Summary:

- Home Depot’s long-term growth potential is supported by its focus on expanding the PRO market and adapting to housing market challenges.

- Despite the impressive past performance, the current valuation is high, leading me to hold shares and collect dividends while waiting for a better buying opportunity.

- The company’s strategic investments in customer experience, PRO capabilities, and supply chain resilience are key to maintaining its competitive edge.

phillyskater

Introduction

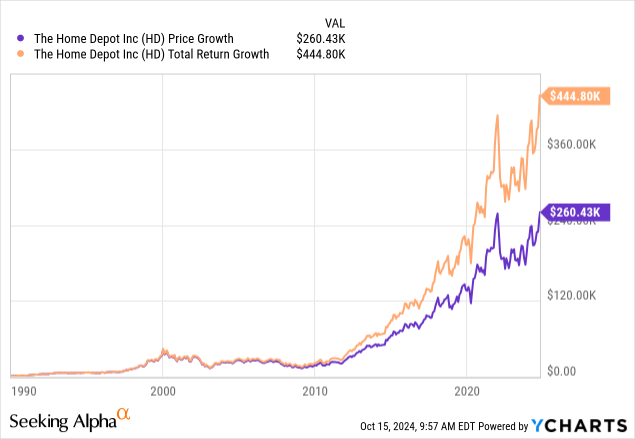

$260,430.

That’s how much money you would have if you had invested $1,000 in The Home Depot, Inc. (NYSE:HD) on the first trading day of 1990 and wasted every single penny of the dividends you received along the way.

If you had reinvested your dividends, you would now be sitting on $444,800, enough to afford a median house in the United States ($360,000) and a very nice car for more than $80,000.

I’m bringing this up because Home Depot has become one of the biggest American success stories, growing into the biggest DIY/home improvement retailer, and making countless Americans a lot of money.

The company is also one of the first five stocks I bought for my dividend portfolio in 2020 when I decided to get serious about dividend investing.

That decision was easy, as the company comes with so many characteristics that make it a worthy long-term investment:

- It provides investors with consumer exposure. Consumption accounts for almost 70% of U.S. GDP.

- Because of its home improvement products, the company also provides investors with housing exposure. Housing is critical, as we all need a place to live. The older homes get, the higher the demand for products sold by Home Depot. Also, housing accounts for almost 20% of U.S. GDP.

- Investors get to buy consumer exposure without having to bet on the next consumer trend. While HD has competitors, it sells products that are very unlikely to be disrupted by new technologies. Also, none of its products rely on viral trends or other consumer preferences. It is very straightforward in consumer retail.

- The company is accelerating its investments to penetrate the PRO market, a segment I am very bullish on, as the average age of a commercial building is 55 years.

Morningstar even assigns a “wide moat” rating, making Home Depot one of the very few consumer stocks with a wide moat – most do not even have a small moat.

We assign Home Depot a wide economic moat. As the largest global home improvement retailer, we believe Home Depot possesses a competitive edge owing to its brand intangible assets and cost advantage. Over the past 10 years, Home Depot’s sales growth has outpaced the building materials and garden equipment and supplies dealer industry’s average growth of 5.3% by 170 basis points annually (based on the US Census Bureau data), an indication of the brand’s ongoing relevance. – Morningstar

Hence, the title of my most recent article was “DIY Your Way TO Retirement: Why Home Depot Remains A Go-To Dividend Pick,” published roughly three months ago on July 22.

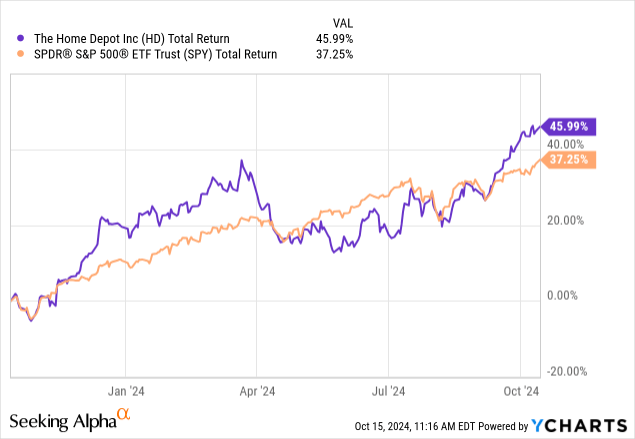

Since then, shares have returned 16%, beating the 5% return of the S&P 500 by a substantial margin.

In this article, I’ll update my thesis, including new economic developments, the company’s strategic updates on its growth plans, and the risk/reward after such an impressive surge in a rather short time. I’ll also tell you which mortgage rate levels we need to watch when it comes to assessing HD’s growth potential.

So, as we have a lot to discuss, let’s get right to it!

Finding Growth In A Mixed Environment

The impressive performance of Home Depot in the past is great. However, what matters is what happens next. Although Home Depot has no influence on consumer health, it can focus on its own actions.

The company’s core objectives are very straightforward:

- Growing market share in the PRO and consumer segments.

- Creating exceptional shareholder value.

It aims to do this by delivering good customer experiences, developing capabilities that set it apart, and always offering competitive prices.

To fuel growth, it builds on these measures by improving the customer experience, investing in PRO capabilities, and opening new stores.

So far, so good.

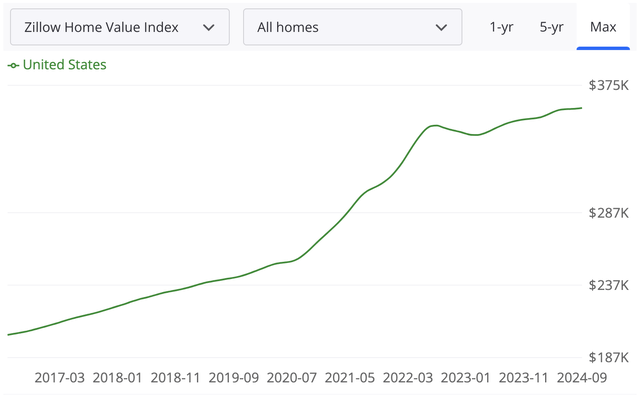

Although some headwinds pressure its growth, it currently enjoys benefits from the wealth effect. During Goldman Sachs’s Annual Global Retailing Conference last month, the company noted that the 50% surge in home prices since 2019 added roughly $18 trillion in incremental value to the housing market.

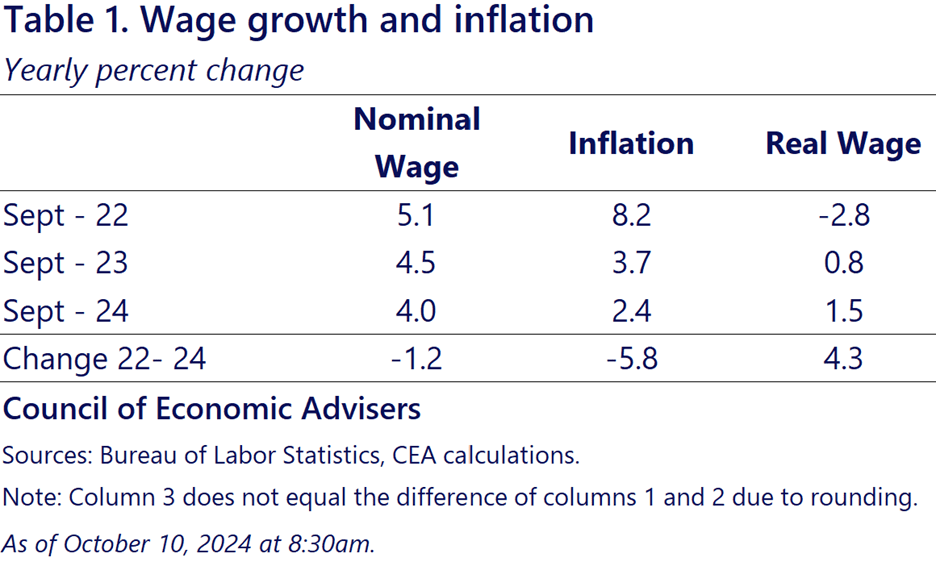

As most Home Depot customers are homeowners with stable jobs, the company also benefitted from the surge in real wage growth in recent years.

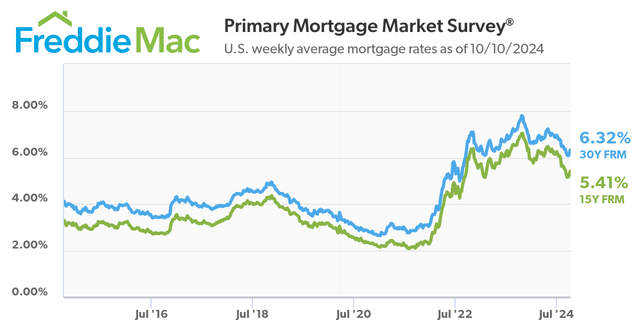

Based on Bureau of Labor Statistics numbers, we see that since September 2022, nominal wage growth has declined by 120 basis points to 4.0%. Inflation has declined by 580 basis points to 2.4%. This provides the consumer with significant real wage growth this year.

The White House

At this point, you are probably thinking the same thing I thought when I wrote this. If the environment is so good, why are Home Depot’s numbers rather weak?

In 2Q24:

- Comparable store sales declined by 3.3%. In the U.S. comparable store sales were down 3.6%.

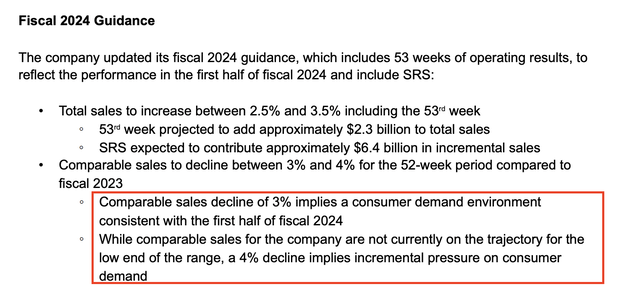

- It guided to full-year sales growth of 2.5% to 3.5%.

- It sees 3% lower comparable store sales on a full-year basis.

So, what’s going wrong?

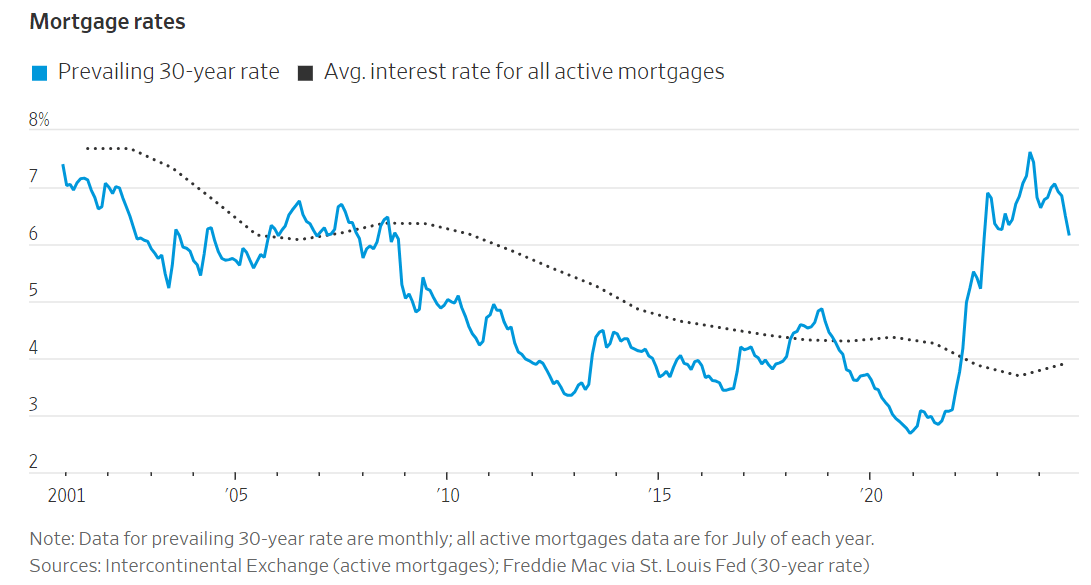

The problem is that elevated home equity benefits are being offset by the impact of elevated rates on the housing market. Because of elevated rates, people are not selling their homes.

People who got cheap funding before (or during) the pandemic are unwilling to sell, which keeps the housing supply limited. This is one of the key reasons why the Fed failed to lower housing inflation by hiking rates.

A Wealth Of Common Sense

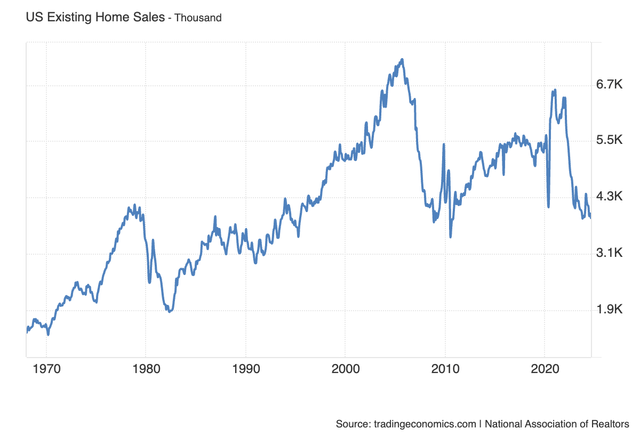

According to Home Depot, roughly 4-5% of homes are sold each year. That’s five to seven million homes. That’s a big deal.

- Homes that are sold create much more demand for companies like Home Depot, as people who move usually spend “a lot of money” on home improvement and refurbishing.

- Because of the Fed’s rate hikes, the number of annual home sales dropped by roughly 1.5 million.

- If we assume $10,000 in incremental revenue per unit, the decline erases roughly $15 billion off the addressable market.

While the company is obviously painting with a very broad brush when it comes to these numbers, it explains perfectly why a high-flying stock like Home Depot suddenly reports weaker sales despite consumer and home equity tailwinds.

Luckily, the Fed made clear that it is willing to keep lowering rates. This is what rating agency Fitch wrote after the Fed’s recent 50 basis points cut:

We now expect the Fed to cut rates by 25bp at both the November and December meetings, followed by four more 25bp cuts through 2025, with rates being lowered at every other FOMC meeting next year.

Because the market expected the Fed to cut rates, Home Depot’s stock price uptrend started well before the Fed made it official. Over the past twelve months, HD has returned 46%, making it one of the best years since the Great Financial Crisis.

While it needs to be seen how bullish the impact of current rate cuts is, the company is adjusting its focus toward smaller repair and maintenance projects.

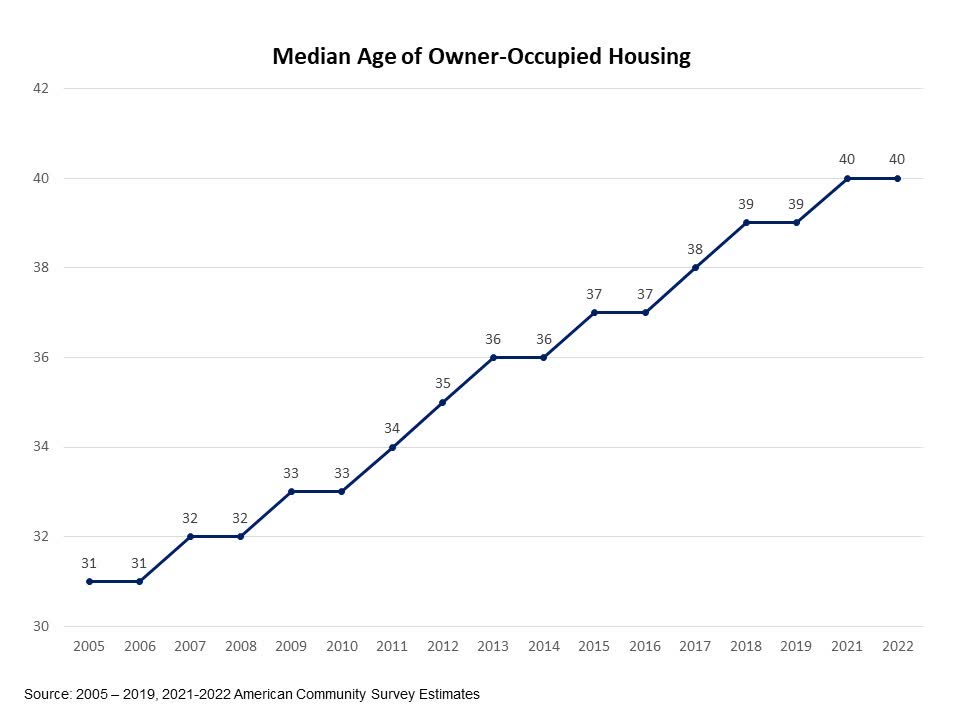

These so-called “break-fix” projects are basic repairs that are not dependent on the state of the housing market – at least to a lesser extent. Although I believe it is fair to say these measures will not entirely offset headwinds from lower housing sales, the focus on maintenance is very important, as the average age of residential homes in America is now roughly 40 years.

American Community Survey

When adding the elevated average age of commercial buildings, I truly believe we are in the golden age of building maintenance, which is one of the reasons why I have been a gradual buyer of Home Depot, as it increasingly services PRO customers. These customers are an extension of homeowners, as they work on behalf of their clients.

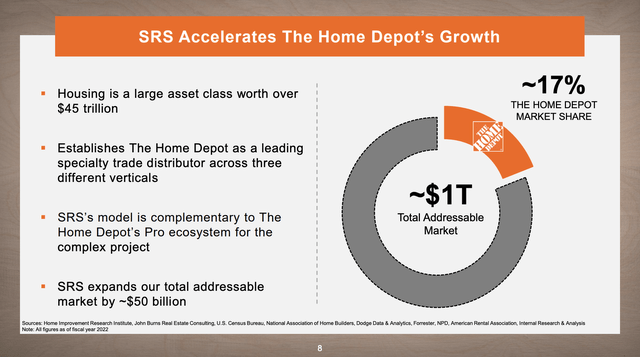

These measures are expected to boost the company’s market share in what is estimated to be a $1 trillion addressable market, which is currently still below 20%.

In order to attract more PRO customers, the company is expanding using three key measures:

- Sales Force: HD establishes a skilled field sales team that can provide tailored solutions and support strong relationships with professional customers. After all, it’s all about creating longer-term relationships that allow PRO customers to rely on a resilient supply of critical products.

- Order Management: The company is implementing systems that allow for complex orders to be managed efficiently. This supports supply resilience.

- Delivery Solutions: Building strong relationships is impossible without efficient ways to deliver supplies to customers.

These measures also include the takeover of SRS Distribution. A few months ago, it completed the multi-billion dollar takeover of the company that has perfected distribution channels to PRO customers. According to Home Depot, this deal expanded its addressable market by $50 billion.

The giant is also improving its real estate footprint, establishing more than 150 distribution facilities in the United States to accelerate store replenishment, streamlining delivery operations by moving away from third-party logistics, and creating the ability to directly serve job sites.

In general, Home Depot has had fantastic supply chain operations for many decades. It is truly a leader when it comes to supply resilience.

Despite the challenges faced by the global supply chain in fiscal 2021, Home Depot’s supply chain investments permitted it to continue to operate effectively and meet customers’ needs. Home Depot centrally forecasts and replenishes the vast majority of its store products through sophisticated inventory management systems and utilizes its distribution centers to serve both stores’ and customers’ needs.

[…] In addition to its distribution and fulfillment centers, Home Depot leverages its stores as a network of convenient customer pickup, return, and delivery fulfillment locations. Home Depot’s premium real estate footprint provides a distinct structural and competitive advantage. – The Strategy Story

So, what does this mean for shareholders?

Finding Shareholder Value

Thankfully, the decline in longer-duration bonds has caused mortgage rates to fall. 30-year fixed-rate mortgages currently yield 6.3%. Home Depot believes that 6% rates are a trigger for higher housing demand, with a lag of roughly two to three months.

This is what the company said with regard to higher demand during the aforementioned conference:

So we’re now 6.5%, 6.4-ish, rates have come down 50-odd basis points the last several weeks in expectation of this cut. But this won’t be an immediate thing. When you think of buy homes, get the mortgage, close in 2, or 3 months, move into the home, hang some pictures, and figure out what project you might want to do. There’s definitely a lag for projects when you buy a new home. – Home Depot

The bad news is that analysts aren’t very upbeat yet.

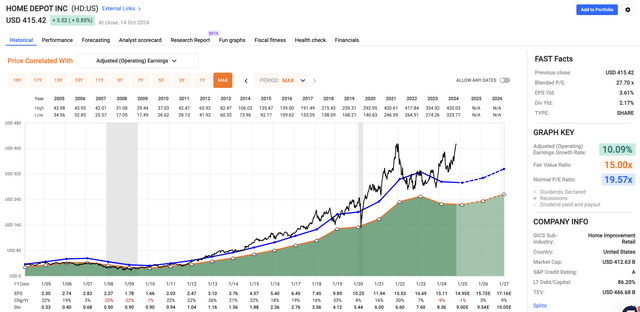

Using the latest FactSet data in the chart below, analysts see a path to 5% and 9% EPS growth in 2025 and 2026, respectively. This would make the recovery the weakest period of growth since the Great Financial Crisis.

Moreover, because of its recent rally, a lot of growth has been priced in. Currently, HD trades at 27.7x earnings, roughly eight points above its long-term average.

Although I would “never” sell HD because of an elevated P/E ratio, I do not believe rates will come down so quickly that this valuation is buyable.

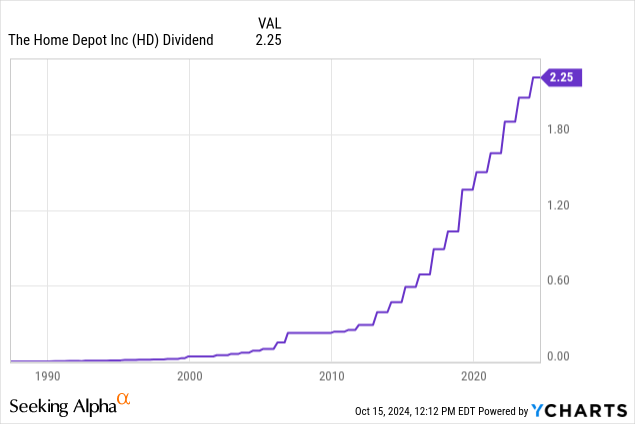

So, while I wait for prices to potentially come down a bit, I’ll keep collecting its dividend.

Currently yielding 2.2%, the dividend has a healthy payout ratio of 60% and a five-year CAGR of 11.6%, making it one of the few >2% dividends with consistently elevated growth. It’s also protected by an A-rated balance sheet.

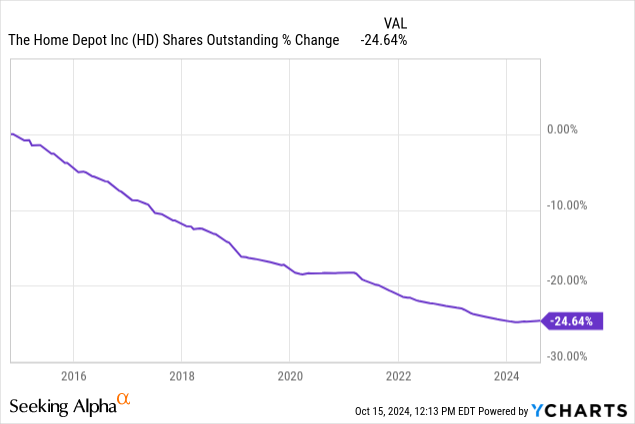

It also has bought back a quarter of its shares over the past ten years, with a pause during the pandemic and a slowdown since comparable store sales started to contract in recent years.

While I will give the stock a Hold rating, I’m looking for buying opportunities, as I believe Home Depot remains one of the best dividend growth stocks on the market. I just cannot get myself to buy more at current prices.

Takeaway

Home Depot has proven itself to be a powerhouse in the home improvement market, with a strong track record of delivering impressive shareholder value.

While the current valuation seems somewhat stretched after an impressive rally, I’m not selling.

Instead, I’m holding my shares and collecting its dividend, which has consistently risen at a very attractive rate.

Meanwhile, the company’s focus on expanding its PRO market and adapting to the housing market’s challenges supports its long-term growth potential.

However, given the stock’s current price, I’ll be patient and wait for a better buying opportunity before adding to my position.

Going forward, the biggest risk is a “higher-for-longer” environment, which could keep a lid on housing-related consumer spending growth. The biggest bull case is a “no-landing” scenario where the Fed keeps lowering rates, supported by easing inflation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.