Summary:

- Meta CEO Mark Zuckerberg sees AI as a longer-term investment for revenue growth.

- Investors should not expect immediate monetization of AI investments, as Meta plans to drive revenue gradually over the long term.

- The company recently delivered better-than-expected second quarter results and solid third quarter guidance.

Derick Hudson

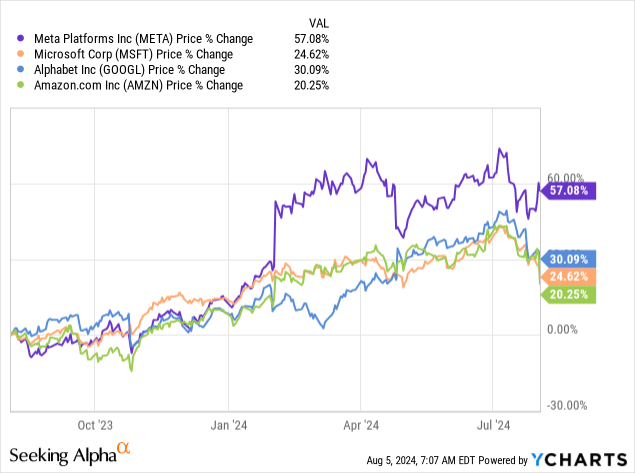

My last article on Meta Platforms (NASDAQ:META) was on October 31, 2023, after the company had already started to rebound from a slumping digital ad market and fears that TikTok was overtaking the social media giant. When I wrote that article, the stock had advanced 140% over the previous year’s comparable quarter. I recommended buying the stock then and stated, “Meta has massive potential growth if its AI [Artificial Intelligence] and Metaverse gambits work out favorably.” Since then, the stock has been up 62.03% compared to the S&P 500’s (SPX) 27.49% rise. Over the last year, it has also outperformed other heavyweight competitors in the generative AI race.

The company recently reported solid second-quarter 2024 results with upbeat guidance that exceeded some analysts’ expectations. Some also believe that Meta is taking the lead in developing generative AI with its open-source strategy. Although AI and the metaverse have yet to pay off, the company’s recent business performance, attractive valuation, and potential upside from AI make it an excellent investment for long-term growth investors. I maintain a buy recommendation on Meta Platforms.

This article will discuss the company’s AI opportunity and fundamentals. It will also discuss the stock’s valuation, a few risks, and why I maintained a buy rating.

AI as a growth driver

Meta is one of several companies that have pushed all their chips into the center of the table on AI. If you ever listen to Meta Chief Executive Officer (“CEO”) Mark Zuckerberg talk about the company’s AI products on earnings calls, he might make you dizzy with all the different products and ways the company plans to use AI. During the second quarter of 2024 earnings call, one analyst tried to pin Zuckerberg down by asking him which generative AI-enabled product would be a growth driver over the next two fiscal years. If you listen carefully to his response, it’s evident that the Meta CEO believes that AI is an investment that the company believes will gradually drive revenue over the long term, rather than something that will result in immediate growth.

Zuckerberg said Meta will primarily drive growth using AI to “[shape] the existing products.” He identified two areas: improving user content recommendations, bettering ad targeting, and increasing ad performance. He said on the second quarter 2024 earnings call:

I think there is a lot of upside there. Those are already products that are at scale. The AI work that we are doing is going to improve that. It will improve the experience and the business results.

Meta will secondarily drive revenue growth by scaling up new AI-based products like Meta AI and AI Studio. Traditionally, the company has scaled up its new products to one billion users or more before gradually monetizing them. Investors can expect it to follow a similar strategy. Zuckerberg said the following about the company’s new AI products:

So realistically, for things like Meta AI or AI Studio, I mean these are things that I think will increase engagement in our products and have other benefits that will improve the business and engagement in the near term. But before we are really talking about monetization of any of those things by themselves, I mean I don’t think that anyone should be surprised that I would expect that — that will be years, right?

So, investors shouldn’t expect an immediate bang for the buck that Meta spends on AI. For those unaware, Meta AI is the company’s chatbot response to OpenAI’s ChatGPT. It can create AI-generated images from text, role-play conversations, and answer questions similar to other chatbots like Alphabet’s (GOOG)(GOOGL) Gemini or Microsoft’s (MSFT) Copilot. Meta AI uses the company’s large language model (“LLM”) Llama technology. The company released Meta AI in the second quarter. Despite the perceived lead that Microsoft and Alphabet have after releasing their respective chatbots over a year before Meta, Zuckerberg said on the earnings call, “It [Meta AI] is on track to achieve our goal of becoming the most used AI assistant by the end of the year.” That is a very bold statement. Meta AI is currently available in over 20 countries and eight languages, with India being the largest Meta AI market based on usage.

Its other prominent product, AI Studio, is a tool built on Llama 3.1 to help people and businesses build custom AI assistants for Instagram, Messenger and WhatsApp. Zuckerberg said about AI Studio:

I think the creators are especially going to find this quite valuable. There are millions of creators across our apps, and these are people who want to engage more with their communities, and their communities want to engage more with them, but there are only so many hours in the day. So now they are going to be able to use AI Studio to create AI agents that can channel them to chat with their community, answer people’s questions, create content and more.

The company also plans to use the product with businesses. Meta has AI Studio in Alpha testing with potential customers. Zuckerberg said on the earnings call, “Our goal is to make it easy for every small business, eventually every business, to pull all of their content and catalog into an AI agent that drives sales and saves them money.” He believes that when this product is fully up and running, it will significantly boost business messaging revenue on products like WhatsApp.

Meta believes its Llama family of foundation LLMs differentiates it from competing products from OpenAI, Microsoft, Google, and others because it’s open source, allowing developers to fine-tune and customize the model for their needs. Zuckerberg stated on the earnings call, “I think we are going to look back at Llama 3.1 as an inflection point in the industry where open-source AI started to become the industry standard, just like Linux is.” Mark Zuckerberg wrote a letter titled “Open-Source AI Is the Path Forward” that explains why he believes that open-source AI is superior to AI based on closed-source AI versions. Investors should read that letter to understand why Zuckerberg might be correct. If his belief proves true and Llama becomes a standard LLM for companies, Meta may have an edge over its competitors, overcoming the perceived lead that Microsoft and Google may have built up.

Although some believe Microsoft is the AI leader, that’s not the perception of NVIDIA’s (NVDA) CEO Jensen Huang, who praised Meta Platforms at the end of July at SIGGRAPH 2024. An NVIDIA blog stated, “Huang credited Zuckerberg and Meta with being leaders in AI, even if only some have noticed until recently.”

Company fundamentals

The company has a dual capital allocation strategy. It invests in areas that improve the user experience, such as content recommendations for users and improving ad targeting. Most investors have little issue with those types of investments because the company has a history of seeing the returns from those types of investments within a few quarters.

The problem that some investors have with Meta is that it also invests in long-term investments, such as generative AI and the metaverse, that are unproven and have the possibility of not paying off. Chief Financial Officer (“CFO”) Susan Li said on the second quarter 2024 earnings call:

While we expect the returns from Generative AI to come in over a longer period of time, we’re mapping these investments against the significant monetization opportunities that we expect to be unlocked across customized ad creative, business messaging, a leading AI assistant and organic content generation. As we scale generative AI training capacity to advance our foundation models, we’ll continue to build our infrastructure in a way that provides us with flexibility in how we use it over time. This will allow us to direct training capacity to gen AI inference or to our core ranking and recommendation work, when we expect that doing so would be more valuable. We will also continue our focus on improving the cost efficiency of our workloads over time.

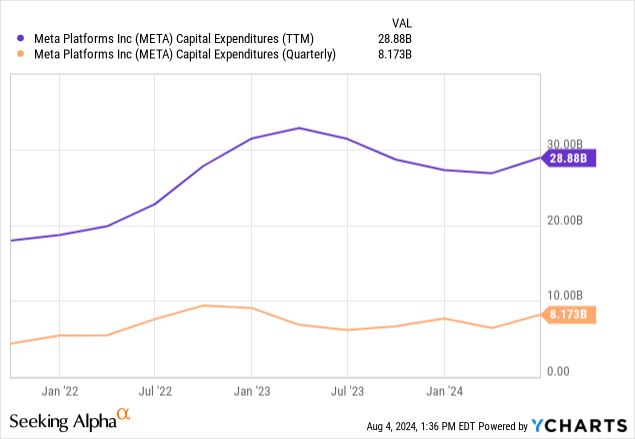

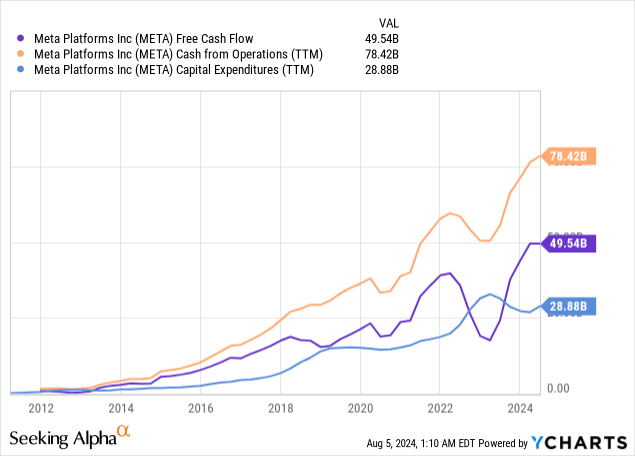

In other words, the company has the flexibility to use its investments in computing infrastructure for long-term or short-term needs based on whatever the most important consideration may be at the time. The following chart shows that the company spent $8.173 billion on capital expenditures (“CapEx”) in the third quarter of 2024. Its trailing 12-month (“TTM”) CapEx was 28.88 billion.

Investors should expect those numbers to increase meaningfully in 2025. CFO Li stated in the company’s second quarter 2024 earnings release:

We anticipate our full-year 2024 capital expenditures will be in the range of $37-40 billion, updated from our prior range of $35-40 billion. While we continue to refine our plans for next year, we currently expect significant capital expenditures growth in 2025 as we invest to support our artificial intelligence research and product development efforts.

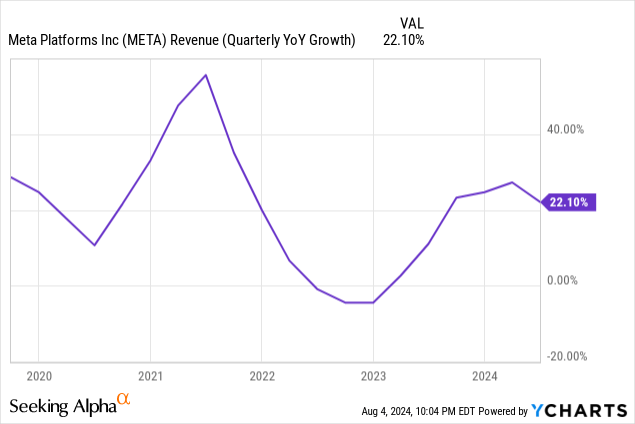

The market may revolt against the level of CapEx spending that the company anticipates spending in 2025 if it cannot maintain solid revenue growth and profitability. Meta’s revenue grew 22.10% in the second quarter to $39.071 billion, beating analysts’ expectations by $760.88 million.

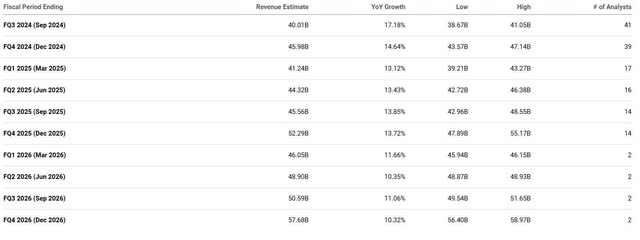

Meta gave third-quarter 2024 revenue guidance between $38.5 billion and $41 billion. The midpoint of this guidance is $39.75 billion, above analysts’ forecasts of $39.1 billion. If the company hits the midpoint of guidance, third-quarter revenue growth will drop to 16.41%. According to Seeking Alpha, analysts expect double-digit revenue growth every quarter until the fourth quarter of 2026.

The following image shows Meta Platforms segment results. The company’s advertising segment revenue grew 21.69% to $38.33 billion. Its “other” segment consists of miscellaneous fees and income generated from its business messaging feature in WhatsApp. If the company’s testing of AI Studio with businesses succeeds, revenue in the “Other” category should jump as businesses start creating chatbots on WhatsApp.

Meta Platforms Second Quarter 2024 Investor Presentation.

Reality Labs is its long-term investment outside of AI. This segment is responsible for developing its Augmented Reality (“AR”) glasses, Smart Glasses, and the operating environment for the metaverse. CFO Li said about this investment during the earnings call, “For Reality Labs, we continue to expect 2024 operating losses to increase meaningfully year-over-year due to our ongoing product development efforts and investments to scale our — to further scale our ecosystem.” This segment’s second-quarter 2024 operating loss increased from $3.739 billion to $4.49 billion year-over-year.

Yet, despite Reality Labs being a drag on operating results, Meta’s total operating income was up 58% over the previous year’s comparable quarter to $14.847 billion. Operating margins expanded 9 points from 29% to 38%, a sign that its cost-cutting and efficiency measures instituted since 2022 have paid off. These numbers are impressive and likely why investors have given the company slack about spending on long-term investments.

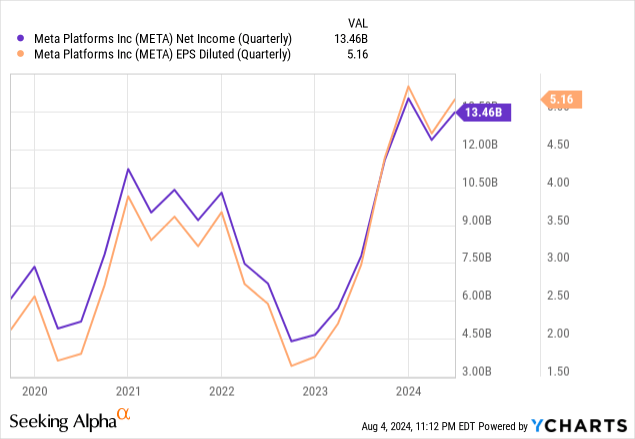

The company generated $13.465 billion in net income in the second quarter of 2024, up 73% year over year. Diluted earnings-per-share (“EPS”) were $5.16, beating analysts’ expectations by $0.40.

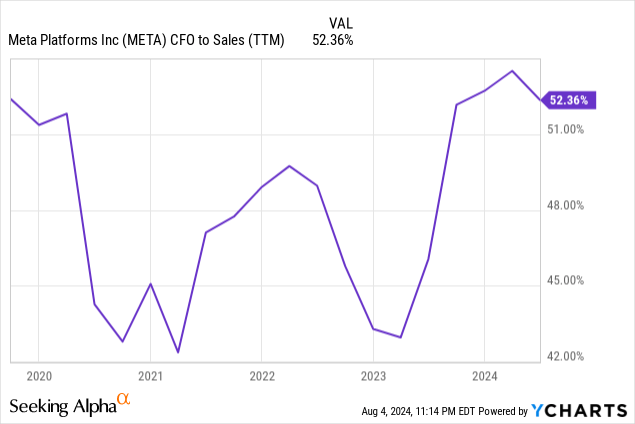

The following chart shows that Meta produced TTM cash flow from operations (“CFO”) to sales of 52.36%, meaning that for every $1.00 in sales, the company generates $0.52 in cash—impressive.

The company’s second-quarter 10-Q states, “We currently anticipate that our available funds and cash flow from operations and financing activities will be sufficient to meet our operational cash needs and fund our investments in infrastructure and AI initiatives, share repurchases and dividend payments for at least the next 12 months and thereafter for the foreseeable future.”

The following chart shows the company produced 49.54 billion in TTM FCF in the second quarter, which aligns with the growth of TTM CFO to $78.42 billion. As CapEx rose to $28.88 billion, notice that FCF has flattened out. The more Meta spends on CapEx, the more it will negatively impact valuations based on FCF.

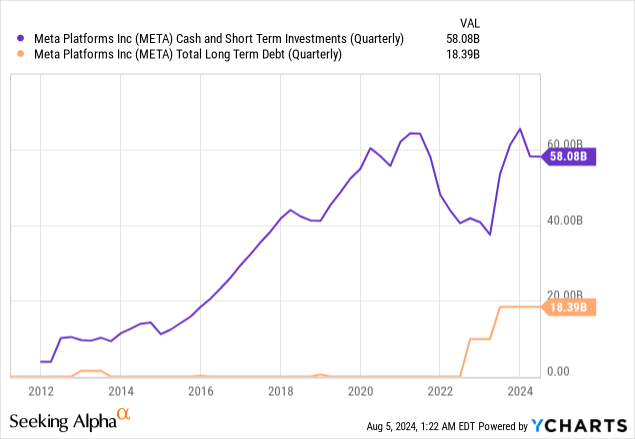

The following chart shows that at the end of June 2024, the company had $58.08 billion in cash and short-term investments against $18.39 billion in long-term debt in the form of senior unsecured notes. The company has a debt-to-EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) ratio of 0.50, meaning it can service its debt obligations using its EBITDA.

Let’s examine its valuation.

Valuation

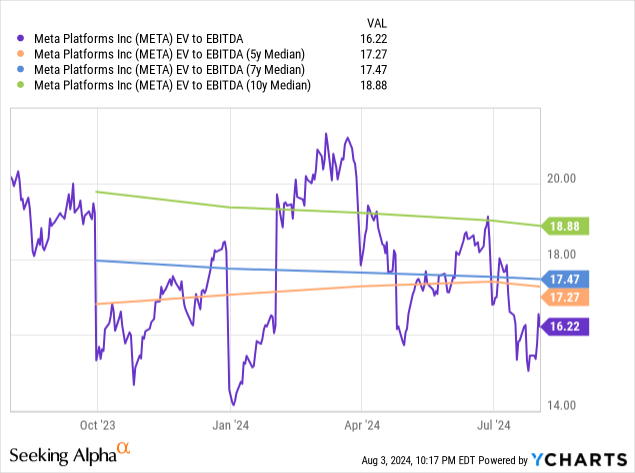

Meta’s EV-to-EBITDA ratio is 16.22, well below its median over the last five, seven, and ten years, suggesting undervaluation.

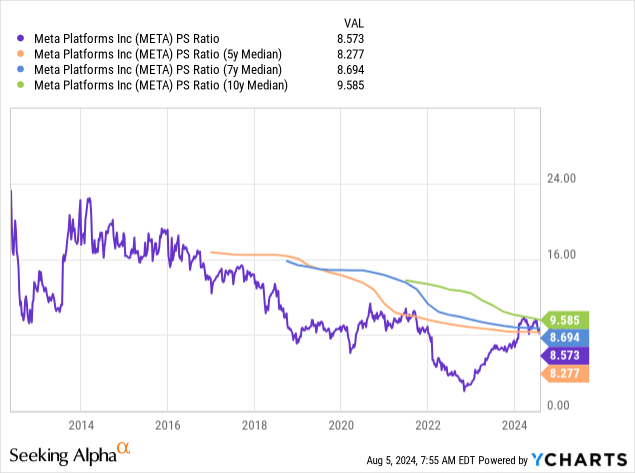

The following chart shows that Meta trades at a P/S ratio of 8.573, below its seven- and ten-year median but below its five-year median, suggesting the market fairly values the stock. Notice that in October 2023, when I first recommended it, the market undervalued Meta based on all three P/S ratio medians. The market may have wised up to Meta’s potential upside based on its P/S valuation.

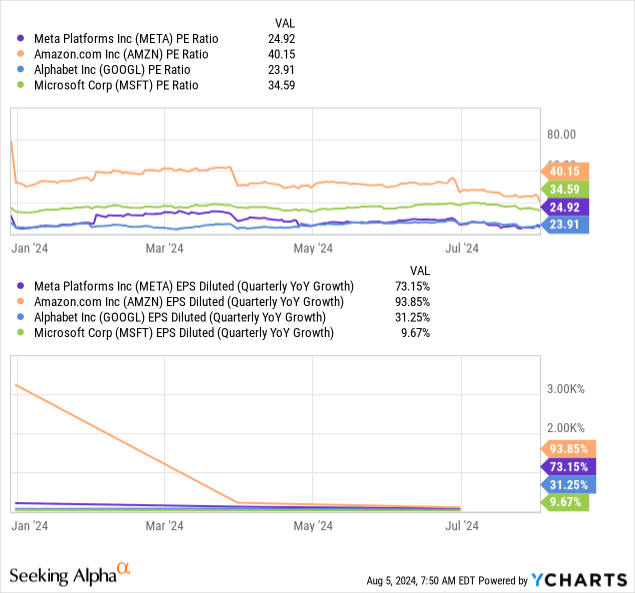

The following chart shows that on a price-to-earnings (P/E) basis, Meta trades at a similar P/E to Alphabet but far lower than Amazon (AMZN)and Microsoft. However, the quarterly EPS growth rates suggest investors may not value Meta’s past growth enough. The stock should have a P/E between Amazon and Microsoft. Suppose the market valued Meta at a P/E of 36; the stock price would be $519.48, up 6.4% above the August 2 closing price of $488.14. If the market valued Meta at a P/E of 38, the stock price would be $548.34, up 12.3%.

However, the market values stocks based on what it believes will happen. One simple rule for valuing a stock using future growth rates is that the market undervalues it when a company’s future EPS growth rate exceeds its forward P/E. Alternatively, the market overvalues a stock when a company’s future EPS growth rate is below its forward P/E. When using that valuation rule, the market undervalues 2024 EPS growth estimates but overvalues 2025, 2026, and 2027 EPS estimates.

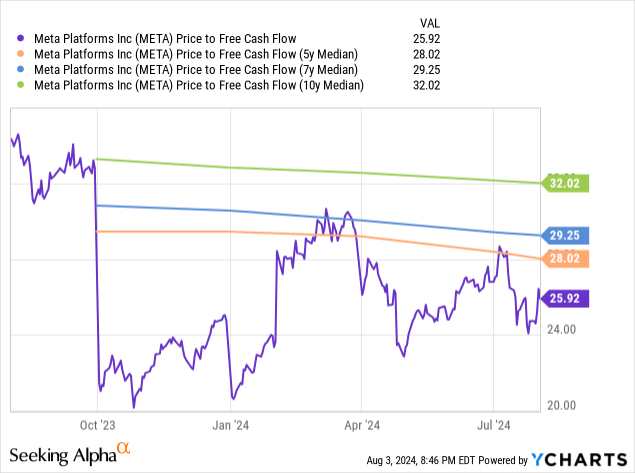

The following chart shows Meta’s price-to-FCF is 25.92, below its five-, seven-, and ten-year medians, suggesting undervaluation. If the stock traded at its seven-year median of 29.25, its price would be $552.53, up 13.19% above the August 2 closing price.

Let’s analyze the company’s reverse discount cash flow (“DCF”).

Meta Platforms Reverse DCF

|

The first quarter of 2024 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$49,540 |

| Terminal growth rate | 2.5% |

| Discount Rate | 10% |

| Years 1 – 10 growth rate | 10.1% |

| Current Stock Price (August 2, 2024 closing price) | $488.14 |

| Terminal FCF value | $7.536 billion |

| Discounted Terminal Value | $36.319 billion |

| TTM FCF margin | 33% |

According to one analyst, Meta should achieve revenue of $322.58 billion in 2033 at a compound annual growth rate of 9.11%, which would not be enough to justify the current stock price when the company needs to grow FCF annually at 10.1%. Additionally, the company is unlikely to maintain a 33% FCF margin over the next ten years. Analysts expect Meta will produce FCF margins of 29.7%, 28.87%, and 28.67% in 2024, 2025, and 2026, respectively.

If I assume that Meta will produce an average FCF margin of 29% over the next ten years, the company would need to generate revenue growth of 11.9% over the next ten years, which is feasible if its AI or metaverse investments pay off. If the company’s AI investments improve the company’s existing operations in advertising and e-commerce, the market may fairly value the stock at current prices. However, suppose Zuckerberg is correct, and the company’s strategy of using open-source AI allows it to vault over competing solutions. In that case, the market may vastly undervalue Meta’s future growth opportunities.

Risks

This company has numerous risks, the top two being government regulation and competition. Meta is the seventh-largest company in the world by market capitalization, currently at $1.17 trillion. It has a virtual monopoly in social media and is second behind Google in digital advertising. Thus, Meta is firmly in global regulators’ eyes concerning its practices, which range from possibly interfering with elections to potentially monopolistic practices against competitors, privacy issues, and, most recently, its use of AI. For instance, the company had to halt its rollout of AI features in Europe in July because of an uncertain regulatory landscape. If you decide to invest in this company, be aware that regulators in various countries could make rulings that could temporarily or permanently stunt the company’s growth.

Meta competes in several markets with some of the world’s largest companies, which have the resources to counter Meta’s initiatives. For instance, Snap (SNAP), TikTok, and Alphabet could potentially disrupt Meta in social media or advertising. Since Meta primarily generates revenue through advertising, anything that hurts its advertising revenue could cause the stock to sink rapidly.

Reasons I maintained its buy rating

In this article, I mainly discussed the company’s opportunity in AI because it has a greater probability of paying off than its metaverse opportunity. However, it’s still possible that the metaverse will pay off, too. Although Zuckerberg has made some past errors, he has a history of mainly being correct in his investments. If the metaverse opportunity pays off in addition to his AI investments, it’s trading at a very cheap valuation compared to its potential upside. If you are an aggressive growth investor, consider buying a few shares. I rate the stock a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.