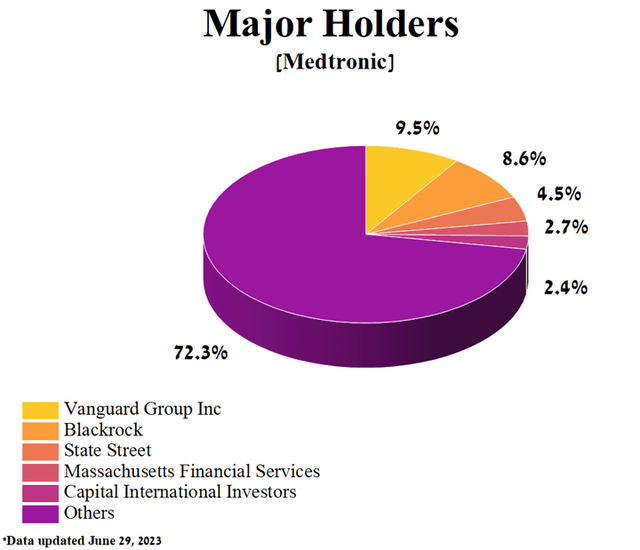

In addition, Medtronic’s top five shareholders, accounting for 27.7% of the company’s shares, include financial giants such as BlackRock, Capital Research Global Investors, Vanguard Group, Massachusetts Financial Services, and State Street. We believe this substantial investment by these powerful Wall Street organizations reflects their confidence in Medtronic’s optimistic prospects, even as the global surgical equipment market becomes increasingly competitive.

Author’s elaboration, based on Yahoo Finance

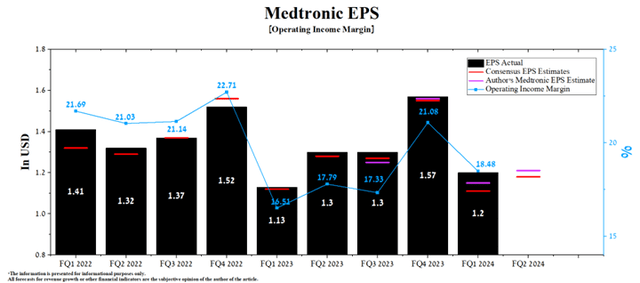

The first quarter of fiscal 2024 delivered stellar results as Medtronic’s revenue and EPS were able to exceed our expectations as well as those of the analysts following the stock. One of the key reasons for this is that its Structural Heart & Aortic division sales continue to show double-digit growth year on year, despite increased competition in the global structural heart devices market.

On November 21, 2023, Medtronic will release financial results for the second quarter of fiscal year 2024, which we estimate should please investors due to the continued growing demand for surgical products and devices for treating and monitoring diabetes.

In addition, according to Seeking Alpha, the company’s revenue for the second quarter of fiscal 2024 is expected to be $7.81-$8.05 billion, which is 4.9% higher than analysts’ expectations for the first quarter of fiscal 2024. At the same time, under our model, Medtronic’s total revenue will be closer to the upper limit of this range and will amount to $8.05 billion. The medical technology leader’s annual and quarterly revenue growth will be driven, among other things, by the expansion of Medtronic’s portfolio of cardiovascular products.

Author’s elaboration, based on Seeking Alpha

We forecast that the operating income margin will reach 19% by fiscal year 2024, and by fiscal year 2025, it will increase to 19.5% due in part to lower inflation, increased prices for medical devices, and increased demand for the Evolut FX system used in the treatment of severe aortic stenosis.

According to Seeking Alpha, Medtronic’s EPS in the second quarter is expected to be $1.16-$1.20, which is 6.3% higher than the consensus estimate for the first quarter of fiscal 2024. At the same time, according to our model, the company’s EPS will be $1.21, slightly higher compared to the previous quarter.

On the other hand, Medtronic’s Non-GAAP P/E (TTM) is 14.65x, which is 20.46% lower than the sector average and 29.9% lower than the average over the past five years. Furthermore, the Dividend Aristocrat’s Non-GAAP P/E (FWD) is 15.36x, which is one of the factors indicating that financial market participants undervalue the company.

Author’s elaboration, based on Seeking Alpha

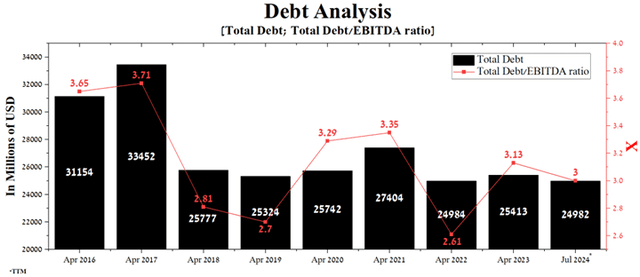

At the end of July 2023, Medtronic’s total debt was $24.98 billion, essentially unchanged from April 2022. On the other hand, despite stabilizing the company’s EBITDA in recent quarters, the total debt/EBITDA ratio increased from 2.61x to 3x.

Author’s elaboration, based on Seeking Alpha

At the same time, given the stable cash flow and the expansion of the diagnostic systems and instruments portfolio, we do not expect the company to have difficulties repaying senior notes with a maturity date between 2025 and 2050. As a result, this will contribute to maintaining the company’s policy of boosting its dividend payments, and inclusion in the S&P 500 Dividend Aristocrats Index.

Conclusion

Medtronic is a leading healthcare technology company headquartered in Dublin, Ireland and has been a key player in the development and commercialization of devices to treat prevalent illnesses such as diabetes, cardiovascular disease, and neurological disorders for decades.

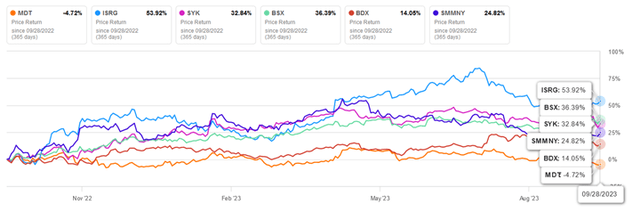

Despite the company’s year-on-year revenue growth, rising demand for its spinal cord stimulator, and the launch of next-generation devices to treat heart disease and diabetes, its share price is down more than 4% year-to-date. Some of the main reasons for this are increased competition in the global neurological device market and the negative outcome of the Circulatory System Devices Panel’s vote regarding the Symplicity Spyral system, which is being developed for blood pressure control.

Author’s elaboration, based on Seeking Alpha

Despite all the challenges Medtronic has faced in recent quarters, we believe that with its growing operating income margin and rising demand from healthcare providers for medical devices to diagnose and treat numerous diseases, interest from conservative investors will continue to grow.

We initiate our coverage of Medtronic with an “outperform” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.