Summary:

- Upwork and Fiverr have seen steep declines due to concerns over slowing revenue growth, partly driven by AI replacing some freelancing services.

- While AI has reduced demand for simple tasks like logo design, it has boosted freelancer productivity and created new service opportunities.

- Both platforms are attractively priced, but Fiverr stands out with better engagement metrics, higher gross margins, and strong app ratings.

- Both companies are trading at historically low valuations, offering potential upside, with Fiverr slightly more appealing due to its positioning.

Alistair Berg/DigitalVision via Getty Images

The manic-depressive Mr. Market does not always price stocks the way an appraiser or a private buyer would value a business. Instead, when stocks are going up, he happily pays more than their objective value; and, when they are going down, he is desperate to dump them for less than their true worth. – Benjamin Graham

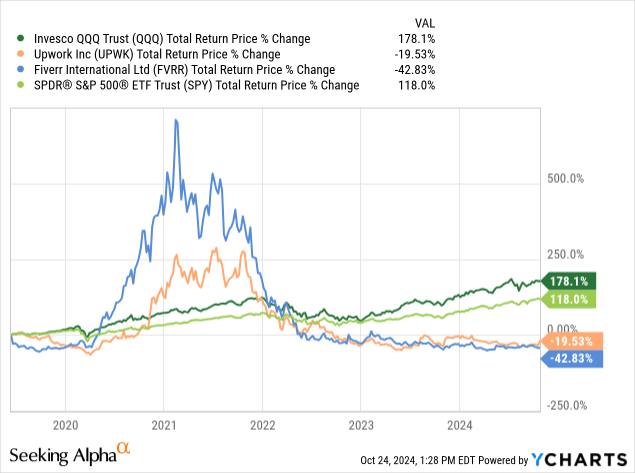

Most seasoned investors are well aware that the stock market can swing from extreme excitement to acute fear in a relatively short period of time. Still, it is rare to see a swing of the magnitude that gig-economy platforms Upwork (NASDAQ:UPWK) and Fiverr (NYSE:FVRR) have experienced. We have been following both companies as we appreciate the network effect moat that two-sided marketplaces tend to develop, but we warned that both companies appeared expensive despite the hyper growth they were delivering. In any case, the companies went from massively outperforming the S&P 500 Index (SPY) and the popular Invesco QQQ Trust (QQQ), to painfully underperforming market benchmarks.

One of the reasons that the market is in panic mode is that revenue growth rates have plunged. We expected growth rates to decelerate, but not as fast as they have declined. It is believed that some of the services typically offered on these platforms have been replaced by artificial intelligence (AI), such as logo designs, language translations, and simple data analysis. Still, even with the AI headwind both platforms are still growing, and expectations are extremely low at this point. When investors become extremely pessimistic, even moderately good news can cause the share price to rise substantially. This recently happened with Upwork after it announced that it was increasing its Q3 revenue guidance to $194 million, up from the original range of $179 million to $184 million. The company also shared some cost reduction initiatives, and shares jumped by more than 26%.

While AI will no doubt reduce demand for certain freelancing services, it has been increasing demand for others, and has made some Freelancers more productive. According to an Upwork presentation, Freelancers on its platform are using AI tools at five times the rate of the average corporate employee. Freelancers leveraging AI on average also generate higher earnings per hour. It is also important to remember that the majority of freelancing is still happening offline, as Fiverr reminds investors in a recent investor presentation, which means these platforms still have an enormous opportunity ahead.

Two-sided Marketplaces

We appreciate businesses with network effects competitive moats. That is, that they become more useful for customers as more people join the platform. These companies tend to have good economics, and in some cases can become natural monopolies or duopolies. A good example is Airbnb (ABNB) with short-term rentals, and Uber (UBER) and Lyft (LYFT) for ride-sharing. Two-sided marketplaces also create powerful flywheel effects that drive further growth. In the case of Upwork and Fiverr, as more Freelancers join, it becomes more likely that companies will find the service they are looking for, and as more companies join, Freelancers are more likely to get hired.

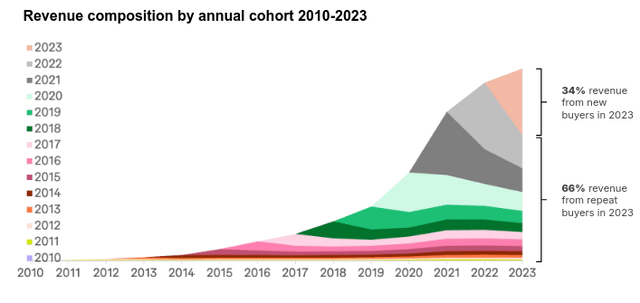

At this point, it seems both Upwork and Fiverr have attained the critical mass necessary to have healthy ecosystems, though they have specialized in different segments. Upwork tends to favor longer lasting work relationships between Freelancers and companies, while Fiverr specializes in what it calls “service-as-a-product” which tend to be better defined but shorter duration services. This is reflected in their corresponding customer numbers, with Upwork generating more revenue despite only having about 868,000 active customers, while Fiverr recently disclosed 3.9 million active buyers. Both companies benefit from repeat purchases, with Fiverr sharing cohort behavior in its investor presentation. For example, Fiverr generated roughly two thirds of its revenue in 2023 from repeat buyers.

Fiverr and Upwork share some of the same growth levers to continue expanding. These include international expansion, including to non-English-speaking countries, adding new service categories, continuing to add buyers and Freelancers to the platform, and offering ads for Freelancers to promote their services. Ads have been one of the fastest growing revenue streams for these companies, with very high incremental profit margins. This has also been reflected in the increasing take-rate that the companies have been reporting. We have mixed-feeling about monetizing visibility on their platforms, as it can improve profit margins and give new Freelancers a way to get their initial projects. At the same time, if the companies don’t balance paid promotions with giving visibility to the highest rated or best-fit Freelancers, this can deteriorate the overall customer experience.

Website & App Rankings

Fiverr has a higher-ranking website and more visits compared to Upwork according to SimilarWeb. Fiverr has approximately 46 million monthly visits, compared to Upwork’s 39 million. Fiverr’s visitors are more engaged as well, with an average visit duration of 27 minutes compared to 13 minutes for Upwork. Fiverr also boasts higher ratings in the app stores, with an average rating of 4.4 in the Play store and 4.9 for iOS, compared to Upwork’s 4.0 and 4.6 stars respectively.

Financials

Fiverr and Upwork have a good amount of fixed costs in relation to costs to maintain the platforms updated and working correctly, as well as its management and administrative structure. While it also has some variable costs that scale with growth like customer service, both companies have healthy operating leverage. As they grow, we would expect to see their operating margins improve as a result of this operating leverage, as well as the benefits of repeat customers that go directly to the website instead of clicking an ad.

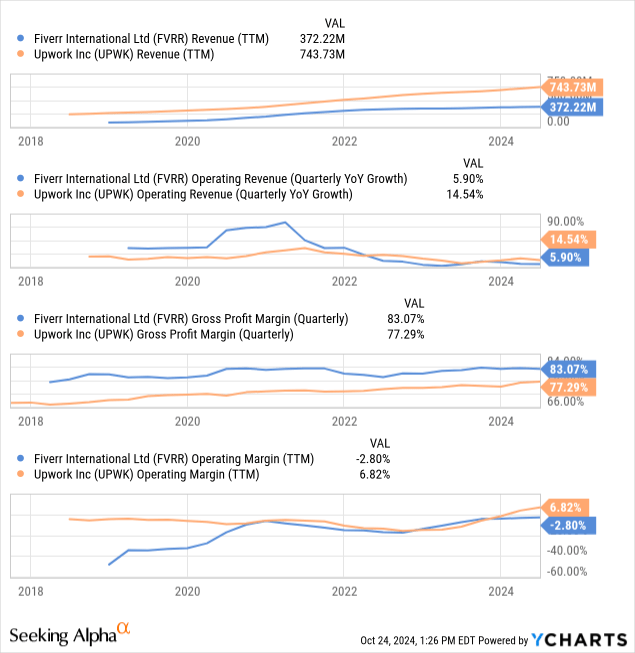

Fiverr has higher gross margins, in part made possible by a take-rate that is about 10% higher compared to Upwork’s. Fiverr used to have the higher revenue growth rate during the post-Covid boom, but that has now reversed, with Upwork recently posting better growth rates. We believe both companies can reignite higher growth rates given the size of the opportunity in transitioning Freelancing online. Given that Fiverr grew significantly more during the post-Covid years, it is understandable that it is taking longer to digest those gains, especially as some companies are relying less on Freelancers now and instead opted to hire full-time employees when the economy stabilized.

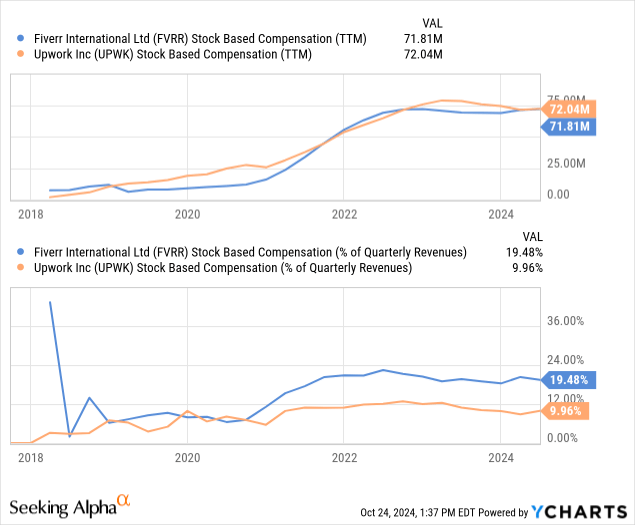

Both companies are currently operating with close to break-even profitability, but they have shared their long-term models with investors. Fiverr is targeting a long-term adjusted EBITDA margin of 25%, while Upwork is more ambitious with an adjusted EBITDA margin target of 35% that it aims to reach in the next five years. Fiverr’s target is lower despite its higher gross margin given that it plans to continue investing heavily in sales and marketing (S&M), directing around 25% of its revenue there, and another 20% towards research and development (R&D). Both companies are spending similar amounts in stock-based compensation (SBC), which they take out from the adjusted EBITDA numbers, but Fiverr’s SBC is considerably higher when measured as a percentage of revenues.

Valuation

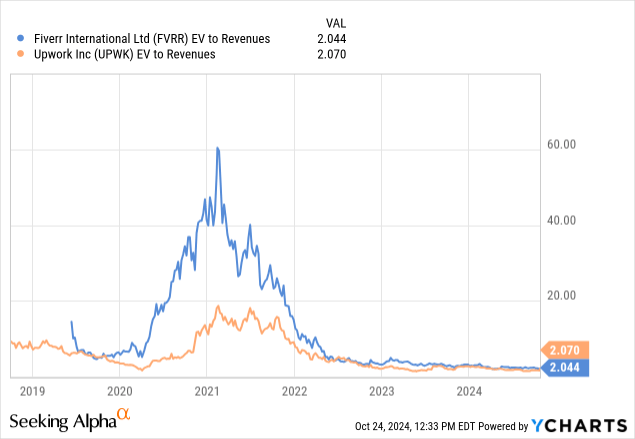

Fiverr and Upwork are both trading near their lowest historical valuations when measured using EV/Revenues. Incredibly, this valuation multiple has compressed by roughly 30x for Fiverr and close to 10x for Upwork, from their respective peaks.

With an EV/Revenues of close to 2x for both companies, not much growth is needed to justify the share prices. For comparison, Uber Technologies (UBER) is currently trading with an EV/Revenues of close to 4.3x and DoorDash (DASH) sports a 5.9x multiple.

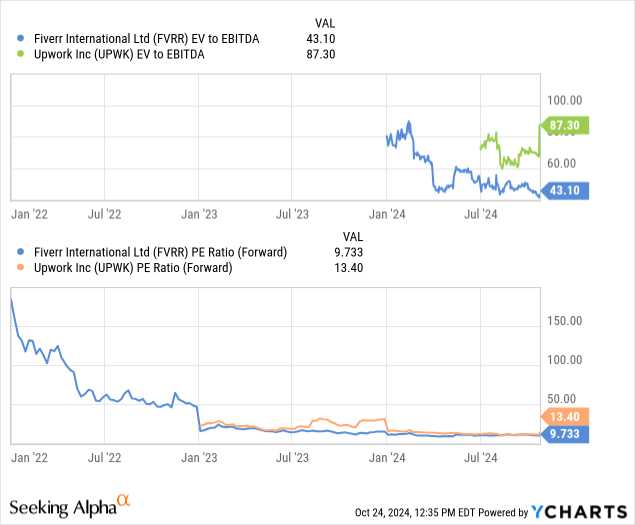

Fiverr is trading with a forward Price/Earnings multiple of only 9.7x, while Upwork is trading with a still very reasonable 13x. Based on analyst estimates for FY2025, Fiverr is trading at a forward Price/Earnings of 8.7x, while Upwork is trading at 12.2x.

Verdict

Given that Fiverr is trading with a lower Price/Earnings multiple, its website ranks better and shows better engagement metrics, and its apps are better rated, we prefer Fiverr to Upwork. Still, we believe at current prices both companies look attractive, and they are targeting slightly different segments of the freelancing market.

Risks

There is a risk that one of the major tech companies could become interested in competing in this space, and they could become a formidable competitor in a matter of months. We think the most likely candidate would be Alphabet (GOOG), as it has previously disrupted hotel, flight, and restaurant bookings.

Still, two-sided marketplaces are resilient, especially if the new product does not have adequate product-market fit. Many thought Meta (META) would pose a serious challenge to Tinder owner Match Group (MTCH) when it entered the dating app market, but so far, its offering has not really resonated with users.

There is also the disruption posed by artificial intelligence, which in some categories like logo design and document translation is clearly having an impact. Still, it appears it is also providing some benefits, like making Freelancers more productive and creating new service categories. Anecdotally, Upwork’s statistic that Freelancers using AI tools are earning significantly more per hour shows that there is likely a benefit from AI in more complex projects like coding or business consulting.

Conclusion

We believe Upwork and Fiverr have gone from extremely overvalued to undervalued, despite a real deceleration in their revenue growth rates. Both companies continue to benefit from structural tailwinds from the migration to online Freelancing and companies getting more comfortable reinforcing their teams with external resources. The impact that artificial intelligence will have remains very difficult to quantify, but it appears that it will reduce demand for certain services, while making other Freelancers more productive and creating new service categories. At current prices, we find the valuation attractive for both companies, but find Fiverr slightly more appealing.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling shares, you should do your own research and reach your own conclusion, or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.