Summary:

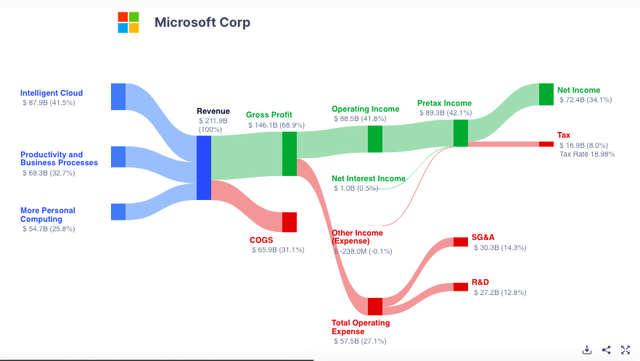

- Microsoft boasts strong financials with high profitability and a dominant position in cloud computing, particularly with Azure.

- The company’s heavy investment in Generative AI has the potential to revolutionize industries and boost revenue through its different platforms.

- Initiating coverage with a buy based on Microsoft’s healthy financials, strong management team, and leadership in AI and cloud. However, I find it fair valued but with high growth potential.

filadendron/E+ via Getty Images

Investment Thesis

Microsoft (NASDAQ:MSFT) boasts impressive financials, with high profitability and a strong balance sheet. Cloud computing, spearheaded by Azure, is a significant growth driver which has been growing at a rate of 31% YoY. I find that the company’s dominance positions it well to capitalize on this growth market. Additionally, MSFT heavily invests in Generative AI (GenAI) through its partnership with OpenAI. This technology has the potential to revolutionize various industries and boost Microsoft’s revenue. Integration of AI into existing products and services further enhances its competitive edge.

As you will read later in this report, I find that MSFT currently trades at a fair valuation which reflects investors’ expectations for sustained growth. MSFT, in my view, is one of the leading “Magnificent 7” for its diversified business model, large user base, and investments in future technologies.

Looking forward, I find the following Key Growth Pillars:

- AI at the forefront: MSFT continued investment in AI, specifically through its partnership with Open AI and integration of ChatGPT, positions it as a major player in the transformative technology. This has the potential to disrupt and redefine software, content creation, and various industries, creating significant revenue opportunities for Microsoft.

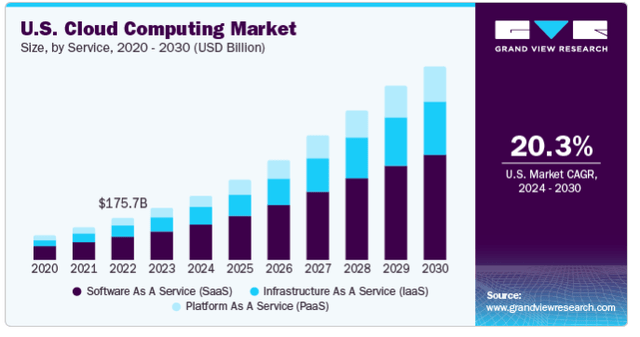

- Cloud Computing Leadership: with Azure, MSFT is a leader in cloud computing, a market anticipated to grow at 20% CAGR. Continued growth in Azure revenue is expected as more business migrate to cloud-based solutions.

- Diversified revenue streams: MSFT diversified business model across productivity software (Office), cloud computing, social (LinkedIn), digital advertising, cybersecurity, video games (XboX), and more fosters long-term stability and mitigates risk. This allows the company to invest in opportunities while its established products continue to generate revenue.

GrandViewResearch

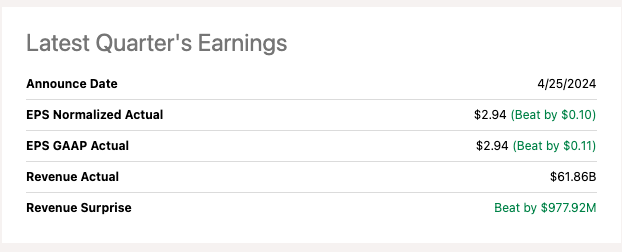

Microsoft reflected this growth with strong Q3 2024 Earnings which exceeded Wall Street expectations, with revenue growth of 17% YoY to $61.86 billion driven by strong performance in productivity, and cloud segment, both bolstered by AI integration. A further reflection of this growth trajectory is that MSFT surpassed AAPL to become the world’s most valuable company in 2024, reflecting confidence in its growth plans.

SeekingAlpha

In this article, I aim to find if MSFT is a solid candidate for my value with potential portfolio. To accomplish this, I will explore various factors like Management effectiveness, corporate strategy, and valuation metrics to determine if it’s aligned with this investment style.

Management Evaluation

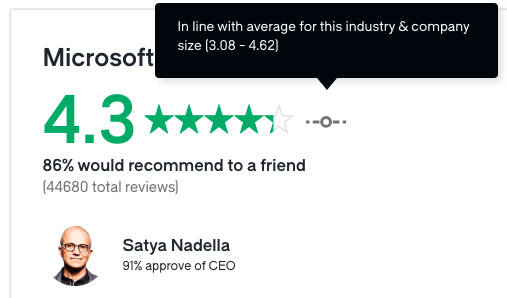

Satya Nadella, has a remarkably high approval rating on Glassdoor, so does MSFT as a company, he has been with Microsoft since 1992 and is currently the Chairman and CEO. This long tenure, along with his compensation of around 70% in stock awards, shows that he has a high alignment with the long-term success of Microsoft.

After the last earnings call, I find that Microsoft’s growth plan heavily involves Artificial Intelligence. Here are a few takeaways I found:

- Focus on Gen AI: through their partnership with OpenAI and integration of ChatGPT and focus on products like Copilot. He acknowledged that AI adoption will be faster than previous technology rollouts.

- AI on Azure: Nadella sees Azure as a key platform for AI with strong growth potential. He points to Azure becoming a standard protocol for AI projects and its use by established companies like ChatGPT. They also see opportunities in adjacent services like data storage and developer tools.

- AI Adoption Challenges: widespread AI adoption requires cultural change within organizations, including process simplification and automation. Microsoft sees itself as a partner in this transformation.

Glassdoor

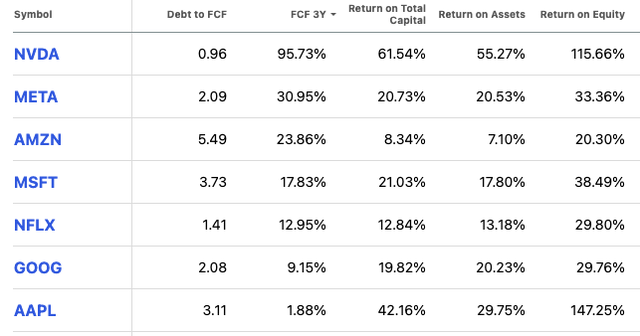

Amy Hood, Microsoft’s CFO since 2013, has overseen strong financial performance during her tenure. Under her leadership, MSFT has maintained a steady ROE and ROA, demonstrating efficient use of resources. However, I find that FCF growth hasn’t kept pace with some of the other “Magnificent 7”. I believe this is likely due to significant investments in AI, a strategic move for Microsoft’s future.

During the earnings call, she shed light on MSFT approach to AI spending. Amy emphasized the importance of investing in infrastructure to meet growing demand. She views AI as the “next wave of cloud infrastructure” and is confident that these investments will secure MSFT leadership position. On the challenges side, she acknowledged temporary capacity constraints on the Azure consumption side, Amy assures that Copilot capacity is not limited. There is a focus on optimizing resource allocation to ensure user growth for per-user businesses.

Overall, I find that MSFT’s leadership delivered a positive message on their growth plans, with a focus on AI and how it interjects with their Azure cloud offering. I find the company is financially sound and well positioned for the future. I have confidence in the management due to the combination of tenure with the company and experience in the industry and due to their success in the last years, I’m inclined to give management an “Exceeds Expectations”.

SeekingAlpha

Corporate Strategy

I find that Microsoft’s current growth strategy hinges on two pillars:

- Cloud dominance: They aim to solidify their position as a leader in cloud computing with Azure. This includes attracting new enterprise customers with established products like Office 365, aggressive pricing strategies, and a focus on scalability and security.

- AI leadership: MSFT heavily invests in AI (Gen AI in particular) and integrates it across various products (Azure, Copilot). This not only enhances existing offerings but positions them as a frontrunner in the transformative potential of AI for businesses.

By focusing on both established cloud services and cutting-edge AI solutions, MSFT seeks to achieve sustainable growth across its business segments.

Gurufocus

Here is a table I created with key differentiators between MSFT and some companies in the industry offering similar services:

|

Microsoft |

Amazon (AMZN) |

Google (GOOGL) |

Alibaba (BABA) |

|

|

Cloud Market Share |

25% |

31% |

11% |

4% |

|

Corporate Growth Strategy |

Focus on enterprise customers, leverage existing office dominance, strong emphasis on AI integration across products (Azure, Copilot) |

Dominate infrastructure as a service (IaaS) aggressive pricing, focus on scalability and flexibility. |

Attract innovative startups with competitive pricing, leverage AI and machine learning (ML) expertise from Google. |

Capture Asian market share, strong partnerships with Chinese businesses, government support. |

|

Advantages |

Strong brand recognition established partner ecosystem, robust security features, wide range of productivity and developer tools. |

Market leader in IaaS, highly scalable architecture, diverse range of cloud services |

Expertise in AI/ML, competitive pricing, strong containerization technology (Kubernetes) |

Dominant player in China, cost effective solutions, focus on vertical cloud offerings. |

|

Disadvantages |

Less flexible pricing compared to some competitors, slower innovation in some areas. |

Reliant on IaaS revenue, potential for vendor lock-in privacy concerns. |

Less established enterprise reputation compared to MSFT, smaller partner ecosystem |

Limited global reach outside of Asia, potential for data security concerns due to government ties. |

Source: From companies’ website, presentations, Seeking Alpha, Bloomberg, Statista

Valuation

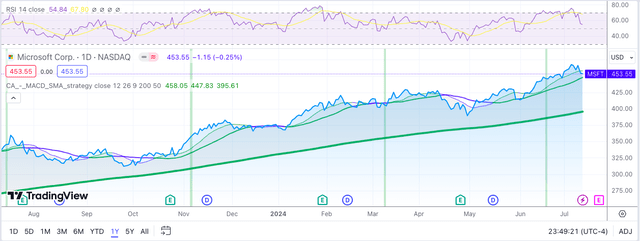

MSFT currently trades at around $453.55 The stock is up around 13% since its last reported earnings at the end of April, and it’s been hitting All-time highs. The stock is also up around 21.05% TR YTD, around 330 bps higher than the S&P 500 return.

Now, to assess its value, I employed an 11% discount rate, this rate reflects the minimum return an investor expects to receive for their investments. Here, I am using a 5% risk free rate, combined with the additional market risk premium for holding stocks versus risk free investments, I’m using 6% for this risk premium. While this could be further refined, lower or higher, I’m using it as a starting point only to get a gauge using unbiased market expectations.

Then, using a simple 15 year + 10 year two staged DCF model, I reversed the formula to solve for the high-growth rate, that is the growth in the first stage.

To achieve this, I assumed a terminal growth rate of 4% in the second stage. Predicting growth beyond a 15-year horizon is challenging, but in my experience, a 4% rate reflects a more sustainable long-term trajectory for mature companies that should be close to historical GDP growth. Again, these assumptions can be higher or lower, but from my experience I will use a 4% rate as a base case scenario due to the nature of their business. The formula used is:

$453.55 = (sum^15 EPS (1 + “X”) / 1+r) + TV (sum^10 EPS (1+g) / (1+r))

Solving for x = 16.7%

This suggests that the market currently prices MSFT EPS to grow at 16.7%. According to Seeking Alpha analyst consensus EPS over the next 3-5 years CAGR at 13.72%. Therefore, for me, it seems that MSFT is fair valued on a fundamental basis.

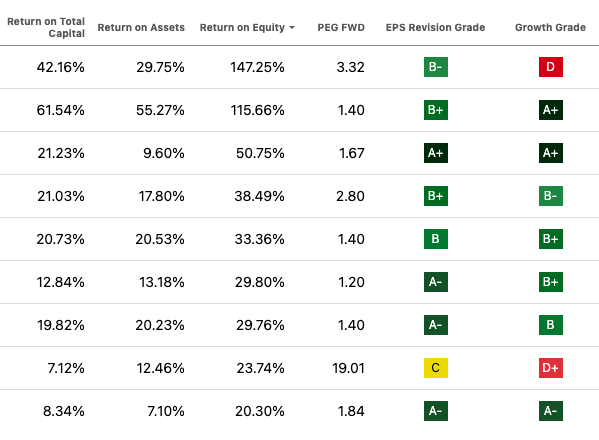

Further, I’ll also look at their forward price earnings to growth (PEG) ratio which sits at 2.80x -versus a sector median of 2.05x- implying the stock price is slightly above the industry. However, when compared to a select group of companies, highlighted below, that are considered leaders in the industry, the company still looks fair valued.

SeekingAlpha

However, I believe MSFT still has a lot of potential and its already capitalizing on AI through all their offerings, cloud solutions, and investments (Open AI). Therefore, I believe its valuation deserves a premium and not merely a fair valuation. Therefore, I am inclined to start coverage of MSFT with a buy.

Technical Action

MSFT has been on a positive momentum since they last reported earnings. The stock has been hitting all-time highs ever since. However, the stock looks fair valued, on a technical basis, with its 1-year average RSI in neutral territory at 54.84 and below its 14-day moving average of 67, indicating the stock price might be changing trends.

TradingView

I’m placing the resistance level for MSFT at its all-time high of $468.35 and support level 10% lower, which is close to the price where it was trading before its previous earning of around $400. Company earnings are July 25.

Takeaway

Microsoft offers a compelling long-term investment opportunity for my value with potential portfolio. Their financial strength, with consistent profitability and a healthy balance sheet, inspires confidence. Azure positions them as a leader in the booming cloud computing market. Furthermore, Microsoft is at the forefront of AI through partnerships like Open AI, which has the potential to disrupt industries and create new revenue streams. Their diversified business model, encompassing software, cloud, gaming, and advertising, mitigate risk. While I consider MSFT fair valued, I believe the stock deserves a premium. Microsoft’s focus on innovation, particularly in AI, positions them for long-term success. Therefore, I am starting my coverage with a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My analysis specializes in identifying companies that are experiencing growth at a reasonable price or value companies with potential. Rating systems don't consider time horizons, risk profiles, or investment strategies. My articles aim to inform, not to make decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.