Summary:

- Despite a challenging operating environment, IIPR continues to post steady rental revenue and AFFO growth, supported by a lean debt profile and effective management of tenant defaults.

- IIPR has a solid history of dividend growth with a conservative payout ratio, offering investors an appealing income opportunity even as the yield has come down from its highs.

- As interest rates ease, IIPR’s lean debt structure and sector-wide improved sentiment position the stock for potential price appreciation.

- With more U.S. states legalizing cannabis and IIPR’s triple-net leases providing organic rent growth, the company is well-positioned to capitalize on the industry’s future growth trajectory.

Magnifical Productions

I have been bullish on Innovative Industrial Properties (NYSE:IIPR) for quite some time, even during the company’s prolonged underperformance in 2022. The market had its reasons for being cautious back then, as investors were wary about putting their money into a cannabis-focused REIT in the face of interest rate hikes.

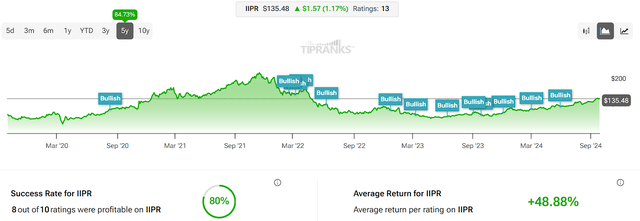

My IIPR Ratings History (TipRanks)

The fear at the time was that IIPR’s tenants, who are legal cannabis operators, may struggle in an environment with higher financing costs. This skepticism wasn’t just about interest rates; it stemmed from the fact that many of these tenants are not traditionally creditworthy.

The cannabis industry, though booming in some aspects, is filled with financial challenges. Many legal cannabis growers, despite growing demand, operate at a loss. This is due to regulatory hurdles, banking restraints, and an oversupply in some states, which have created a volatile landscape for these businesses.

Of course, this becomes a risk for IIPR, whose business model relies on these tenants paying rent. Specifically, its portfolio comprises specialized industrial properties leased to state-licensed cannabis operators through long-term, triple-net lease agreements, where the tenant bears almost all operational costs, including maintenance and taxes. However, even with these favorable lease structures, the risk remains that tenants might not survive, and some have indeed defaulted.

Take Kings Garden, for example, one of IIPR’s larger tenants, which underwent financial troubles in 2022. Kings Garden’s default challenged IIPR. Still, IIPR’s management handled the situation nicely. To elaborate, instead of allowing this default to have a significant negative impact, management took swift action by securing deposits from Kings Garden and working on a structured settlement.

They repossessed the properties, initiated legal proceedings, and negotiated a confidential, contingent settlement agreement. IIPR managed to re-lease some of these properties, and last year, they successfully sold the portfolio of four properties in California that had been leased to Kings Garden affiliates for $16.2 million.

Challenging Operating Environment, Yet Solid Results

Throughout 2024, IIPR’s performance continues to be shaped by a less-than-ideal operating environment. Still, its results continue to come in solid quarter after quarter. In Q2, the company posted rental revenues of $79.3 million, a modest but steady increase from $75.9 million compared to last year.

In addition, AFFO came in at $1.44 per share for the quarter, which is stable year-over-year despite most REITs experiencing significant pressure in their profitability due to notably higher interest expenses. IIPR’s interest expenses, in fact, marginally declined in the quarter primarily due to the full repayment of its 3.75% Exchangeable Senior Notes.

Today, IIPR’s debt profile remains a strength. Its total debt consists of a single $297.1 million note due in 2026, leaving the company well-positioned with manageable leverage and considerable financial flexibility.

The Dividend Remains a Strong Catalyst To Buy IIPR Stock

In my earlier updates, I highlighted IIPR’s dividend as a significant reason for being bullish on the stock. I encouraged investors to consider the stock when the dividend yield was still in the double digits. While shares have rallied since then, and the yield is now down to 5.6%, I believe that IIPR still presents an attractive income opportunity to lock in today.

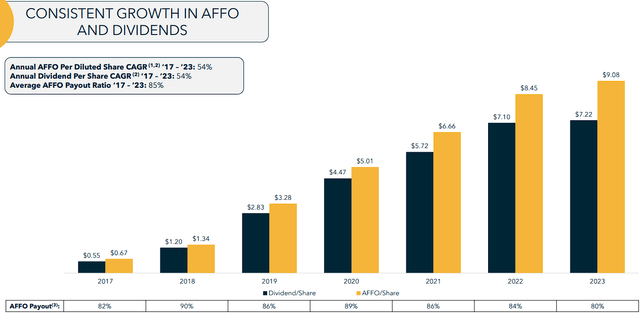

To begin with, it’s important to note that IIPR has built a solid track record of dividend growth, boasting seven consecutive annual increases (i.e., since its IPO). On top of that, the company’s payout ratio remains conservative by REIT standards. Last year, IIPR generated an AFFO of $9.08 per share, comfortably surpassing its dividend of $7.22 per share.

IIPR’s AFFO/Share and DPS history (Q2 Investor Presentation)

With AFFO per share at $4.50 for the first half of the year, consistent with last year’s $4.51, I expect a similar result for the full year, which effortlessly covers the current dividend run rate of $7.60. AFFO growth should resume next year (more on that in a minute), strengthening the potential for continued robust dividend increases.

The Valuation is Attractive as Interest Rates Ease

To elaborate further on why I believe IIPR stock remains attractive at today’s price levels, note that we head into what many expect to be a period of lower interest rates. With shares trading under 15 times last (and this) year’s AFFO per share, a valuation expansion seems possible. Historically, rising interest rates are a headwind for REITs, as increased borrowing costs can compress profitability and make alternative income investments more attractive.

However, with the possibility of further rate cuts on the horizon following the most recent 50 bps cut, the entire REIT sector, including IIPR, should benefit. While IIPR’s AFFO/share won’t necessarily rise directly, as the company has a lean debt profile, as I mentioned earlier, the stock price is likely to keep rising for two reasons: improved sentiment across the sector, and investors hunting for income chasing IIPR’s above-average yield along with its dividend growth prospects.

IIPR’s Growth Prospects Remain Robust

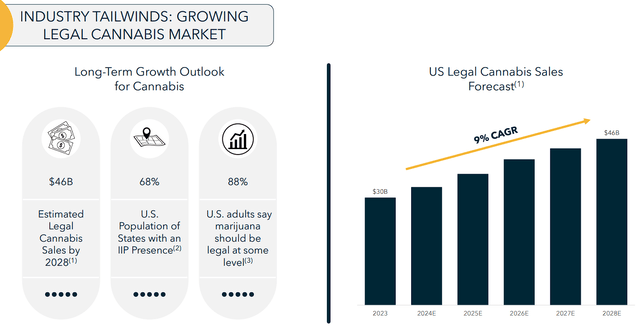

I previously noted that IIPR’s growth prospects remain robust. To elaborate on that, I believe they remain highly promising after this year’s AFFO per share lag. I think this is true as more U.S. states move to legalize both medical and recreational cannabis. BDSA’s Legal Cannabis Market Forecast shows that the cannabis industry is expected to grow at a compound annual growth rate (OTC:CAGR) of 9% over the next five years. With IIPR being the leading REIT in the space and having exceptional access to financing compared to its peers, it should be able to capitalize on this trend successfully.

IIPR’s Industry Tailwinds (Q2 Investor Presentation)

Furthermore, IIPR has built-in organic growth drivers through its long-term, triple-net leases, which feature contractual annual rent escalations. These escalations, typically ranging from 2.5% to 4%, provide IIPR with a reliable source of income growth regardless of broader market conditions. For these reasons, I remain confident in the stock’s investment case even after its quite extended rally from 2022’s lows.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Wheel of FORTUNE is a most comprehensive service, covering all asset-classes: common stocks, preferred shares, bonds, options, currencies, commodities, ETFs, and CEFs.

- WoF is 1 out-of-only 3 services with 50+ reviews that have a 5* rating.

- WoF is 1 out-of-only 7 services with 25+ reviews that have a 5* rating.

- Single, uncorrelated, trading ideas [ >250/year, on average].

- Managed portfolios, aim at outperforming SPY on a risk-adjusted basis.